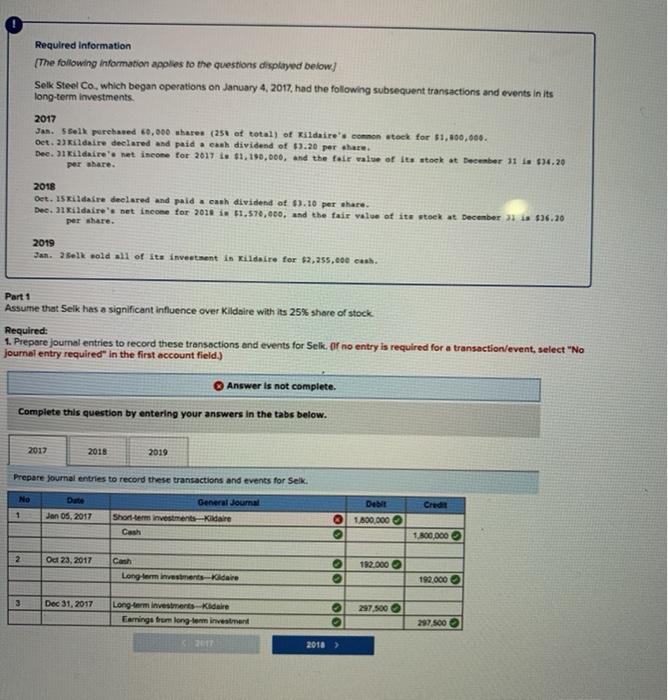

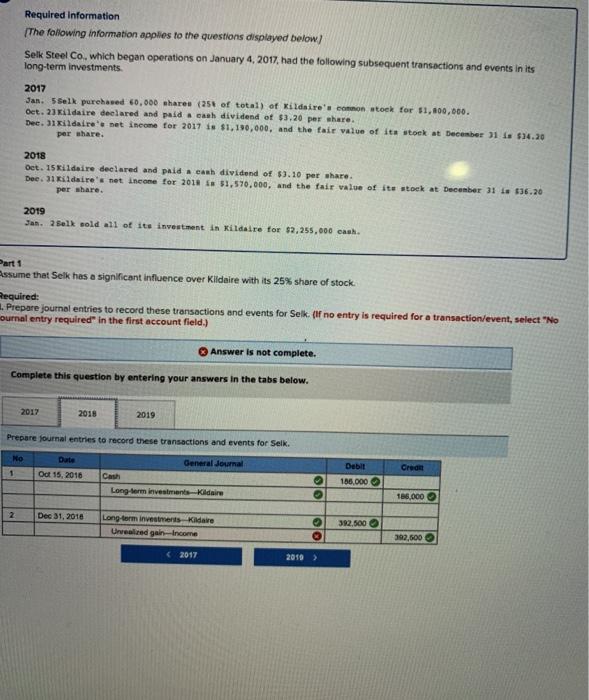

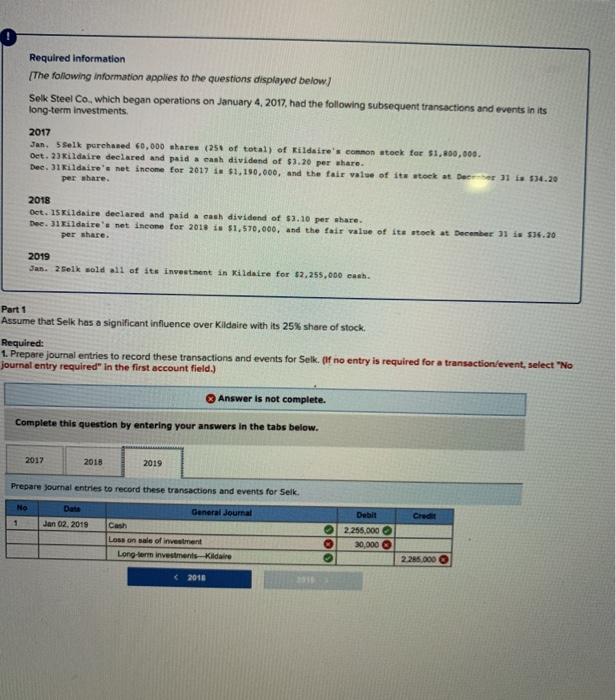

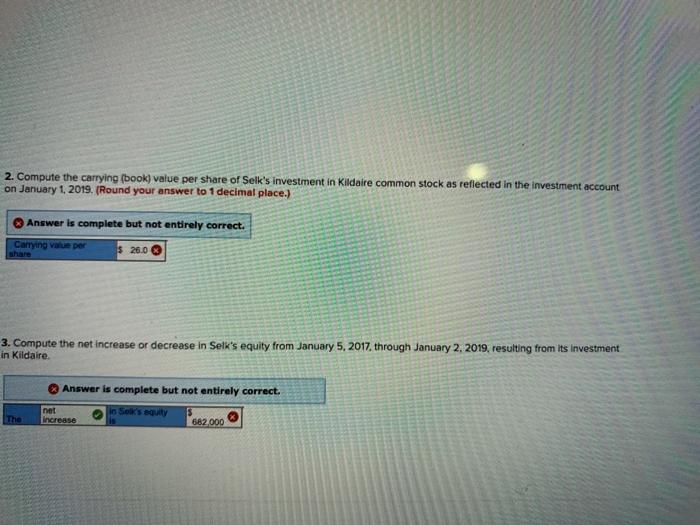

Required information (The following information applies to the questions displayed below.) Selk Steel Co, which began operations on January 4, 2017. had the following subsequent transactions and events in its long-term investments 2017 Jan. sell purchased 60,000 shares (251 of total) of Kildaire' common stock for $1,800,000. bet. 2) Kildare declared and paid a cash dividend of 63.20 per share Dec. 1 Kildaire net income for 2017 Le $1,190,000, and the fair value of its stock at December 31 is $34.20 per share. 2018 Oet. 15 ildaire declared and paid a cash dividend of 9).10 per share. Dee. 31 xildaire net income for 2018 is $1.570,000, and the fair value of its stock at December 3 L 636.20 per share. 2019 Jan. 2 elk sold all of its investment in Kildaire for $2,255,00 cash. Part 1 Assume that Selk has a significant influence over Kildaire with its 25% share of stock Required: 1. Prepare journal entries to record these transactions and events for Selk. Or no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is not complete. Complete this question by entering your answers in the tabs below. 2017 2015 2019 Prepare yournal entries to record these transactions and events for Selk. NO Credit 1 Jan 05, 2017 General Journal Short-term investments Kidaire Cash Det O 1.800,000 Olo 1.800.000 2 Oct 23, 2017 Cash Long term investments Kidare Olo 182.000 192.000 3 Dec 31, 2017 Long-term investments Kidaire Earringe tum long term investment OO 297.500 2018 Required information The following information applies to the questions displayed below) Selk Steel Co, which began operations on January 4, 2017. had the following subsequent transactions and events in its long-term investments 2017 Jan. 5Selk purchased 60,000 shares (256 of total) of Kildaire's common stock for $1,800,000. Oct. 23 xildaire declared and paid a cash dividend of $3.20 per share Dee. Dixildaire net income for 2017 is $1,190,000, and the fair value of its stock at December 31 is $14.20 per share. 2018 Oct. 15 kildaire declared and paid cash dividend of $).10 per share. Dee. Kildaire's net income for 2018 is $1.570,000, and the fair value of its stock at December 31 = $36.20 per share. 