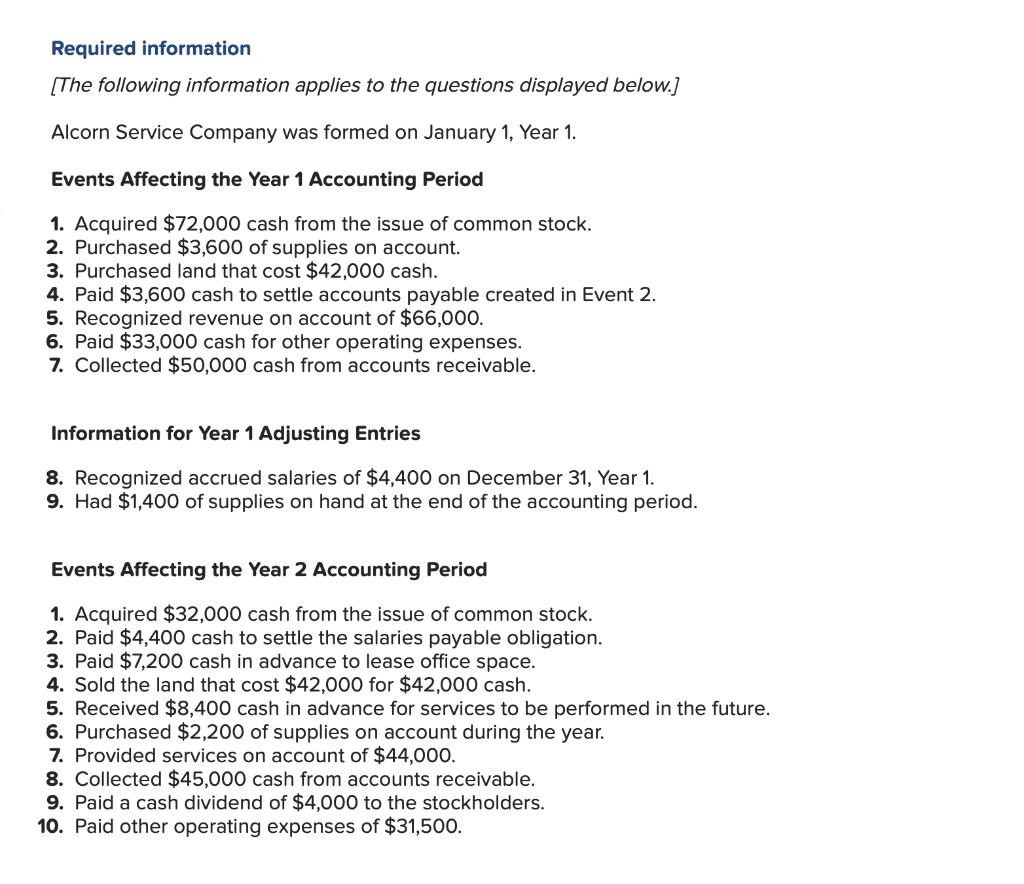

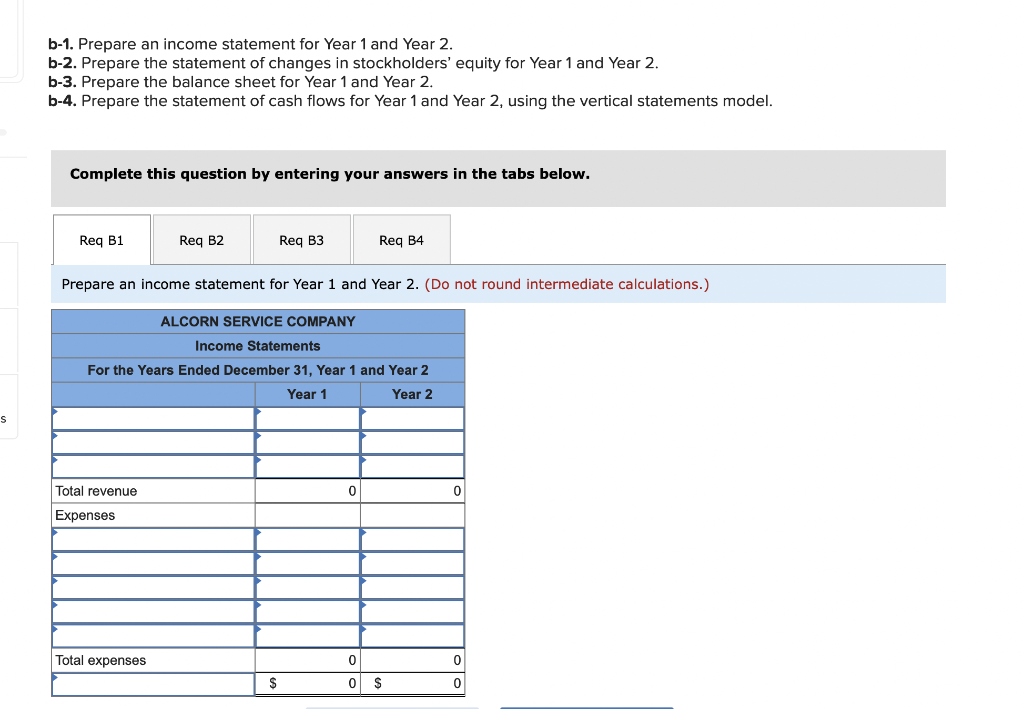

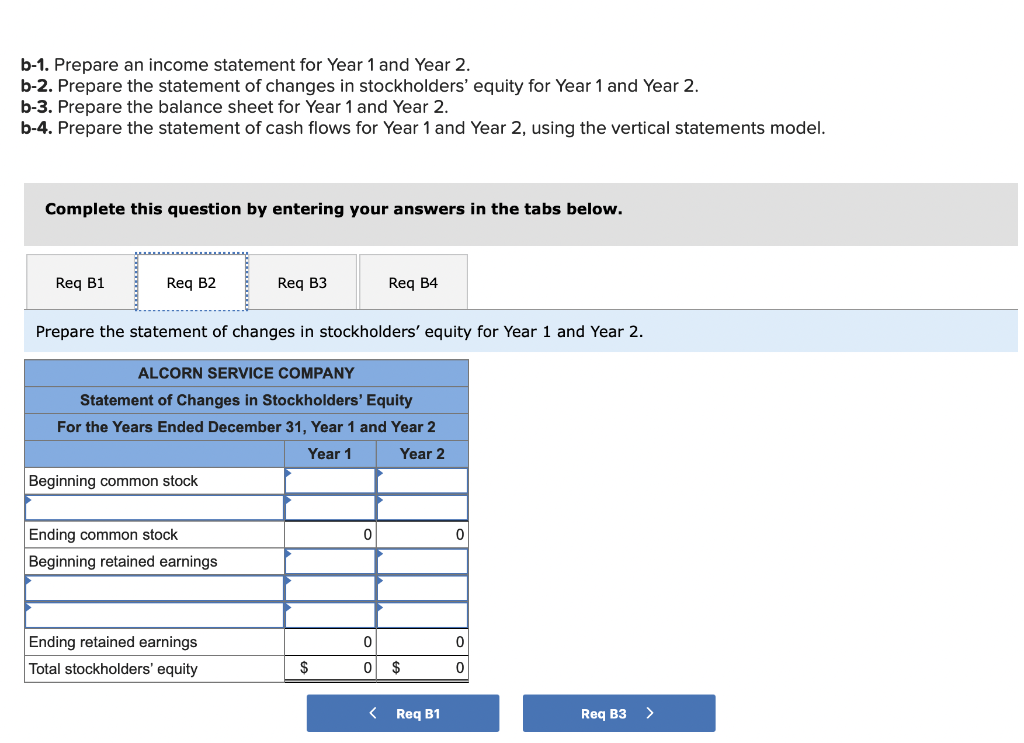

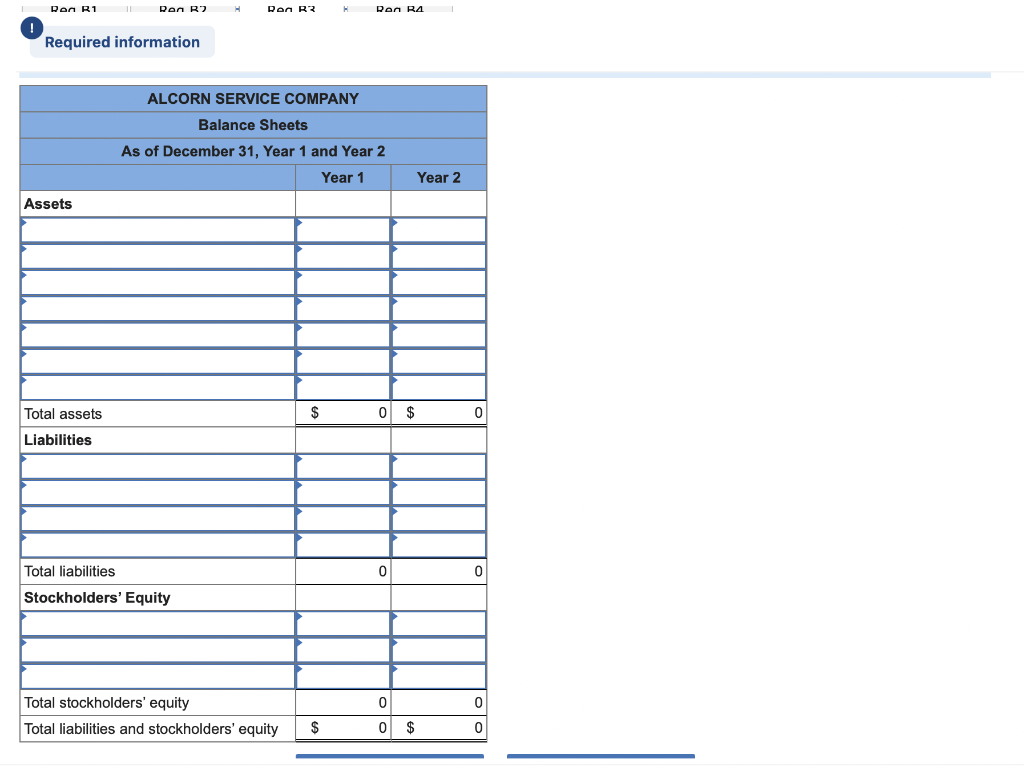

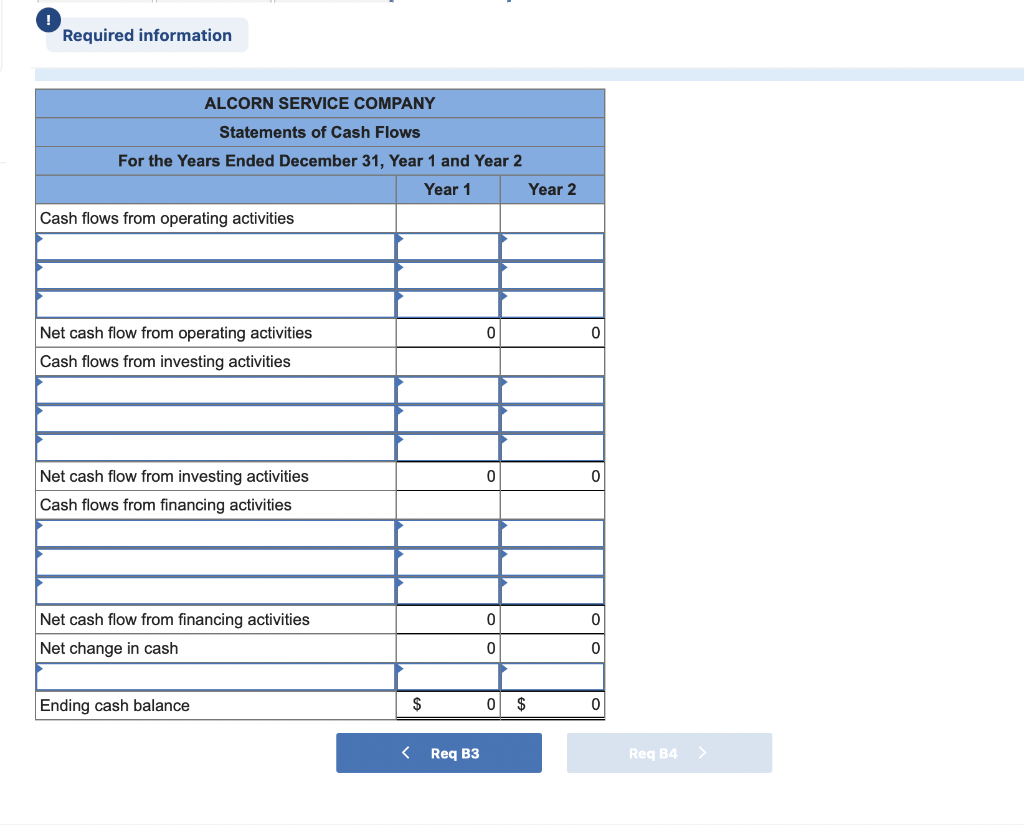

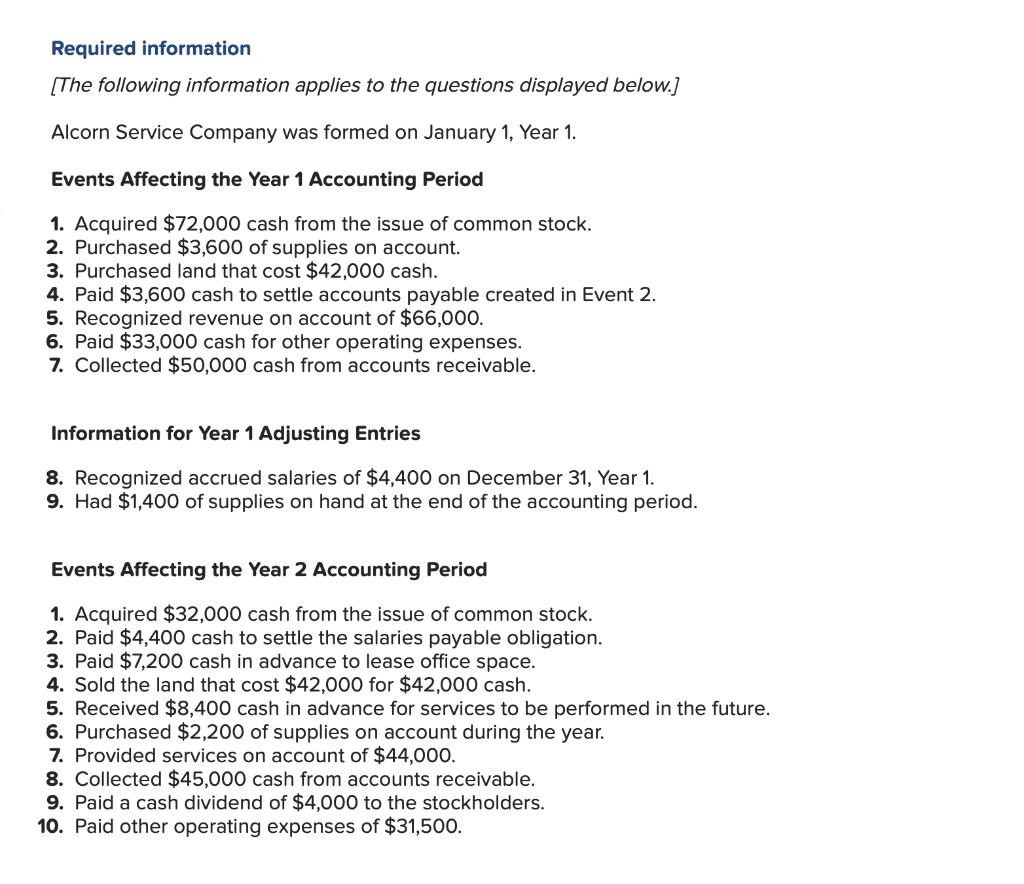

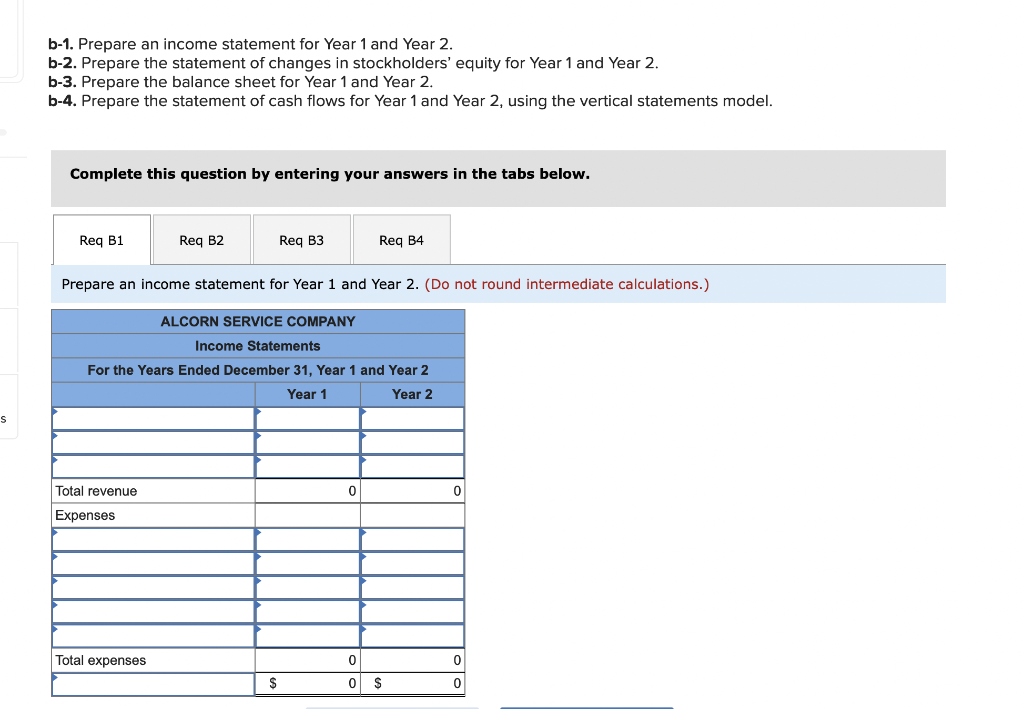

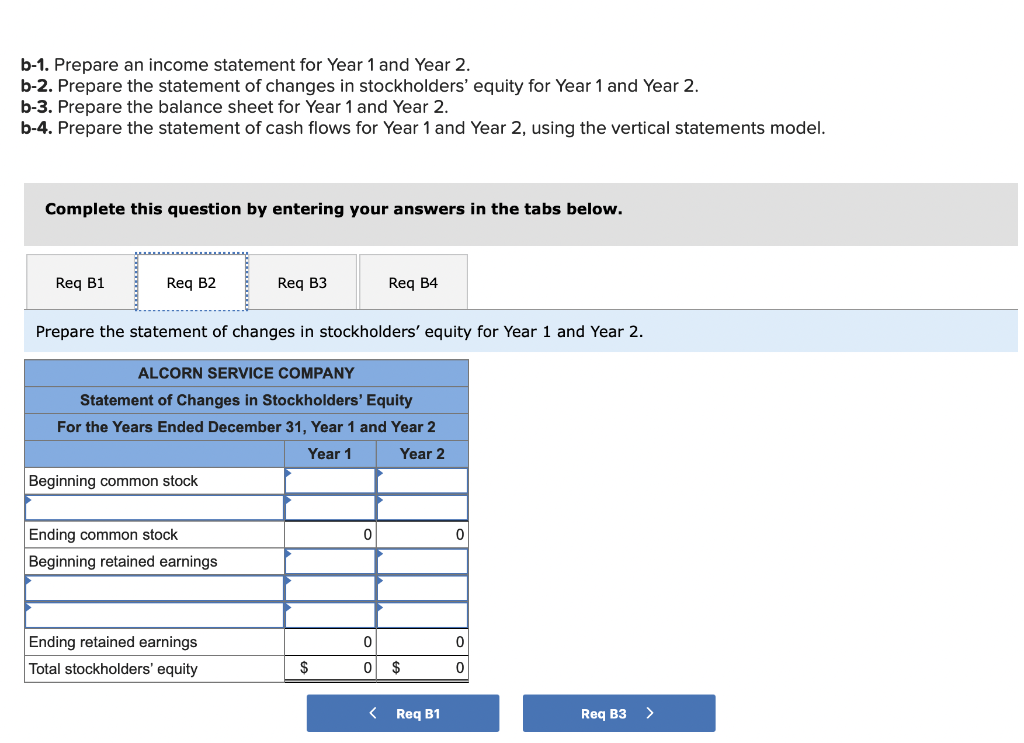

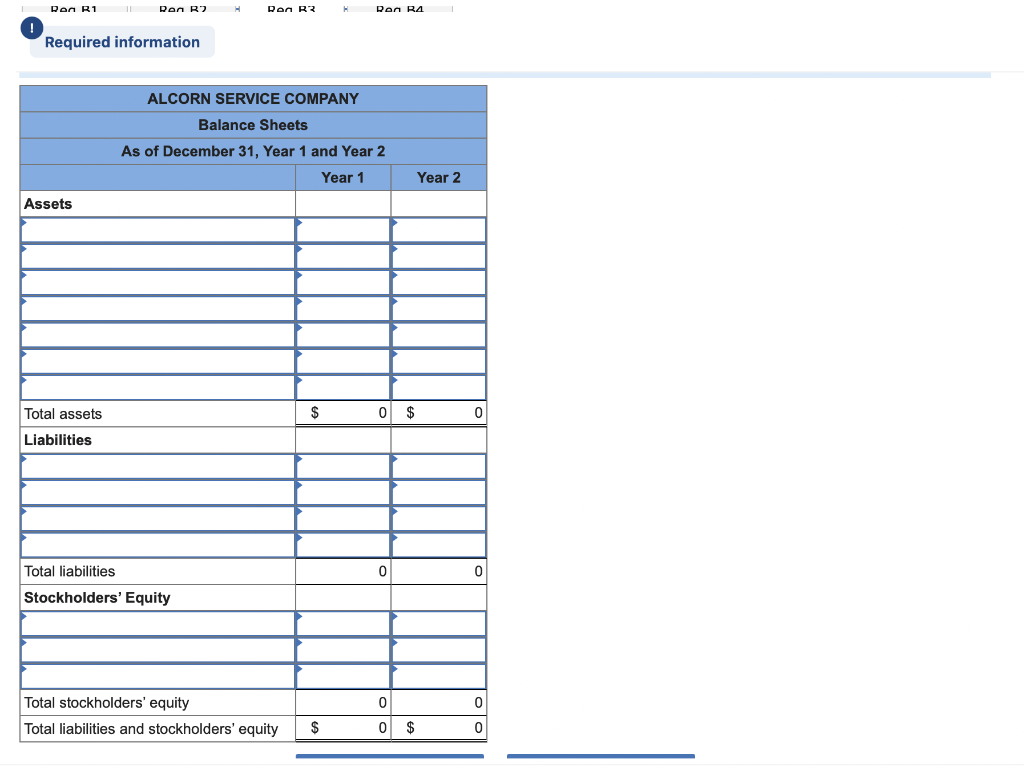

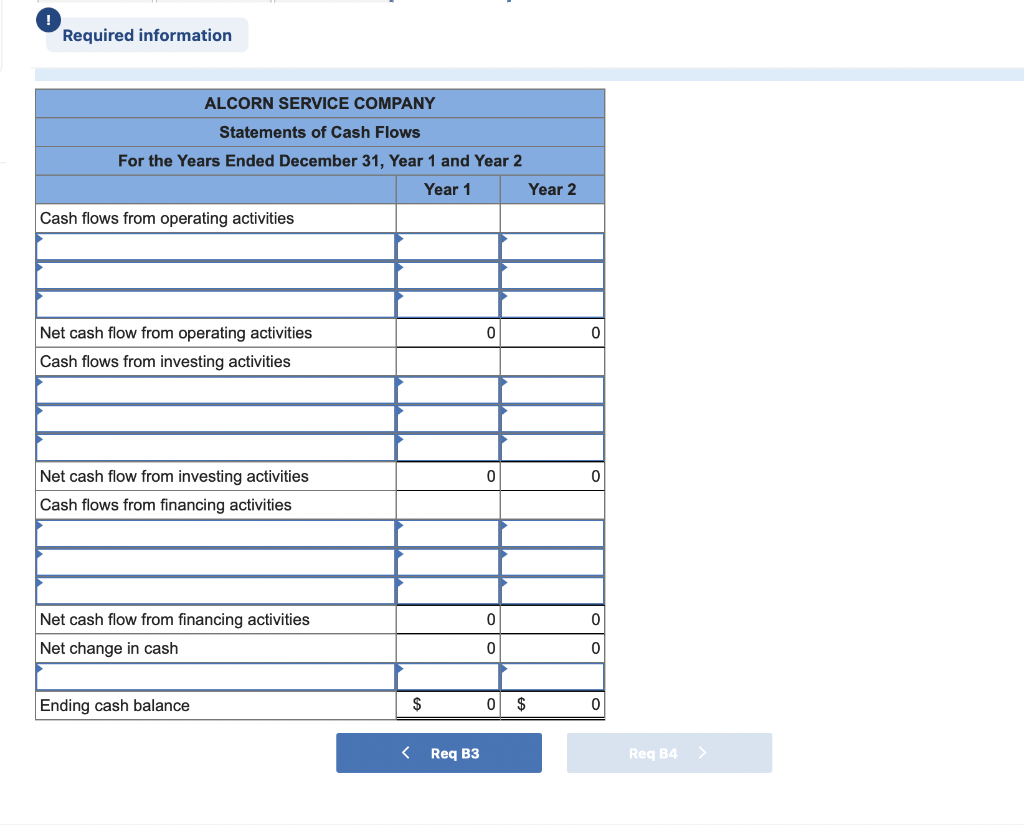

Required information [The following information applies to the questions displayed below.] Alcorn Service Company was formed on January 1, Year 1. Events Affecting the Year 1 Accounting Period 1. Acquired $72,000 cash from the issue of common stock. 