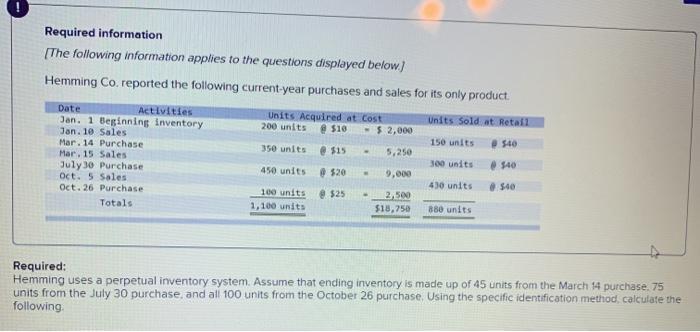

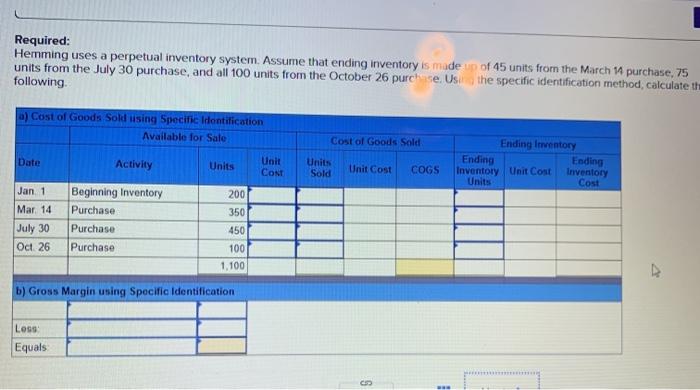

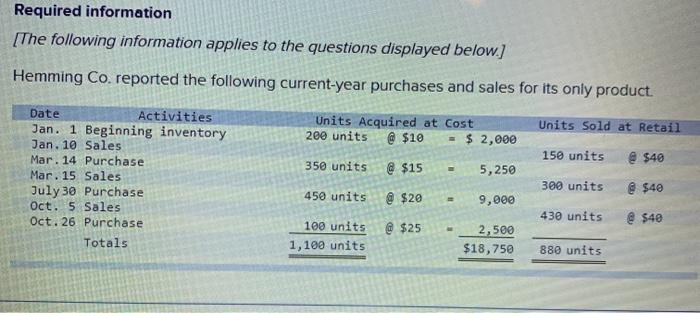

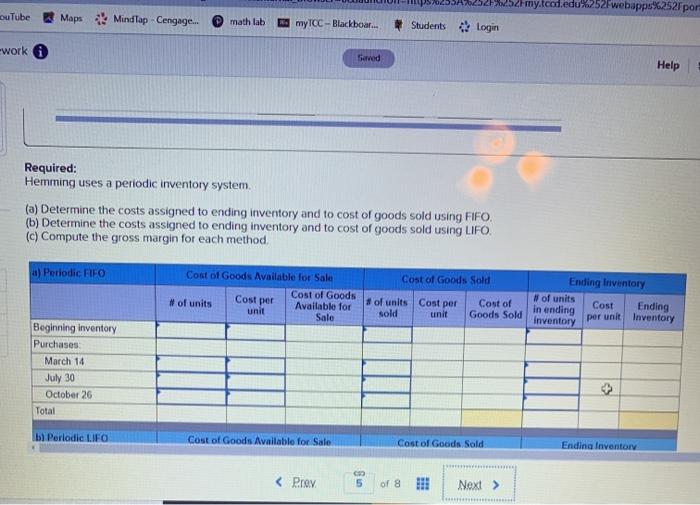

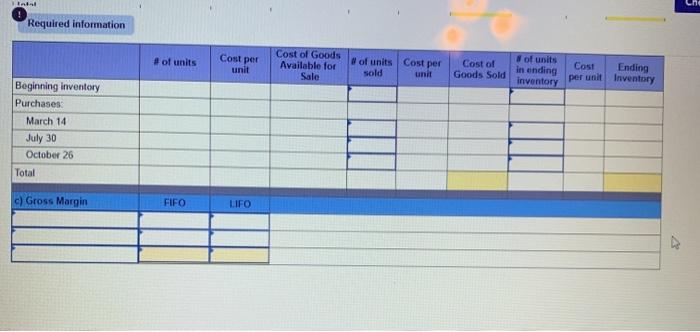

Required information The following information applies to the questions displayed below) Hemming Co. reported the following current-year purchases and sales for its only product. Units Acquired at Cost 200 units - $ 2,000 @ $10 Units sold at Retail 150 units 540 350 units @ $15 Date Activities Jan. 1 Beginning inventory Jan. 10 Sales Mar. 14 Purchase Mar.15 Sales July 30 Purchase Oct. 5 Sales Oct. 26 Purchase Totals 5,250 300 units 450 units 540 $20 9,000 430 units .$40 100 units @ $25 1,100 units 2,500 $18,750 888 units Required: Hemming uses a perpetual inventory system. Assume that ending inventory is made up of 45 units from the March 14 purchase. 75 units from the July 30 purchase, and all 100 units from the October 26 purchase. Using the specific identification method, calculate the following Required: Hemming uses a perpetual inventory system. Assume that ending inventory is made up of 45 units from the March 14 purchase, 75 units from the July 30 purchase, and all 100 units from the October 26 purch se. Us the specific identification method, calculate the following a) Cost of Goods Sold using Specific Identification Available for Sale Cost of Goods Sole Date Activity Units Unit CONE Units Sold Ending Inventory Ending Ending Inventory Unit Cost Inventory Units Cost Unit Cost COGS 200 350 Jan 1 Mar 14 July 30 Oct 26 Beginning Inventory Purchase Purchase Purchase 450 100 1,100 b) Gross Margin using Specific Identification Loss Equals S Required information [The following information applies to the questions displayed below.] Hemming Co. reported the following current-year purchases and sales for its only product Units Sold at Retail Units Acquired at Cost 200 units @ $10 = $ 2,000 350 units @ $15 5,250 150 units @ $40 Date Activities Jan. 1 Beginning inventory Jan. 10 Sales Mar. 14 Purchase Mar. 15 Sales July 30 Purchase Oct. 5. Sales Oct. 26 Purchase Totals 300 units 450 units @ $40 @ $20 9,000 430 units @ $40 100 units 1,100 units @ $25 2,500 $18,750 880 units 52 my.tcod.edu%252Fwebapps%252Fpor ouTube Maps MindTap.Cengage... math lab Be my TCC-Blackboar... Students Login work i Served Help Required: Hemming uses a periodic inventory system (a) Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. (b) Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. (c) Compute the gross margin for each method a) Periodic FIFO Cost of Goods Sold Cost of Goods Available for Sale Cost of Goods # of units unit Available for Sale Cost per # of units Cost per sold unit Cost of Goods Sold Ending Inventory W of units Cost in ending Ending Inventory por unit Inventory Beginning inventory Purchases March 14 July 30 October 26 Total b) Periodie LIFO Cost of Goods Available for Sale Cost of Goods Sold Ending Inventory Required information # of units Cost per unit Cost of Goods Available for Sale # of units Cost per sold unit Cost of Goods Sold of units In ending inventory Cost Ending per unit Inventory Beginning inventory Purchases: March 14 July 30 October 26 Total c) Gross Margin FIFO LIFO