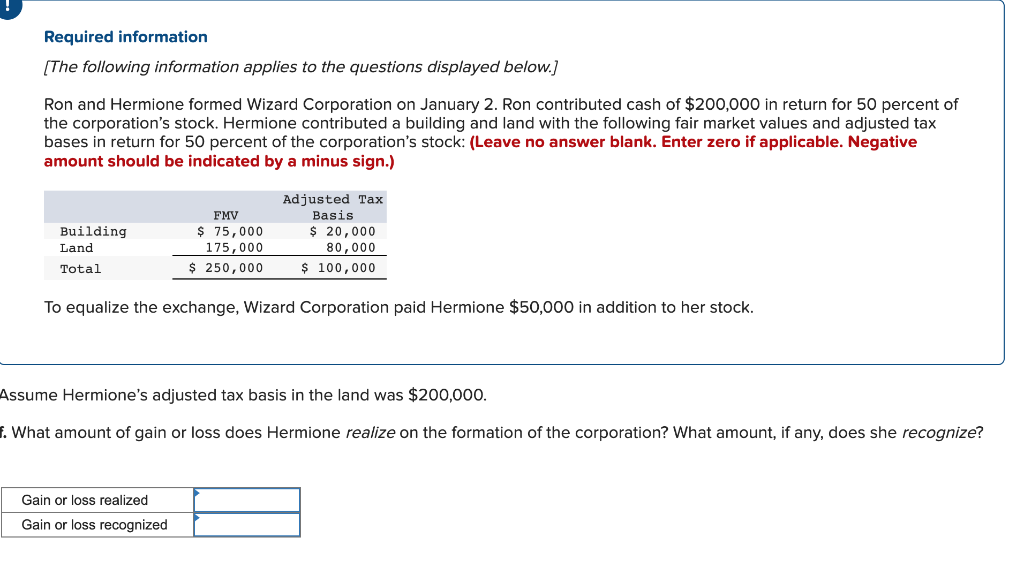

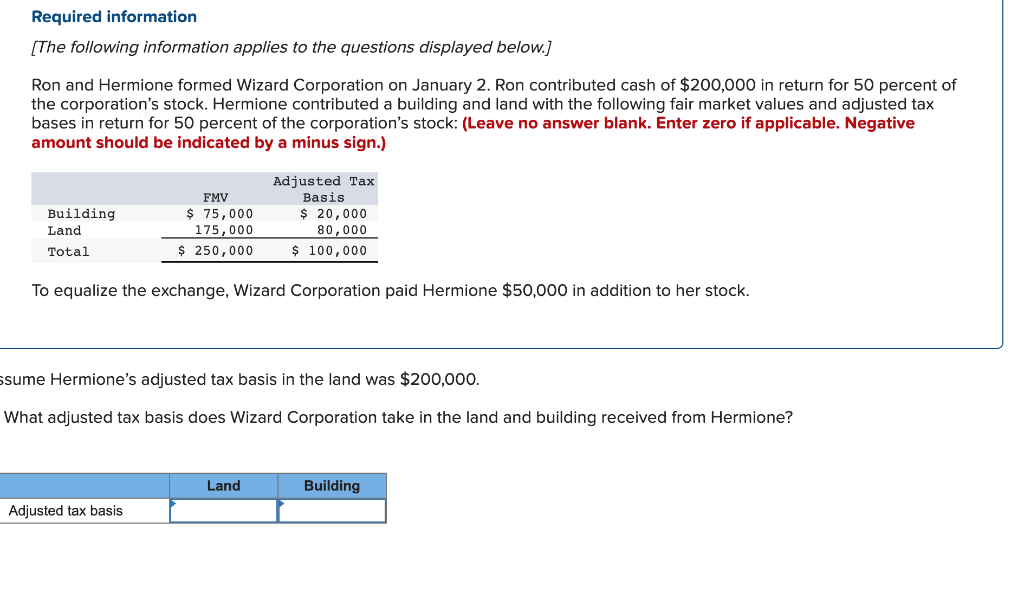

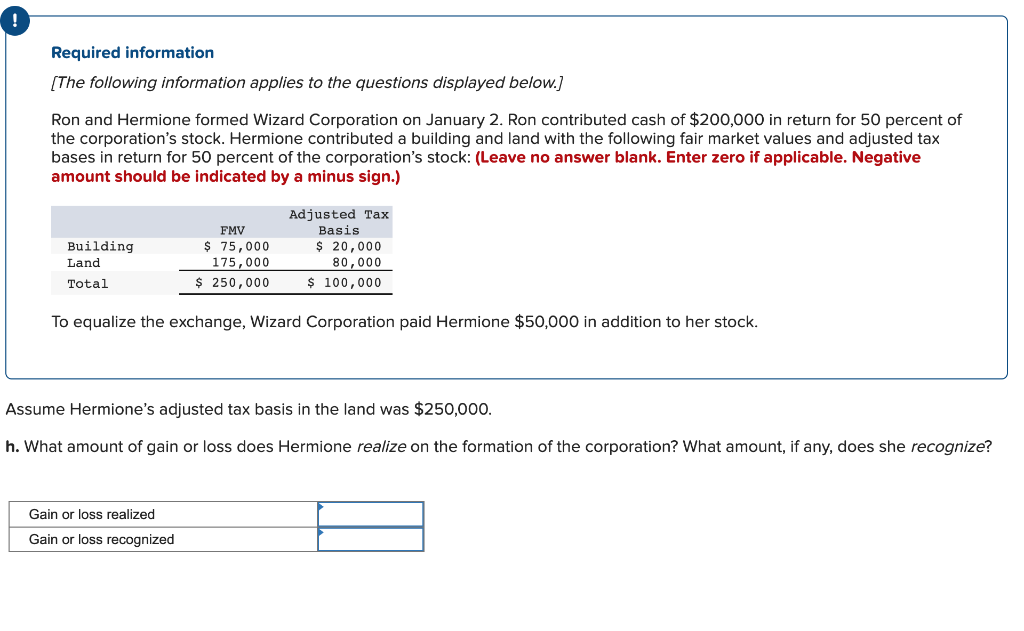

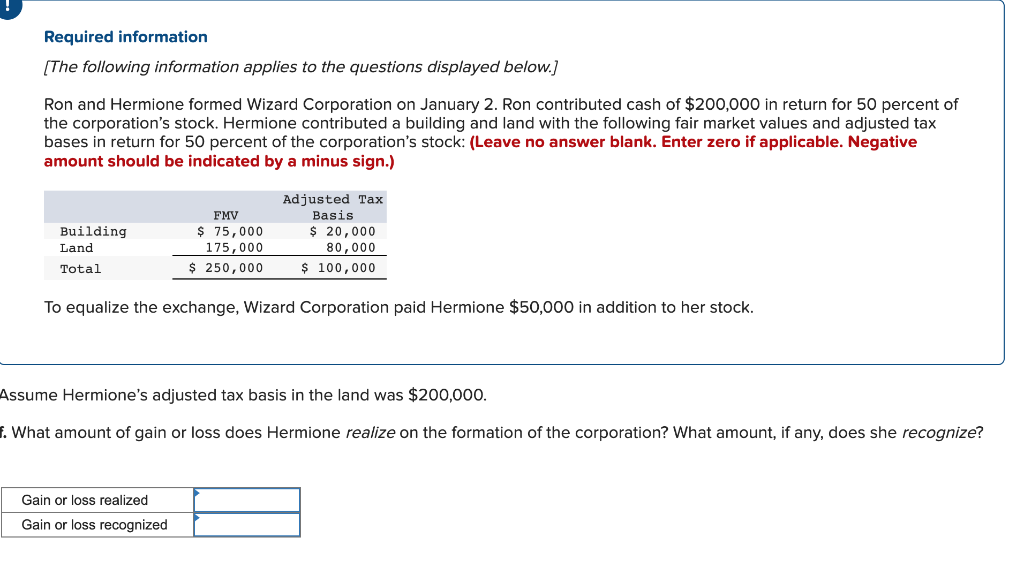

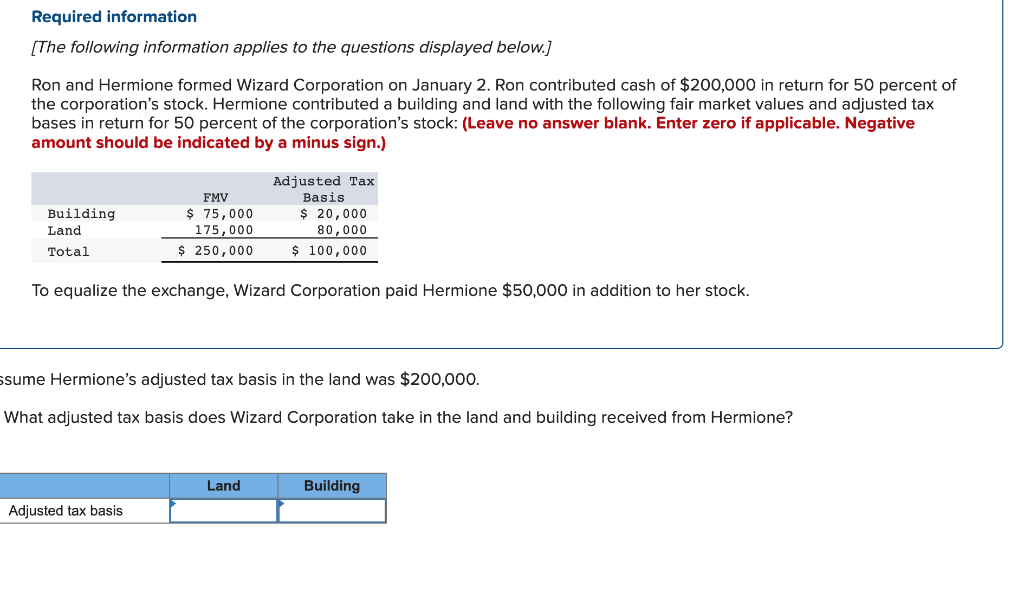

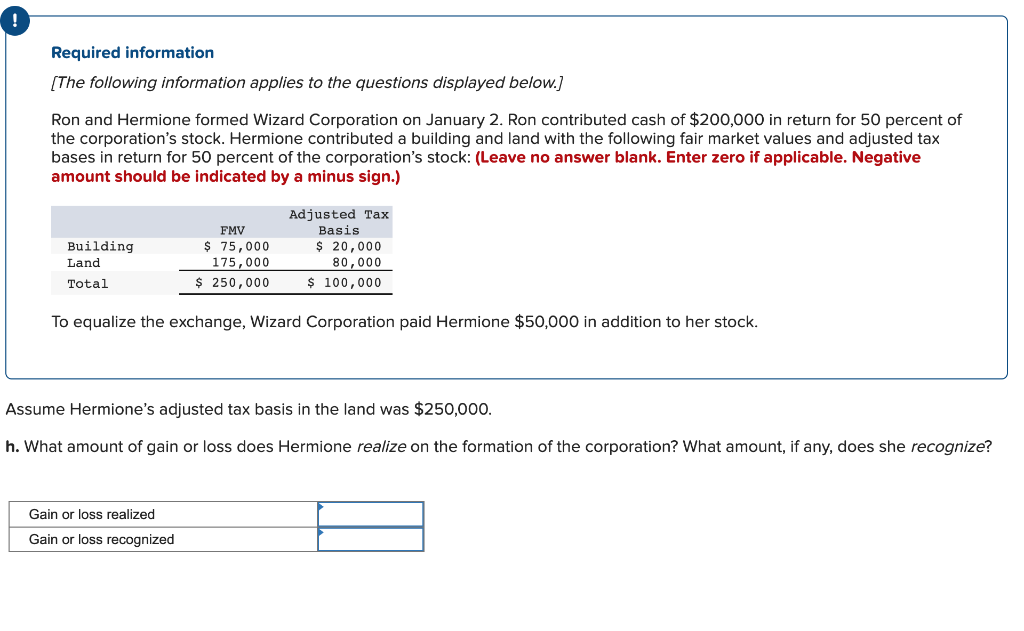

Required information [The following information applies to the questions displayed below.] Ron and Hermione formed Wizard Corporation on January 2. Ron contributed cash of $200,000 in return for 50 percent of the corporation's stock. Hermione contributed a building and land with the following fair market values and adjusted tax bases in return for 50 percent of the corporation's stock: (Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign.) To equalize the exchange, Wizard Corporation paid Hermione $50,000 in addition to her stock. sume Hermione's adjusted tax basis in the land was $200,000. What amount of gain or loss does Hermione realize on the formation of the corporation? What amount, if any, does she recognize? Required information [The following information applies to the questions displayed below.] Ron and Hermione formed Wizard Corporation on January 2. Ron contributed