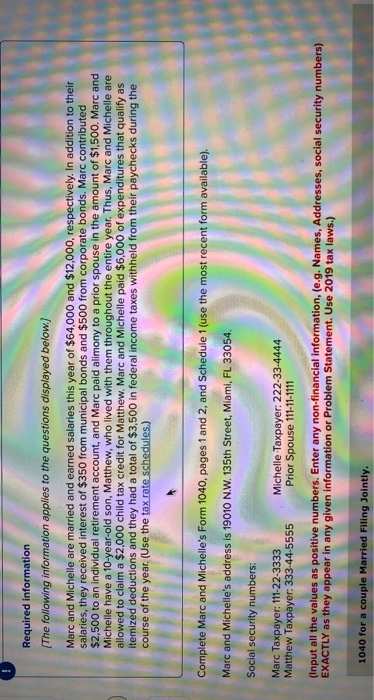

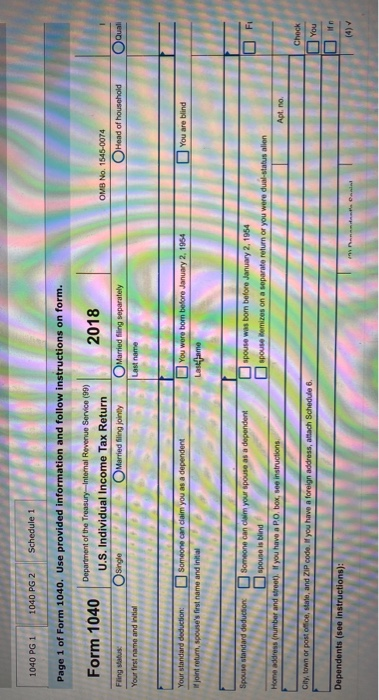

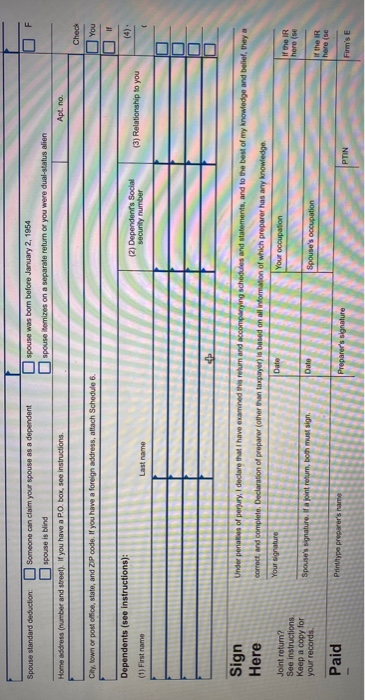

Required information (The following information applies to the questions displayed below) Marc and Michelle are married and earned salaries this year of $64.000 and $12,000, respectively. In addition to their salaries, they received interest of $350 from municipal bonds and $500 from corporate bonds. Marc contributed $2,500 to an individual retirement account, and Marc paid alimony to a prior spouse in the amount of $1,500. Marc and Michelle have a 10-year-old son, Matthew, who lived with them throughout the entire year. Thus, Marc and Michelle are allowed to claim a $2,000 child tax credit for Matthew. Marc and Michelle paid $6,000 of expenditures that qualify as itemized deductions and they had a total of $3,500 in federal income taxes withheld from their paychecks during the course of the year. (Use the tax rate schedules.) Complete Marc and Michelle's Form 1040, pages 1 and 2, and Schedule 1 (use the most recent form available). Marc and Michelle's address is 19010 N.W. 135th Street, Miami, FL 33054. Social security numbers: Marc Taxpayer: 111-22-3333 Matthew Taxpayer: 333-44-5555 Michelle Taxpayer: 222-33-4444 Prior Spouse 111-11-1111 (Input all the values as positive numbers. Enter any non-financial Information, (e.g. Names, Addresses, social security numbers) EXACTLY as they appear in any given information or Problem Statement. Use 2019 tax laws.) 1040 for a couple Married Filing Jointly. F Spouse standard deduction: Someone can claim your spouse as a dependent spouse is blind Home address number and street). If you have a P.O.box, see instructions spouse was born before January 2, 1954 spouse itemizes on a separate return or you were dual-status alien Apt. no. Check City, town or post office, state, and ZIP code. If you have a foreign address, attach Schedule 6. You Dependents (see instructions): (2) Dependent's Social security number (3) Relationship to you (1) First name PP Sign Here Under penalties of perjury, I declare that I have examined this reluma accompanying schedules and statements, and to the best of my knowledge and belief, they a correct, and complete Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge Your signature Your occupation If the IR Joint return? See instructions Keep a copy for your records. Spouse's gnature. If a joint ret Spouse's of the IR Paid Printtype preparer's name