Question

Required information [The following information applies to the questions displayed below.] Chavez Company most recently reconciled its bank statement and book balances of cash on

Required information

[The following information applies to the questions displayed below.]

Chavez Company most recently reconciled its bank statement and book balances of cash on August 31 and it reported two checks outstanding, No. 5888 for $1,028 and No. 5893 for $494. Check No. 5893 was still outstanding as of September 30. The following information is available for its September 30 reconciliation. From the September 30 Bank Statement

| PREVIOUS BALANCE | TOTAL CHECKS AND DEBITS | TOTAL DEPOSITS AND CREDITS | CURRENT BALANCE |

| 16,800 | 9,617 | 11,270 | 18,453 |

| CHECKS AND DEBITS | DEPOSITS AND CREDITS | ||||||||

| Date | No. | Amount | Date | Amount | |||||

| 09/03 | 5888 | 1,028 | 09/05 | 1,103 | |||||

| 09/04 | 5902 | 719 | 09/12 | 2,226 | |||||

| 09/07 | 5901 | 1,824 | 09/21 | 4,093 | |||||

| 09/17 | 600 | NSF | 09/25 | 2,351 | |||||

| 09/20 | 5905 | 937 | 09/30 | 12 | IN | ||||

| 09/22 | 5903 | 399 | 09/30 | 1,485 | CM | ||||

| 09/22 | 5904 | 2,090 | |||||||

| 09/28 | 5907 | 213 | |||||||

| 09/29 | 5909 | 1,807 | |||||||

From Chavez Companys Accounting Records

| Cash Receipts Deposited | ||||

| Date | Cash Debit | |||

| Sept. | 5 | 1,103 | ||

| 12 | 2,226 | |||

| 21 | 4,093 | |||

| 25 | 2,351 | |||

| 30 | 1,682 | |||

| 11,455 | ||||

| Cash Payments | ||||

| Check No. | Cash Credit | |||

| 5901 | 1,824 | |||

| 5902 | 719 | |||

| 5903 | 399 | |||

| 5904 | 2,060 | |||

| 5905 | 937 | |||

| 5906 | 982 | |||

| 5907 | 213 | |||

| 5908 | 388 | |||

| 5909 | 1,807 | |||

| 9,329 | ||||

| Cash | Acct. No. 101 | ||||||||||

| Date | Explanation | PR | Debit | Credit | Balance | ||||||

| Aug. 31 | Balance | 15,278 | |||||||||

| Sept. 30 | Total receipts | R12 | 11,455 | 26,733 | |||||||

| 30 | Total payments | D23 | 9,329 | 17,404 | |||||||

Additional Information

- (a) Check No. 5904 is correctly drawn for $2,090 to pay for computer equipment; however, the recordkeeper misread the amount and entered it in the accounting records with a debit to Computer Equipment and a credit to Cash of $2,060.

- (b) The NSF check shown in the statement was originally received from a customer, S. Nilson, in payment of her account. Its return has not yet been recorded by the company.

- (c) The credit memorandum (CM) is from the collection of a $1,485 note for Chavez Company by the bank. The collection is not yet recorded.

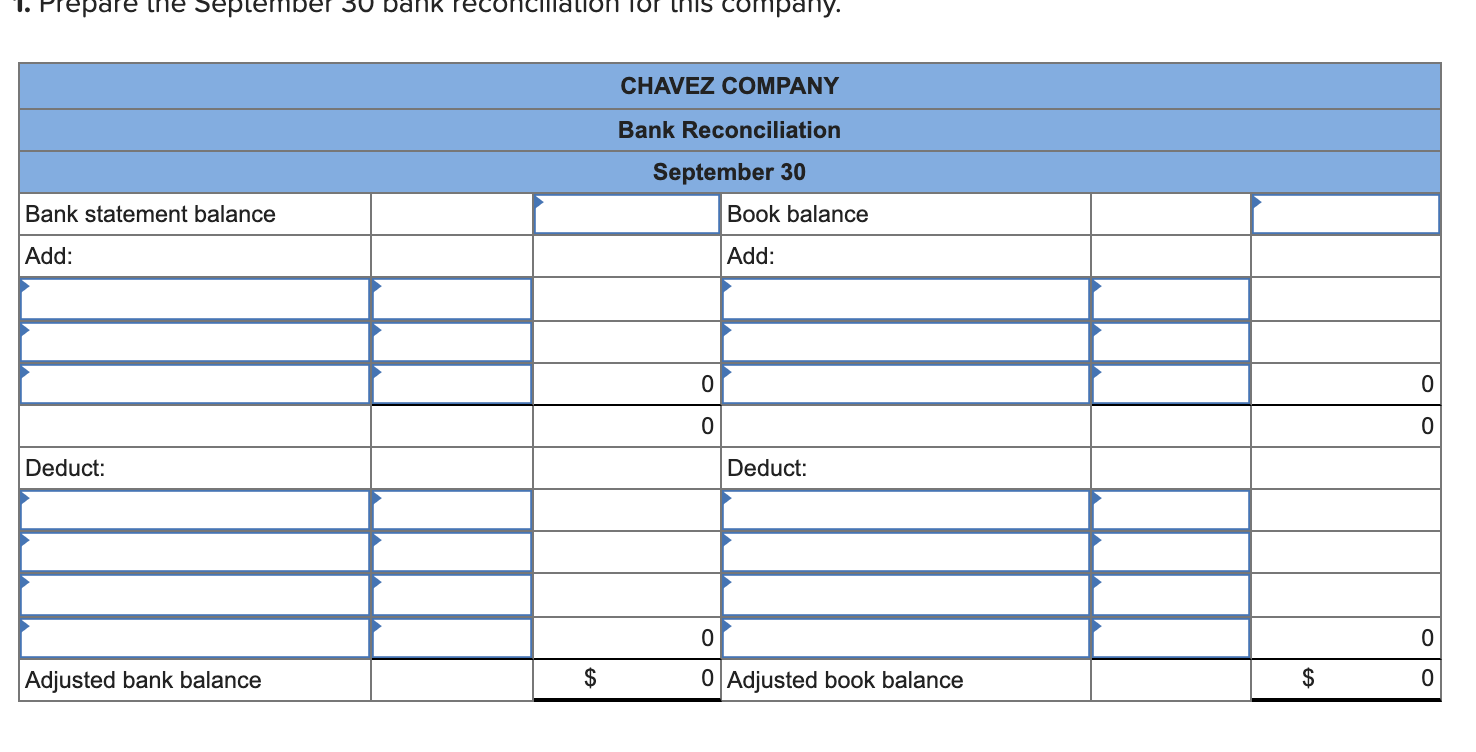

Required: 1. Prepare the September 30 bank reconciliation for this company.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started