Answered step by step

Verified Expert Solution

Question

1 Approved Answer

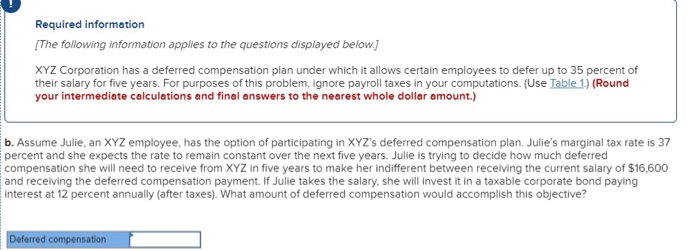

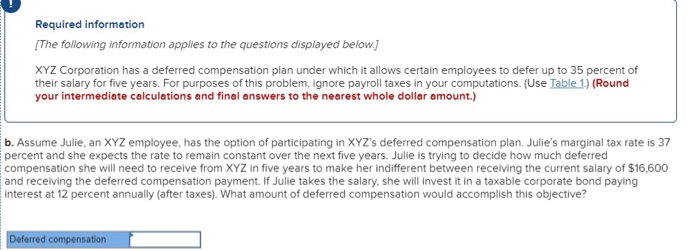

Required information The following information applies to the questions displayed below.] XYZ Corporation has a deferred compensation plan under which it allows certain employees to

