Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required Information The following information applies to the questions displayed below) Movelt Corporation is the world's leading express-distribution company. In addition to its 643 aircraft,

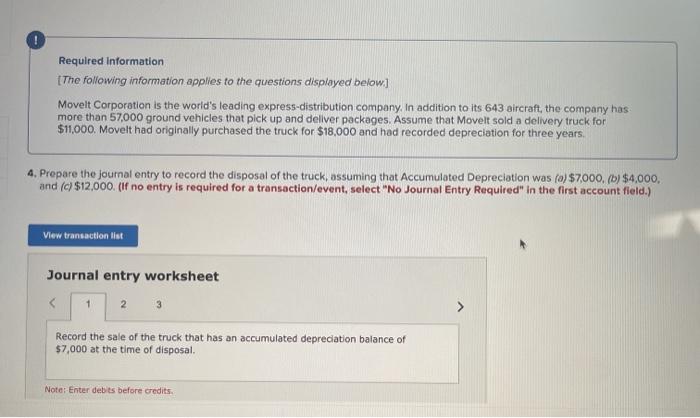

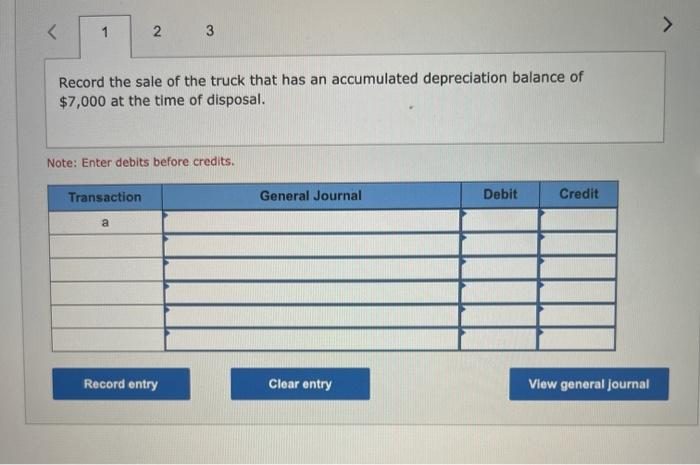

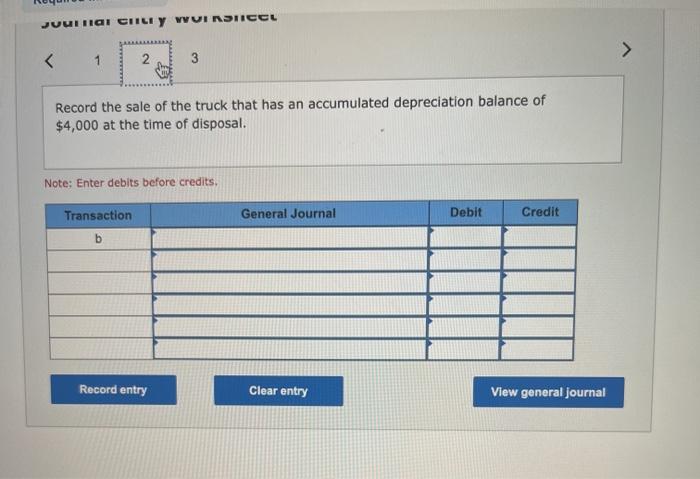

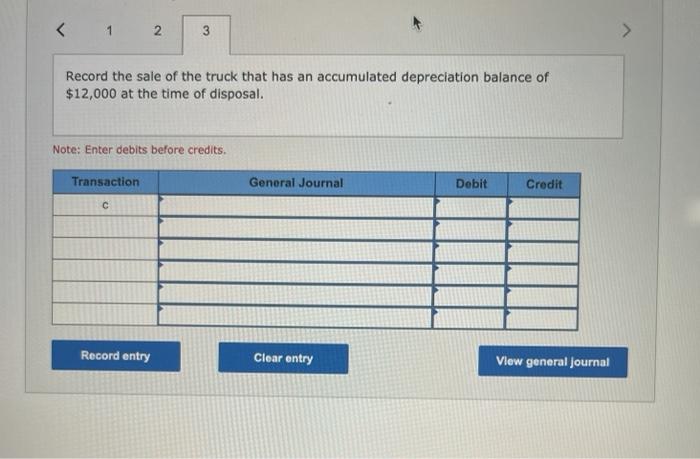

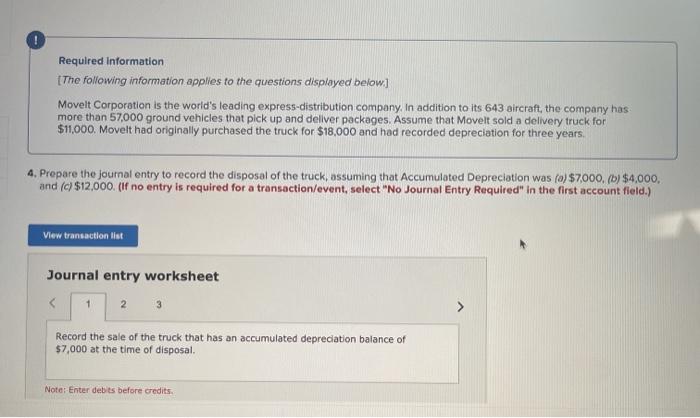

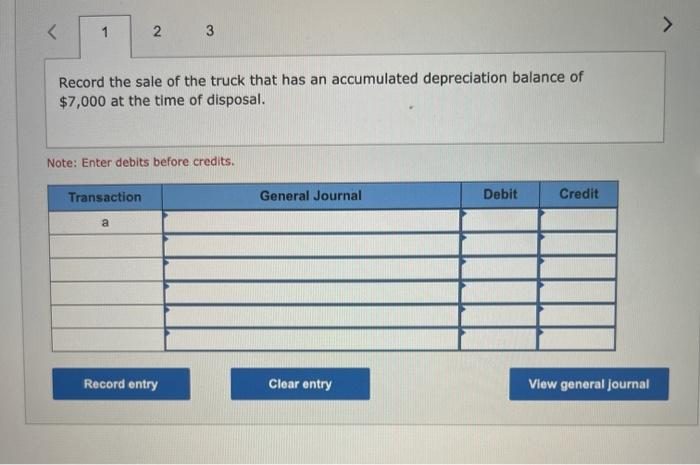

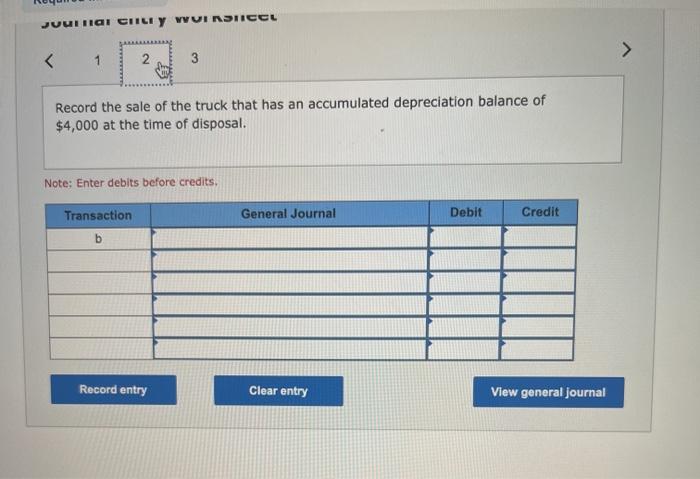

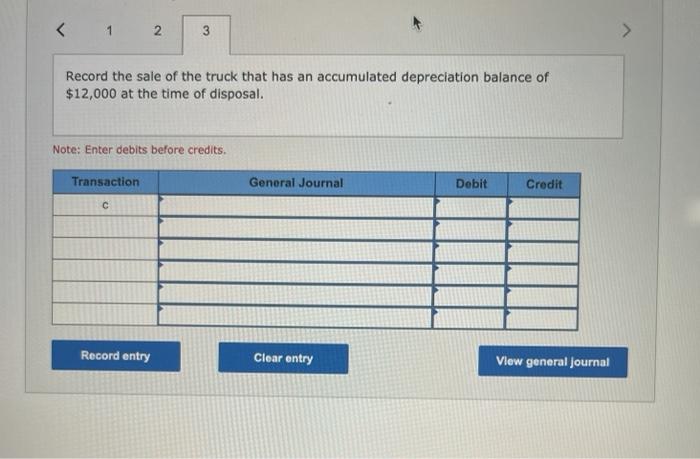

Required Information The following information applies to the questions displayed below) Movelt Corporation is the world's leading express-distribution company. In addition to its 643 aircraft, the company has more than 57,000 ground vehicles that pick up and deliver packages. Assume that Movelt sold a delivery truck for $11,000. Movelt had originally purchased the truck for $18,000 and had recorded depreciation for three years. 4. Prepare the journal entry to record the disposal of the truck, assuming that Accumulated Depreciation was (a)$7000, (b) $4,000, and (c)$12,000. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 Record the sale of the truck that has an accumulated depreciation balance of $7,000 at the time of disposal. Note: Enter debts before credits 1 2 3 Record the sale of the truck that has an accumulated depreciation balance of $7,000 at the time of disposal. Note: Enter debits before credits. Transaction General Journal Debit Credit a Record entry Clear entry View general Journal Jvui tial City vi site Record the sale of the truck that has an accumulated depreciation balance of $12,000 at the time of disposal. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal

Required Information The following information applies to the questions displayed below) Movelt Corporation is the world's leading express-distribution company. In addition to its 643 aircraft, the company has more than 57,000 ground vehicles that pick up and deliver packages. Assume that Movelt sold a delivery truck for $11,000. Movelt had originally purchased the truck for $18,000 and had recorded depreciation for three years. 4. Prepare the journal entry to record the disposal of the truck, assuming that Accumulated Depreciation was (a)$7000, (b) $4,000, and (c)$12,000. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 Record the sale of the truck that has an accumulated depreciation balance of $7,000 at the time of disposal. Note: Enter debts before credits 1 2 3 Record the sale of the truck that has an accumulated depreciation balance of $7,000 at the time of disposal. Note: Enter debits before credits. Transaction General Journal Debit Credit a Record entry Clear entry View general Journal Jvui tial City vi site Record the sale of the truck that has an accumulated depreciation balance of $12,000 at the time of disposal. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started