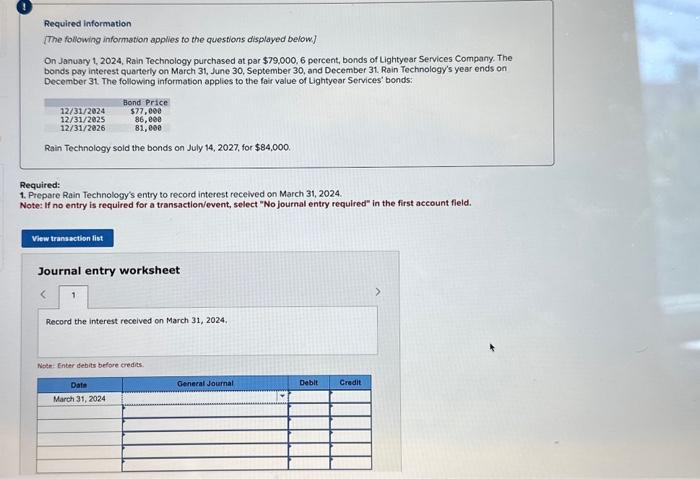

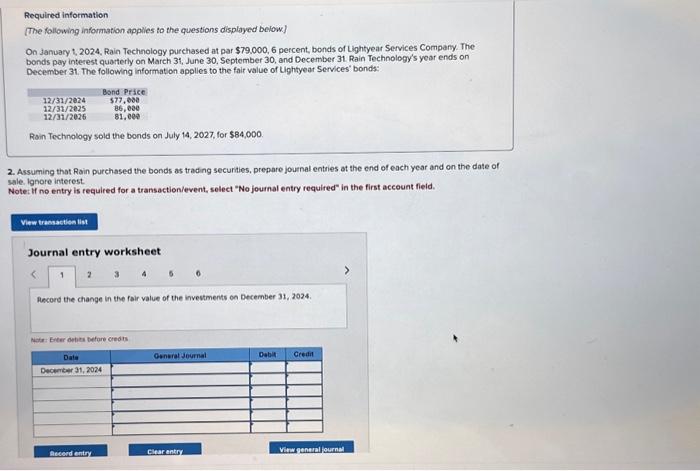

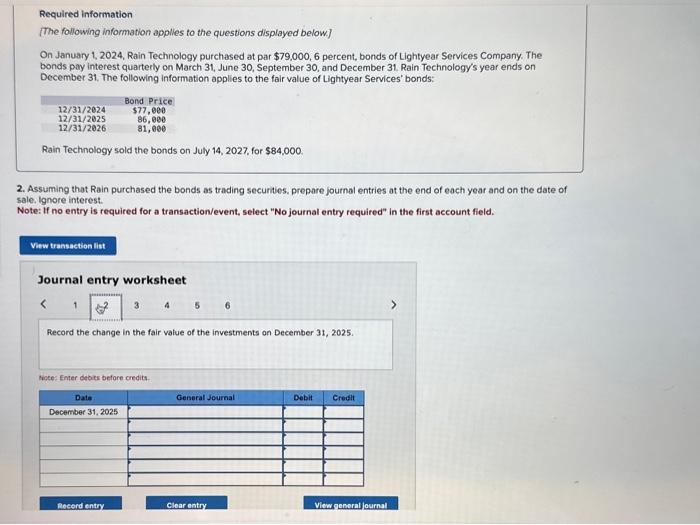

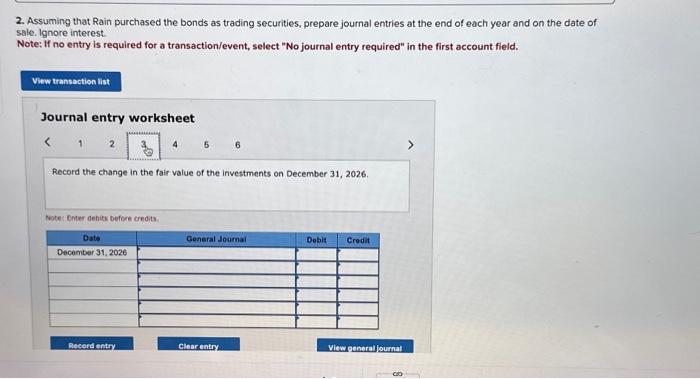

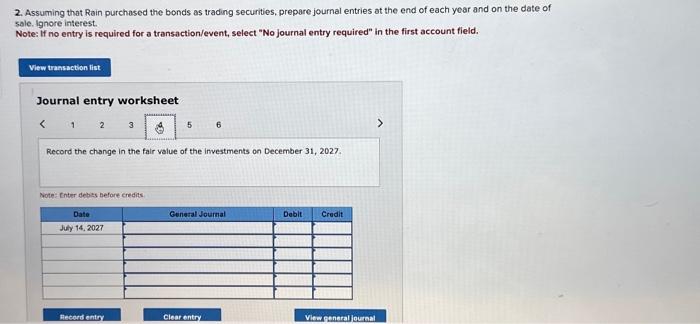

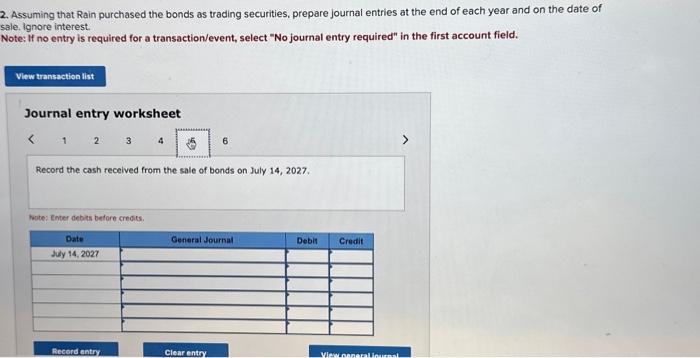

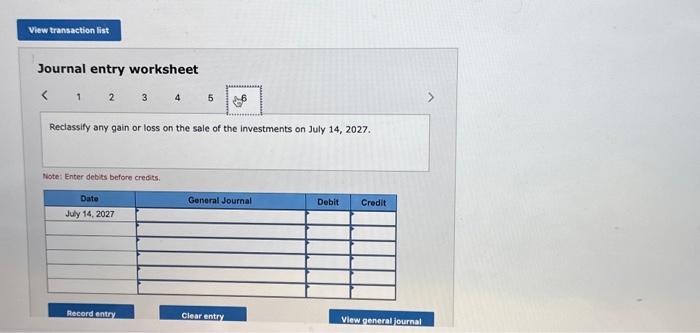

Required information [The following information applies to the questions displayed below] On January 1, 2024, Rain Technology purchased at par $79.000,6 percent, bonds of Lightyear Services Company. The bonds pay inserest quarterly on March 31, June 30, September 30, and December 31. Rain Technology's year ends on December 31. The following information applies to the fair value of Lightyoar Services' bonds: Rain Technology sold the bonds on July 14,2027, for $84,000. Required: 1. Prepare Rain Technology's entry to record interest recelved on March 31, 2024. 1. Prepe: If no entry is required for a transactionvevent, select "No journal entry required" in the first account field. Journal entry worksheet Required information [The following information applies to the questions displayed beiow.] On January 1, 2024, Rain Technology purchased at par $79,000,6 percent, bonds of Lightyear Services Company. The bonds pay interest quarterly on March 31, June 30. September 30, and December 31. Rain Technology's yoar ends on December 31. The following information applies to the fait value of Lightyear Services" bonds: Rsin Technology sold the bonds on July 14, 2027, for $84,000 2. Assuming that Rain purchased the bonds as trading securties, prepare journal entries at the end of each year and on the date of sale. Ignore interest Note: H no entry is required for a transaction/event, solect "No journal entry required" in the first account field. Journal entry worksheet 366 Aecord the change in the fair value of the invevments on December 31, 