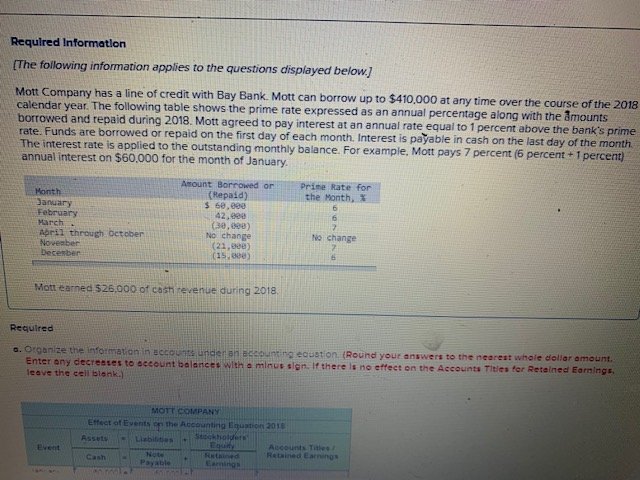

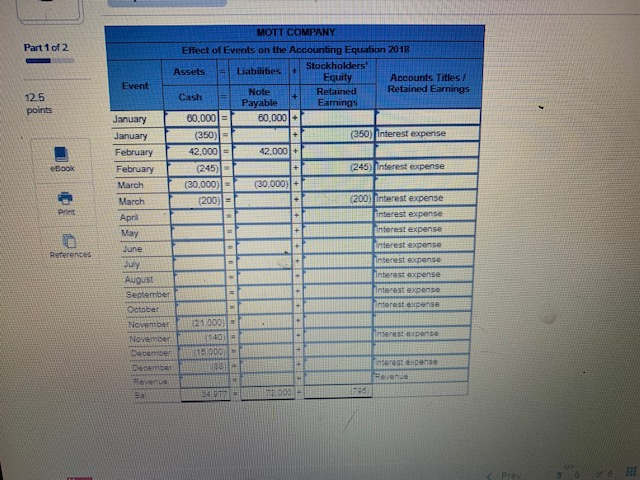

Required Information (The following information applies to the questions displayed below.) Mott Company has a line of credit with Bay Bank. Mott can borrow up to $410,000 at any time over the course of the 2018 calendar year. The following table shows the prime rate expressed as an annual percentage along with the amounts borrowed and repaid during 2018. Mott agreed to pay interest at an annual rate equal to 1 percent above the bank's prime rate. Funds are borrowed or repaid on the first day of each month. Interest is payable in cash on the last day of the month The interest rate is applied to the outstanding monthly balance. For example, Mott pays 7 percent (6 percent +1 percent) annual interest on $60.000 for the month of January Prime Rate for the Month * Month January February March April through October November December Amount Borrowed or (Repaid) $ 60,000 42, Ce.000) No change (21,000) 15,00) No change Mott earned $26.000 of cash revenue during 2018, Required .. Organize the information in accounts under an accounting equation (Round your answers to the nearest whole dollar amount. Enter any decreases to account balances with a minus sign. If there is no effect on the Accounts Titles for Retained Earnings. leave the cell blank.) MOTT COMPANY Effect of Events on the Accounting Equation 2016 holders Equity Cash Part 1 of 2 Event 12.5 points MOTT COMPANY Effect of Events on the Accounting Equation 2018 Assets Liabilities Stockholders' Equity Accounts Titles Cash Note Retained Retained Earnings Pavable Earnings 30,000/= 60.000 (350) (350) Interest expense 42.000-T 42.0001 (245) (245) Interest expense (30,000) - (30,000) (200) . (200) Interest expense interest expense Interest expense January January February February March March April May June July August September October November November BOOK Interest expense References interest conse Required Information (The following information applies to the questions displayed below.) Mott Company has a line of credit with Bay Bank. Mott can borrow up to $410,000 at any time over the course of the 2018 calendar year. The following table shows the prime rate expressed as an annual percentage along with the amounts borrowed and repaid during 2018. Mott agreed to pay interest at an annual rate equal to 1 percent above the bank's prime rate. Funds are borrowed or repaid on the first day of each month. Interest is payable in cash on the last day of the month The interest rate is applied to the outstanding monthly balance. For example, Mott pays 7 percent (6 percent +1 percent) annual interest on $60.000 for the month of January Prime Rate for the Month * Month January February March April through October November December Amount Borrowed or (Repaid) $ 60,000 42, Ce.000) No change (21,000) 15,00) No change Mott earned $26.000 of cash revenue during 2018, Required .. Organize the information in accounts under an accounting equation (Round your answers to the nearest whole dollar amount. Enter any decreases to account balances with a minus sign. If there is no effect on the Accounts Titles for Retained Earnings. leave the cell blank.) MOTT COMPANY Effect of Events on the Accounting Equation 2016 holders Equity Cash Part 1 of 2 Event 12.5 points MOTT COMPANY Effect of Events on the Accounting Equation 2018 Assets Liabilities Stockholders' Equity Accounts Titles Cash Note Retained Retained Earnings Pavable Earnings 30,000/= 60.000 (350) (350) Interest expense 42.000-T 42.0001 (245) (245) Interest expense (30,000) - (30,000) (200) . (200) Interest expense interest expense Interest expense January January February February March March April May June July August September October November November BOOK Interest expense References interest conse