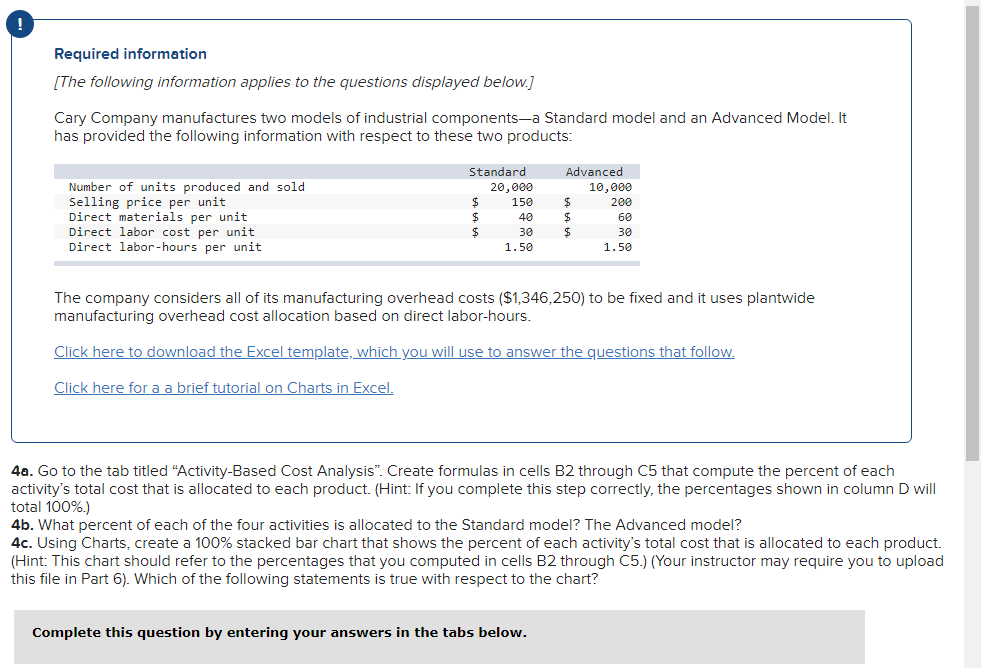

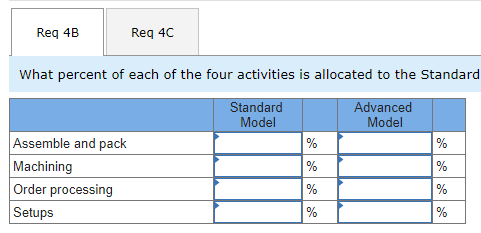

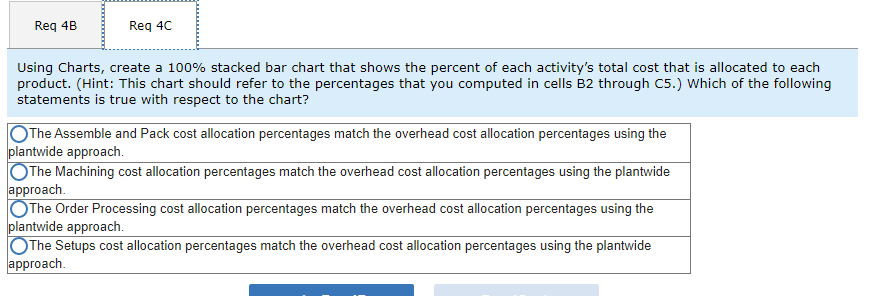

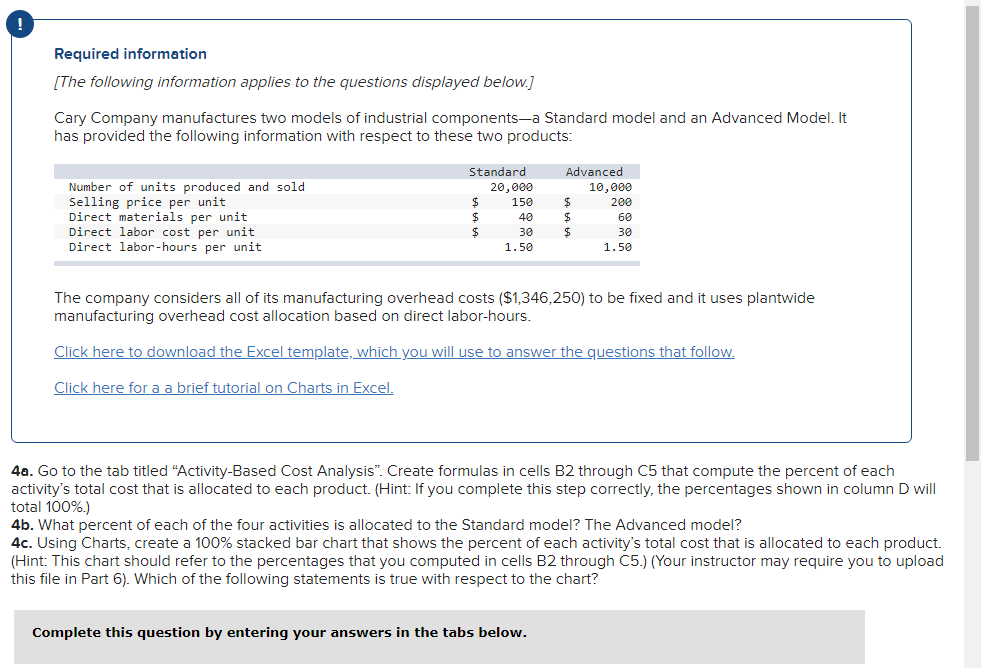

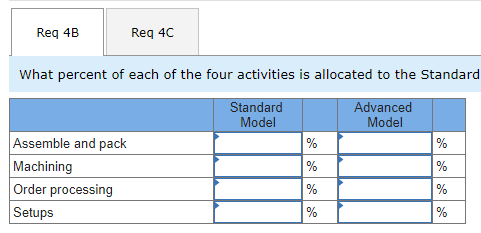

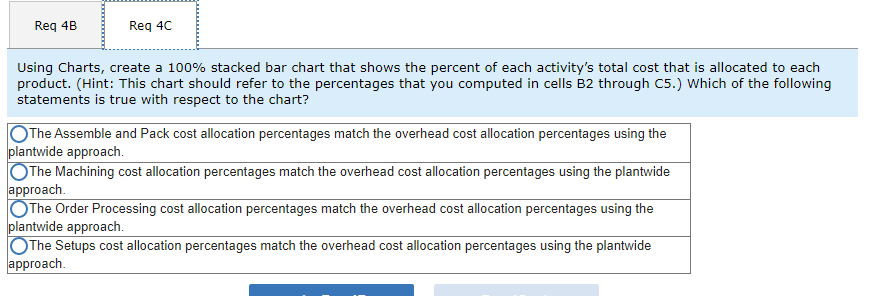

Required information [The following information applies to the questions displayed below.] Cary Company manufactures two models of industrial components-a Standard model and an Advanced Model. It has provided the following information with respect to these two products: The company considers all of its manufacturing overhead costs ($1,346,250) to be fixed and it uses plantwide manufacturing overhead cost allocation based on direct labor-hours. Click here to download the Excel template, which you will use to answer the questions that follow. Click here for a a brief tutorial on Charts in Excel. 4a. Go to the tab titled "Activity-Based Cost Analysis". Create formulas in cells B2 through C5 that compute the percent of each activity's total cost that is allocated to each product. (Hint: If you complete this step correctly, the percentages shown in column D will total 100%.) 4b. What percent of each of the four activities is allocated to the Standard model? The Advanced model? 4c. Using Charts, create a 100% stacked bar chart that shows the percent of each activity's total cost that is allocated to each product. (Hint: This chart should refer to the percentages that you computed in cells B2 through C5.) (Your instructor may require you to uploac this file in Part 6). Which of the following statements is true with respect to the chart? Complete this question by entering your answers in the tabs below. What percent of each of the four activities is allocated to the Standarc Using Charts, create a 100% stacked bar chart that shows the percent of each activity's total cost that is allocated to each product. (Hint: This chart should refer to