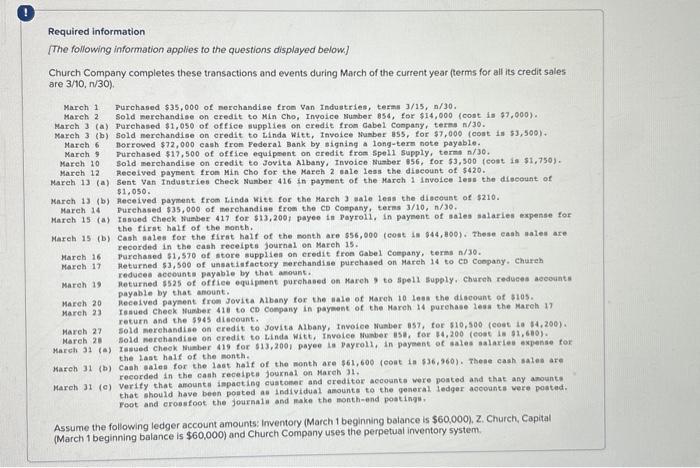

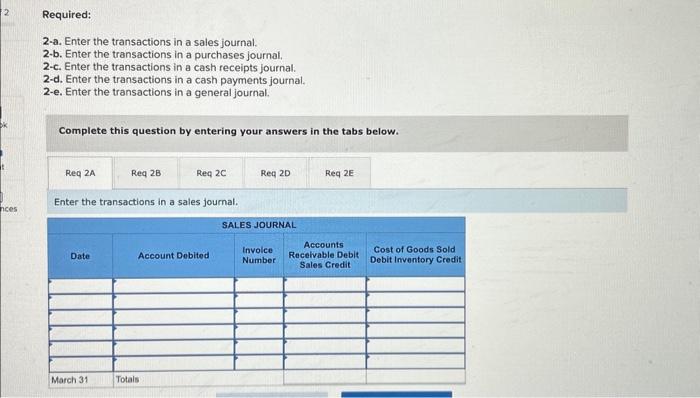

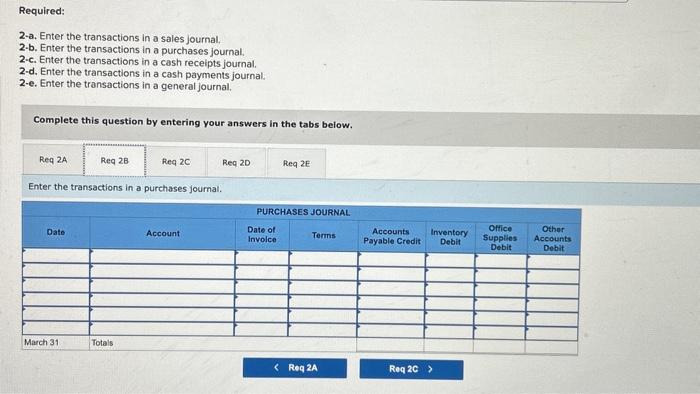

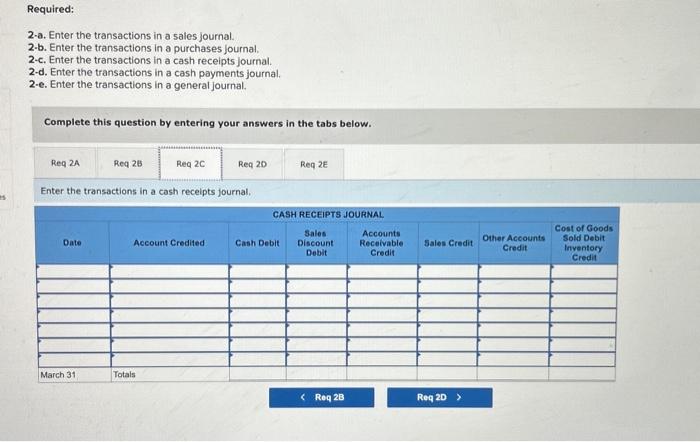

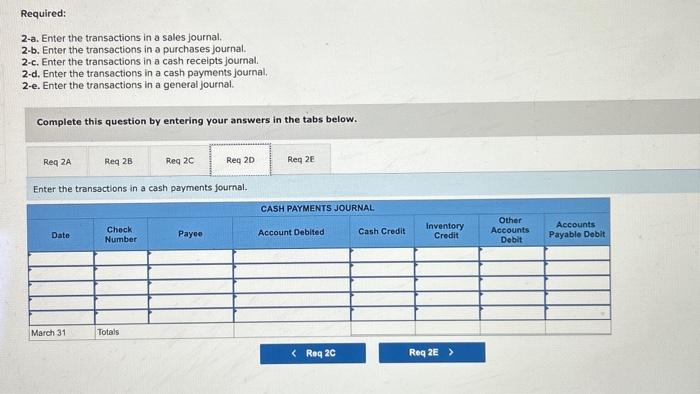

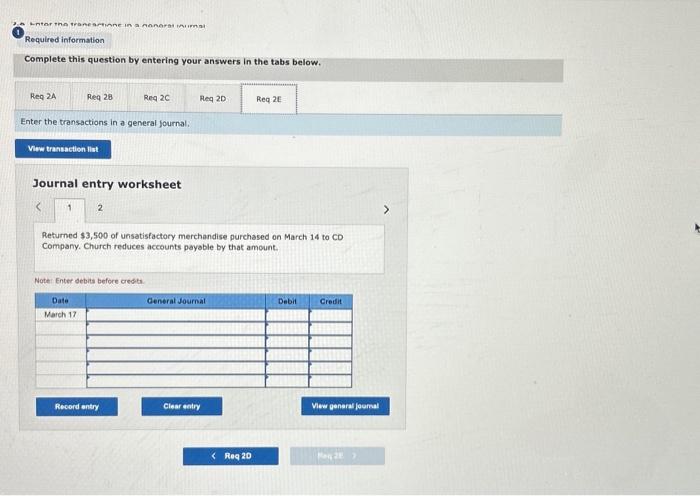

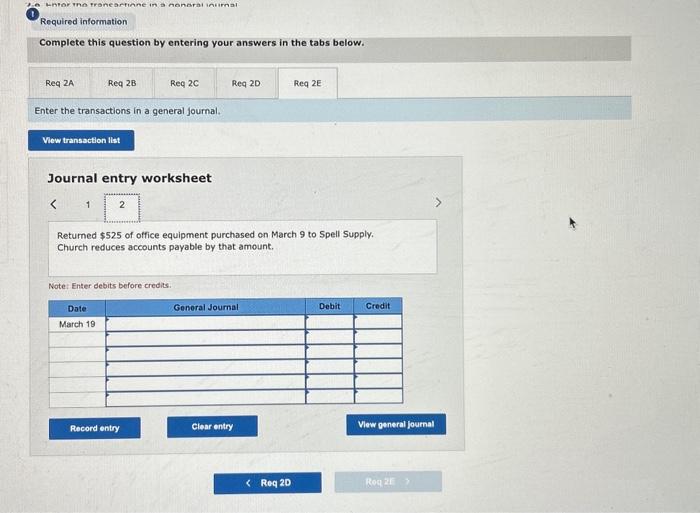

Required information [The following information applies to the questions displayed below] Church Company completes these transactions and events during March of the current year ferms for all its credit sales are 3/10,n/30). March 1 Purchased $35,000 of nerchandise fron Van Industries, teran 3/15,n/30. March 3 (a) Purchased $1,050 of office supplies on eredit from Cabel Conpany, teres n/30. Nareh 6 norrowed $72,000 eash fron Federal Bank by signing a long-term note payable. Narch 9 Purchased $17,500 of offlee equipenent on eredit fron spel1 supply, terms n/30. Mareh 10 Sold merchandise on oredit to Jovita Albany, Invoice Nuaber 856 , for 53,500 (cost is 51,750). March 12 Recelved paypent fron Min cho for the Karch 2 sale less the discount of 5420. March 13 (a) Sent Van Industrien Check Nunber 416 in paysent of the March 1 invelce lese the difecunt of March 13 (b) Peceived payment from I.isda Wite for the March 3 sale leas the discouse of $210. March 15 (a) Insued Check Humber 417 for 513,2001 payeo in payroll. in paysent of ales salaries expense for the first half of the month. recorded in the cash receipes Journal on Mareh 15. March 16 parchased $1,570 of store supplies on eredit fron fabel coepany, terms n/30. March 17 Heturned 53,500 of unsatisfactory merchandise purehased on Mareh 14 to co