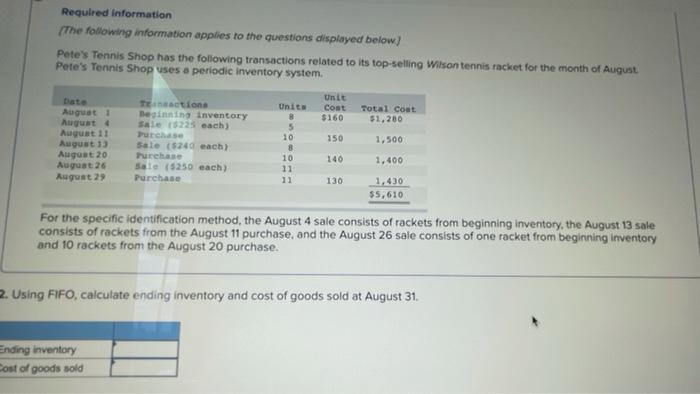

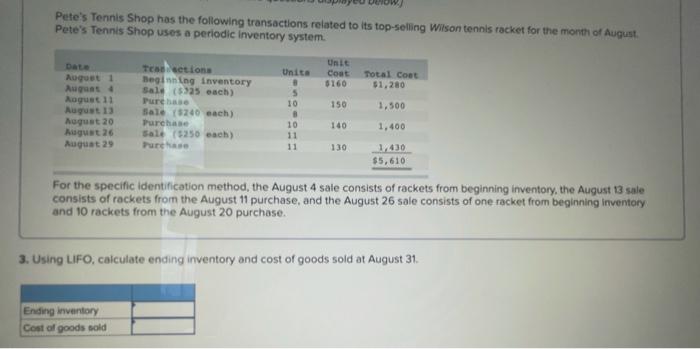

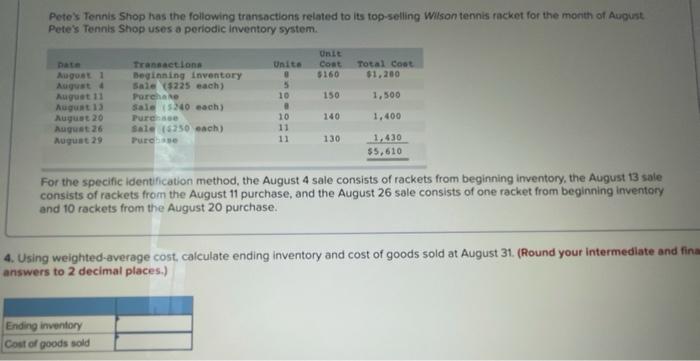

Required information The following information applies to the questions displayed below) Pete's Tennis Shop has the following transactions related to its top-selling Wilson tennis racket for the month of August Pete's Tennis Shop uses a periodic inventory system. Unit Date Tesactions Unita Cost Total coat August Beginning inventory B $160 51,280 August Sale $225 each) 5 August 11 Purchase 10 150 August 13 Sale (5249 each) 1,500 8 August 20 Purchase 10 140 1.400 August 26 Sato (5250 each) 11 August 2 Purchase 11 130 1,430 $5,610 For the specific identification method, the August 4 sale consists of rackets from beginning inventory, the August 13 sale consists of rackets from the August 11 purchase, and the August 26 sale consists of one racket from beginning inventory and 10 rackets from the August 20 purchase. 2. Using Fifo, calculate ending inventory and cost of goods sold at August 31. Ending inventory Cost of goods sold Pete's Tennis Shop has the following transactions related to its top-selling Wilson tennis racket for the month of August. Pete's Tennis Shop uses a periodic Inventory system. Unita Unit Coat Total Coat $160 $1,280 Date August 1 August August 11 August 19 August 20 August 26 August 29 Teletions Beginning inventory Sale $325 each) Pure Sale (5240 each) Purchase Sale (5250 each) Purchase 150 1,500 5 10 8 10 11 140 1,400 130 1.430 $5,610 For the specific identification method, the August 4 sale consists of rackets from beginning inventory, the August 13 sale consists of rackets from the August 11 purchase, and the August 26 sale consists of one racket from beginning inventory and 10 rackets from the August 20 purchase. 3. Using LIFO, calculate ending inventory and cost of goods sold at August 31. Ending inventory Cost of goods sold Pete's Tennis Shop has the following transactions related to its top-selling Wilson tennis racket for the month of August Pete's Tennis Shop uses a periodic inventory system Unite 5 10 Unit Cont $160 Total cont $1,200 150 1,500 August August 4 August 11 August 13 August 20 August 26 August 29 Transactions Beginning inventory Sale $225 each) Parete Sale 240 each) Purense Sale $250 each Purdose 140 1,400 10 11 11 130 1.430 $5,610 For the specific identification method, the August 4 sale consists of rackets from beginning inventory, the August 13 sale consists of rackets from the August 11 purchase, and the August 26 sole consists of one racket from beginning inventory and 10 rackets from the August 20 purchase. 4. Using weighted average cost calculate ending inventory and cost of goods sold at August 31. (Round your intermediate and fina answers to 2 decimal places.) Ending inventory Cost of goods sold