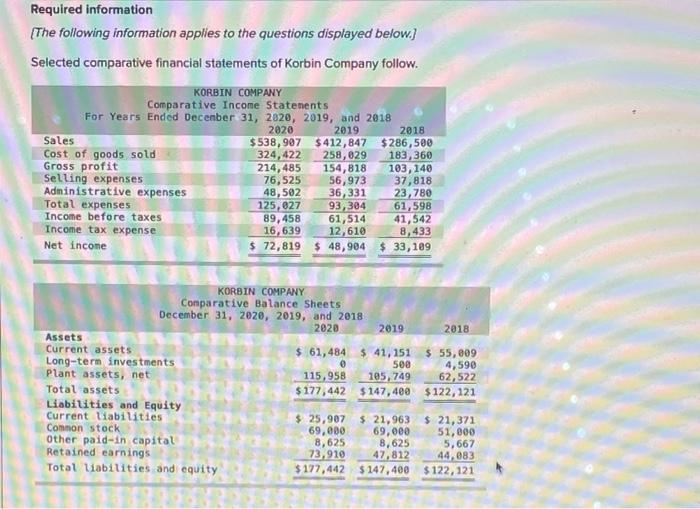

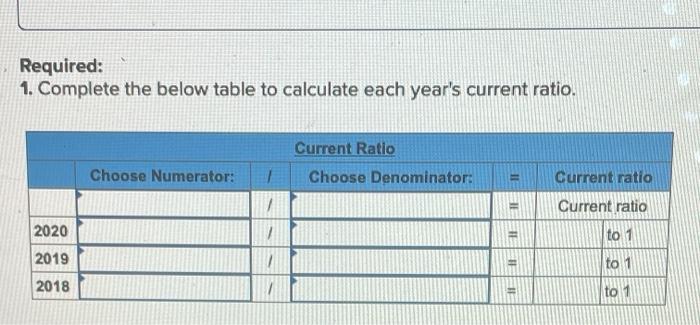

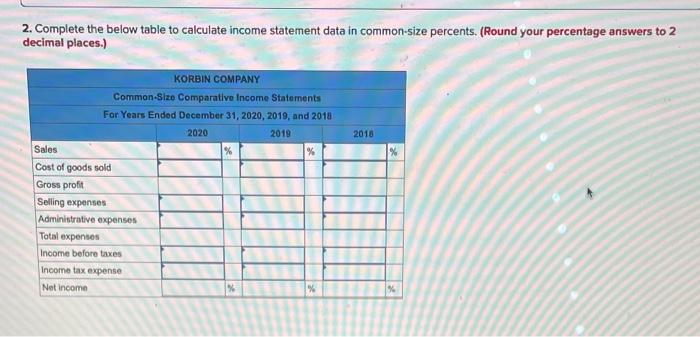

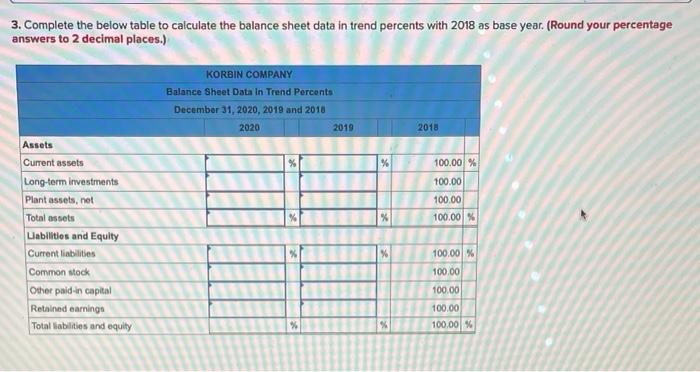

Required information (The following information applies to the questions displayed below) Selected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended December 31, 2020, 2019, and 2018 2020 2019 2018 Sales $538,907 $412,847 $286,500 Cost of goods sold 324,422 258, 029 183,360 Gross profit 214,485 154,818 103, 140 Selling expenses 76,525 56,973 37,818 Administrative expenses 48,502 36,331 23,780 Total expenses 125,827 93, 304 61,598 Income before taxes 89,458 61,514 41,542 Income tax expense 16,639 12,610 8,433 Net income $ 72,819 $ 48,904 $ 33,109 KORBIN COMPANY Comparative Balance Sheets December 31, 2020, 2019, and 2018 2020 2019 2018 Assets Current assets $ 61,484 $ 41, 151 $ 55,009 Long-term investments 500 4,590 Plant assets, net 115,958 105, 749 62,522 Total assets $177,442 $147, 400 $122, 121 Liabilities and Equity Current liabilities $ 25,907 $ 21,963 $ 21,371 Common stock 69,000 69,000 51,000 Other paid-in capital 8,625 8,625 5,667 Retained earnings 73,910 47.812 44,083 Total liabilities and equity $177,442 $147, 400 $ 122, 121 Required: 1. Complete the below table to calculate each year's current ratio. Current Ratio Choose Denominator: Choose Numerator: 1 II Current ratio 1 11 Current ratio 2020 = to 1 2019 1 to 1 2018 to 1 2. Complete the below table to calculate income statement data in common-size percents. (Round your percentage answers to 2 decimal places.) 2018 KORBIN COMPANY Common-Size Comparative Income Statements For Years Ended December 31, 2020, 2019, and 2018 2020 2019 Sales % % Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income % % 3. Complete the below table to calculate the balance sheet data in trend percents with 2018 as base year. (Round your percentage answers to 2 decimal places.) KORBIN COMPANY Balance Sheet Data in Trend Percenta December 31, 2020, 2019 and 2010 2020 2019 2018 % % 100.00% 100.00 100.00 100.00 % Assets Current assets Long-term investments Plant assets, net Total assets Llabilities and Equity Current liabilities Common stock Other paid in capital Retained earnings Total abilities and equity 100.00% 100.00 100.00 100.00 100,00 % % % 4. Refer to the results from parts 1, 2, and 3. (a) Did cost of goods sold make up a greater portion of sales for the most recent year compared to the prior year? Yes O No (b) Did income as a percent of sales improve in the most recent year compared to the prior year? Yes ONo (c) Did plant assets grow over this period? Yes No