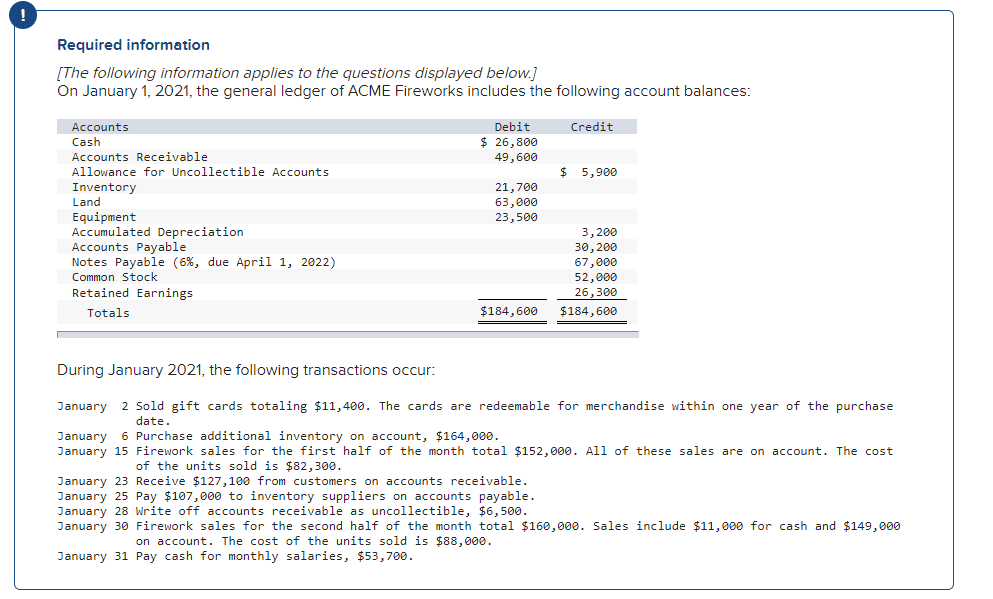

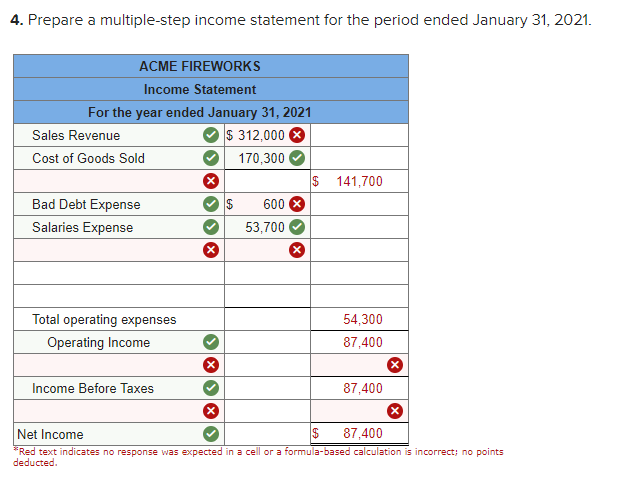

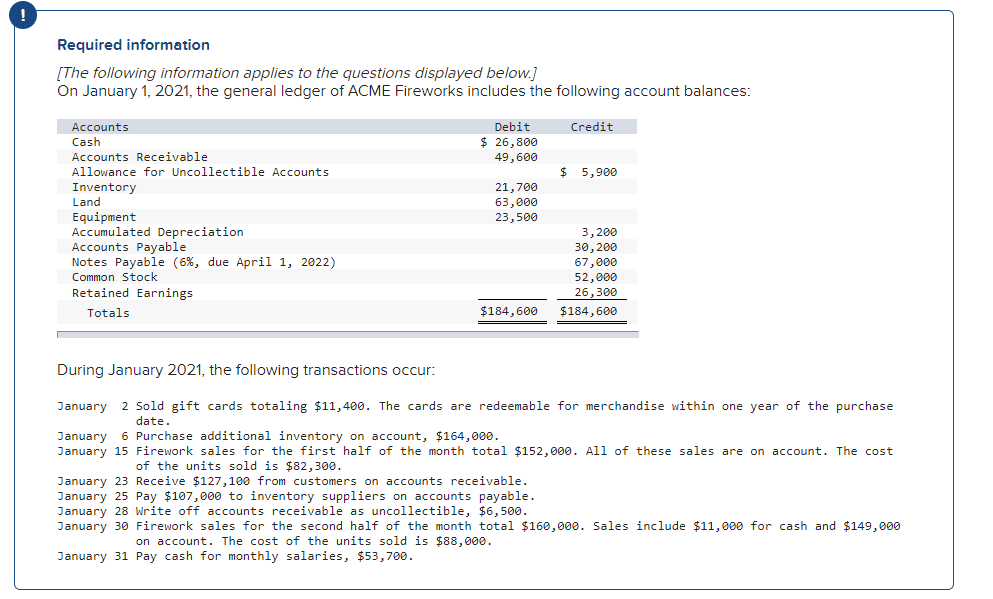

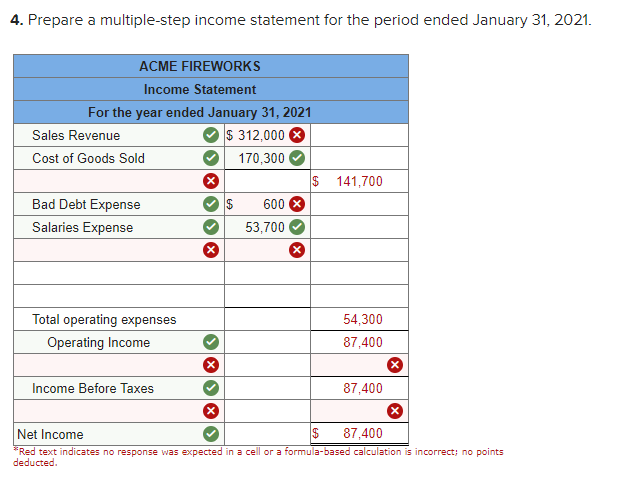

Required information [The following information applies to the questions displayed below.] On January 1, 2021, the general ledger of ACME Fireworks includes the following account balances: During January 2021 , the following transactions occur: January 2 Sold gift cards totaling $11,400. The cards are redeemable for merchandise within one year of the purchase date. January 6 Purchase additional inventory on account, $164,000. January 15 Firework sales for the first half of the month total $152,000. All of these sales are on account. The cost of the units sold is $82,300. January 23 Receive $127,100 from customers on accounts receivable. January 25 Pay $107,000 to inventory suppliers on accounts payable. January 28 Write off accounts receivable as uncollectible, $6,500. January 30 Firework sales for the second half of the month total $160,000. Sales include $11,000 for cash and $149,000 on account. The cost of the units sold is $88,000. January 31 Pay cash for monthly salaries, $53,700. 4. Prepare a multiple-step income statement for the period ended January 31, 2021. incorrect; no points Required information [The following information applies to the questions displayed below.] On January 1, 2021, the general ledger of ACME Fireworks includes the following account balances: During January 2021 , the following transactions occur: January 2 Sold gift cards totaling $11,400. The cards are redeemable for merchandise within one year of the purchase date. January 6 Purchase additional inventory on account, $164,000. January 15 Firework sales for the first half of the month total $152,000. All of these sales are on account. The cost of the units sold is $82,300. January 23 Receive $127,100 from customers on accounts receivable. January 25 Pay $107,000 to inventory suppliers on accounts payable. January 28 Write off accounts receivable as uncollectible, $6,500. January 30 Firework sales for the second half of the month total $160,000. Sales include $11,000 for cash and $149,000 on account. The cost of the units sold is $88,000. January 31 Pay cash for monthly salaries, $53,700. 4. Prepare a multiple-step income statement for the period ended January 31, 2021. incorrect; no points