Coopany. Chureh Mareh 19 Redvee accounts payable by that apount. payable by that anount. Bareh 20 Recelved payment from Jovita Albany for the ale of Mareh 10 lesa the diacount of sios. March 23 rasued cheek Number 418 to co Company in payment of ehe March 14 purehase 2 esa the Mareh 17 return and the 5945 discount. March 31 (a) Iasued cheok Nueber 419 tor 513,2001 payee la payrol1, in payent of sales salariea expesse for Warch 31 (b) Cash ales for the last half of the month are $61,600,(00at1a536,960).7 these cash sales are recorded in the eash receipes journal on Narch 31 , March 31 (c) Verity that amounta impacting customer and creditor accoaste were poated and that any anounta chat should have been poated as Individual amounts to the general. ledger accoanta vere poated. Foot and erobsfoot the journal a and make the month-end poatings. Assume the following ledger account amounts; inventory (March 1 beginning balance is \$60,000), Z, Church, Capital (March 1 beginning balance is $60,000 ) and Church Company uses the perpetual inventory system. Required: 2-a. Enter the transactions in a sales journal. 2-b. Enter the transactions in a purchases journal. 2-c. Enter the transactions in a cash receipts journal. 2-d. Enter the transactions in a cash payments journal. 2-e. Enter the transactions in a general journal. Complete this question by entering your answers in the tabs below. Enter the transactions in a sales journal. Required: 2-a. Enter the transactions in a sales journal. 2-b. Enter the transactions in a purchases journal. 2-c. Enter the transactions in a cash receipts journal. 