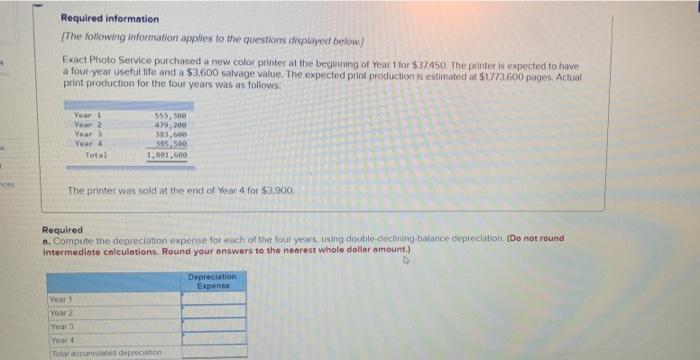

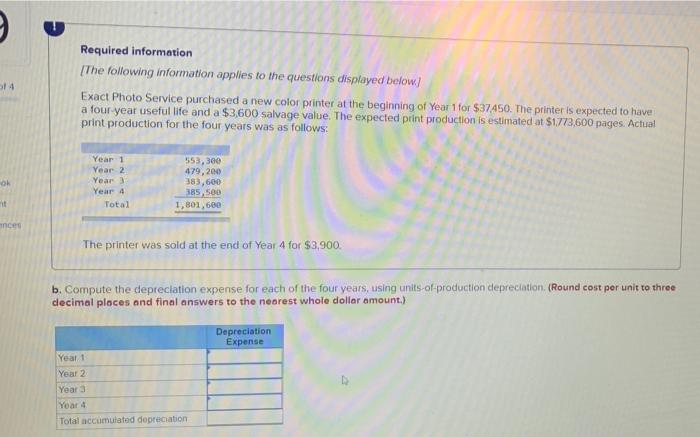

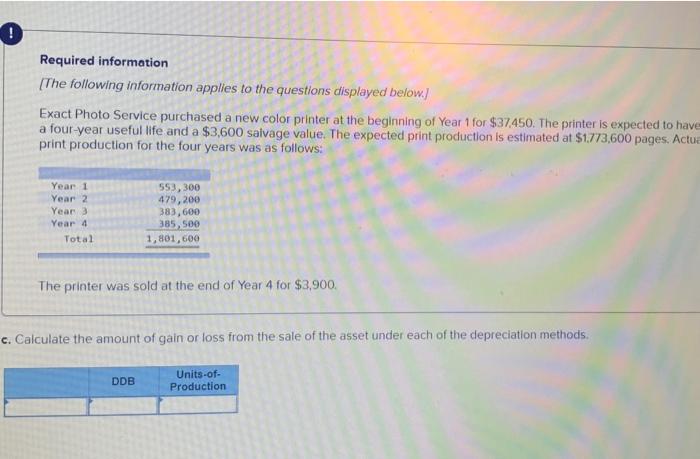

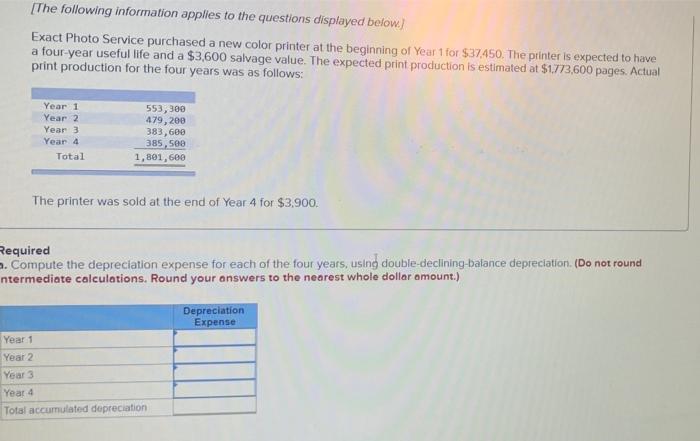

Required information The following information applies to the questions displayed below) Exact Photo Service purchased a new color printer at the beginning of Yeart for $37450 The printer is expected to have a four year useful life and a $3,600 salvage value. The expected print production is estimated at $1773.600 pages. Actual print production for the four years was as follows. 4 Year 1 Year 2 Year Year 4 Total 555.300 479,200 383.600 335,500 1,001,600 The printer was sold at the end of Year 4 for $3,900. Required 6. Compute the depreciation expense for each of the four years using double-declining balance depreciation (Do not round Intermediate calculations. Round your answers to the nearest whole dollar amount) Depreciation Expense Year 1 Yea Year Year Total accumdated depreciation 3 54 Required information [The following information applies to the questions displayed below. Exact Photo Service purchased a new color printer at the beginning of Year 1 for $37,450. The printer is expected to have a four year useful life and a $3,600 salvage value. The expected print production is estimated at $1773,600 pages. Actual print production for the four years was as follows: OL Year 1 Year 2 Year 3 Year 4 Total 553,300 479,200 383,600 385,500 1,801,600 st ances The printer was sold at the end of Year 4 for $3,900. b. Compute the depreciation expense for each of the four years, using units-of-production depreciation (Round cost per unit to three decimal places and final answers to the nearest whole dollar amount.) Depreciation Expense Year 1 Year 2 Year 3 Year 4 Total accumulated depreciation Required information (The following information applies to the questions displayed below.) Exact Photo Service purchased a new color printer at the beginning of Year 1 for $37,450. The printer is expected to have a four-year useful life and a $3,600 salvage value. The expected print production is estimated at $1773,600 pages. Actua print production for the four years was as follows: Year 1 Year 2 Year 3 Year 4 Total 553,300 479,200 383,600 385,500 1,801,600 The printer was sold at the end of Year 4 for $3,900. c. Calculate the amount of gain or loss from the sale of the asset under each of the depreciation methods. DDB Units-of- Production [The following information applies to the questions displayed below.) Exact Photo Service purchased a new color printer at the beginning of Year 1 for $37,450. The printer is expected to have a four-year useful life and a $3,600 salvage value. The expected print production is estimated at $1.773,600 pages. Actual print production for the four years was as follows: Year 1 Year 2 Year 3 Year 4 Total 553,300 479,200 383,600 385,500 1,801, 600 The printer was sold at the end of Year 4 for $3,900. Required . Compute the depreciation expense for each of the four years, using double-declining balance depreciation. (Do not round ntermediate calculations. Round your answers to the nearest whole dollar amount.) Depreciation Expense Year 1 Year 2 Year 3 Year 4 Total accumulated depreciation