2. Purchased $3,600 of supplies on account. 3. Purchased land that cost $42,000 cash. 4. Paid $3,600 cash to settle accounts payable created in Event 2. 5. Recognized revenue on account of $66,000. 6. Paid $33,000 cash for other operating expenses. 7. Collected $50,000 cash from accounts receivable. Information for Year 1 Adjusting Entries 8. Recognized accrued salaries of $4,400 on December 31, Year 1 . 9. Had $1,400 of supplies on hand at the end of the accounting period. Events Affecting the Year 2 Accounting Period 1. Acquired $32,000 cash from the issue of common stock. 2. Paid $4,400 cash to settle the salaries payable obligation. 3. Paid $7,200 cash in advance to lease office space. 4. Sold the land that cost $42,000 for $42,000 cash. 5. Received $8,400 cash in advance for services to be performed in the future. 6. Purchased $2,200 of supplies on account during the year. 7. Provided services on account of $44,000. 8. Collected $45,000 cash from accounts receivable. 9. Paid a cash dividend of $4,000 to the stockholders. 10. Paid other operating expenses of $31,500. b-1. Prepare an income statement for Year 1 and Year 2. b-2. Prepare the statement of changes in stockholders' equity for Year 1 and Year 2. b-3. Prepare the balance sheet for Year 1 and Year 2. b-4. Prepare the statement of cash flows for