Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information [The following information applies to the questions displayed below.] Melissa recently paid $400 for round-trip airfare to San Francisco to attend a business

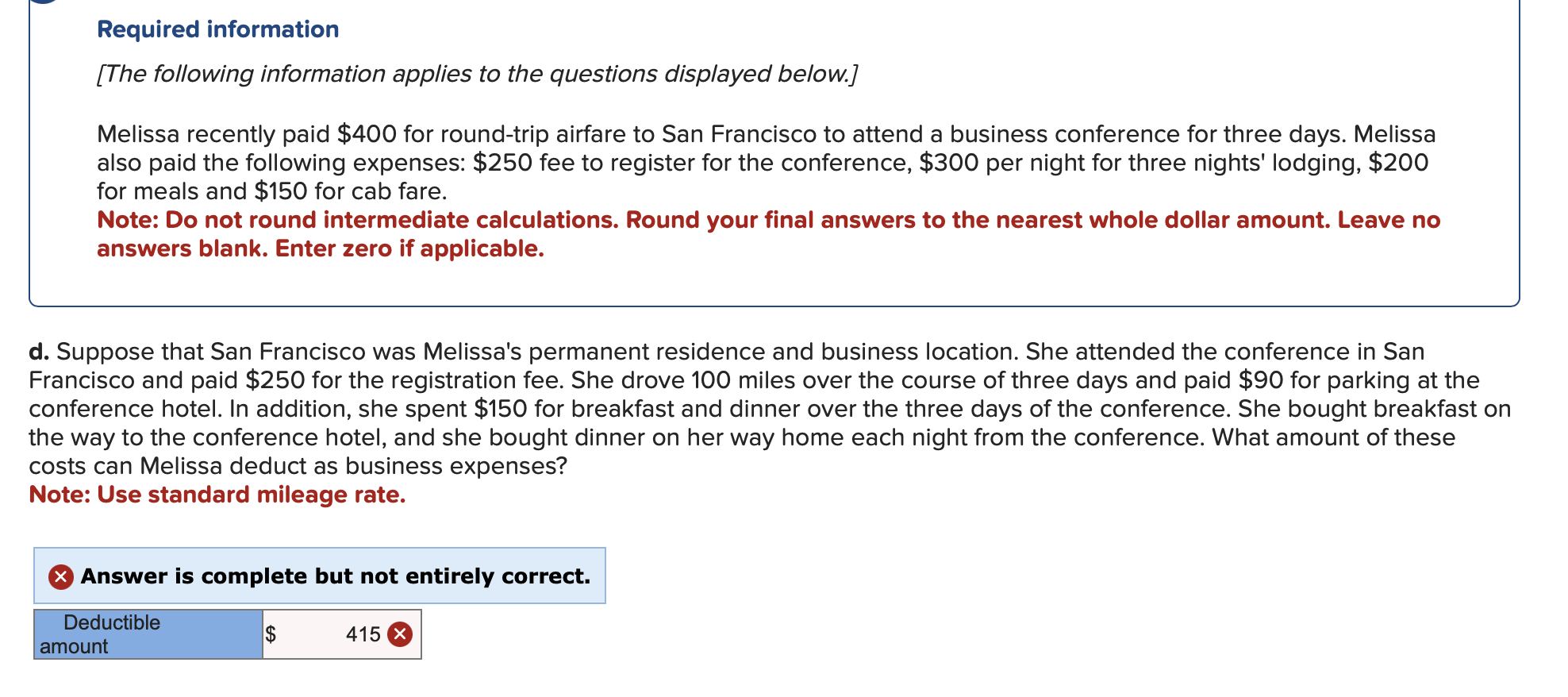

Required information [The following information applies to the questions displayed below.] Melissa recently paid $400 for round-trip airfare to San Francisco to attend a business conference for three days. Melissa also paid the following expenses: $250 fee to register for the conference, $300 per night for three nights' lodging, $200 for meals and $150 for cab fare. Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answers blank. Enter zero if applicable. . Suppose that San Francisco was Melissa's permanent residence and business location. She attended the conference in San rancisco and paid $250 for the registration fee. She drove 100 miles over the course of three days and paid $90 for parking at the onference hotel. In addition, she spent $150 for breakfast and dinner over the three days of the conference. She bought breakfast on le way to the conference hotel, and she bought dinner on her way home each night from the conference. What amount of these osts can Melissa deduct as business expenses? lote: Use standard mileage rate

Required information [The following information applies to the questions displayed below.] Melissa recently paid $400 for round-trip airfare to San Francisco to attend a business conference for three days. Melissa also paid the following expenses: $250 fee to register for the conference, $300 per night for three nights' lodging, $200 for meals and $150 for cab fare. Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answers blank. Enter zero if applicable. . Suppose that San Francisco was Melissa's permanent residence and business location. She attended the conference in San rancisco and paid $250 for the registration fee. She drove 100 miles over the course of three days and paid $90 for parking at the onference hotel. In addition, she spent $150 for breakfast and dinner over the three days of the conference. She bought breakfast on le way to the conference hotel, and she bought dinner on her way home each night from the conference. What amount of these osts can Melissa deduct as business expenses? lote: Use standard mileage rate Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started