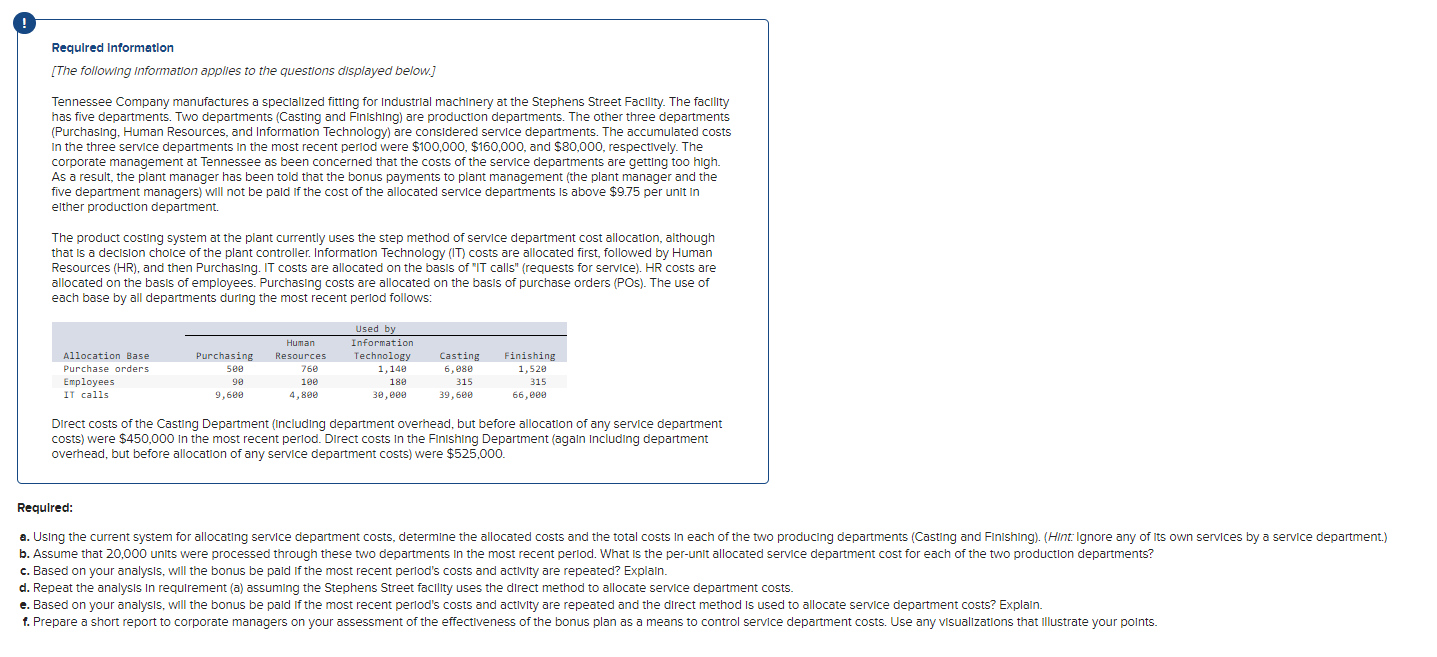

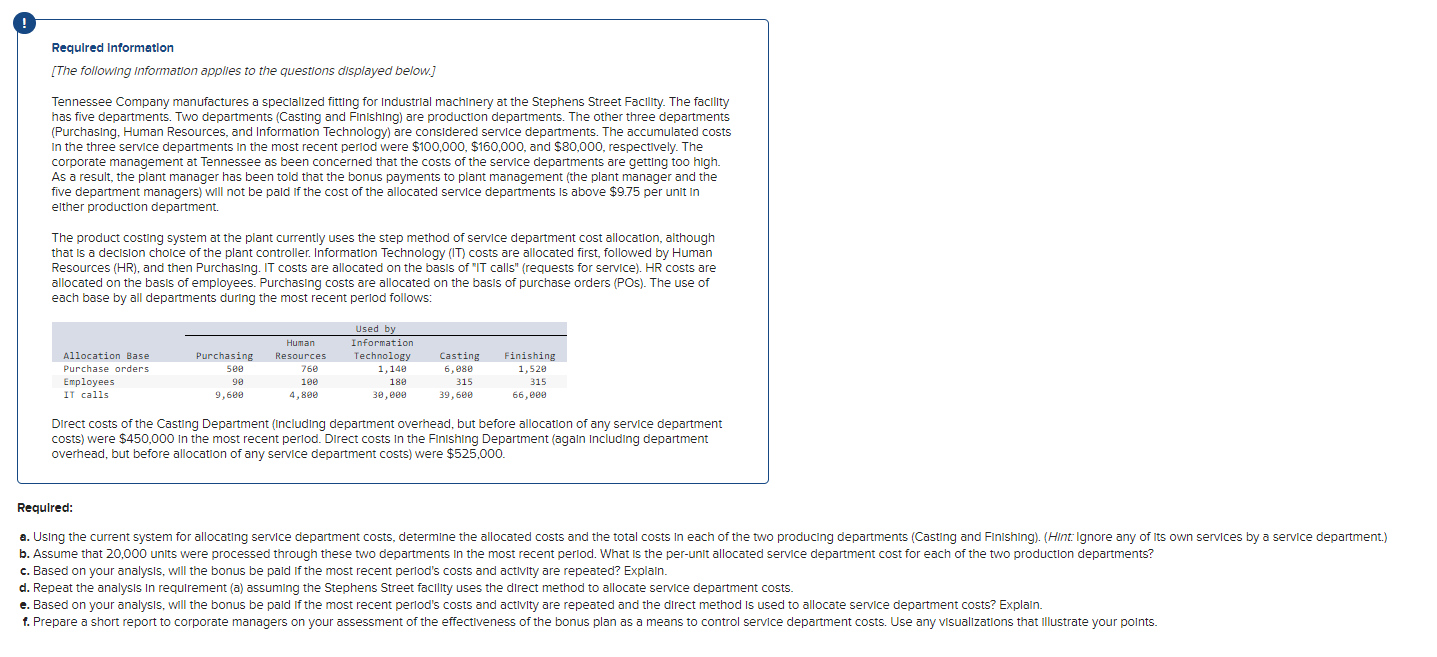

Required Information [The following information applies to the questions displayed below.] Tennessee Company manufactures a speclalized fitting for Industrial machInery at the Stephens Street Facility. The facility has five departments. Two departments (Casting and Finishing) are production departments. The other three departments (Purchasing, Human Resources, and Information Technology) are considered service departments. The accumulated costs In the three service departments in the most recent perlod were $100,000,$160,000, and $80,000, respectlvely. The corporate management at Tennessee as been concerned that the costs of the service departments are getting too high. As a result, the plant manager has been told that the bonus payments to plant management (the plant manager and the five department managers) will not be pald if the cost of the allocated service departments is above $9.75 per unit in elther production department. The product costing system at the plant currently uses the step method of service department cost allocation, although that is a decision choice of the plant controller. Information Technology (IT) costs are allocated first, followed by Human Resources (HR), and then Purchasing. IT costs are allocated on the basIs of "IT calls" (requests for service). HR costs are allocated on the basis of employees. Purchasing costs are allocated on the basIs of purchase orders (POs). The use of each base by all departments during the most recent perlod follows: Direct costs of the Casting Department (Includling department overhead, but before allocation of any service department costs) were $450,000 In the most recent perlod. Direct costs in the Finishing Department (again Including department overhead, but before allocation of any service department costs) were $525,000. Required: b. Assume that 20,000 units were processed through these two departments in the most recent perlod. What is the per-unit allocated service department cost for each of the two production departments? c. Based on your analysis, will the bonus be pald If the most recent perlod's costs and actlvity are repeated? Explain. d. Repeat the analysis in requirement (a) assuming the Stephens Street facility uses the direct method to allocate service department costs. e. Based on your analysis, will the bonus be paid lf the most recent perlod's costs and actlvity are repeated and the direct method is used to allocate service department costs? Explain. f. Prepare a short report to corporate managers on your assessment of the effectlveness of the bonus plan as a means to control service department costs. Use any visualizations that illustrate your points