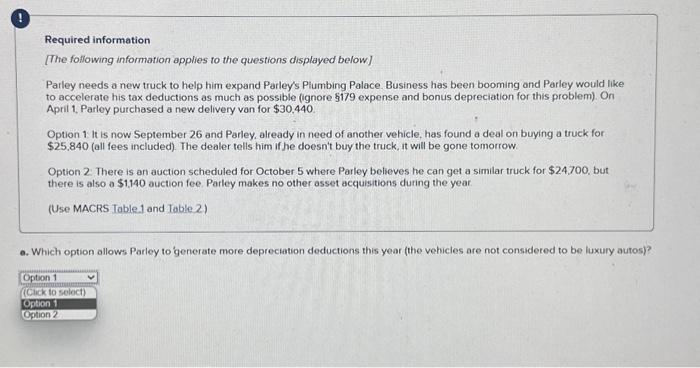

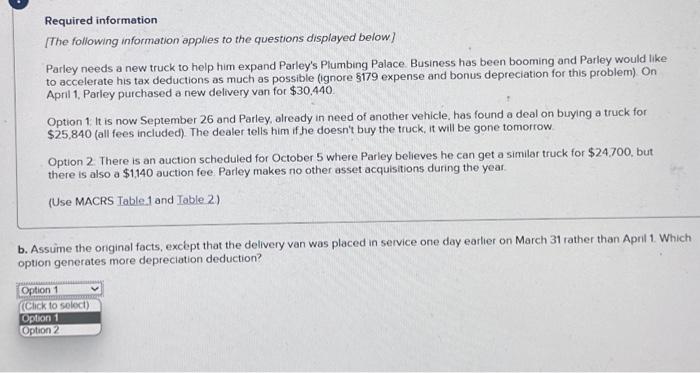

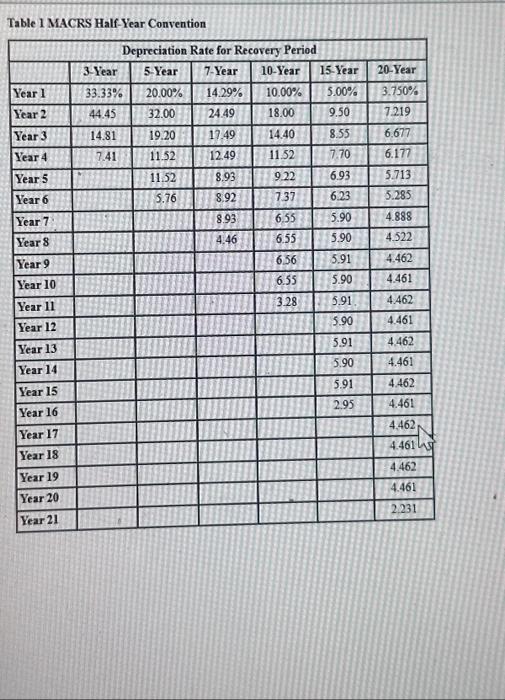

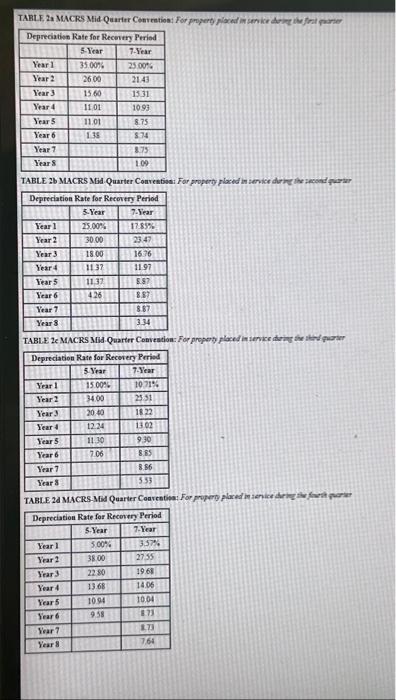

Required information [The following information applies to the questions displayed below] Parley needs a new truck to help him expand Parley's Plumbing Palace. Business has been booming and Parley would like to accelerate his tax deductions as much as possible (ignore $179 expense and bonus depreciation for this problem). On April 1, Parley purchased a new delivery van for $30.440. Option 1 it is now September 26 and Parley, already in need of another vehicle, has found a deal on buying a truck for $25,840 (all fees included). The dealer tells him if he doesn't buy the truck, it will be gone tomorrow. Option 2 . There is an auction scheduled for October 5 where Parley believes he can get a similar truck for $24,700, but there is also a $1,140 auction fee. Parley makes no other asset acquisitions during the year (Use MACRS Table. 1 and Table 2 ) Which option allows Parley to 'generate more deprectation deductions this year (the vehicles are not considered to be luxury autos)? Required information [The following information applies to the questions displayed below] Parley needs a new truck to help him expand Parley's Plumbing Palace. Business has been booming and Parley would like to accelerate his tax deductions as much as possible (ignore $179 expense and bonus depreciation for this problem) On April 1, Parley purchased a new delivery van for $30.440 Option 1 . It is now September 26 and Parley, already in need of another vehicle, has found a deal on buying a truck for $25,840 (all fees included). The dealer tells him if he doesn't buy the truck, it will be gone tomorrow. Option 2. There is an auction scheduled for October 5 where Parley believes he can get a similar truck for $24,700, but there is also a $1,140 auction fee. Parley