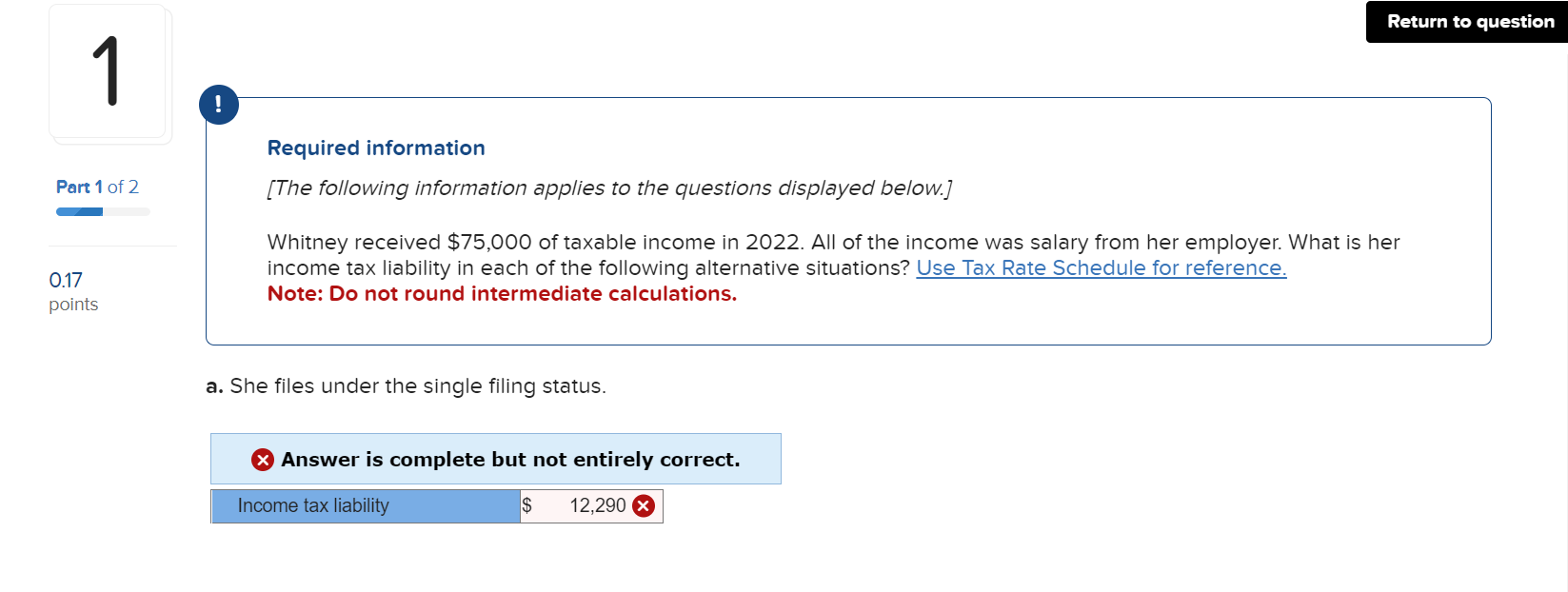

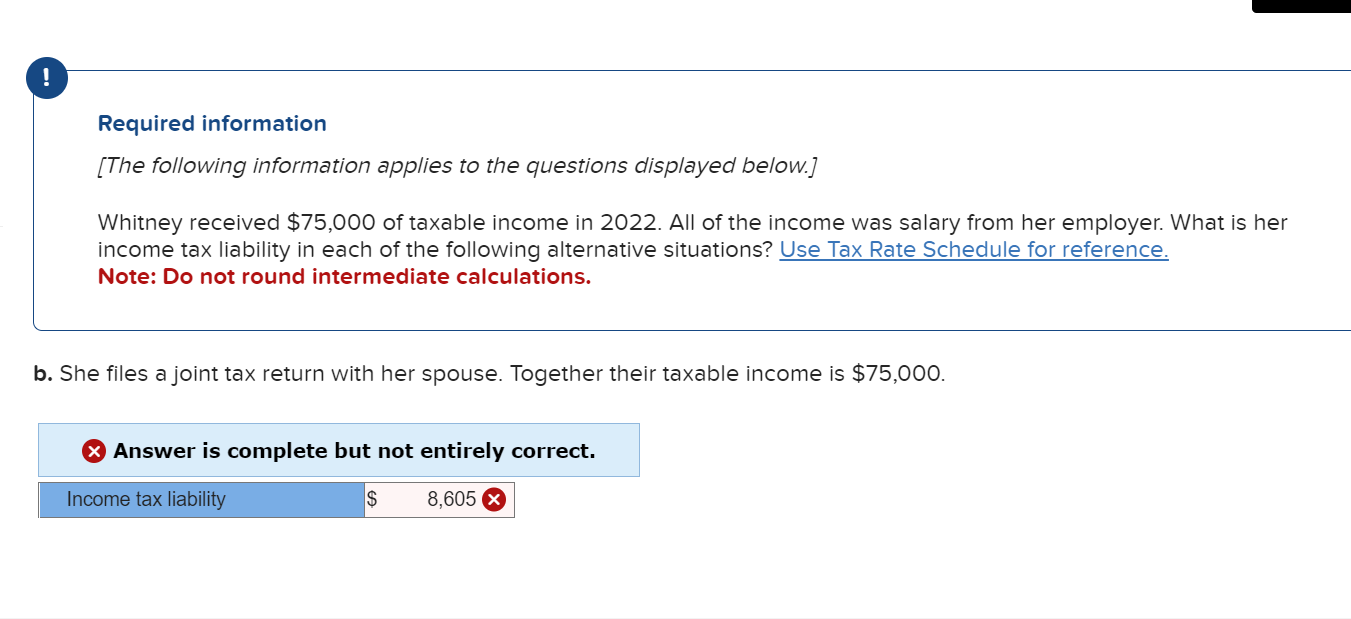

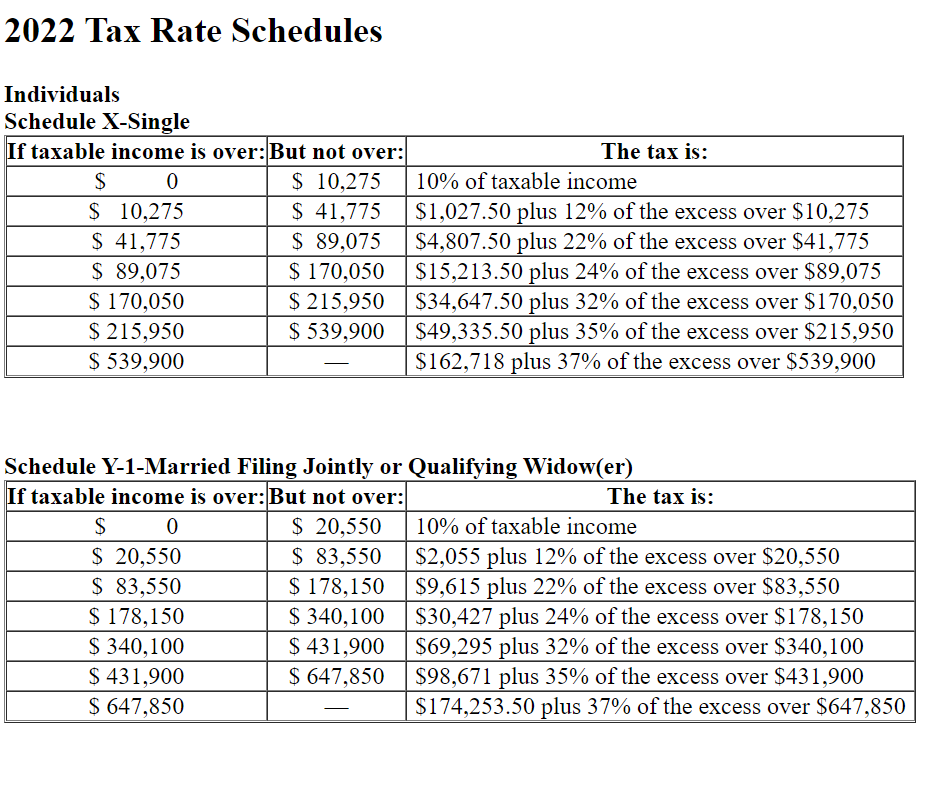

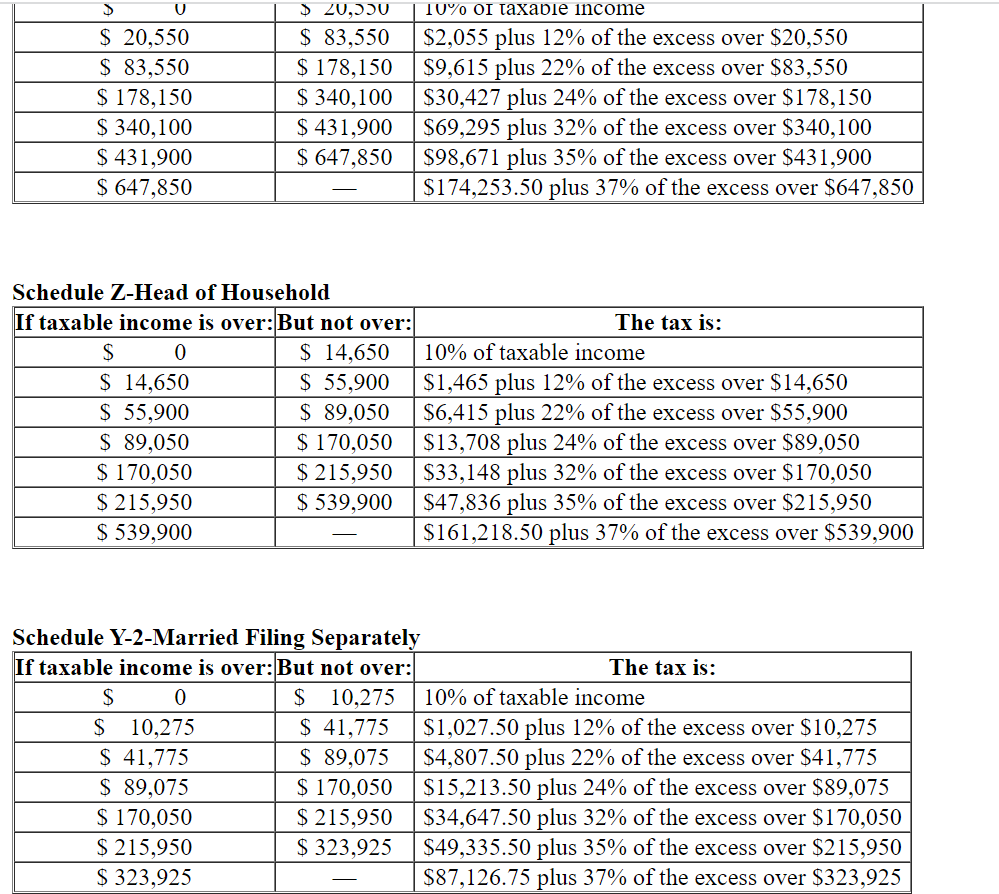

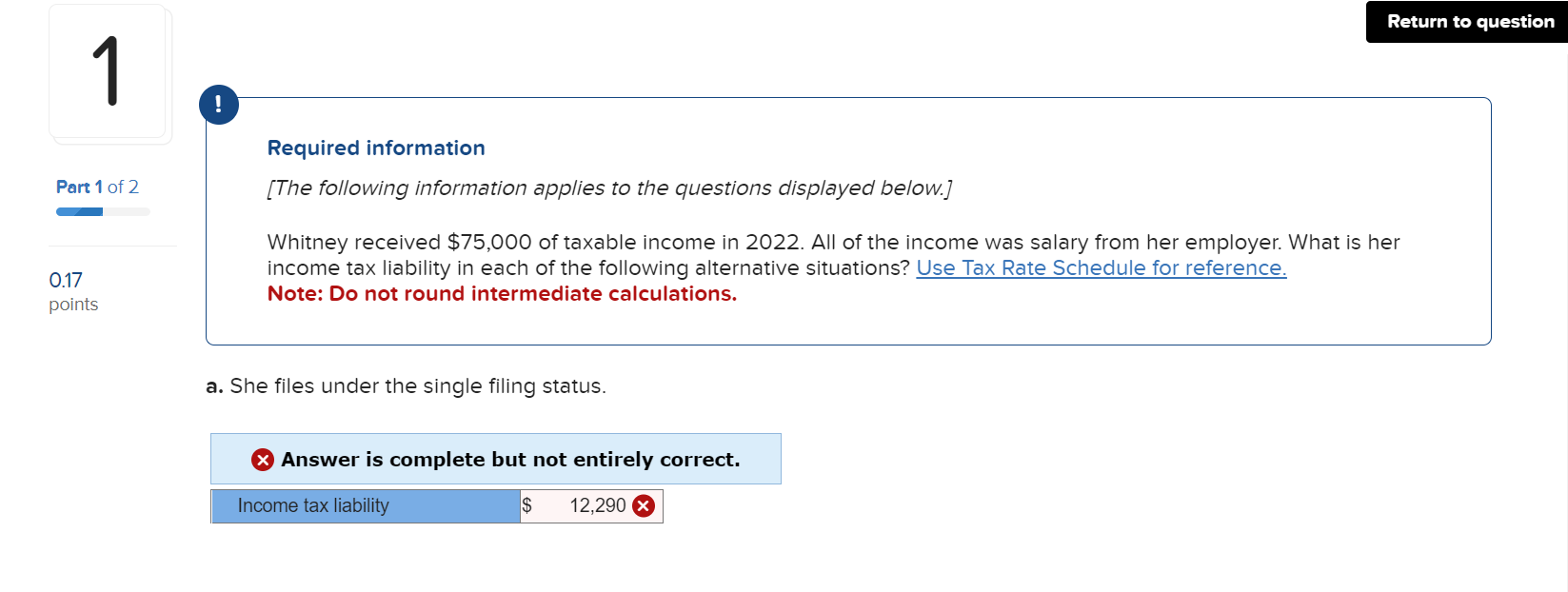

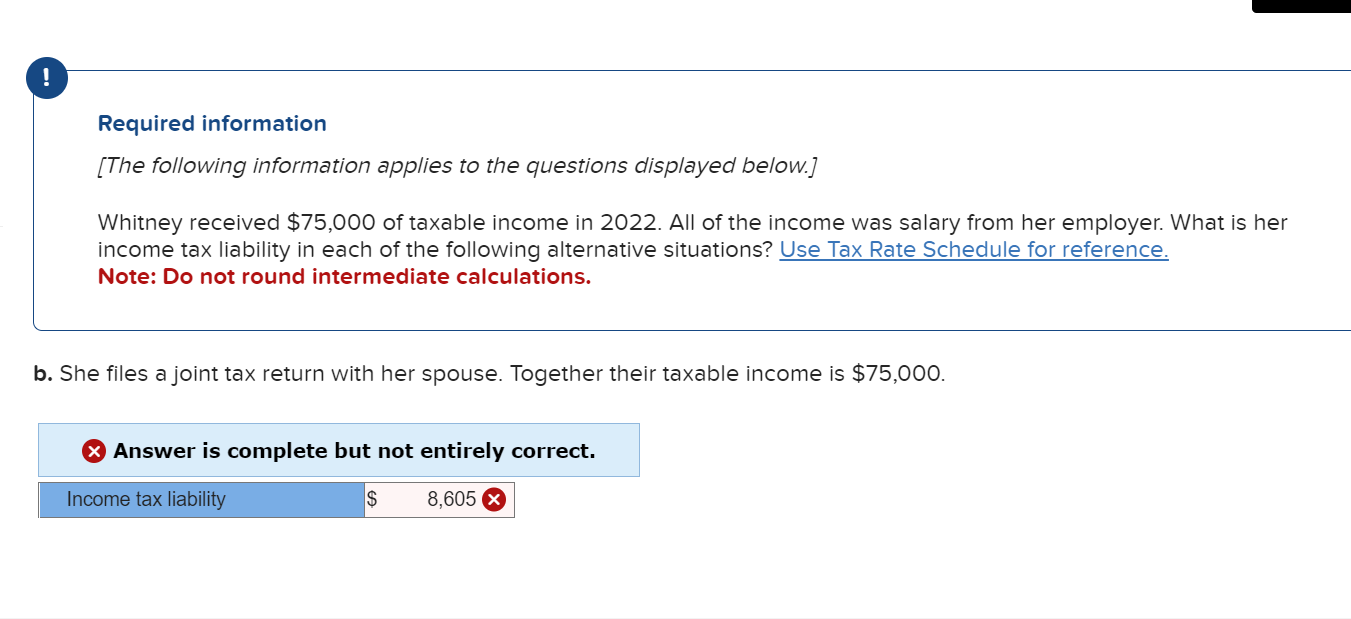

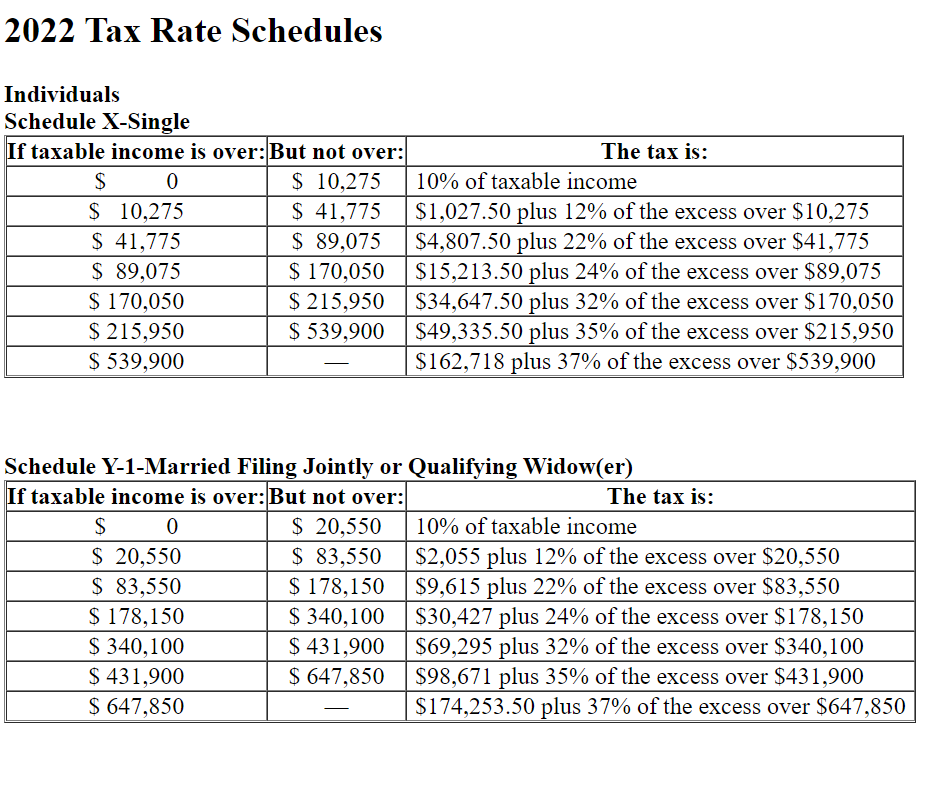

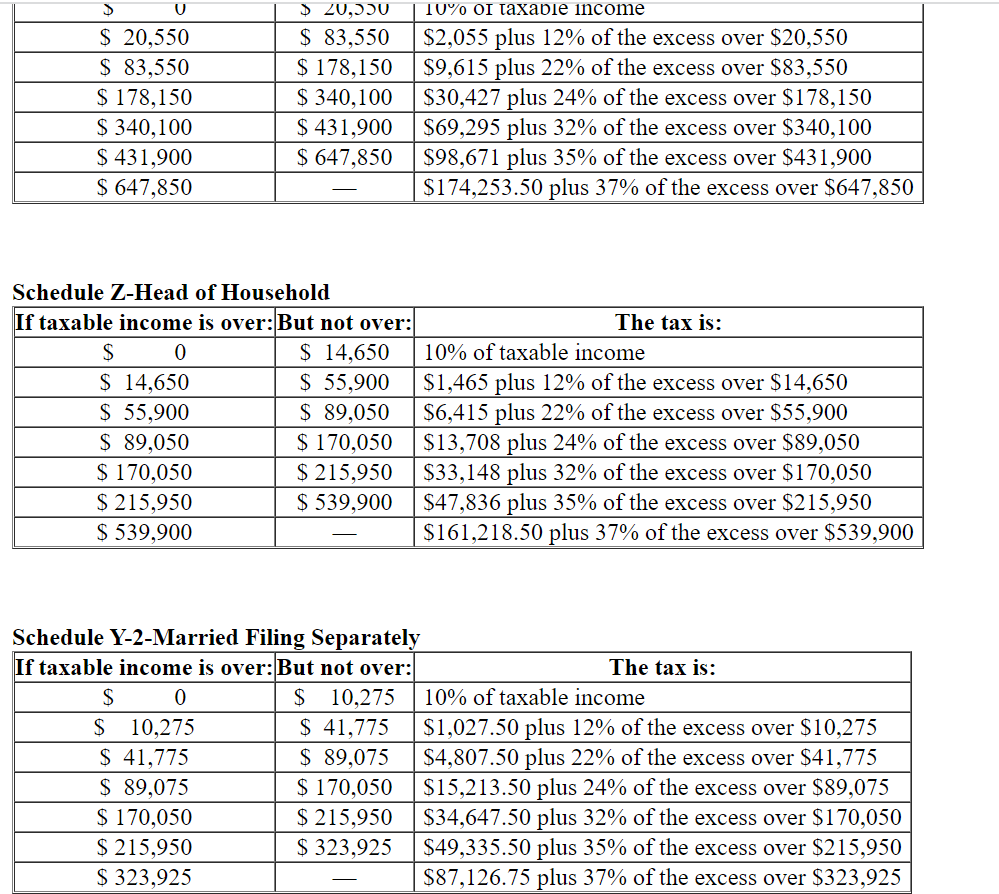

Required information [The following information applies to the questions displayed below.] Whitney