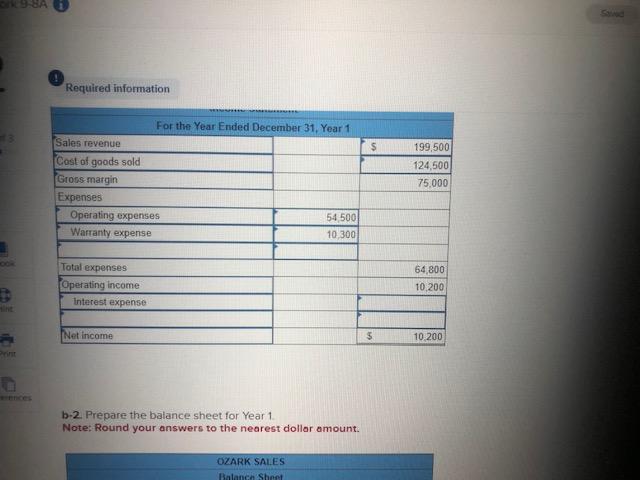

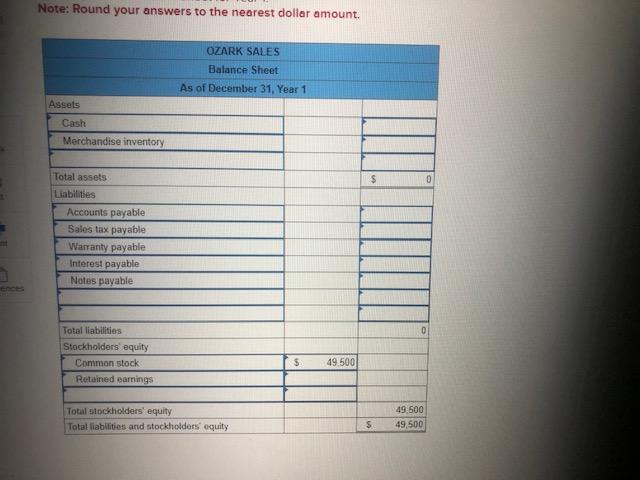

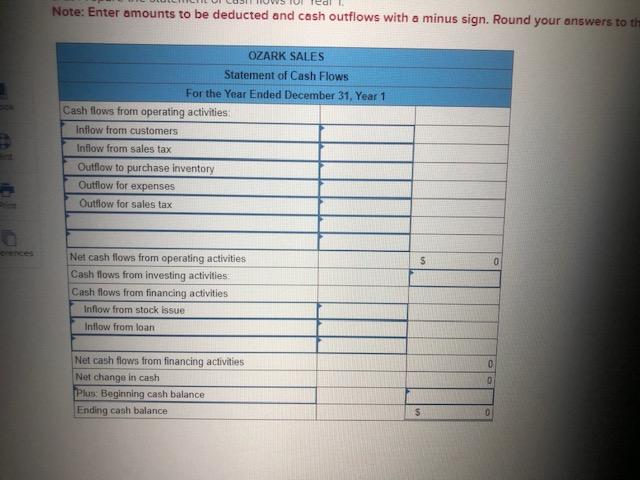

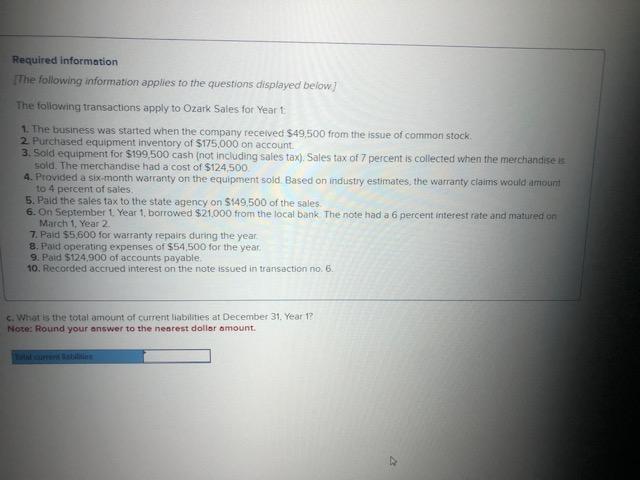

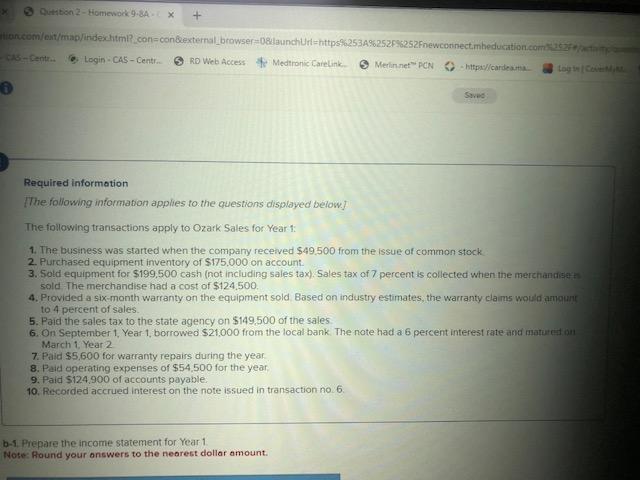

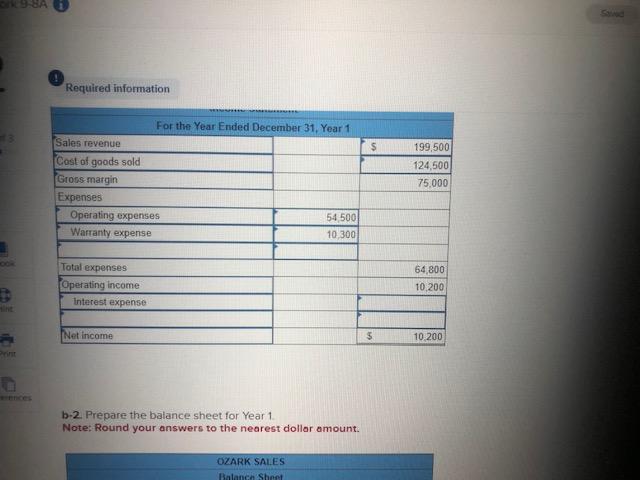

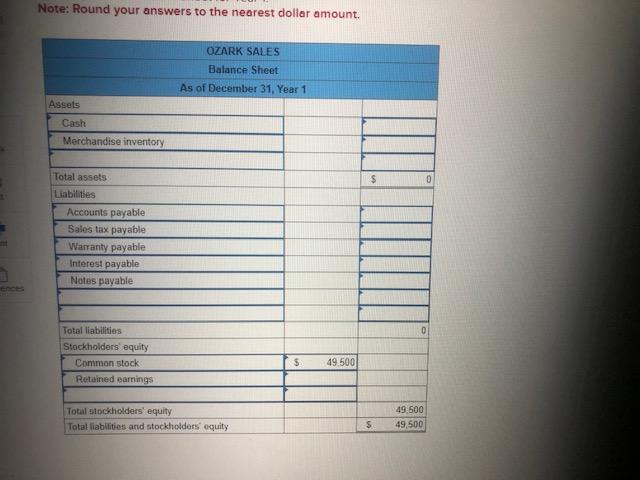

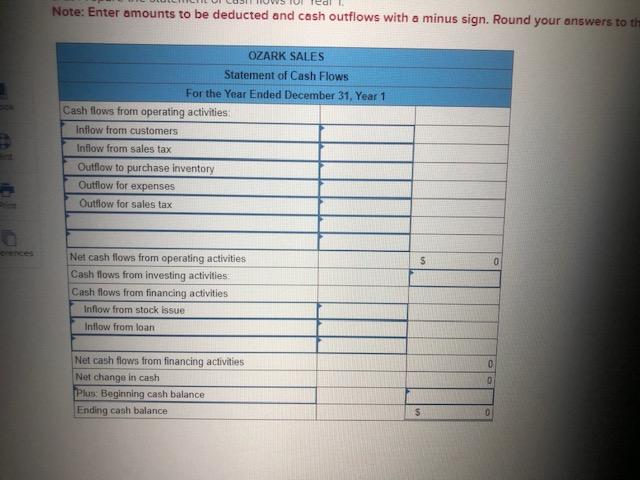

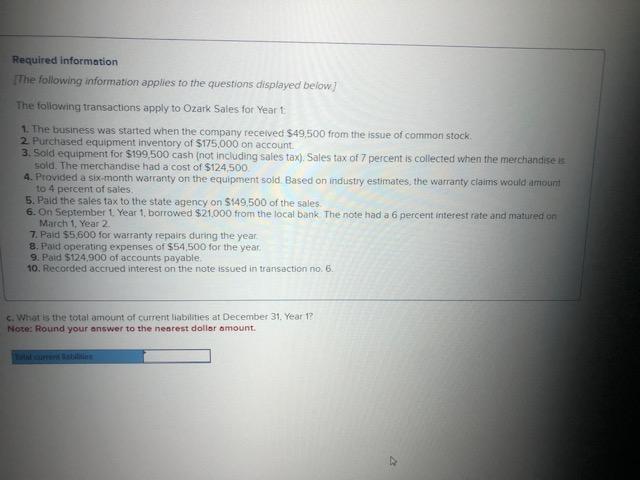

Required information [The following information applies to the questions displayed below]. The following transactions apply to Ozark Sales for Year 1: 1. The business was started when the company received $49.500 from the issue of common stock 2. Purchased equipment inventory of $175,000 on account. 3. Sold equipment for $199,500 cash (not including sales tax). Sales tax of 7 percent is collected when the merchandisq sold The merchandise had a cost of $124.500. 4. Provided a six-month warranty on the equipment sold. Based on industry estimates, the warranty cla ims would armang to 4 percent of sales. 