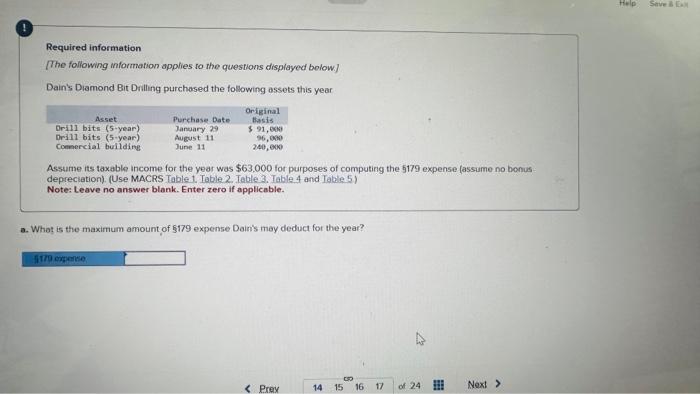

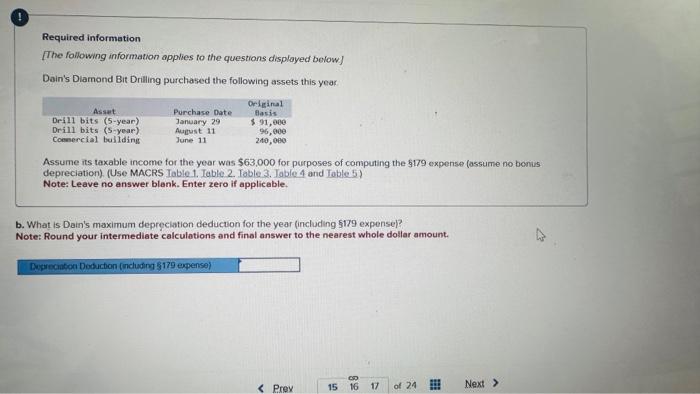

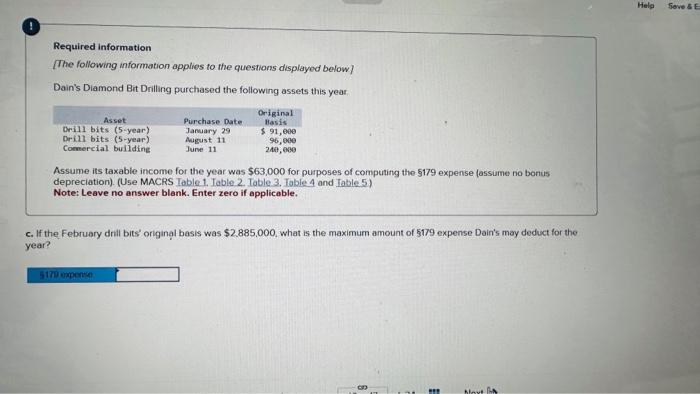

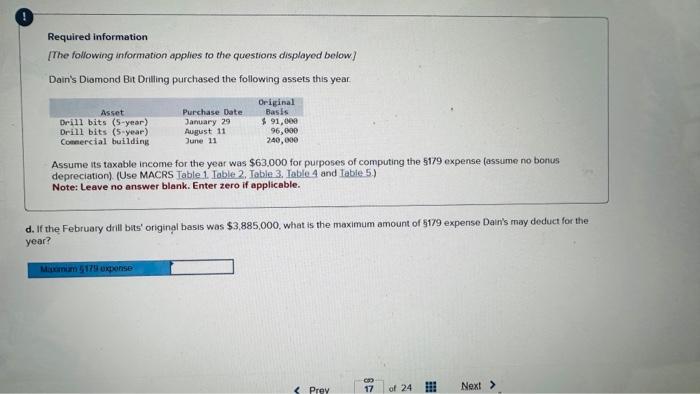

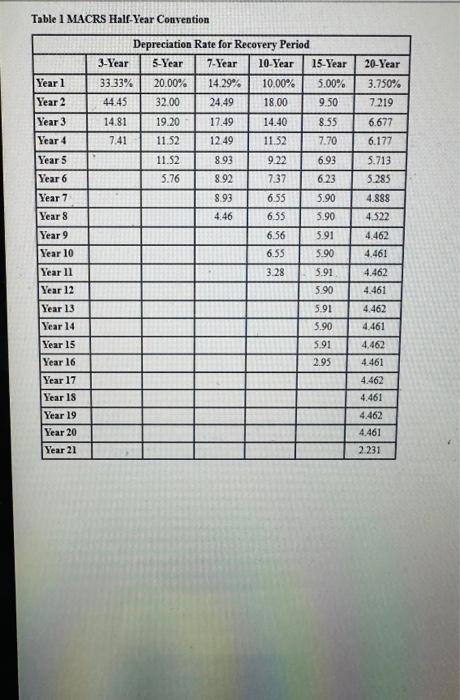

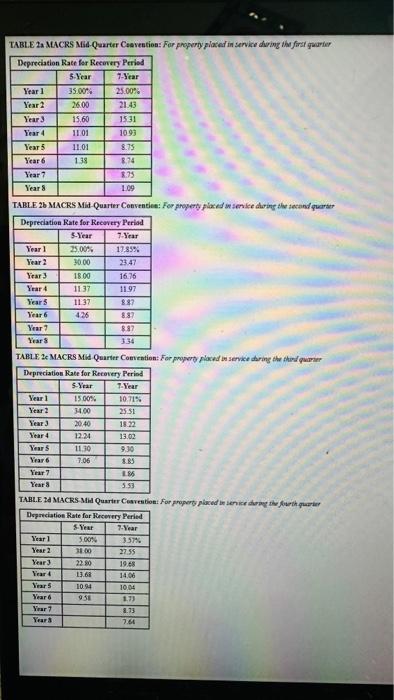

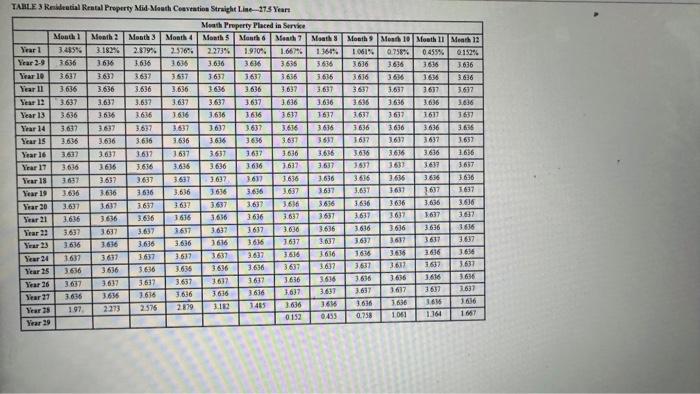

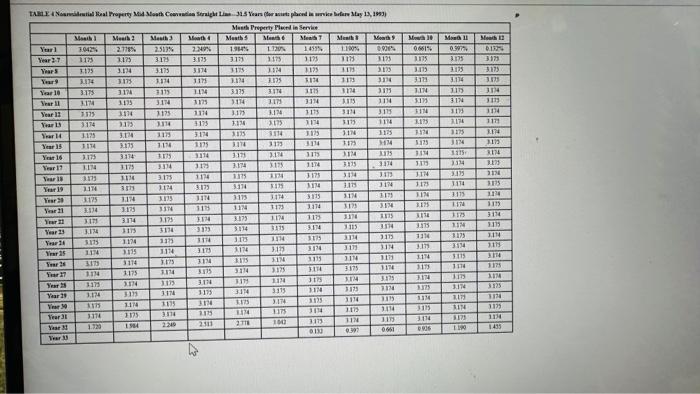

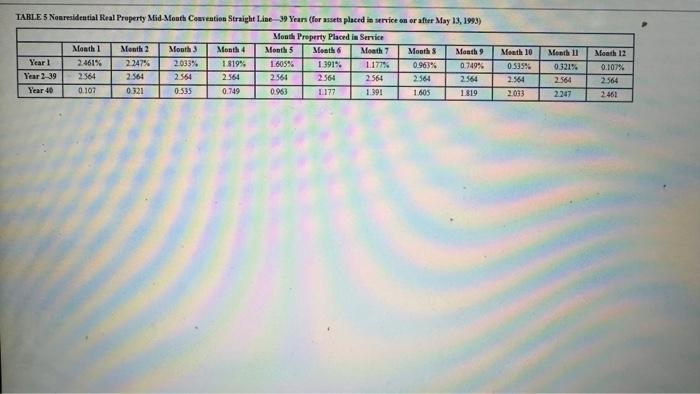

Required information [The following information applies to the questions displayed bolow] Dain's Diamond Bit Dilling purchased the following assets this year Assume its taxable income for the year was $63.000 for purposes of computing the 5179 expense fassume no bonus depreciation). (Use MACRS Table 1. Table 2. Table 3. Table 4 and Iable 5) Note: Leave no answer blank. Enter zero if applicable. a. What is the maximum amount of 5179 expense Doin's mey deduct for the year? Required information [The following information applies to the questions displayed below] Dain's Diamond Bit Drilling purchased the following assets this year Assume its taxable income for the year was $63,000 for purposes of computing the $179 expense (assume no bonus depreciation). (Use MACRS Table 1. Table 2. Table 3. Iable 4 and Table 5) Note: Leave no answer