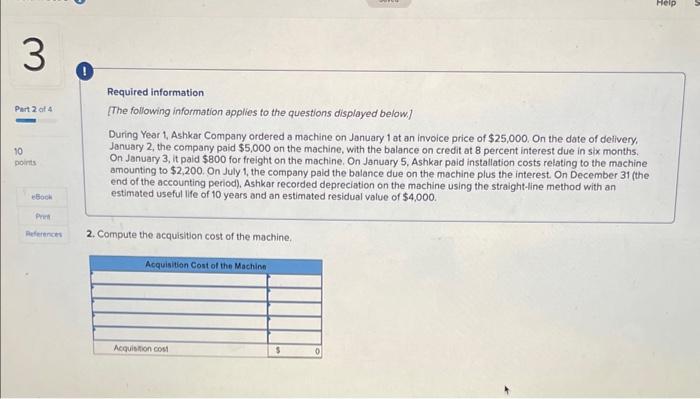

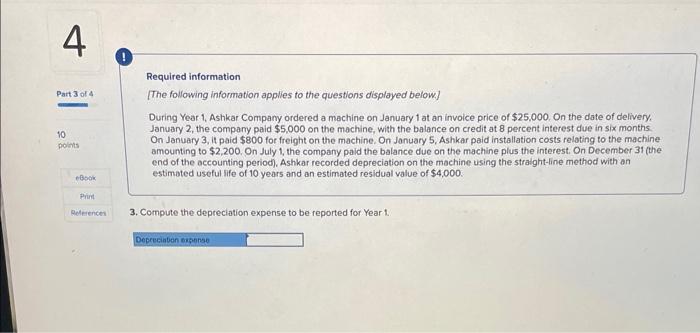

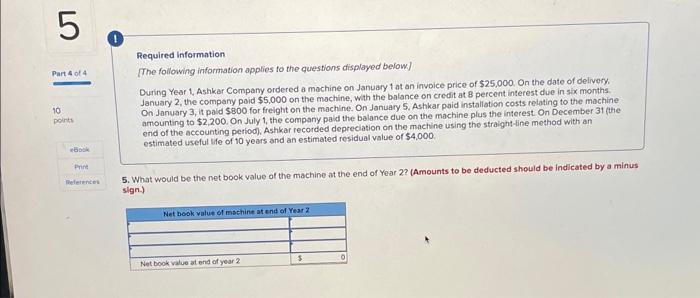

Required information [The following information applies to the questions displayed below] During Year 1, Ashkar Company ordered a machine on January 1 at an invoice price of $25,000. On the date of delivery, January 2 , the company paid $5,000 on the machine, with the balance on credit at 8 percent interest due in six months. On January 3, it paid $800 for freight on the machine. On January 5. Ashkar paid installation costs relating to the machine amounting to $2,200. On July 1, the company paid the balance due on the machine plus the interest. On December 31 (the end of the accounting period), Ashkar recorded depreciation on the machine using the straight-line method with an estimated useful life of 10 years and an estimated residual volue of $4,000. 2. Compute the acquisition cost of the machine. Required information [The following information applles to the questlons displayed below.] During Year 1, Ashkar Compary ordered a machine on January 1 at an invoice price of $25,000, On the date of delivery. January 2, the company paid $5,000 on the machine, with the balance on credit at 8 percent interest due in six months On January 3, it paid $800 for freight on the machine. On January 5. Ashkar paid installation costs relating to the machine amounting to $2,200. On July 1, the company paid the balance due on the machine plus the interest: On December 31 (the end of the occounting period). Ashkar recorded depreciation on the mochine using the straight-line method with an estimated useful life of 10 years and an estimated residual value of $4,000. 3. Compute the depreciation expense to be reported for Year 1 . Required information [The following information applies to the questions displayed below.) During Year 1, Ashkar Company ordered a mochine on January 1 at an invoice price of $25,000. On the date of delivory. January 2, the company paid $5,000 on the machine, with the balance on credit at 8 percent interest due in six months On January 3, it pald $800 for freight on the machine. On January 5. Ashkar paid installation costs relating to the machine amounting to $2,200. On July 1 , the company paid the balance due on the machine plus the interest. On December 31 (the end of the accounting period). Ashkar recorded depreciation on the machine using the straight-line method with an estimated useful lfe of 10 years and an estimated residual value of $4,000 : 5. What would be the net book value of the machine ot the end of Year 2? (Amounts to be deducted should be indicated by a minus sign.)