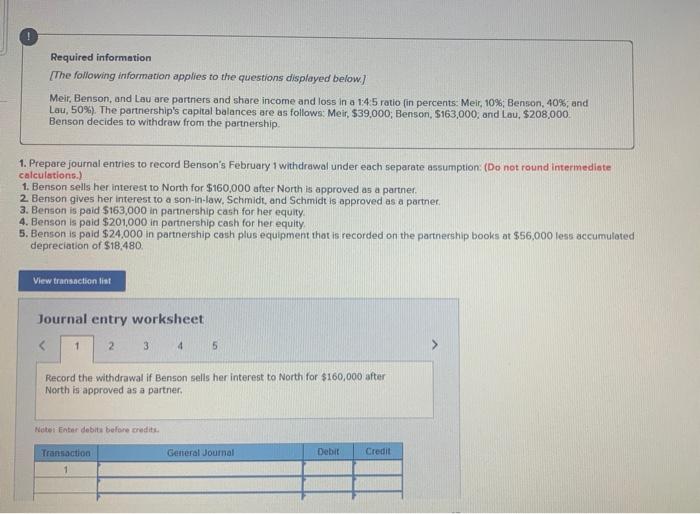

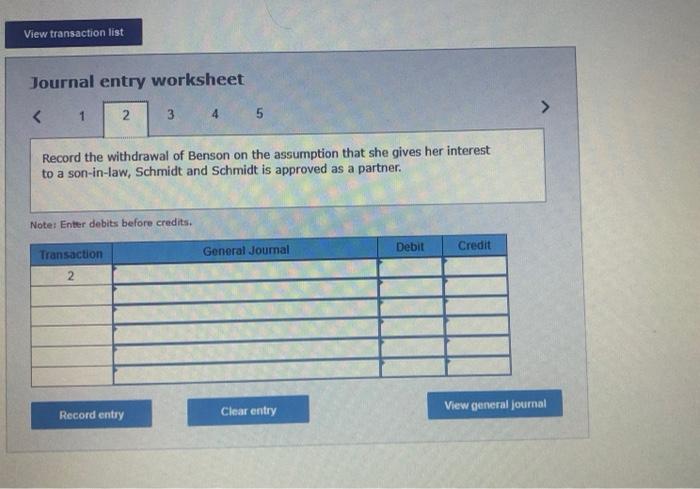

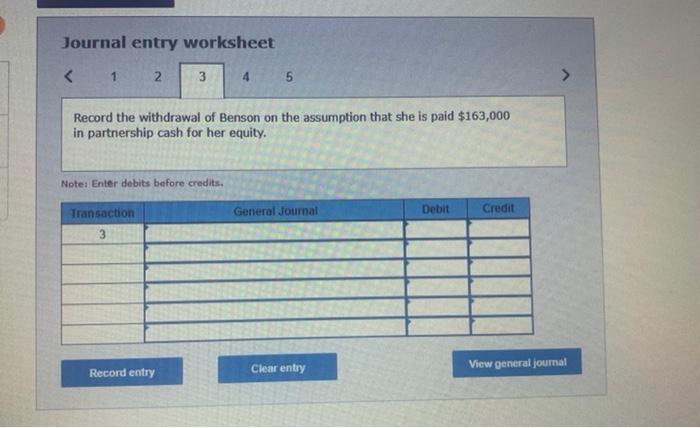

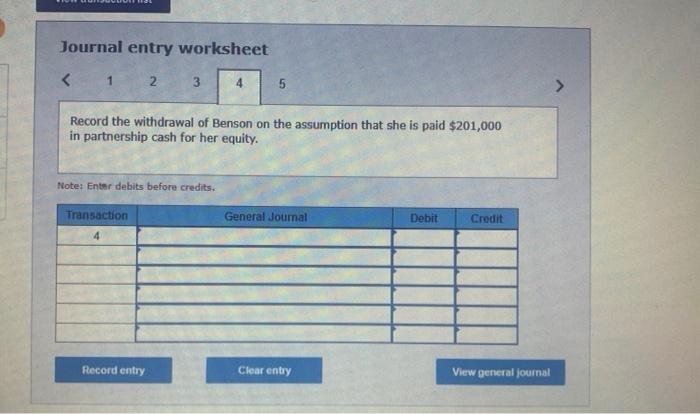

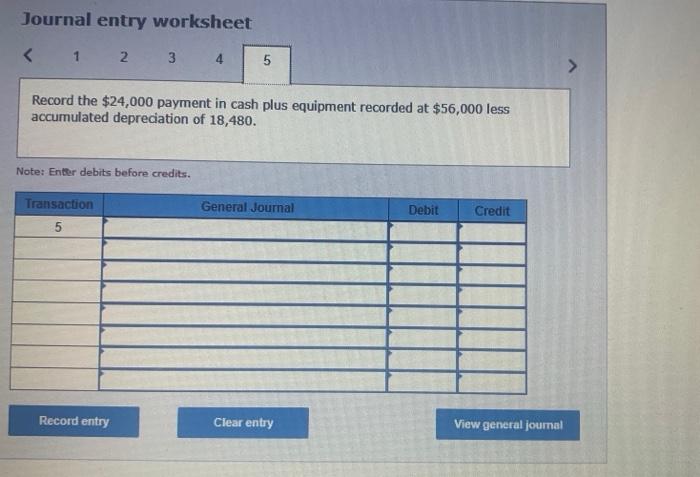

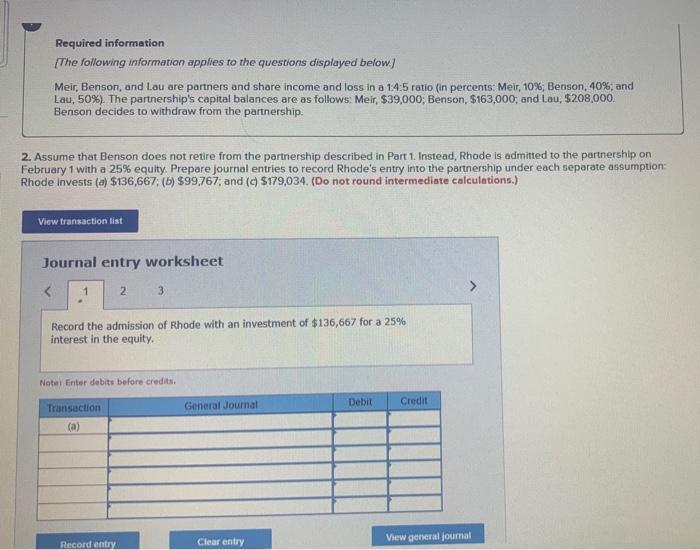

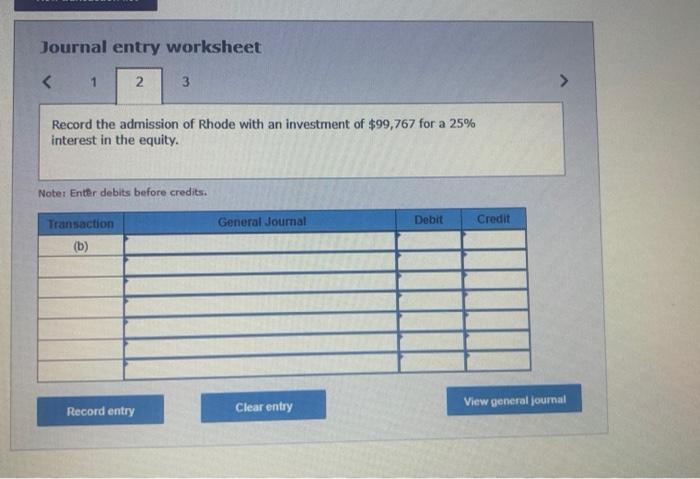

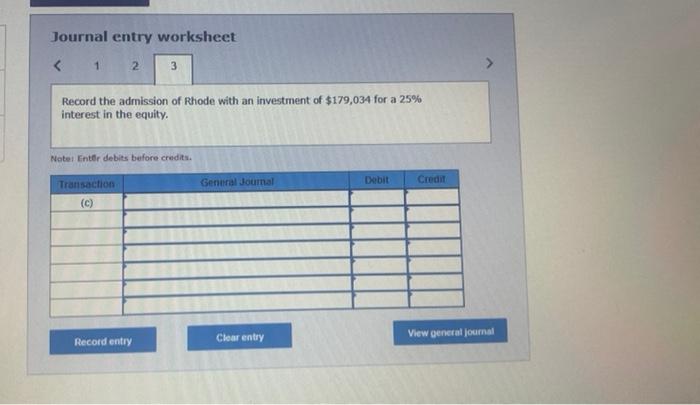

Required information [The following information applies to the questions displayed below] Meir, Benson, and Lau are partners and share income and loss in a 1.4:5 ratio (in percents: Meir, 10\%; Benson, 40%; and Lau, 50\%). The partnership's capital balances are as follows: Meir, $39,000; Benson, $163,000; and Lau, $208,000. Benson decides to withdraw from the partnership. 1. Prepare journal entries to record Benson's February i withdrawal under each separate assumption: (Do not round intermediate calculations.) 1. Benson sells her interest to North for $160,000 after North is approved as a partner. 2. Benson gives her interest to a son-in-law. Schmidt, and Schmidt is approved as a partner. 3. Benson is paid $163,000 in partnership cash for her equity. 4. Benson is paid $201,000 in partnership cash for her equity. 