the percentages that you computed in cells B2 through C5.) Which of the following statements is true with respect to the chart? Required information [The following information applies to the questions displayed below.] Cary Company manufactures two models of industrial components-a Standard model and an Advanced Model. It has provided the following information with respect to these two products: The company considers all of its manufacturing overhead costs ($1,346,250) to be fixed and it uses plantwide manufacturing overhead cost allocation based on direct labor-hours. Click here to download the Excel template, which you will use to answer the questions that follow. Click here for a a brief tutorial on Charts in Excel. 4a. Go to the tab titled "Activity-Based Cost Analysis". Create formulas in cells B2 through C5 that compute the percent of each activity's total cost that is allocated to each product. (Hint: If you complete this step correctly, the percentages shown in column D will total 100%.) 4b. What percent of each of the four activities is allocated to the Standard model? The Advanced model? 4c. Using Charts, create a 100% stacked bar chart that shows the percent of each activity's total cost that is allocated to each product. (Hint: This chart should refer to the percentages that you computed in cells B2 through C5.) (Your instructor may require you to uploac this file in Part 6). Which of the following statements is true with respect to the chart? Complete this question by entering your answers in the tabs below. What percent of each of the four activities is allocated to the Standarc Using Charts, create a 100% stacked bar chart that shows the percent of each activity's total cost that is allocated to each product. (Hint: This chart should refer to the percentages that you computed in cells B2 through C5.) Which of the following statements is true with respect to the chart