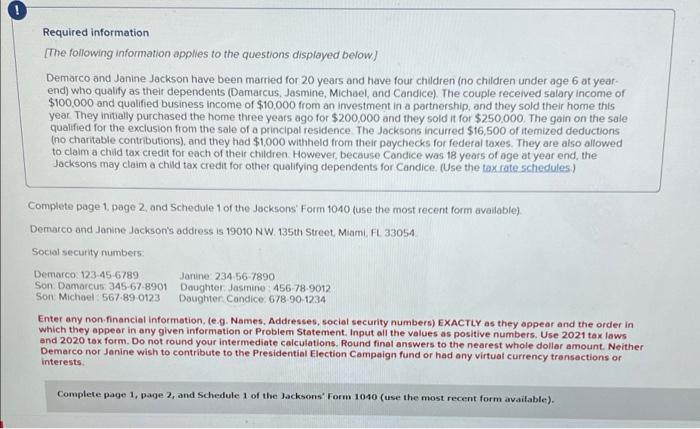

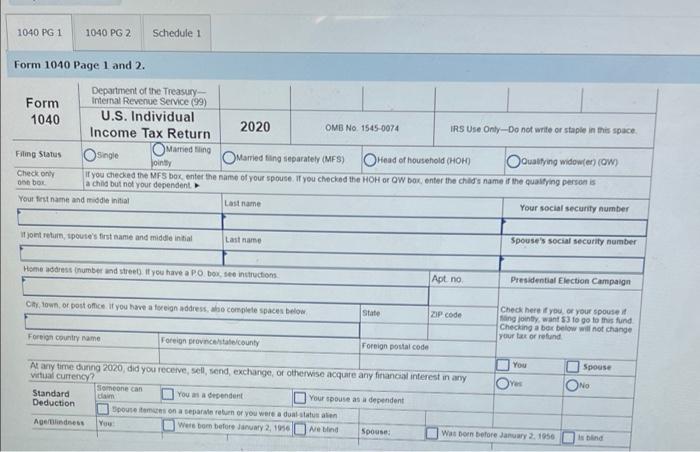

Required information The following information applies to the questions displayed below) Demarco and Janine Jackson have been married for 20 years and have four children (no children under age 6 at year end) who qualify as their dependents (Damarcus, Jasmine, Michael and Candice). The couple received salary income of $100,000 and qualified business income of $10,000 from an investment in a partnership, and they sold their home this year. They initially purchased the home three years ago for $200,000 and they sold it for $250,000. The gain on the sale qualified for the exclusion from the sale of a principal residence The Jacksons incurred $16,500 of itemized deductions (no charitable contributions), and they had $1,000 withheld from their paychecks for federal taxes. They are also allowed to claim a child tax credit for each of their children. However, because Candice was 18 years of age at year end, the Jacksons may claim a child tax credit for other qualifying dependents for Candice (Use the tax rate schedules) Complete page 1, page 2 and Schedule 1 of the Jacksons Form 1040 (use the most recent form available) Demarco and Janine Jackson's address is 19010 NW 135th Street, Miami, FL 33054 Social security numbers Demarco 123-456789 Janine 234 56 7890 Son Damarcus: 345-67-8901 Daughter Jasmine 456 78.9012 Son Michael: 567.89-0123 Daughter Condice678.90-1234 Enter any non financial information. (e.g. Nomes, Addresses, social security numbers) EXACTLY as they appear and the order in which they appear in any given information or Problem Statement. Input all the values as positive numbers. Use 2021 tax laws and 2020 tox form. Do not round your intermediate calculations. Round final answers to the nearest whole dollar amount. Neither Demarco nor Janine wish to contribute to the Presidential Election Campaign fund or had any virtual currency transactions or interests Complete page 1, page 2, and schedule 1 of the Jacksons Form 1040 (use the most recent form available) 1040 PG 1 1040 PG 2 Schedule 1 Form 1040 Page 1 and 2. Department of the Treasury- Form Internal Revenue Service (99) 1040 U.S. Individual 2020 OMB No 1545-0074 Income Tax Return IRS Use Onty--Do not write or staple in this space Filing Status O single Married ning Married ting separately (MFS) Head of household (HOHO Qualitying widowien cow Joint Check on If you checked the MFS box, enter the name of your spouse. Il you checked the HOH or GW box, enter the child's name if the qualifying person is a child but not your dependent Youttist name and middle initial Last name Your social security number bor I joint return, toute's first name and middle initial Last name Spouse's social security number Home address number and street if you have a PO boxes instructions Apt no Presidential Election Campaign City, town, or post office if you have a foreign address who complete spaces below State ZIP code Check here you or your spouse ang jointly want to go to this fund Checking a box below will not change your tax or refund Foreign country Name Foreign provincstatcounty Foreign postal code You Spouse At any time unna 2020, did you receive, sell, send, exchange or otherwise acquire any financial interest in any virtual currency O. ONO Someone can Standard You a dependent claim Your spouse as a dependent Deduction spoustmes on a separate roburn or you were a dual status alien Agendness You Wersom before January 2, 1956 Neblind Spouse: Was born before January 2.1956