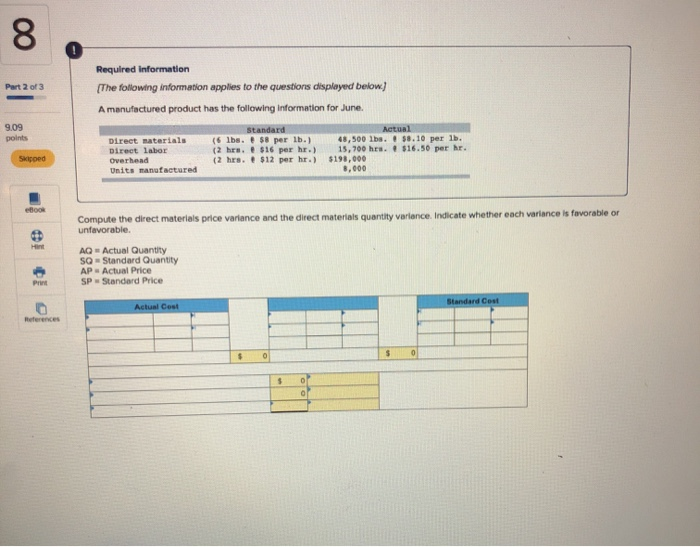

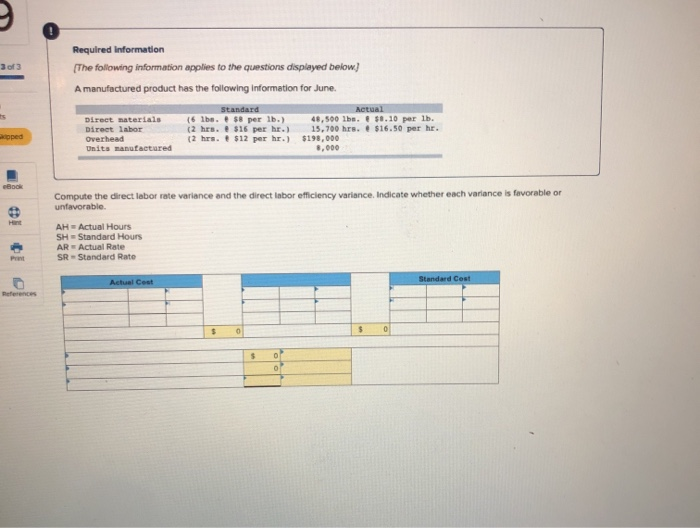

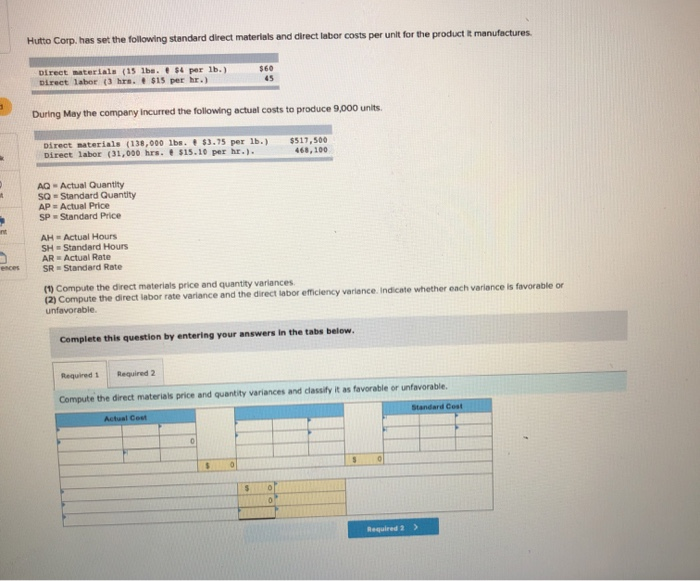

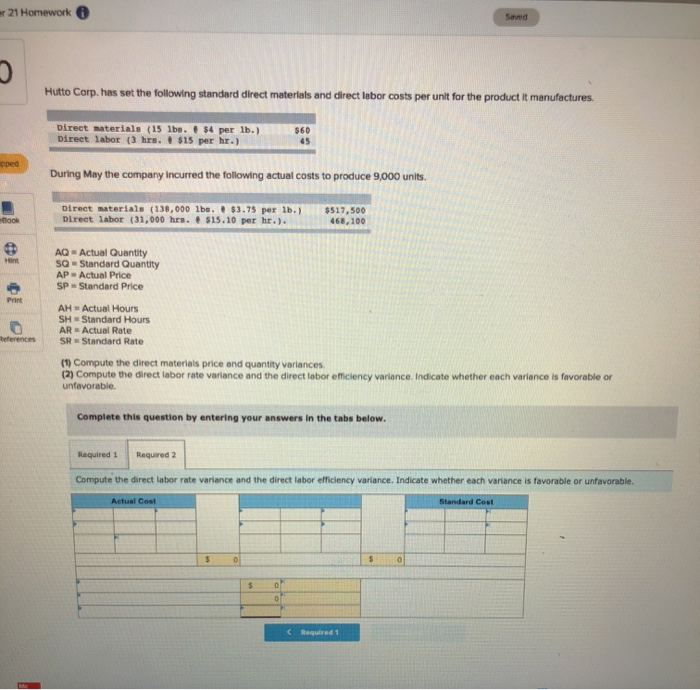

Required information The following information applies to the questions displayed below Part 2 of 3 A manufactured product has the following information for June. 9.09 points Actual Standard (6 lbs. s8 per lb.) (2 hrs.$16 per hr.) (2 hrs. $12 per hr.) 48,500 1bs. s.10 per 1b. 15,700 hrs. $16.50 per hr. $198,000 8,000 Direct materials Direct labor Skipped Overhead Units manufactured efook Compute the direct materials price variance and the direct materials quantity varlance. Indicate whether each variance is favorable or unfavorable. Hint AQ Actual Quantity sQ Standard Quantity AP Actual Price SP Standard Price Print Standard Cost Actual Cost References S 0 Required Information The following information applies to the questions displayed below 3 of 3 A manufactured product has the following iInformation for June. Actual Standard ts (6 1be.s8 per 1b.) (2 hrs. $16 per hr.) (2 hrs. $12 per hr.) $198, 000 48,500 1be.$.10 per 1b. 15,700 hrs. $16.50 per hr. Direct naterials Direct labor Overhead Units manufactured pped ,000 eBook Compute the direct labor rate variance and the direct labor efficiency variance. Indicate whether each variance is favorable or unfavorable. Hint AH Actual Hours SH Standard Hours AR Actual Rate SR Standard Rate Print Standard Cost Actual Cest References 0 Hutto Corp. has set the following standard direct materlals and direct labor costs per unit for the product it manufactures Direct materials (15 lbe. s4 per 1b.) pirect labor (3 hrs.$15 per hr.) $60 45 During May the company Incurred the following actual costs to produce 9,000 units. Direct materials (138,000 1bs.