Year 1 and Year 2, using the vertical statements model. Complete this question by entering your answers in the tabs below. Prepare an income statement for Year 1 and Year 2. (Do not round intermediate calculations.) b-1. Prepare an income statement for Year 1 and Year 2. b-2. Prepare the statement of changes in stockholders' equity for Year 1 and Year 2. b-3. Prepare the balance sheet for Year 1 and Year 2. b-4. Prepare the statement of cash flows for Year 1 and Year 2, using the vertical statements model. Complete this question by entering your answers in the tabs below. Prepare the statement of changes in stockholders' equity for Year 1 and Year 2. Required information ALCORN SERVICE COMPANY Balance Sheets As of December 31, Year 1 and Year 2 ! Required information ALCORN SERVICE COMPANY Statements of Cash Flows For the Years Ended December 31, Year 1 and Year 2 Required information [The following information applies to the questions displayed below.] Alcorn Service Company was formed on January 1, Year 1. Events Affecting the Year 1 Accounting Period 1. Acquired $72,000 cash from the issue of common stock. 2. Purchased $3,600 of supplies on account. 3. Purchased land that cost $42,000 cash. 4. Paid $3,600 cash to settle accounts payable created in Event 2. 5. Recognized revenue on account of $66,000. 6. Paid $33,000 cash for other operating expenses. 7. Collected $50,000 cash from accounts receivable. Information for Year 1 Adjusting Entries 8. Recognized accrued salaries of $4,400 on December 31, Year 1 . 9. Had $1,400 of supplies on hand at the end of the accounting period. Events Affecting the Year 2 Accounting Period 1. Acquired $32,000 cash from the issue of common stock. 2. Paid $4,400 cash to settle the salaries payable obligation. 3. Paid $7,200 cash in advance to lease office space. 4. Sold the land that cost $42,000 for $42,000 cash. 5. Received $8,400 cash in advance for services to be performed in the future. 