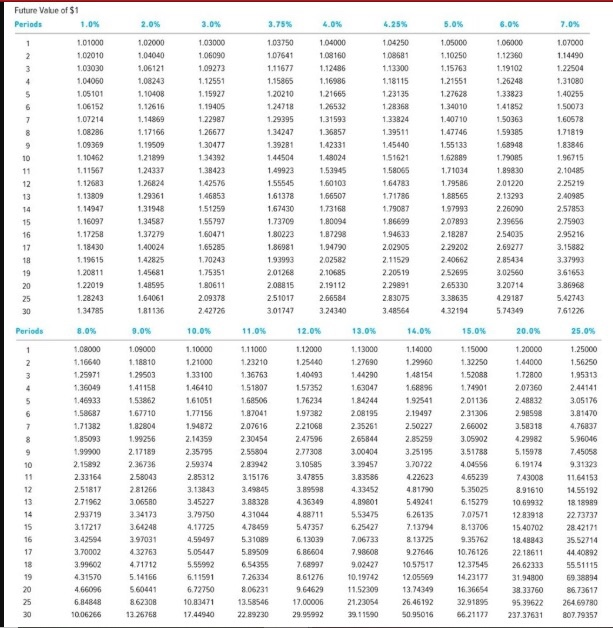

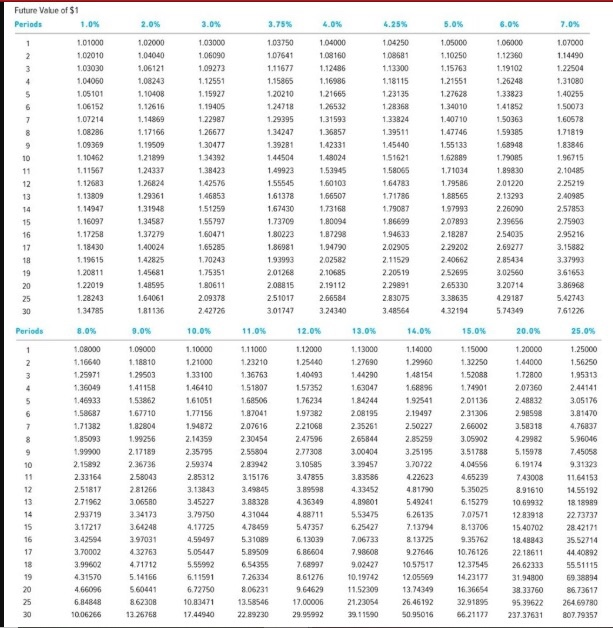

Required information The following information applies to the questions displayed below.] XYZ Corporation has a deferred compensation plan under which it allows certain employees to defer up to 35 percent of their salary for five years. For purposes of this problem, ignore payroll taxes in your computations. (Use Table 1.) (Round your intermediate calculations and final answers to the nearest whole dollar amount.) b. Assume Julie, an XYZ employee, has the option of participating in XYZ's deferred compensation plan. Julie's marginal tax rate is 37 percent and she expects the rate to remain constant over the next five years. Julie is trying to decide how much deferred compensation she will need to receive from XYZ in five years to make her indifferent between receiving the current salary of $16.600 and receiving the deferred compensation payment. If Julie takes the salary, she will invest it in a taxable corporate bond paying interest at 12 percent annually (after taxes). What amount of deferred compensation would accomplish this objective? Deferred compensation Future Value of $1 Periods 1.0% 2.0% 3.0% 3.75% 4.0% 4.25% 5.0% 6.0% 7.0% 101000 1,02010 1.03030 1.04060 1.05101 1.06152 1,07214 1.08286 1.09359 1.10462 1.11567 1.12683 1.13809 1.14947 1.16097 1.17258 1.18430 1.19615 1.20811 1.22019 1.28243 1.34785 1.02000 1.04040 1.06121 1,08243 1.10408 1.12616 1.14859 1.17166 1.19509 1.2 1899 1.24337 1.26824 1.29361 131948 1.34587 1.37279 1.40024 1.42825 1.45681 1.48595 1.64061 1 81136 103000 1.06090 1.09273 1.12551 1.15927 1.19405 1.22987 1.26677 1.30477 1.34392 1.38423 1.42576 1.46853 151259 1.55797 1.60471 1.65285 1.70243 1.75351 1.80611 2.09378 2.42726 103750 1.07641 1.11677 1.15865 1.20210 1.24718 1.29395 1.34247 1.39281 1.44504 1.49923 1.55545 1.61378 1.67430 1.73709 1.80223 1.86981 1.93993 2.01268 2015 2.51017 3.01747 104000 1.08160 1.12486 1.16986 1.21665 1.26532 1.31593 1.36857 1.42331 1.48024 1.53945 1.60100 1.66507 1.73168 1.80094 1.87298 1.94790 202582 2.10685 219112 2.66584 3.24340 104250 108581 1.13300 1.18115 1.23135 1.28368 133024 1.39511 1.45440 1.51621 1.58065 1.64783 1.71785 1.79087 196699 1.94633 2.02905 2.11529 2.20519 2.29891 2.83075 3.48564 1.05000 1.10250 1.15763 1.21551 1.27628 