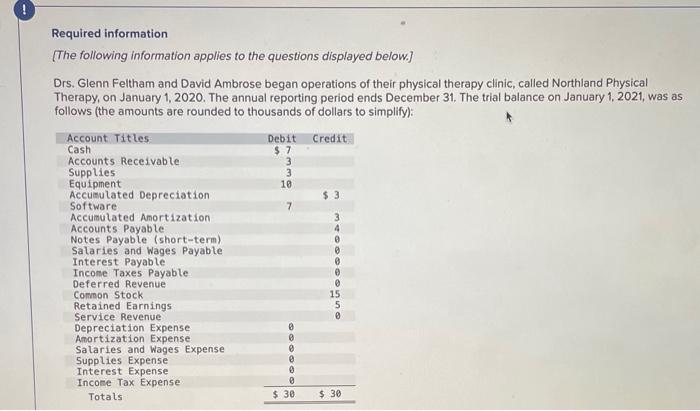

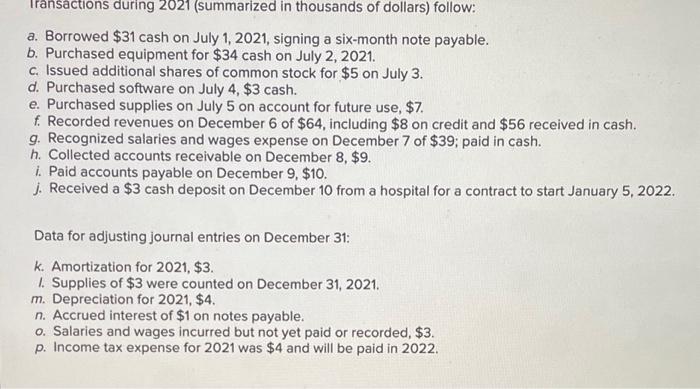

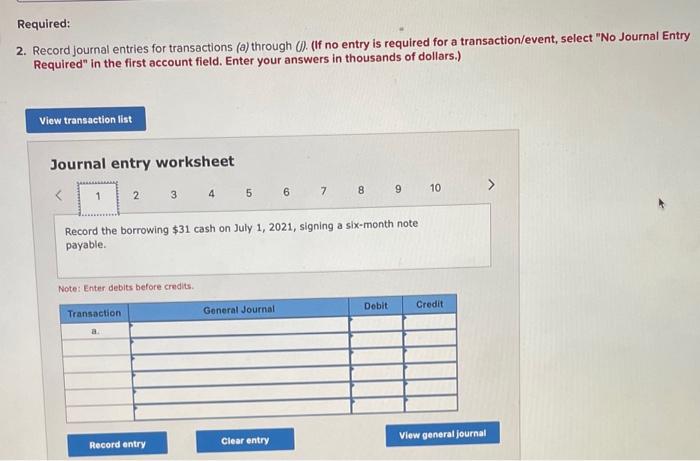

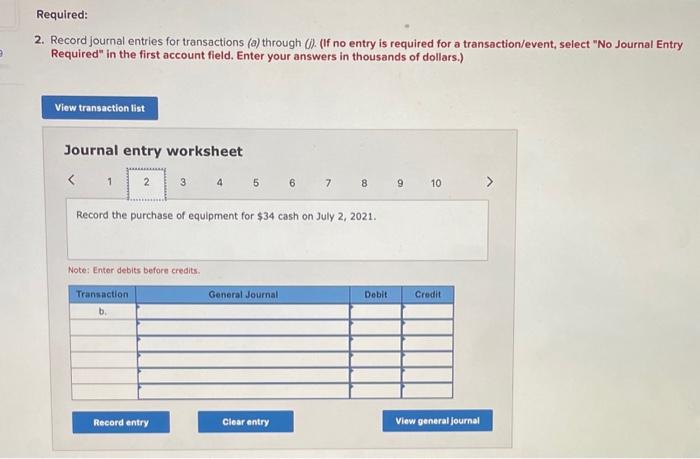

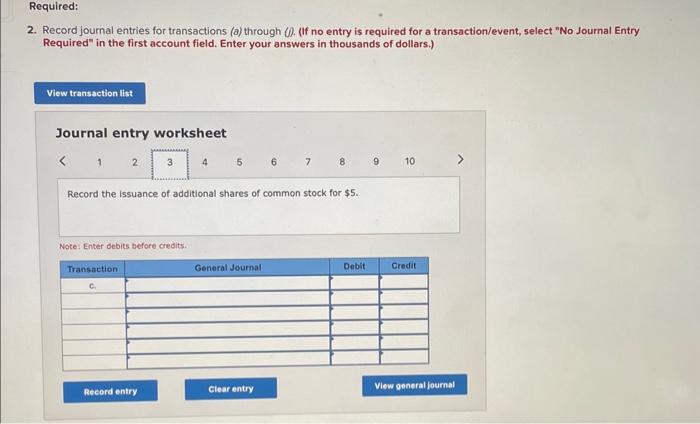

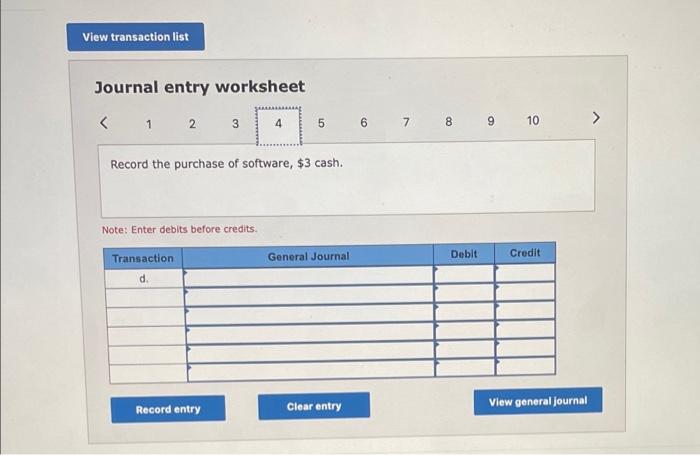

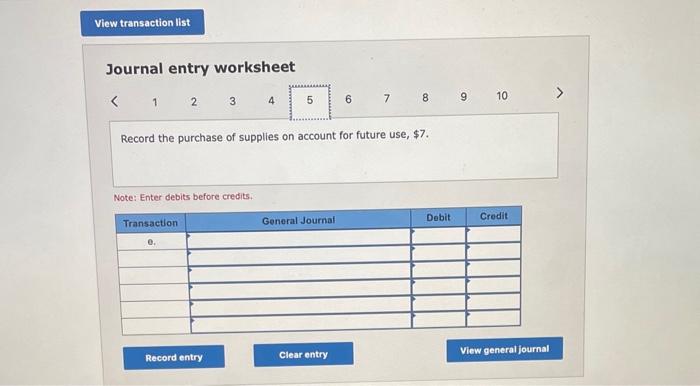

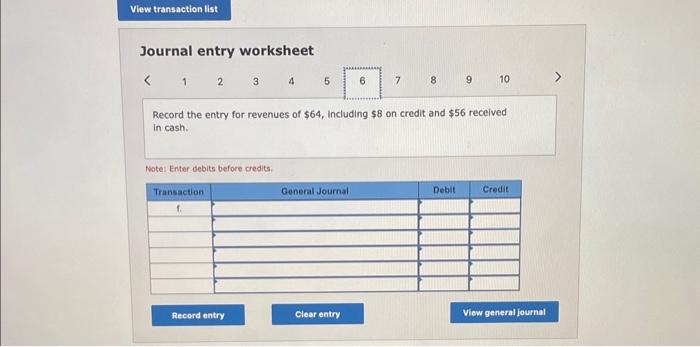

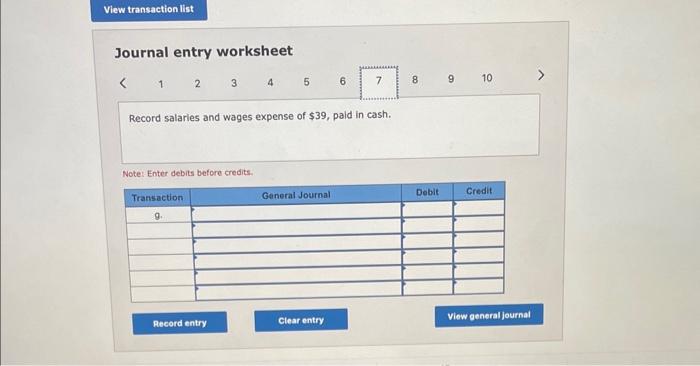

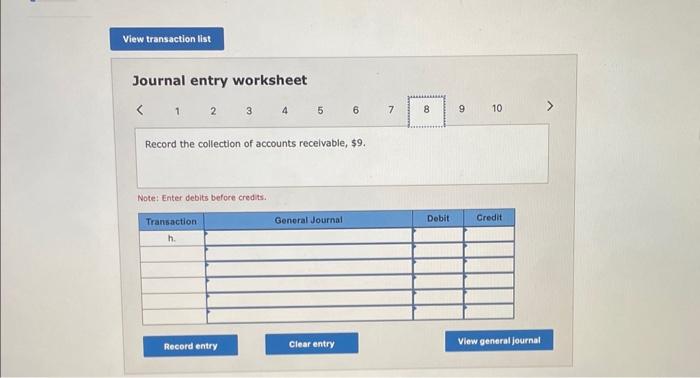

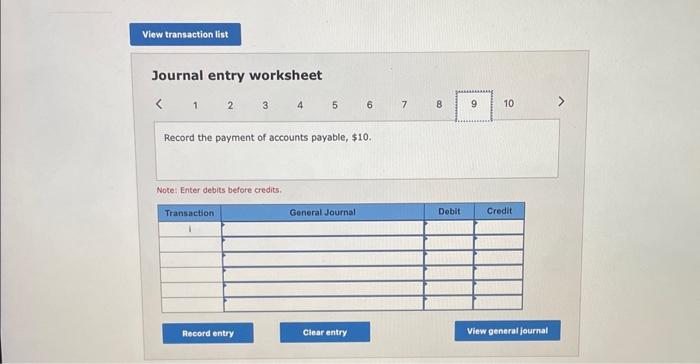

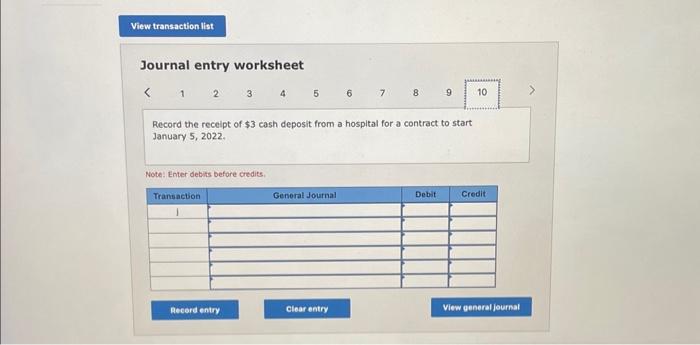

Required information [The following information applies to the questions displayed below.] Drs. Glenn Feltham and David Ambrose began operations of their physical therapy clinic, called Northland Physical Therapy, on January 1, 2020. The annual reporting period ends December 31 . The trial balance on January 1, 2021, was as follows (the amounts are rounded to thousands of dollars to simplify): Iransactions during 2021 (summarized in