makes no other asset acquisitions during the year. (Use MACRS Table 1 and Table 2) b. Assume the onginal facts, except that the delivery van was placed in service one day earlier on March 31 rather than April 1. Which option generates more depreciation deduction? Table 1 MACRS Half-Year Convention \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Depreciation Rate for Reconer Period } \\ \hline & 5 . Year & 7. Year \\ \hline Year 1 & 35.005 & 25005 \\ \hline Year 2 & 2600 & 21.43 \\ \hline Year 3 & 15.60 & 15.31 \\ \hline Year 4 & 11.01 & 10.93 \\ \hline Year 5 & 11.01 & 8.75 \\ \hline Year 6 & 135 & 874 \\ \hline Year 7 & & 875 \\ \hline Year 8 & & 109 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Depreciation Rate for Recover Period } \\ \hline & 5. Year & 7. Year \\ \hline Year 1 & 25.00% & 1785% \\ \hline Year 2 & 30.00 & 23.47 \\ \hline Year 3 & 18.00 & 1636 \\ \hline Year 4 & 1137 & 11.97 \\ \hline Year 5 & 11.37 & 8.87 \\ \hline Year 6 & 426 & 8.87 \\ \hline Year 7 & & 8.87 \\ \hline Year 8 & & 3.3 \\ \hline \end{tabular} TABLE 2e MACRS Mid Quartrr Convention: For propeb floced in tenice dories the the purar \begin{tabular}{|l|c|c|} \hline \multicolumn{3}{|c|}{ Depreciacion Rate for Recorery Peried } \\ \hline & 5 Yrar & 7.Year \\ \hline Year 1 & 1500%6 & 1071% \\ \hline Year 2 & 34.00 & 25.51 \\ \hline Year 3 & 20.40 & 18.22 \\ \hline Year 4 & 12.24 & 13.2 \\ \hline Year 5 & 11.30 & 9.30 \\ \hline Year 6 & 7.06 & 8.85 \\ \hline Year 7 & & 8.86 \\ \hline Year 8 & & 533 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline \multicolumn{2}{|c|}{ Depreciation Rate for Recovery Period } \\ \hline & 5-Year & 7. Year \\ \hline Year 1 & 5.00% & 357% \\ \hline Year 2 & 38.00 & 2755 \\ \hline Year 3 & 22.80 & 19.61 \\ \hline Year 4 & 13.68 & 14.06 \\ \hline Year 5 & 10.94 & 10.04 \\ \hline Year 6 & 958 & 173 \\ \hline Year 7 & & 1.73 \\ \hline Year 8 & & 7.64 \\ \hline \end{tabular}