5. Benson is paid $24,000 in partnership cash plus equipment that is recorded on the partnership books at $56,000 less accumulated depreciation of $18,480. Journal entry worksheet Record the withdrawal if Benson sells her interest to North for $160,000 after North is approved as a partner. Moter Enter debita belore credits. Journal entry worksheet Record the withdrawal of Benson on the assumption that she gives her interest to a son-in-law, Schmidt and Schmidt is approved as a partner. Note: Enter debits before credits. Journal entry worksheet Record the withdrawal of Benson on the assumption that she is paid $163,000 in partnership cash for her equity. Notes Enter debits before credits. Journal entry worksheet Record the withdrawal of Benson on the assumption that she is paid $201,000 in partnership cash for her equity. Note: Enter debits before credits. Journal entry worksheet Record the $24,000 payment in cash plus equipment recorded at $56,000 less accumulated depreciation of 18,480 . Note: Enter debits before credits. Required information [The following information applies to the questions displayed below] Meir, Benson, and Lau are partners and share income and loss in a 1.4:5 ratio (in percents: Meir, 10\%; Benson, 40\%, and Lau, 50\%). The partnership's capital balances are as follows: Meir, \$39,000; Benson, \$163,000; and Lau, \$208,000. Benson decides to withdraw from the partnership. 2. Assume that Benson does not retire from the partnership described in Part 1. Instead, Rhode is admitted to the partnership on February 1 with a 25% equity. Prepare journal entries to record Rhode's entry into the partnership under each separate assumption: Rhode invests (a) \$136,667; (b) \$99,767; and (c) \$179,034. (Do not round intermediate calculations.) Journal entry worksheet Record the admission of Rhode with an investment of $136,667 for a 25% interest in the equity. Notei Enter debits before credits. Journal entry worksheet Record the admission of Rhode with an investment of $99,767 for a 25% interest in the equity. Notes Enter debits before credits. Journal entry worksheet Record the admission of Rhode with an investment of $179,034 for a 25% interest in the equity. Netel Fnter debits before credit