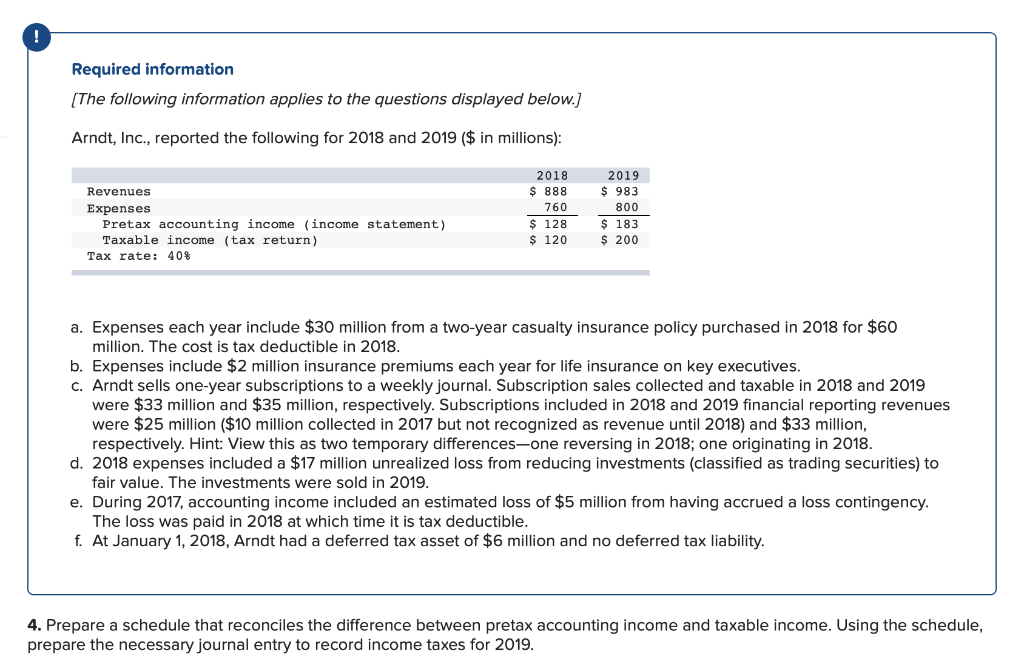

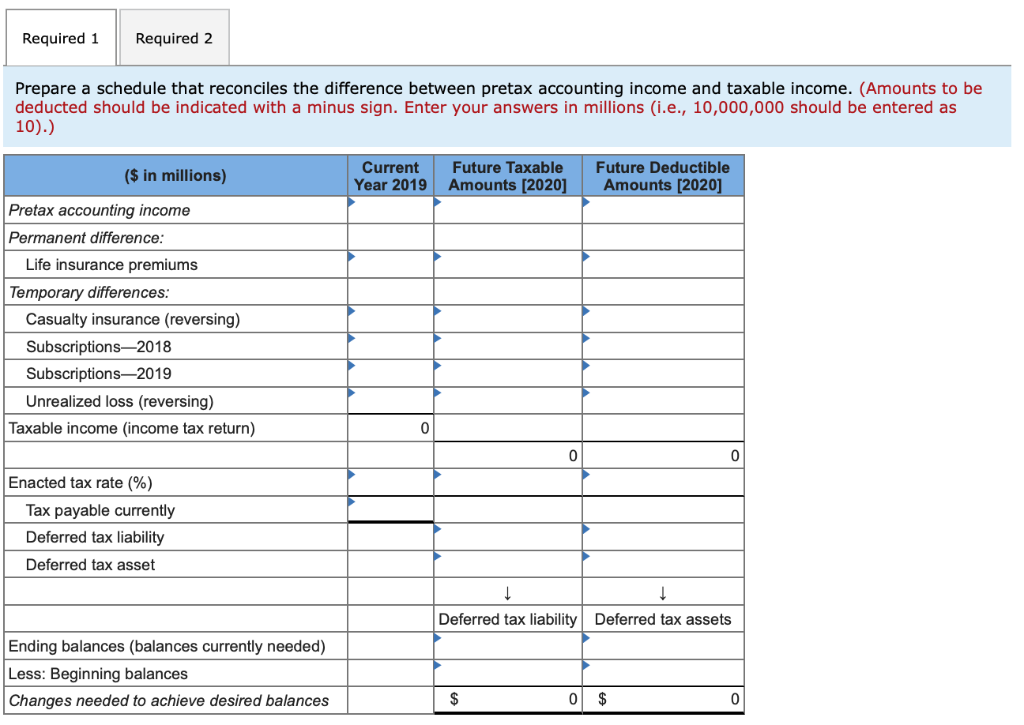

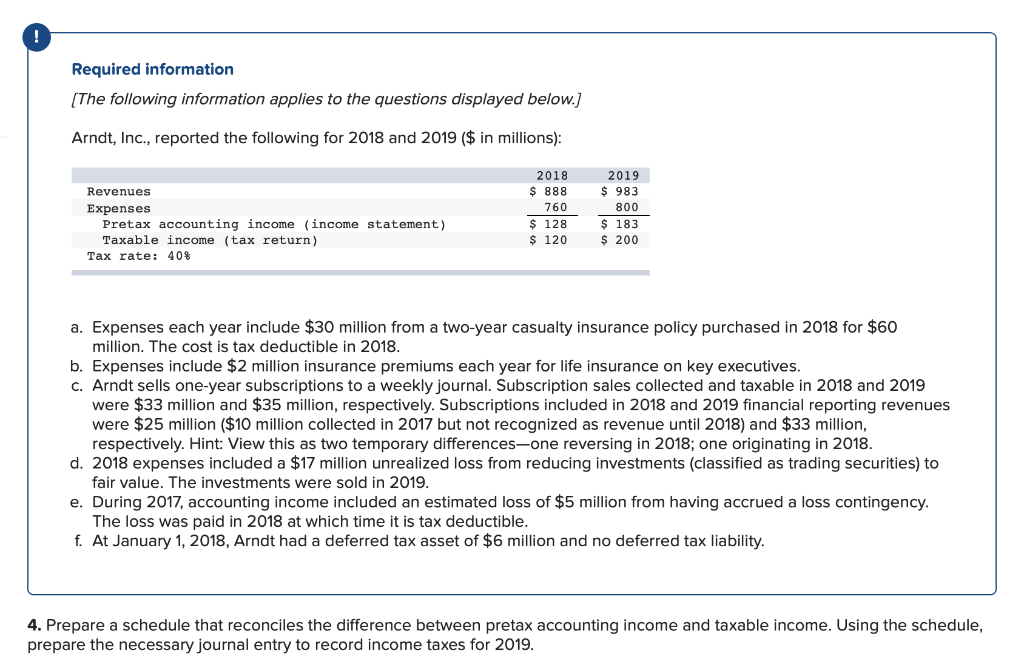

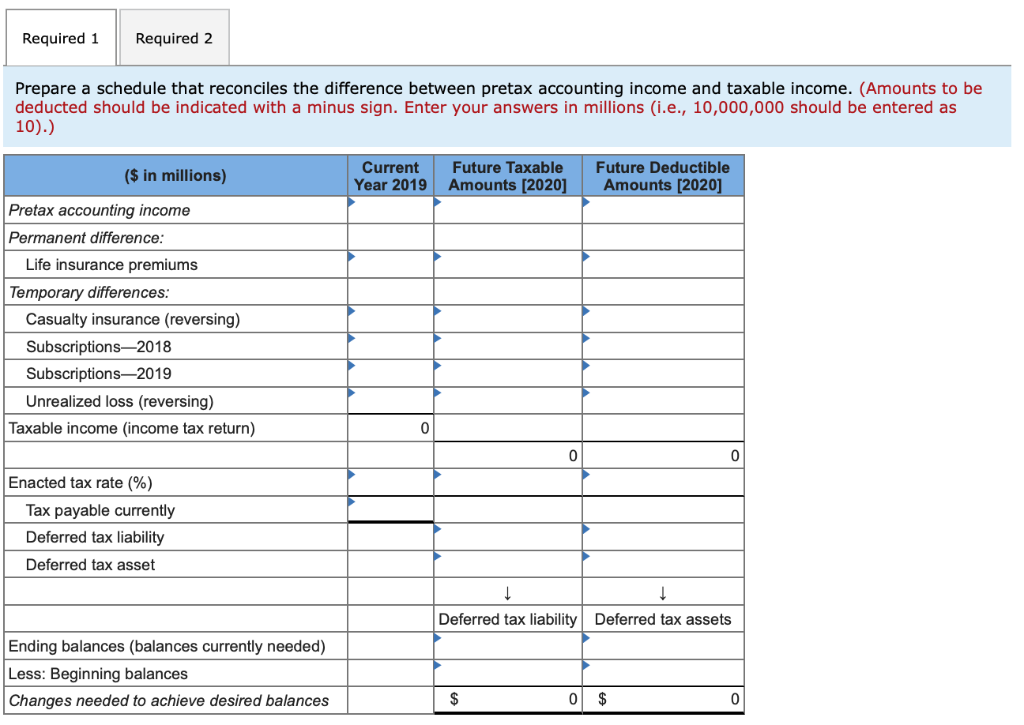

Required information [The following information applies to the questions displayed below.j Arndt, Inc., reported the following for 2018 and 2019 ($ in millions) 2018 $ 888 760 $983 800 183 $ 200 Revenues Expenses Pretax accounting income (income statement) Taxable income (tax return) 120 Tax rate: 40% a. Expenses each year include $30 million from a two-year casualty insurance policy purchased in 2018 for $60 million. The cost is tax deductible in 2018 D. Expenses include $2 million insurance premiums each year for life insurance on key executives c. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2018 and 2019 were $33 million and $35 million, respectively. Subscriptions included in 2018 and 2019 financial reporting revenues were $25 million ($10 million collected in 2017 but not recognized as revenue until 2018) and $33 million, respectively. Hint: View this as two temporary differences-one reversing in 2018; one originating in 2018 d. 2018 expenses included a $17 million unrealized loss from reducing investments (classified as trading securities) to e. During 2017, accounting income included an estimated loss of $5 million from having accrued a loss contingency f. At January 1, 2018, Arndt had a deferred tax asset of $6 million and no deferred tax liability. fair value. The investments were sold in 2019 The loss was paid in 2018 at which time it is tax deductible 4. Prepare a schedule that reconciles the difference between pretax accounting income and taxable income. Using the schedule, prepare the necessary journal entry to record income taxes for 2019 Required 1 Required 2 Prepare a schedule that reconciles the difference between pretax accounting income and taxable income. (Amounts to be deducted should be indicated with a minus sign. Enter your answers in millions (i.e., 10,000,000 should be entered as 10).) Current Year 2019 Future TaxableFuture Deductible Amounts [2020 ($ in millions) Amounts [202 Pretax accounting income Permanent difference Life insurance premiums Temporary differences: Casualty insurance (reversing) Subscriptions-2018 Subscriptions-2019 Unrealized loss (reversing) Taxable income (income tax return) Enacted tax rate (%) Tax payable currently Deferred tax liability Deferred tax asset Deferred tax liability Deferred tax assets Ending balances (balances currently needed) Less: Beginning balances Changes needed to achieve desired balances