Answered step by step

Verified Expert Solution

Question

1 Approved Answer

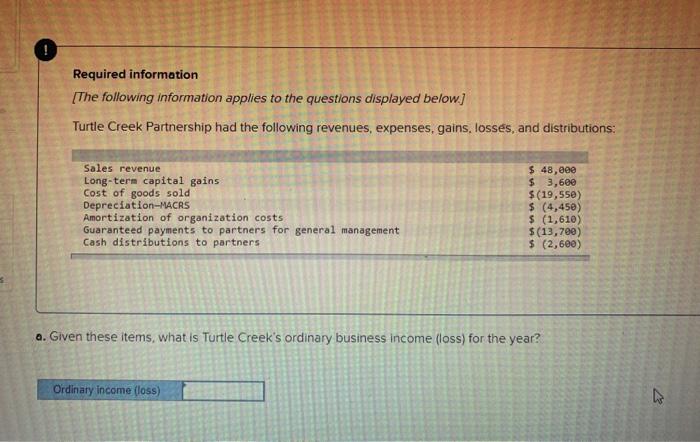

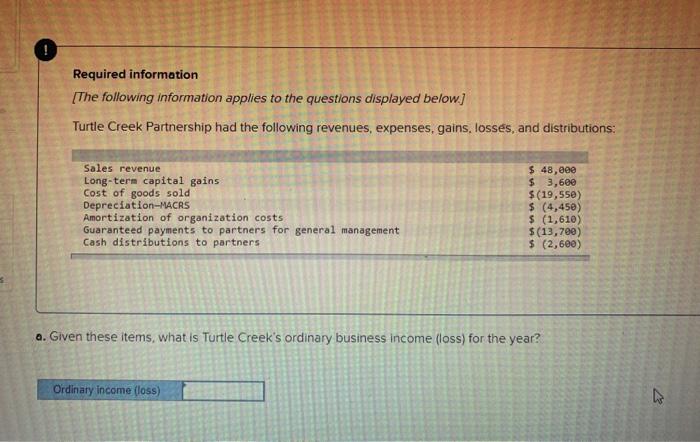

Required information The following information applies to the questions displayed below] Turtle Creek Partnership had the following revenues, expenses, gains, losses, and distributions: Sales revenue

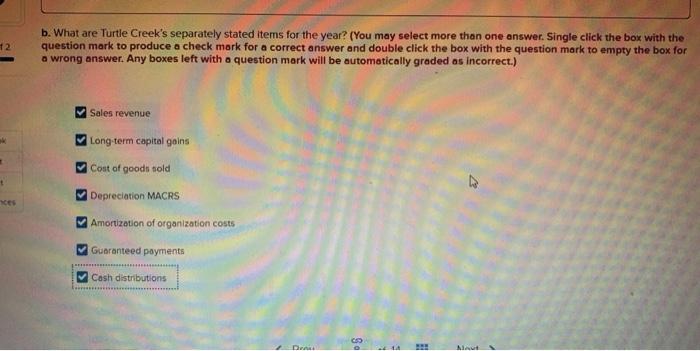

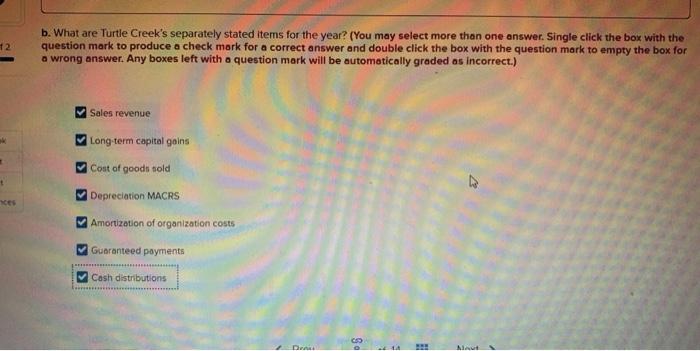

Required information The following information applies to the questions displayed below] Turtle Creek Partnership had the following revenues, expenses, gains, losses, and distributions: Sales revenue Long-term capital gains Cost of goods sold Depreciation-MACRS Amortization of organization costs Guaranteed payments to partners for general management Cash distributions to partners $ 48,000 $ 3,600 $(19,558) $ (4,450) $ (1,610) $(13,700) $ (2,600) a. Given these items, what is Turtle Creek's ordinary business income (loss) for the year? Ordinary Income (loss) b. What are Turtle Creek's separately stated items for the year? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Sales revenue Long-term capital gains Cost of goods sold + Depreciation MACRS Amortization of organization costs Guaranteed payments Cash distributions OS D At

Required information The following information applies to the questions displayed below] Turtle Creek Partnership had the following revenues, expenses, gains, losses, and distributions: Sales revenue Long-term capital gains Cost of goods sold Depreciation-MACRS Amortization of organization costs Guaranteed payments to partners for general management Cash distributions to partners $ 48,000 $ 3,600 $(19,558) $ (4,450) $ (1,610) $(13,700) $ (2,600) a. Given these items, what is Turtle Creek's ordinary business income (loss) for the year? Ordinary Income (loss) b. What are Turtle Creek's separately stated items for the year? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Sales revenue Long-term capital gains Cost of goods sold + Depreciation MACRS Amortization of organization costs Guaranteed payments Cash distributions OS D At

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started