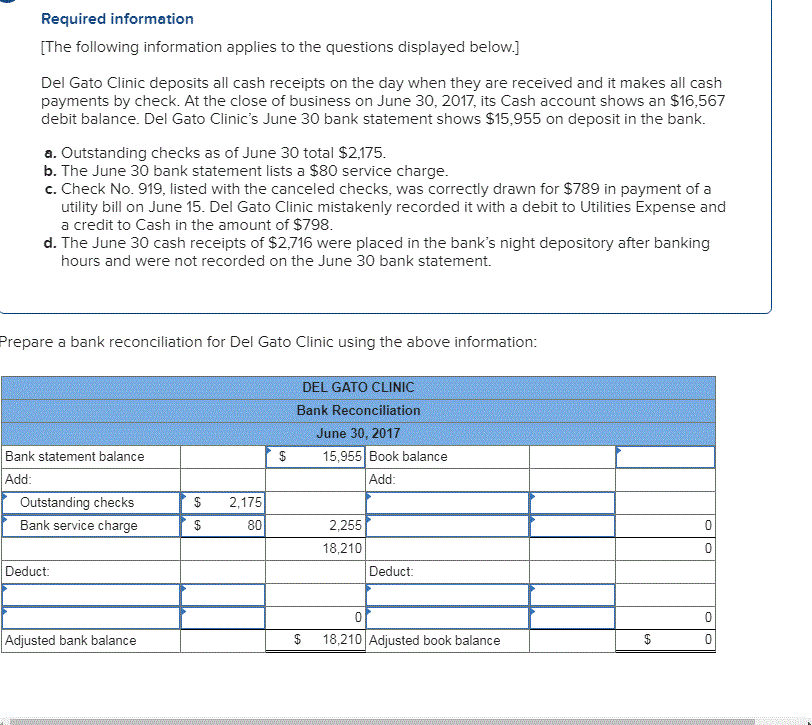

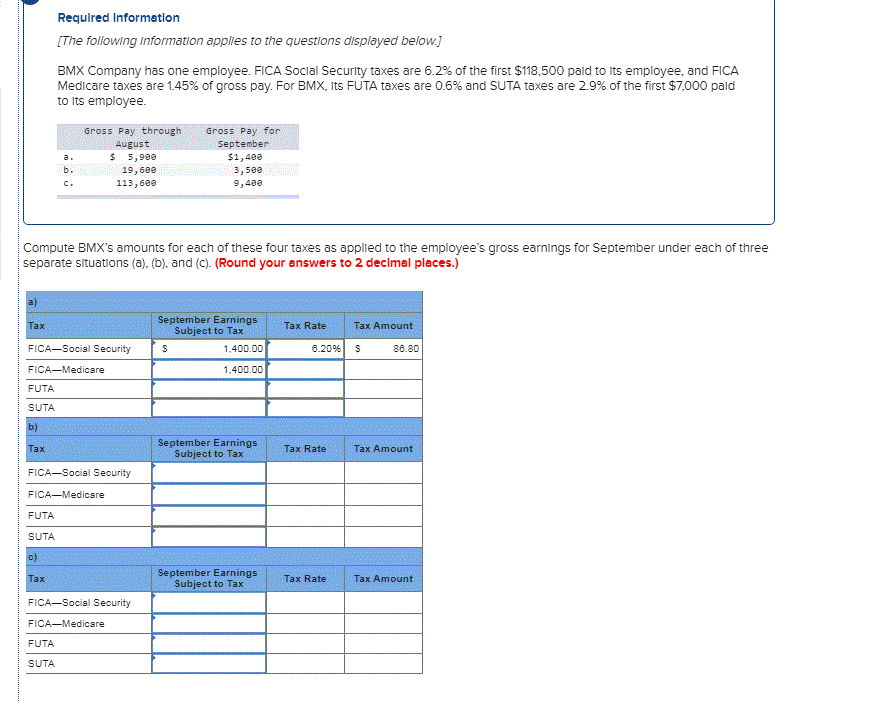

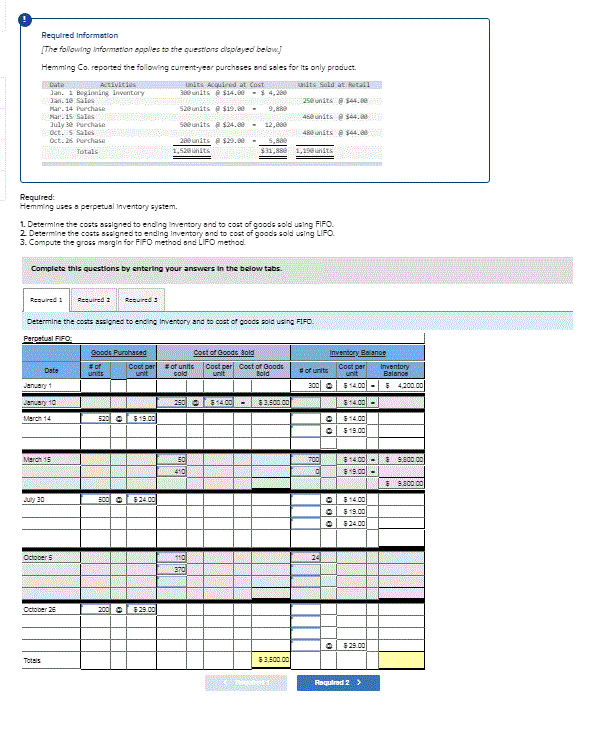

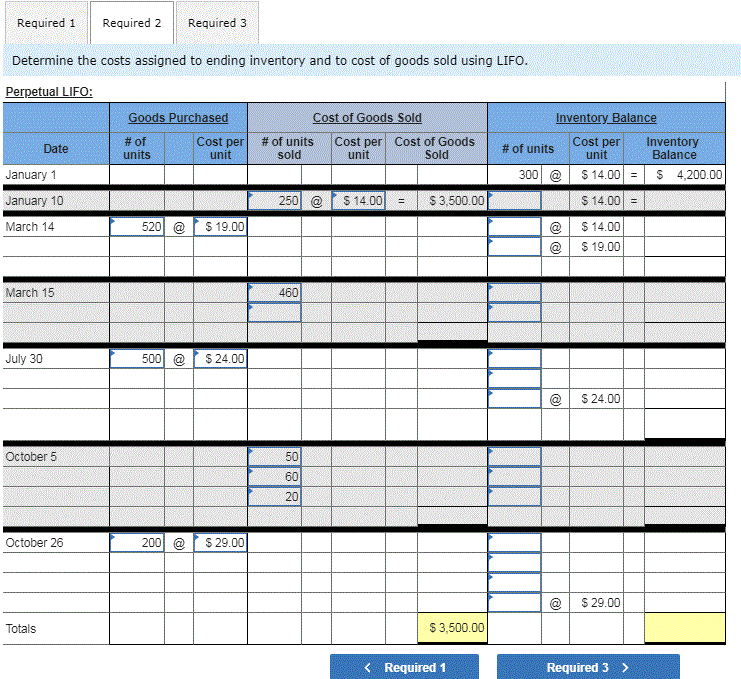

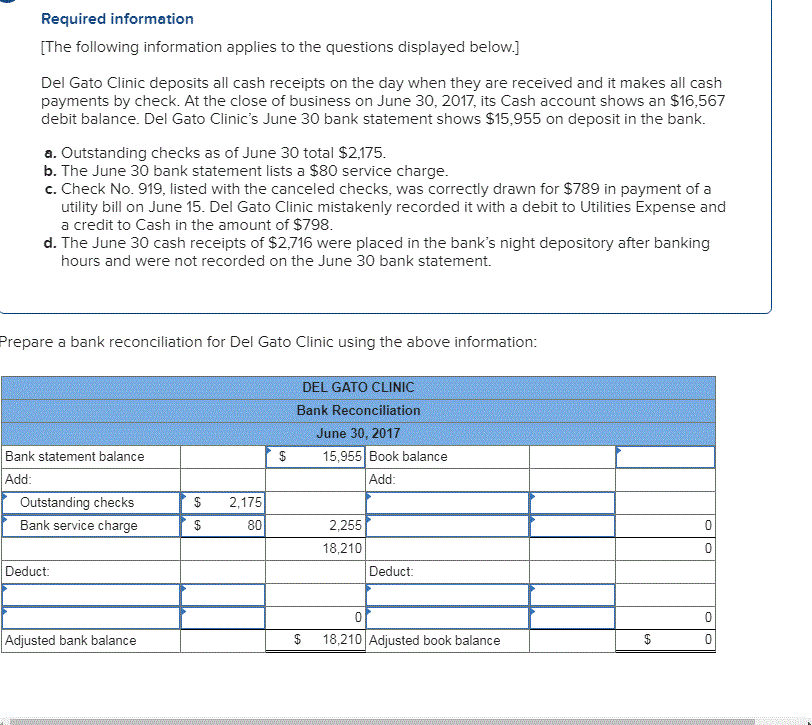

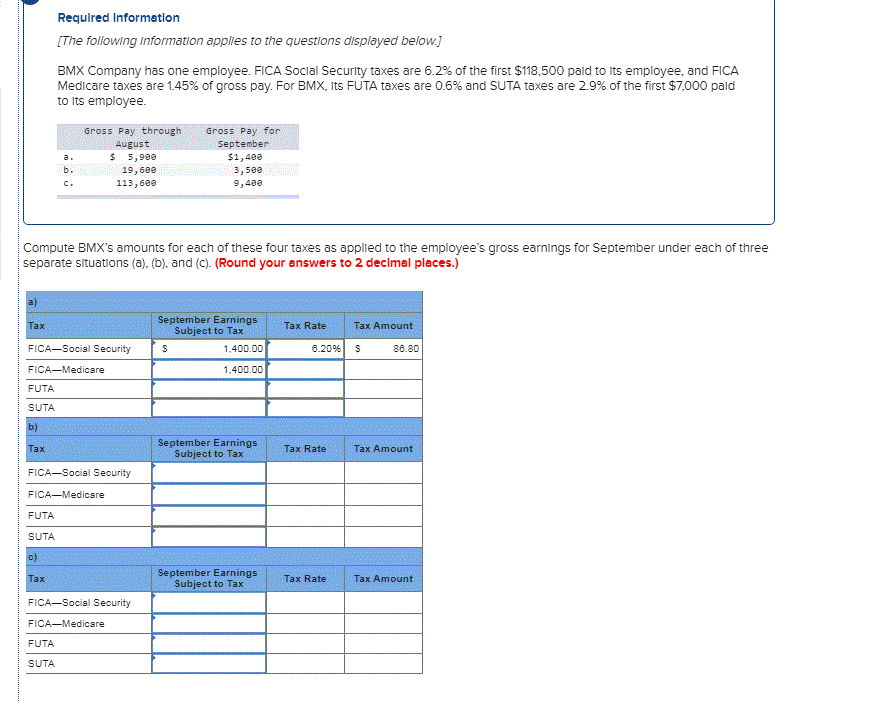

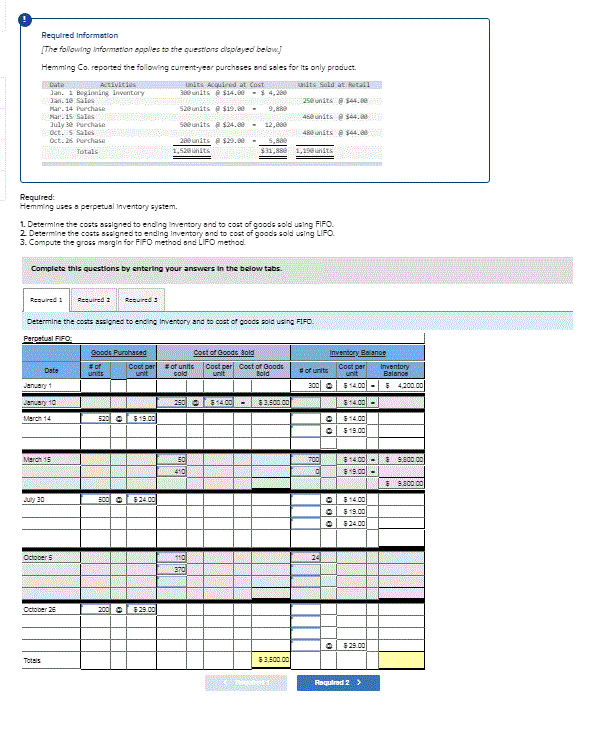

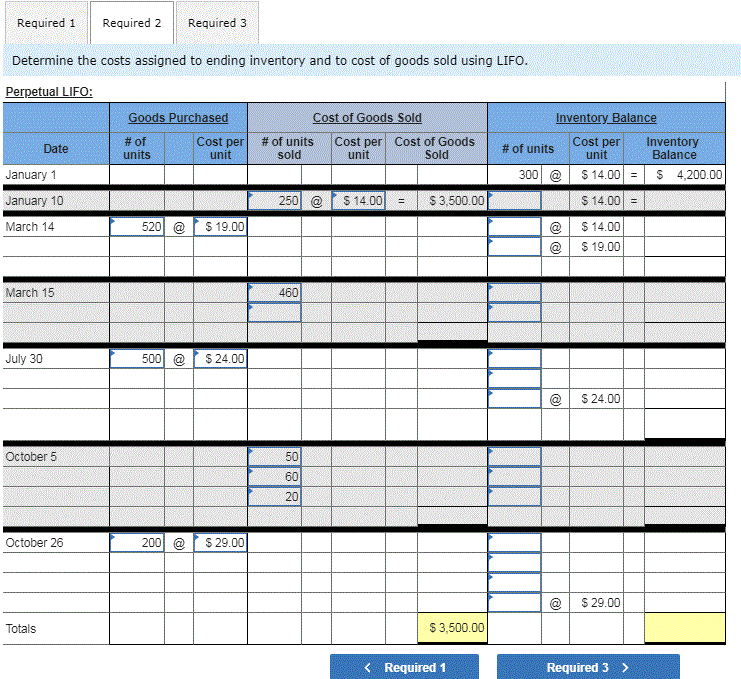

Required information [The following information applies to the questions displayed below.] Del Gato Clinic deposits all cash receipts on the day when they are received and it makes all cash payments by check. At the close of business on June 30, 2017, its Cash account shows an $16,567 debit balance. Del Gato Clinic's June 30 bank statement shows $15,955 on deposit in the bank. a. Outstanding checks as of June 30 total $2,175. b. The June 30 bank statement lists a $80 service charge. c. Check