2024. Nicter Ereter ofbis before oredis Required information [The following information applles to the questions displayed below] On January 1, 2024, Rain Technology purchased at par $79,000,6 percent, bonds of Lightyear Services Company. The bonds pay interest quarterly on March 31, June 30, September 30, and December 31. Rain Technology's year ends on December 31. The following information applies to the fair value of Lightyear Services' bonds: Rain Technology sold the bonds on July 14,2027 , for $84,000 2. Assuming that Rain purchased the bonds as trading securities, prepare journal entries at the end of each year and on the date of sale. lgnore interest. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 56 Fecord the change in the fair value of the investments on December 31,2025. mote: Enter debits before credits. 2. Assuming that Rain purchased the bonds as trading securities, prepare journal entries at the end of each year and on the date of sale. Ignore interest. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 6 Record the change in the fair value of the investments on December 31,2026. Notes fmer dehiti before credits. 2. Assuming that Rain purchased the bonds as trading securities, prepare journal entries at the end of each year and on the date of sale. Ignore interest. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the change in the fair value of the investments on December 31,2027. Note: enter debis before credis. Assuming that Rain purchased the bonds as trading securities, prepare journal entries at the end of each year and on the date of ale. lgnore interest. lote: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Fobe: Enter debots betore creots. Journal entry worksheet 12345 Reclassify any gain or loss on the sale of the investments on July 14, 2027. Miote: Enter debiss before creots