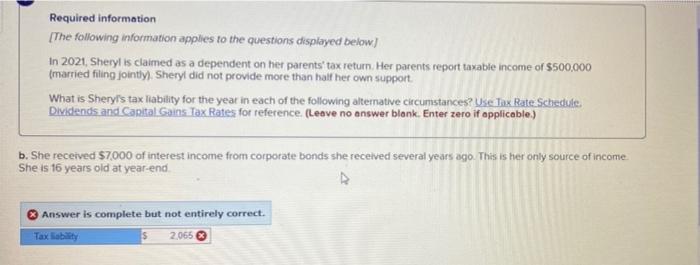

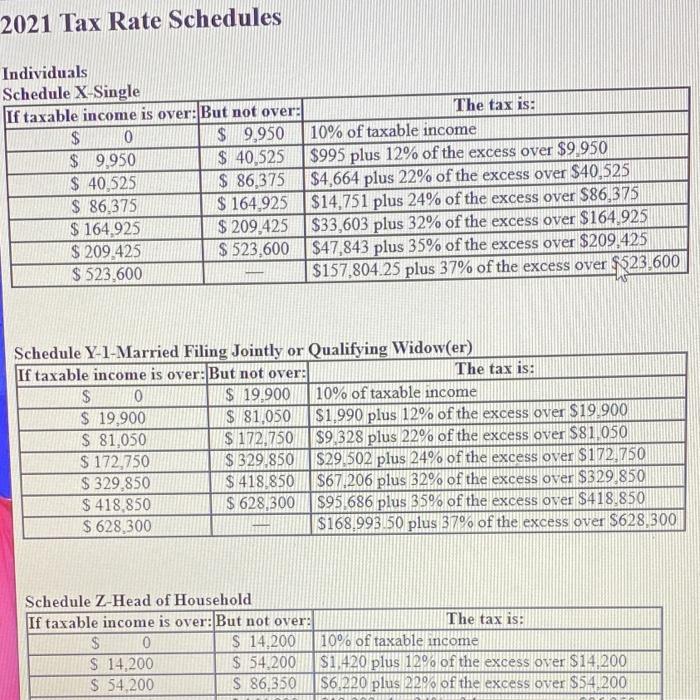

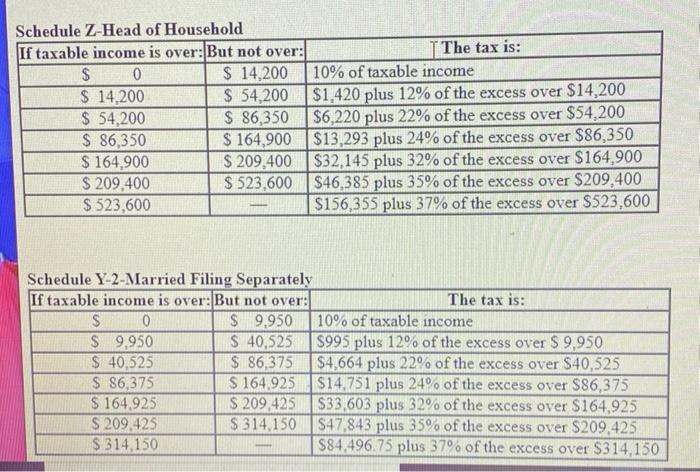

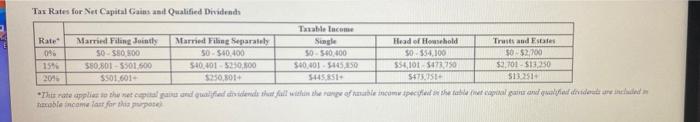

Required information [The following information applies to the questions displayed below) In 2021. Sheryl is claimed as a dependent on her parents' tax return. Her parents report taxable income of $500,000 (married filing jointly). Sheryl did not provide more than half her own support What is Sheryl's tax liability for the year in each of the following alternative circumstances? Use Tax Rate Schedule Divklends and Capital Gains Tax Rates for reference (Leave no answer blank. Enter zero if applicable) b. She received $7000 of interest income from corporate bonds she received several years ago. This is her only source of income She is 16 years old at year-end Answer is complete but not entirely correct. Tax Baby s 2065 2021 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over: But not over: The tax is: $ 0 $ 9,950 10% of taxable income $9.950 $ 40,525 $995 plus 12% of the excess over $9.950 $ 40,525 $ 86,375 $4,664 plus 22% of the excess over $40,525 $ 86.375 $164.925 $14.751 plus 24% of the excess over $86,375 $164.925 $ 209,425 $33,603 plus 32% of the excess over $164.925 $ 209.425 $ 523,600 $47,843 plus 35% of the excess over $209,425 $ 523,600 |$157,804.25 plus 37% of the excess over $323,600 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: $ 0 $ 19.900 10% of taxable income $ 19,900 $ 81,050 $1,990 plus 12% of the excess over $19.900 $ 81,050 $ 172.750 $9.328 plus 22% of the excess over $81.050 $ 172.750 $ 329,850 $29.502 plus 24% of the excess over $172.750 $ 329,850 $ 418,850 $67,206 plus 32% of the excess over $329,850 $ 418,850 $ 628,300 $95.686 plus 35% of the excess over $418.850 $ 628,300 $168.993.50 plus 37% of the excess over $628,300 Schedule Z-Head of Household If taxable income is over: But not over: The tax is: 0 $ 14,200 10% of taxable income $ 14,200 $ 54,200 $1,420 plus 12% of the excess over $14,200 $ 54,200 $ 86,350 $6.220 plus 22% of the excess over $54 200 Schedule Z-Head of Household If taxable income is over:But not over: The tax is: $ 0 $ 14,200 10% of taxable income $ 14,200 $ 54,200 $1,420 plus 12% of the excess over $14,200 $ 54,200 $ 86,350 $6,220 plus 22% of the excess over $54,200 $ 86,350 $ 164,900 $13,293 plus 24% of the excess over $86,350 $ 164,900 $ 209,400 $32,145 plus 32% of the excess over $164,900 $ 209,400 $ 523,600 $46,385 plus 35% of the excess over $209,400 $ 523,600 $156,355 plus 37% of the excess over $523,600 Schedule Y-2-Married Filing Separately If taxable income is over: But not over: The tax is: $ 0 $9.950 10% of taxable income $9.950 $ 40,525 $995 plus 12% of the excess over $ 9,950 $ 40,525 $ 86,375 $4,664 plus 22% of the excess over $40,525 $ 86,375 $164.925 $14.751 plus 24% of the excess over $86,375 $ 164.925 $ 209,425 $33,603 plus 32% of the excess over $164,925 $ 209,425 $ 314,150 $47,843 plus 35% of the excess over $209,425 $ 314,150 $84,496.75 plus 37% of the excess over $314,150 Tas Rates for Net Capital Gains and Qualified Dividend Table Lace Rate Married Filing Jointly Married Piling Separately Sage Head of Howald Truits and Estates 096 50-50.00 50-500.00 50 50 100 50354,100 50 $2,700 15% 550.801-3501 500 540.401 5250,00 500,0015445,50 554101 5471.750 $2,01$13,250 2015 $501.601 $250.301 5445851 547.251 513251 *This rate applies to the capital and qualified in the full within the paper of becomwichele land waar die deutuneid Table income it for the