Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information [The following information applies to the questions displayed below.] Chavez Company most recently reconciled its bank statement and book balances of cash on

Required information

[The following information applies to the questions displayed below.]

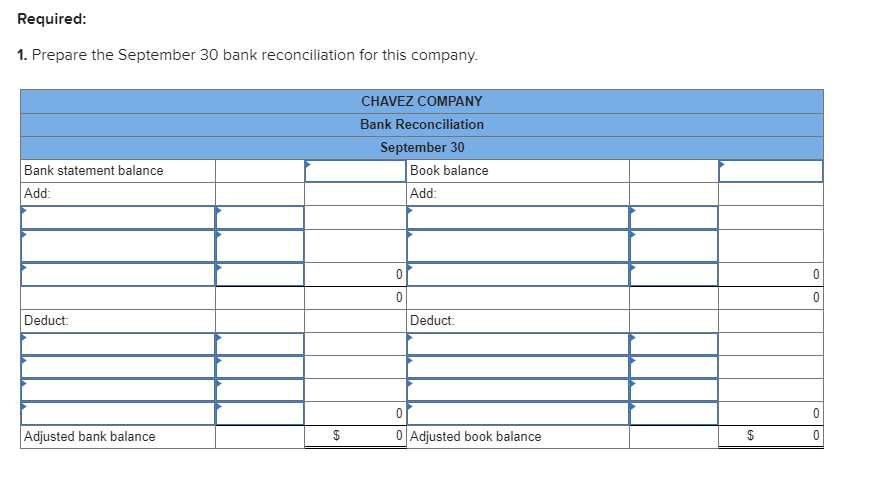

Chavez Company most recently reconciled its bank statement and book balances of cash on August 31 and it reported two checks outstanding, No. 5888 for $1,084 and No. 5893 for $498. Check No. 5893 was still outstanding as of September 30. The following information is available for its September 30 reconciliation. From the September 30 Bank Statement

| PREVIOUS BALANCE | TOTAL CHECKS AND DEBITS | TOTAL DEPOSITS AND CREDITS | CURRENT BALANCE |

| 17,500 | 9,913 | 11,455 | 19,042 |

| CHECKS AND DEBITS | DEPOSITS AND CREDITS | ||||||

| Date | No. | Amount | Date | Amount | |||

| 09/03 | 5888 | 1,084 | 09/05 | 1,117 | |||

| 09/04 | 5902 | 765 | 09/12 | 2,278 | |||

| 09/07 | 5901 | 1,865 | 09/21 | 4,134 | |||

| 09/17 | 674 | NSF | 09/25 | 2,384 | |||

| 09/20 | 5905 | 930 | 09/30 | 22 | IN | ||

| 09/22 | 5903 | 360 | 09/30 | 1,520 | CM | ||

| 09/22 | 5904 | 2,082 | |||||

| 09/28 | 5907 | 267 | |||||

| 09/29 | 5909 | 1,886 | |||||

From Chavez Companys Accounting Records

| Cash Receipts Deposited | ||||

| Date | Cash Debit | |||

| Sept. | 5 | 1,117 | ||

| 12 | 2,278 | |||

| 21 | 4,134 | |||

| 25 | 2,384 | |||

| 30 | 1,741 | |||

| 11,654 | ||||

| Cash Payments | ||||

| Check No. | Cash Credit | |||

| 5901 | 1,865 | |||

| 5902 | 765 | |||

| 5903 | 360 | |||

| 5904 | 2,037 | |||

| 5905 | 930 | |||

| 5906 | 1,020 | |||

| 5907 | 267 | |||

| 5908 | 394 | |||

| 5909 | 1,886 | |||

| 9,524 | ||||

| Cash | Acct. No. 101 | ||||

| Date | Explanation | PR | Debit | Credit | Balance |

| Aug. 31 | Balance | 15,918 | |||

| Sept. 30 | Total receipts | R12 | 11,654 | 27,572 | |

| 30 | Total payments | D23 | 9,524 | 18,048 | |

Additional Information

- (a) Check No. 5904 is correctly drawn for $2,082 to pay for computer equipment; however, the recordkeeper misread the amount and entered it in the accounting records with a debit to Computer Equipment and a credit to Cash of $2,037.

- (b) The NSF check shown in the statement was originally received from a customer, S. Nilson, in payment of her account. Its return has not yet been recorded by the company.

- (c) The credit memorandum (CM) is from the collection of a $1,520 note for Chavez Company by the bank. The collection is not yet recorded.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started