5. Paid the sales tax to the state agency on $149.500 of the sales 6. On September 1, Year 1, borrowed $21,000 from the local bank. The note had a 6 percent interest rate and matur iad on March 1, Year 2 7. Paid $5,600 for watranty repairs during the year. 8. Paid operating expenses of $54,500 for the year. 9. Paid $124,900 of accounts payable: 10. Recorded accrued interest on the note issued in transaction no. 6. b-1. Prepare the income statement for Year 1 . Nose: Round your onswers to the nearest dollar amount. Required information b-2. Prepare the balance sheet for Year 1 . Note: Round your answers to the nearest dollar amount. Note: Round your answers to the nearest doliar amount. Note: Enter amounts to be deducted and cash outflows with a minus sign. Round your answers to t Required information The following information applies to the questions displayed beiow] The folioving transactions apply to Ozark Sales for Year L 1. The business was started when the company received $49,500 from the issue of common stock: 2. Purchased equipment inventory of $175,000 on account. 3. Sold equipment for $199,500 cash (not including sales tax). Sales tax of 7 percent is collected when the merchandise is sold. The merchandise had a cost of $124,500. 4. Provided a six-month warranty on the equipment sold. Based on industry estimates, the warranty claims would arrioumi to 4 pereent of sales. 5. Paid the sales tax to the state agency on $149.500 of the sales. 6. On September 1, Year 1, borrowed $21,000 from the local bank. The note had a 6 percent interest rate and matured on March 1, Year 2. 7. Paid $5,600 for warranty repairs during the year. 8. Pald operating expenses of $54.500 for the year: 9. Paid $124,900 of accounts payable: 10. Piecorded accrued interest on the note issued in transection no. 6 . c. What is the total amount of current liabinties at December 31. Year 1? Mose: Round your answer to the nearest dollor omount