2019 Jan. 2Bell sold all of its investment in Kildare for $2,255,000 Part 1 Pssume that Selk has a significant influence over Kildaire with its 25% share of stock. Required: 1. Prepare journal entries to record these transactions and events for Selk (if no entry is required for a transaction/event, select "No ournal entry required in the first account field.) Answer is not complete Complete this question by entering your answers in the tabs below. 2017 2018 2019 Prepare journal entries to record these transactions and events for Selk. No General Journal Date Oct 15, 2010 Cream 1 Debit 185.000 Long-term investments Kidaire Olo 186,000 2 Dec 31, 2018 Long term investments Kildave Urvealized gain Income olo 392.500 392,600 (2017 2019 > Required information [The following information applies to the questions displayed below) Selk Steel Co, which began operations on January 4, 2017, had the following subsequent transactions and events in its long-term investments 2017 Jan. Selk purchased 0,000 shares (256 of total) of Kildaire's common stock for $1,800,000. Det. 23 Kildaire declared and paid a cash dividend of $1.20 per share. Dee. Kildaire's net income for 2017 1 $1,190,000, and the fair value of its stock at Dec 31 ts $14.20 per mare. 2018 Oct. 15 kildaire declared and paid a cash dividend of $2.10 per share. Dee. Ji xildaire's net income for 2018 is $1,570,000, and the fair value of its stock at December 31 is 516.10 per share. 2019 Jan. 2 Selk sold all of its investment in Kildaire for 62,255,000 cash. Part 1 Assume that Selk has a significant influence over Kildnire with its 25% share of stock. Required: 1. Prepare journal entries to record these transactions and events for Selk. (if no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is not complete. Complete this question by entering your answers in the tabs below. 2017 2018 2019 Prepare journal entries to record these transactions and events for Selk. No Data Jan 02, 2018 General Journal Credit 1 Debit 2.255.000 30,000 Loss on sale of investment Long-term investments Kildare OOO 2.285.000 2018 2. Compute the carrying (book) value per share of Selk's investment in Kildaire common stock as reflected in the investment account on January 1, 2019. (Round your answer to 1 decimal place.) Answer is complete but not entirely correct. Carrying value per $ 26.0 3. Compute the net increase or decrease in Selk's equity from January 5, 2017, through January 2, 2019, resulting from its investment in Kildaire Answer is complete but not entirely correct. net increase in Sok's The 682.000