6. Purchased $2,200 of supplies on account during the year. 7. Provided services on account of $44,000. 8. Collected $45,000 cash from accounts receivable. 9. Paid a cash dividend of $4,000 to the stockholders. 10. Paid other operating expenses of $31,500. b-1. Prepare an income statement for Year 1 and Year 2. b-2. Prepare the statement of changes in stockholders' equity for Year 1 and Year 2. b-3. Prepare the balance sheet for Year 1 and Year 2. b-4. Prepare the statement of cash flows for Year 1 and Year 2, using the vertical statements model. Complete this question by entering your answers in the tabs below. Prepare an income statement for Year 1 and Year 2. (Do not round intermediate calculations.) b-1. Prepare an income statement for Year 1 and Year 2. b-2. Prepare the statement of changes in stockholders' equity for Year 1 and Year 2. b-3. Prepare the balance sheet for Year 1 and Year 2. b-4. Prepare the statement of cash flows for Year 1 and Year 2, using the vertical statements model. Complete this question by entering your answers in the tabs below. Prepare the statement of changes in stockholders' equity for Year 1 and Year 2. Required information ALCORN SERVICE COMPANY Balance Sheets As of December 31, Year 1 and Year 2 ! Required information ALCORN SERVICE COMPANY Statements of Cash Flows For the Years Ended December 31, Year 1 and Year 2