$3.75 per 1b.) Direct labor (31,000 hrs. $15.10 per hr.). $517,500 468,100 AQ Actual Quantity SQ Standard Quantity AP Actual Price SP Standard Price t nt AH Actual Hours SH Standard Hours AR Actual Rate SR Standard Rate ences (1) Compute the direct materials price and quantity variances (2) Compute the direct labor rate variance and the direct labor efficiency variance. Indicate whether each variance is favorable or unfavorable. Complete this question by entering your answers in the tabs below. Required 2 Required 1 Compute the direct materials price and quantity variances and classify it as favorable or unfavorable. Standard Cost Actual Cost Required 2 er 21 Homework Saed Hutto Corp. has set the following standard direct materlals and direct labor costs per unit for the product it manufactures. Direct materials (15 lbs.$4 per 1b.) Direct labor (3 hrs. t$15 per hr.) $60 45 pped During May the company incurred the following actual costs to produce 9,000 unlts. Direct materials (138,000 lbs.$3.75 per 1b.) Direct labor (31,000 hrs.$15.10 per hr.) $517,500 468,100 eBook AQ Actual Quantity SQ Standard Quantity AP Actual Price SP Standard Price Hint Print AH Actual Hours SH Standard Hours AR Actual Rate SR Standard Rate References (1) Compute the direct materials price and quantity variances. (2) Compute the direct labor rate variance and the direct labor efficiency variance. Indicate whether each variance is favorable or unfavorable. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the direct labor rate variance and the direct labor efficiency variance. Indicate whether each variance is favorable or unfavorable. Actual Cost Standard Cost 0 0 0