2-d. Enter the transactions in a cash payments journal. 2-e. Enter the transactions in a general journal. Complete this question by entering your answers in the tabs below. Enter the transactions in a purchases joumal. Required: 2-a. Enter the transactions in a sales journal. 2-b. Enter the transactions in a purchases journal, 2-c. Enter the transactions in a cash receipts journal. 2-d. Enter the transactions in a cash payments journal. 2-e. Enter the transactions in a general journal. Complete this question by entering your answers in the tabs below. Enter the transactions in a cash receipts journal. Required: 2-a. Enter the transactions in a sales journal. 2-b. Enter the transactions in a purchases journal. 2-c. Enter the transactions in a cash receipts journal. 2-d. Enter the transactions in a cash payments journal, 2-e. Enter the transactions in a general journal. Complete this question by entering your answers in the tabs below. Enter the transactions in a cash payments foumal. Lntar tha traneartinne in a nonarat inumna Complete this question by entering your answers in the tabs below. Enter the transactions in a general journal. Journal entry worksheet Returned $3,500 of unsatisfactory merchandise purchased on March 14 to CD Company. Church reduces accounts payable by that amount. Noter Enter debits before credta. Complete this question by entering your answers in the tabs below. Enter the transactions in a general journal. Journal entry worksheet Returned $525 of office equipment purchased on March 9 to Spell Supply. Church reduces accounts payable by that amount. Note: Enter debits before credits