received $75,000 of taxable income in 2022 . All of the income was salary from her employer. What is her income tax liability in each of the following alternative situations? Use Tax Rate Schedule for reference. Note: Do not round intermediate calculations. a. She files under the single filing status. Answer is complete but not entirely correct. Required information [The following information applies to the questions displayed below.] Whitney received $75,000 of taxable income in 2022. All of the income was salary from her employer. What is her income tax liability in each of the following alternative situations? Use Tax Rate Schedule for reference. Note: Do not round intermediate calculations. b. She files a joint tax return with her spouse. Together their taxable income is $75,000. Answer is complete but not entirely correct. 2022 Tax Rate Schedules Schedule Z-Head of Household \begin{tabular}{|c|c|l|} \hline If taxable income is over: & But not over: & The tax is: \\ \hline$0 & $14,650 & 10% of taxable income \\ \hline$14,650 & $55,900 & $1,465 plus 12% of the excess over $14,650 \\ \hline$55,900 & $89,050 & $6,415 plus 22% of the excess over $55,900 \\ \hline$89,050 & $170,050 & $13,708 plus 24% of the excess over $89,050 \\ \hline$170,050 & $215,950 & $33,148 plus 32% of the excess over $170,050 \\ \hline$215,950 & $539,900 & $47,836 plus 35% of the excess over $215,950 \\ \hline$539,900 & & $161,218.50 plus 37% of the excess over $539,900 \\ \hline \end{tabular} Schedule Y-2-Married Filing Separately \begin{tabular}{|c|c|c|} \hline If taxable income is over: & But not over: & The tax is: \\ \hline$0 & $10,275 & 10% of taxable income \\ \hline$10,275 & $41,775 & $1,027.50 plus 12% of the excess over $10,275 \\ \hline$41,775 & $89,075 & $4,807.50 plus 22% of the excess over $41,775 \\ \hline$89,075 & $170,050 & $15,213.50 plus 24% of the excess over $89,075 \\ \hline$170,050 & $215,950 & $34,647.50 plus 32% of the excess over $170,050 \\ \hline$215,950 & $323,925 & $49,335.50 plus 35% of the excess over $215,950 \\ \hline$323,925 & & $87,126.75 plus 37% of the excess over $323,925 \\ \hline \end{tabular}