No. 919, listed with the canceled checks, was correctly drawn for $789 in payment of a utility bill on June 15. Del Gato Clinic mistakenly recorded it with a debit to Utilities Expense and a credit to Cash in the amount of $798. d. The June 30 cash receipts of $2,716 were placed in the bank's night depository after banking hours and were not recorded on the June 30 bank statement. Prepare a bank reconciliation for Del Gato Clinic using the above information: DEL GATO CLINIC Bank Reconciliation June 30, 2017 15,955 Book balance Add: $ Bank statement balance Add: Outstanding checks Bank service charge 1$ $ 2,175 80 2,255 18,210 Deduct: Deduct: Adjusted bank balance $ 18,210 Adjusted book balance Required Information [The following Information applies to the questions displayed below.) BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $118,500 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, Its FUTA taxes are 0.6% and SUTA taxes are 2.9% of the first $7,000 pald to its employee. Gross Pay through August $ 5,980 19,600 113,600 Gross Pay for September $1,400 3,500 9,490 Compute BMX's amounts for each of these four taxes as applied to the employee's gross earnings for September under each of three separate situations (a), (b), and (C). (Round your answers to 2 decimal places.) Tax Rate Tax Amount September Earnings Subject to Tax Is 1,400.00 6.20% 5 88.80 FICASocial Security FICA-Medicare 1.400.00 FUTA SUTA September Earnings Subject to Tax Tax Rate Tax Amount FICA-Social Security FICA-Medicare FUTA SUTA September Earnings Subject to Tax Tax Rate Tax Amount FICA-Social Security FICA-Medicare FUTA SUTA Required information The following information a s to the questions displayed below Hemming Co. reported the following currentear purchases and ses for only product Units Anal Cost s Soldat ATIVE tory all S e units a mar 16 urdha 15 Sals Duyurdu OCESS Oct. Purcha units $44. Required: 1. Determine the cost signed to ending inventory and to cost of goods sold using FIFO. 2. Determine the costs as gred to ending Inventory and to cost of Goods sold in LIFO 3. Compute the gross margin for FIFO method and LIFO method Complete this questions by entering your answers in the below tabs Rewire : Resis Determine the costs assigned to ending inventory and to cost of goods sold in FIFO. Goods Purohead Couter code old Inventory of units cost per cost des Coot par Inventory of units 300 - 14.00 - 4.20000 290 8 4400 - $3,500.00 1 6001 - $19.00 Odabers