134010 1.40710 1.47746 1.55133 1.62889 1.71034 1.79586 1.88565 1.97993 2.07893 2.18287 2.29202 2.40662 2.52695 265330 3.38635 432194 106000 1.12360 1.19102 1.26248 133823 1.41852 1.50363 1.59385 1.68948 1.79085 1.89830 2.01220 2.13293 2.26090 2.39656 2.54035 2.69277 2,85434 3.02560 3.20714 4.29187 5.74349 1.07000 114490 1.22504 1.31080 1.40255 1.50073 1.60578 1.71819 1.83845 1.96715 2.10485 2.25219 2.40985 2.57853 2.75903 2.95216 3.15882 337993 3.61653 3.86968 5.42743 761226 Periods 8.0% 9.0% 10.0% 11.0% 12.0% 13.0% 14.0% 15.0* 20.0% 25.0% 1.08000 1.16600 1 25971 1.36049 1.46933 1.58687 1.71382 1.85093 1.99900 2.15892 2.33164 251817 2.71962 2.93719 3.17217 3.42594 3.70002 3.99602 4.31570 4.66096 6.34848 10.06256 1.09000 1.18810 1.29503 1.41158 1.53862 1.67710 1.82804 1.99256 2.17189 2.36736 2.58043 281266 306580 3.34173 3.64248 397031 432753 4.71712 5.14166 560441 8.62308 13.26768 1.10000 1.21000 1.33100 1.46410 1.61051 1.77156 194872 2.14359 2.35795 2.59374 2.85312 3. 11843 3.45227 3.79750 4.17725 4.59497 5.05447 5.55992 6.11591 6.72750 10.83471 17.44940 111000 123210 1.36763 1.51807 1.68506 1.87041 2.07616 2.30454 2.55804 2.83942 315176 3.49845 3.88328 4.31044 478459 531089 5.89509 6.54355 7.26334 8.06231 1358546 22.89230 112000 125440 1.40093 1.57352 1.76234 1.97382 2.21068 2.47596 2.77308 3.10585 3.47855 3.89598 4.36349 498711 5.47357 6.13039 6.86604 7.68997 861276 9.64629 1700006 29.95992 1.13000 1.27690 1.44290 163047 1.84244 208195 235261 265844 3.00404 3.39457 3.83586 4.33452 4,89601 5.53475 6.25427 7.06733 7.98608 9.02427 10.19742 11,52309 21.23054 39.11590 1.14000 1.29960 1.48154 1.6899 1.92541 2.19497 2.50227 2.85259 3.25195 3.70722 422623 481790 5.49241 6.26135 7.13794 813725 9.27646 10.57517 1205569 13.74349 26 46192 50.95016 1.15000 1.32250 1.52088 1.74901 2.01136 2.31306 266002 3.05902 351788 404556 4.65239 535025 6.15279 7,07571 8.13706 9.35762 10.76126 12.37545 14.23177 16.36654 32.91895 66.21177 1.20000 1.44000 1.72800 202360 2.48832 2.98598 3.58318 4.29982 5.15978 6.19174 743008 8.91610 10.69937 12.83918 15.40702 18.48843 22.18611 26,62333 3194300 38 33760 95 39622 237.37631 1.25000 1.56250 1.95313 2.44141 3.05176 3.81470 4.76837 5.96046 7.45058 9.31323 11.64153 14 55192 18. 18989 22.73737 28.42171 35.52714 44.40892 55 51115 6938894 86.73617 26469780 3 07.79357

