Answered step by step

Verified Expert Solution

Question

1 Approved Answer

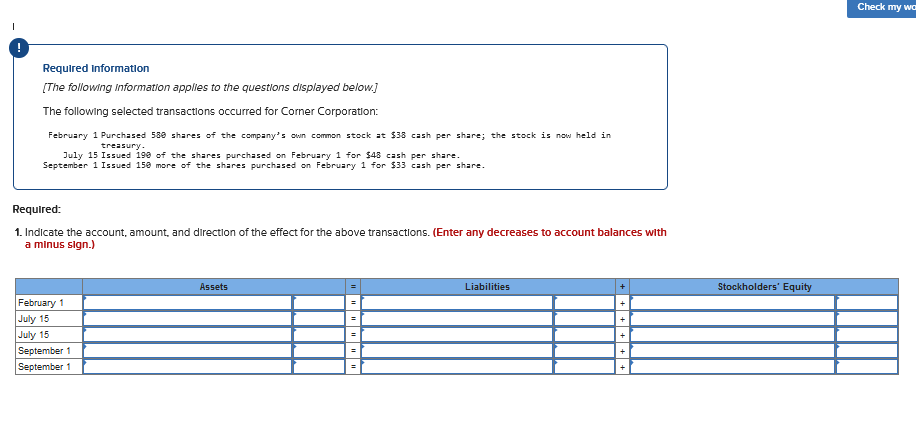

Required information [The following information applies to the questions displayed below.] The following selected transactlons occurred for Corner Corporation: February 1 Purchased 589 shares of

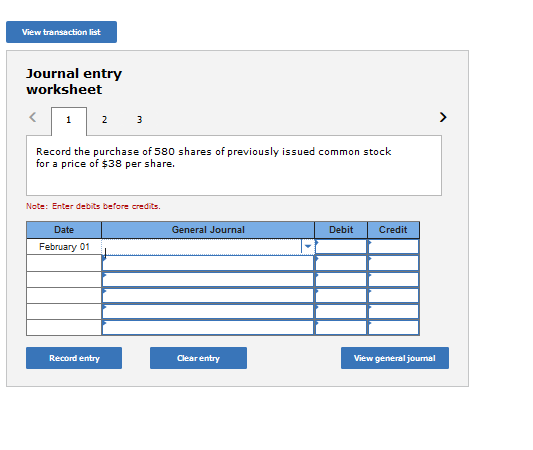

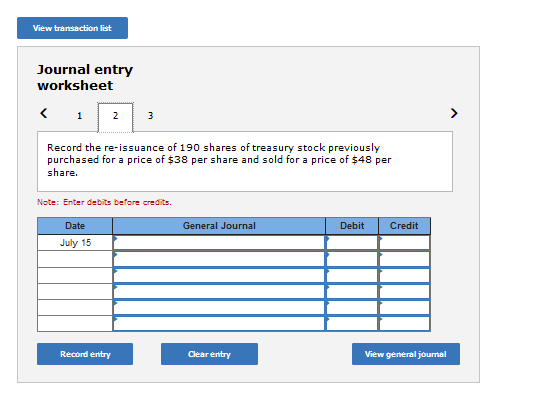

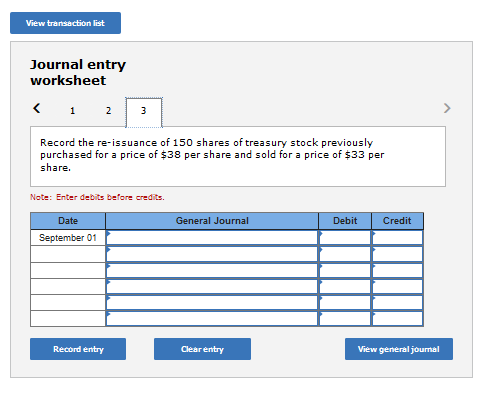

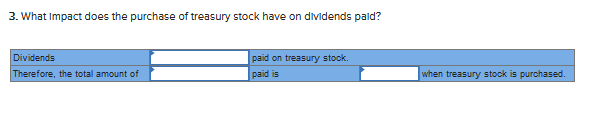

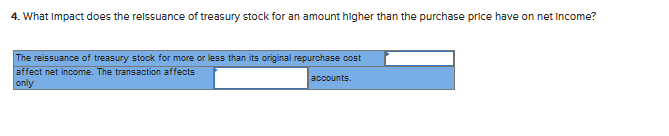

Required information [The following information applies to the questions displayed below.] The following selected transactlons occurred for Corner Corporation: February 1 Purchased 589 shares of the company's own common stock at \\( \\$ 38 \\) cash per share; the stock is now held in treasury. July 15 Issued 190 of the shares purchased on February 1 for \\( \\$ 48 \\) cash per share. September 1 Issued 150 more of the shares purchased on February 1 for \\( \\$ 33 \\) cash per share. Required: 1. Indicate the account, amount, and direction of the effect for the above transactions. (Enter any decreases to account balances with a minus sign.) Journal entry worksheet Record the purchase of 580 shares of previously issued common stock for a price of \\( \\$ 38 \\) per share. Note: Enter debits before credits. Journal entry worksheet Record the re-issuance of 190 shares of treasury stock previously purchased for a price of \\( \\$ 38 \\) per share and sold for a price of \\( \\$ 48 \\) per share. Note: Enter debits before credits. Journal entry worksheet Record the re-issuance of 150 shares of treasury stock previously purchased for a price of \\( \\$ 38 \\) per share and sold for a price of \\( \\$ 33 \\) per share. Note: Enter debits before credits. 3. What impact does the purchase of treasury stock have on dividends pald? 4. What Impact does the relssuance of treasury stock for an amount higher than the purchase price have on net Income

Required information [The following information applies to the questions displayed below.] The following selected transactlons occurred for Corner Corporation: February 1 Purchased 589 shares of the company's own common stock at \\( \\$ 38 \\) cash per share; the stock is now held in treasury. July 15 Issued 190 of the shares purchased on February 1 for \\( \\$ 48 \\) cash per share. September 1 Issued 150 more of the shares purchased on February 1 for \\( \\$ 33 \\) cash per share. Required: 1. Indicate the account, amount, and direction of the effect for the above transactions. (Enter any decreases to account balances with a minus sign.) Journal entry worksheet Record the purchase of 580 shares of previously issued common stock for a price of \\( \\$ 38 \\) per share. Note: Enter debits before credits. Journal entry worksheet Record the re-issuance of 190 shares of treasury stock previously purchased for a price of \\( \\$ 38 \\) per share and sold for a price of \\( \\$ 48 \\) per share. Note: Enter debits before credits. Journal entry worksheet Record the re-issuance of 150 shares of treasury stock previously purchased for a price of \\( \\$ 38 \\) per share and sold for a price of \\( \\$ 33 \\) per share. Note: Enter debits before credits. 3. What impact does the purchase of treasury stock have on dividends pald? 4. What Impact does the relssuance of treasury stock for an amount higher than the purchase price have on net Income Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started