blank. Enter zero if applicable. b. What is Dain's maximum depreciation deduction for the year (including $179 expense)? Note: Round your intermediate calculations and finol answer to the nearest whole dollar amount. Required information [The following information applies to the questions displayod below] Dain's Diamond Bit Drilling purchased the following assets this year Assume its taxable income for the year was $63,000 for purposes of computing the 5179 expense (assume no bonus depreciation). (Use MACRS Table 1. Iable 2. Table 3. Table 4 and Iable 5) Note: Leave no answer blank. Enter zero if applicable. c. If the February drill bits' original basis was $2.885,000, what is the maximum amount of $179 expense Dain's may deduct for the year? Required information [The following information applies to the questions displayed below] Dain's Diamond Bit Drilling purchased the following assets this year Assume its taxable income for the year was $63.000 for purposes of computing the $179 expense (assume no bonus depreciation). (Use MACRS Table1. Table 2. Table 3. Table 4 and Table 5.) Note: Leave no answer blank. Enter zero if applicable. d. If the February drill bats' origingl basis was $3,885,000, what is the maximum amount of 5179 expense Dain's may deduct for the year? Table 1 MACRS Half-Year Convention TABL.E 2a MLACRS Mid Quearter Cenvention: Fir proporiy placed in service diving the first gaurter \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Depreciation Rate for Recorery Period } \\ \hline & 5-Year & 7-Year \\ \hline Year 1 & 35.00% & 25.00% \\ \hline Year 2 & 26.00 & 21.43 \\ \hline Year 3 & 15.60 & 1531 \\ \hline Year 4 & 11.01 & 10.93 \\ \hline Year 5 & 11.01 & 8.75 \\ \hline Year 6 & 1.38 & 8.74 \\ \hline Year 7 & & 8.75 \\ \hline Year 8 & & 1.09 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|} \hline \multicolumn{3}{|c|}{ Depreciation Rate for Recover Feriod } \\ \hline & 5-Year & 7. Year \\ \hline Year 1 & 15.00% & 10.7% \\ \hline Year 2 & 3400 & 25.51 \\ \hline Year 3 & 20.40 & 18.22 \\ \hline Year 4 & 12.24 & 13.02 \\ \hline Year 5 & 11.30 & 9.30 \\ \hline Year 6 & 7.06 & 185 \\ \hline Year 7 & & 1.85 \\ \hline Year 8 & & 5.53 \\ \hline \end{tabular} TABt.E 3 Renbleatial Rental Property Mid Moath Ceaveation Straight Line-213 Year TABLE 5 Nonrecidential Real Property Mid-Montb Convention Straight Liee-39 Yean (for assets placed in service an or after May 13, 1953)