Required information The following information applies to the questions displayed below.] XYZ Corporation has a deferred compensation plan under which it allows certain employees to defer up to 35 percent of their salary for five years. For purposes of this problem, ignore payroll taxes in your computations. (Use Table 1.) (Round your intermediate calculations and final answers to the nearest whole dollar amount.) b. Assume Julie, an XYZ employee, has the option of participating in XYZ's deferred compensation plan. Julie's marginal tax rate is 37 percent and she expects the rate to remain constant over the next five years. Julie is trying to decide how much deferred compensation she will need to receive from XYZ in five years to make her indifferent between receiving the current salary of $16.600 and receiving the deferred compensation payment. If Julie takes the salary, she will invest it in a taxable corporate bond paying interest at 12 percent annually (after taxes). What amount of deferred compensation would accomplish this objective? Deferred compensation Future Value of $1 Periods 1.0% 2.0% 3.0% 3.75% 4.0% 4.25% 5.0% 6.0% 7.0% 101000 1,02010 1.03030 1.04060 1.05101 1.06152 1,07214 1.08286 1.09359 1.10462 1.11567 1.12683 1.13809 1.14947 1.16097 1.17258 1.18430 1.19615 1.20811 1.22019 1.28243 1.34785 1.02000 1.04040 1.06121 1,08243 1.10408 1.12616 1.14859 1.17166 1.19509 1.2 1899 1.24337 1.26824 1.29361 131948 1.34587 1.37279 1.40024 1.42825 1.45681 1.48595 1.64061 1 81136 103000 1.06090 1.09273 1.12551 1.15927 1.19405 1.22987 1.26677 1.30477 1.34392 1.38423 1.42576 1.46853 151259 1.55797 1.60471 1.65285 1.70243 1.75351 1.80611 2.09378 2.42726 103750 1.07641 1.11677 1.15865 1.20210 1.24718 1.29395 1.34247 1.39281 1.44504 1.49923 1.55545 1.61378 1.67430 1.73709 1.80223 1.86981 1.93993 2.01268 2015 2.51017 3.01747 104000 1.08160 1.12486 1.16986 1.21665 1.26532 1.31593 1.36857 1.42331 1.48024 1.53945 1.60100 1.66507 1.73168 1.80094 1.87298 1.94790 202582 2.10685 219112 2.66584 3.24340 104250 108581 1.13300 1.18115 1.23135 1.28368 133024 1.39511 1.45440 1.51621 1.58065 1.64783 1.71785 1.79087 196699 1.94633 2.02905 2.11529 2.20519 2.29891 2.83075 3.48564 1.05000 1.10250 1.15763 1.21551 1.27628 134010 1.40710 1.47746 1.55133 1.62889 1.71034 1.79586 1.88565 1.97993 2.07893 2.18287 2.29202 2.40662 2.52695 265330 3.38635 432194 106000 1.12360 1.19102 1.26248 133823 1.41852 1.50363 1.59385 1.68948 1.79085 1.89830 2.01220 2.13293 2.26090 2.39656 2.54035 2.69277 2,85434 3.02560 3.20714 4.29187 5.74349 1.07000 114490 1.22504 1.31080 1.40255 1.50073 1.60578 1.71819 1.83845 1.96715 2.10485 2.25219 2.40985 2.57853 2.75903 2.95216 3.15882 337993 3.61653 3.86968 5.42743 761226 Periods 8.0% 9.0% 10.0% 11.0% 12.0% 13.0% 14.0% 15.0* 20.0% 25.0% 1.08000 1.16600 1 25971 1.36049 1.46933 1.58687 1.71382 1.85093 1.99900 2.15892 2.33164 251817 2.71962 2.93719 3.17217 3.42594 3.70002 3.99602 4.31570 4.66096 6.34848 10.06256 1.09000 1.18810 1.29503 1.41158 1.53862 1.67710 1.82804 1.99256 2.17189 2.36736 2.58043 281266 306580 3.34173 3.64248 397031 432753 4.71712 5.14166 560441 8.62308 13.26768 1.10000 1.21000 1.33100 1.46410 1.61051 1.77156 194872 2.14359 2.35795 2.59374 2.85312 3. 11843 3.45227 3.79750 4.17725 4.59497 5.05447 5.55992 6.11591 6.72750 10.83471 17.44940 111000 123210 1.36763 1.51807 1.68506 1.87041 2.07616 2.30454 2.55804 2.83942 315176 3.49845 3.88328 4.31044 478459 531089 5.89509 6.54355 7.26334 8.06231 1358546 22.89230 112000 125440 1.40093 1.57352 1.76234 1.97382 2.21068 2.47596 2.77308 3.10585 3.47855 3.89598 4.36349 498711 5.47357 6.13039 6.86604 7.68997 861276 9.64629 1700006 29.95992 1.13000 1.27690 1.44290 163047 1.84244 208195 235261 265844 3.00404 3.39457 3.83586 4.33452 4,89601 5.53475 6.25427 7.06733 7.98608 9.02427 10.19742 11,52309 21.23054 39.11590 1.14000 1.29960 1.48154 1.6899 1.92541 2.19497 2.50227 2.85259 3.25195 3.70722 422623 481790 5.49241 6.26135 7.13794 813725 9.27646 10.57517 1205569 13.74349 26 46192 50.95016 1.15000 1.32250 1.52088 1.74901 2.01136 2.31306 266002 3.05902 351788 404556 4.65239 535025 6.15279 7,07571 8.13706 9.35762 10.76126 12.37545 14.23177 16.36654 32.91895 66.21177 1.20000 1.44000 1.72800 202360 2.48832 2.98598 3.58318 4.29982 5.15978 6.19174 743008 8.91610 10.69937 12.83918 15.40702 18.48843 22.18611 26,62333 3194300 38 33760 95 39622 237.37631 1.25000 1.56250 1.95313 2.44141 3.05176 3.81470 4.76837 5.96046 7.45058 9.31323 11.64153 14 55192 18. 18989 22.73737 28.42171 35.52714 44.40892 55 51115 6938894 86.73617 26469780 3 07.79357

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started