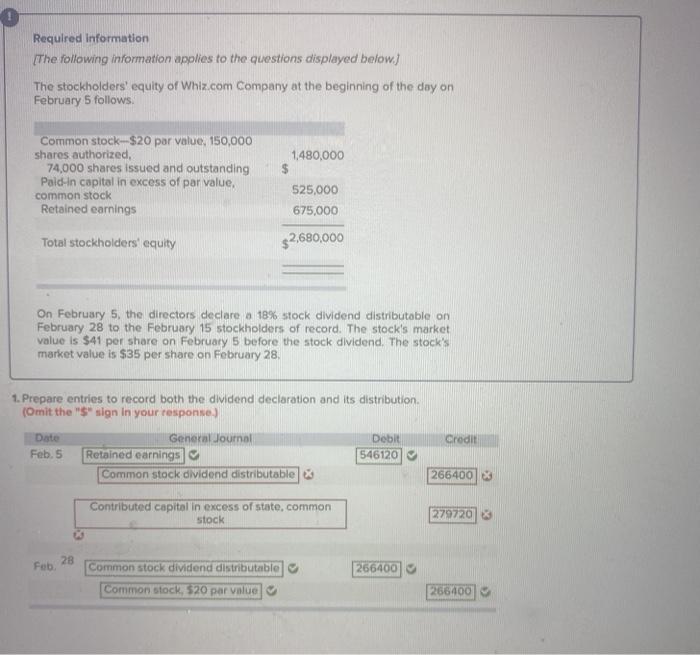

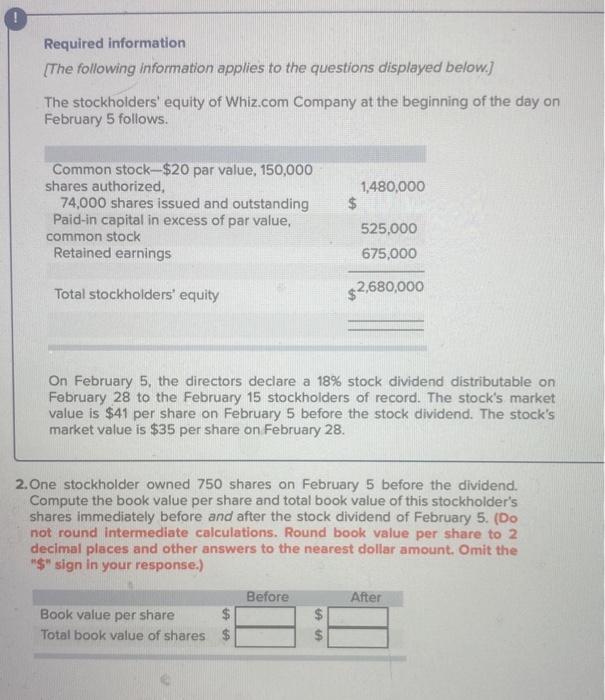

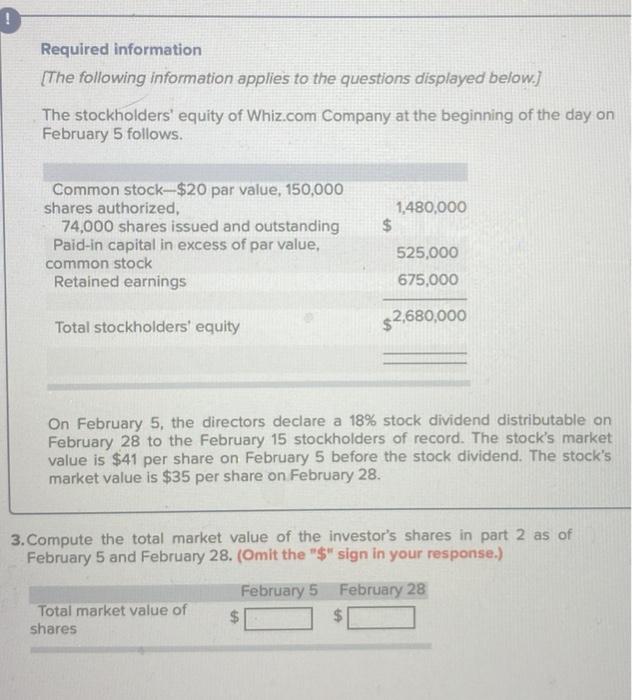

Required information The following information applies to the questions displayed below.) The stockholders' equity of Whiz.com Company at the beginning of the day on February 5 follows Common stock-$20 par value, 150,000 shares authorized 74,000 shares issued and outstanding Paid in capital in excess of par value. common stock Retained earnings 1,480,000 $ 525,000 675,000 Total stockholders' equity $2,680,000 On February 5, the directors declare a 18% stock dividend distributoble on February 28 to the February 15 stockholders of record. The stock's market value is $41 per share on February 5 before the stock dividend. The stock's market value is $35 per share on February 28, 1. Prepare entries to record both the dividend declaration and its distribution (Omit the "S" sign in your response.) Credit Date Feb. 5 General Journal Retained earnings Common stock dividend distributable Debit 546120 266400 Contributed capital in excess of state.common stock 279720 Feb 28 Common stock dividend distributable 266400 Common stock, 520 par value 266400 Required information [The following information applies to the questions displayed below.) The stockholders' equity of Whiz.com Company at the beginning of the day on February 5 follows. Common stock-$20 par value, 150,000 shares authorized 74,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings 1,480,000 $ 525,000 675,000 Total stockholders' equity $2,680,000 On February 5, the directors declare a 18% stock dividend distributable on February 28 to the February 15 stockholders of record. The stock's market value is $41 per share on February 5 before the stock dividend. The stock's market value is $35 per share on February 28. 2. One stockholder owned 750 shares on February 5 before the dividend. Compute the book value per share and total book value of this stockholder's shares immediately before and after the stock dividend of February 5. (Do not round Intermediate calculations. Round book value per share to 2 decimal places and other answers to the nearest dollar amount. Omit the "$" sign in your response.) Before After Book value per share $ Total book value of shares $ Required information [The following information applies to the questions displayed below.) The stockholders' equity of Whiz.com Company at the beginning of the day on February 5 follows. 1.480,000 $ Common stock-$20 par value, 150,000 shares authorized 74,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings 525,000 675,000 Total stockholders' equity $2,680,000 On February 5, the directors declare a 18% stock dividend distributable on February 28 to the February 15 stockholders of record. The stock's market value is $41 per share on February 5 before the stock dividend. The stock's market value is $35 per share on February 28. 3. Compute the total market value of the investor's shares in part 2 as of February 5 and February 28. (Omit the "$" sign in your response.) Total market value of shares February 5 February 28 $