thousands of dollars) follow: a. Borrowed $31 cash on July 1,2021 , signing a six-month note payable. b. Purchased equipment for $34 cash on July 2,2021. c. Issued additional shares of common stock for $5 on July 3. d. Purchased software on July 4,$3 cash. e. Purchased supplies on July 5 on account for future use, $7. f. Recorded revenues on December 6 of $64, including $8 on credit and $56 received in cash. g. Recognized salaries and wages expense on December 7 of $39; paid in cash. h. Collected accounts receivable on December 8,$9. i. Paid accounts payable on December 9,$10. j. Received a $3 cash deposit on December 10 from a hospital for a contract to start January 5, 2022. Data for adjusting journal entries on December 31: k. Amortization for 2021,$3. 1. Supplies of $3 were counted on December 31, 2021. m. Depreciation for 2021,$4. n. Accrued interest of $1 on notes payable. o. Salaries and wages incurred but not yet paid or recorded, $3. p. Income tax expense for 2021 was $4 and will be paid in 2022. Required: 2. Record journal entries for transactions (a) through (J). (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in thousands of dollars.) Journal entry worksheet 45678910> Record the borrowing $31 cash on July 1,2021 , signing a six-month note payable. Note: Enter debits before credits. 2. Record journal entries for transactions (a) through (j). (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in thousands of dollars.) Journal entry worksheet 45678910> Record the purchase of equipment for $34 cash on July 2,2021. Note: Entor debits before credits. 2. Record journal entries for transactions (a) through (i). (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in thousands of dollars.) Journal entry worksheet \begin{tabular}{l|ccccccc} \langle & 5 & 6 & 7 & 8 & 9 & 10 \end{tabular}> Note: Enter debits before credits. Journal entry worksheet