cash of $200,000 in return for 50 percent of the corporation's stock. Hermione contributed a building and land with the following fair market values and adjusted tax bases in return for 50 percent of the corporation's stock: (Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign.) To equalize the exchange, Wizard Corporation paid Hermione \$50,000 in addition to her stock. sume Hermione's adjusted tax basis in the land was $200,000. What adjusted tax basis does Wizard Corporation take in the land and building received from Hermione? Required information [The following information applies to the questions displayed below.] Ron and Hermione formed Wizard Corporation on January 2. Ron contributed cash of $200,000 in return for 50 percent of the corporation's stock. Hermione contributed a building and land with the following fair market values and adjusted tax bases in return for 50 percent of the corporation's stock: (Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign.) To equalize the exchange, Wizard Corporation paid Hermione $50,000 in addition to her stock. ssume Hermione's adjusted tax basis in the land was $250,000. What amount of gain or loss does Hermione realize on the formation of the corporation? What amount, if any, does she recognize? Required information [The following information applies to the questions displayed below.] Ron and Hermione formed Wizard Corporation on January 2. Ron contributed cash of $200,000 in return for 50 percent of the corporation's stock. Hermione contributed a building and land with the following fair market values and adjusted tax bases in return for 50 percent of the corporation's stock: (Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign.) To equalize the exchange, Wizard Corporation paid Hermione $50,000 in addition to her stock. sume Hermione's adjusted tax basis in the land was $200,000. What amount of gain or loss does Hermione realize on the formation of the corporation? What amount, if any, does she recognize? Required information [The following information applies to the questions displayed below.] Ron and Hermione formed Wizard Corporation on January 2. Ron contributed cash of $200,000 in return for 50 percent of the corporation's stock. Hermione contributed a building and land with the following fair market values and adjusted tax bases in return for 50 percent of the corporation's stock: (Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign.) To equalize the exchange, Wizard Corporation paid Hermione \$50,000 in addition to her stock. sume Hermione's adjusted tax basis in the land was $200,000. What adjusted tax basis does Wizard Corporation take in the land and building received from Hermione? Required information [The following information applies to the questions displayed below.] Ron and Hermione formed Wizard Corporation on January 2. Ron contributed cash of $200,000 in return for 50 percent of the corporation's stock. Hermione contributed a building and land with the following fair market values and adjusted tax bases in return for 50 percent of the corporation's stock: (Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign.) To equalize the exchange, Wizard Corporation paid Hermione $50,000 in addition to her stock. ssume Hermione's adjusted tax basis in the land was $250,000. What amount of gain or loss does Hermione realize on the formation of the corporation? What amount, if any, does she recognize