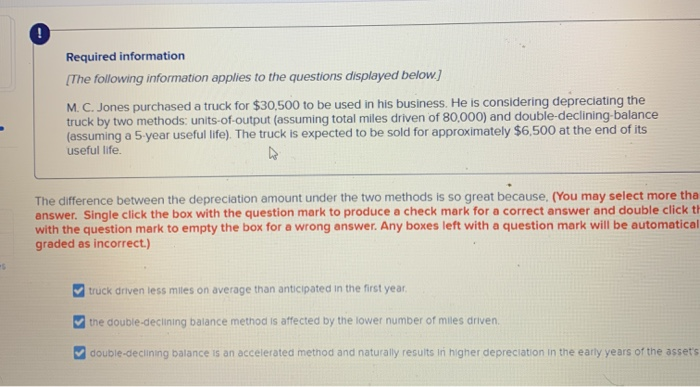

Required information The following information applies to the questions displayed below. M.C. Jones purchased a truck for $30,500 to be used in his business. He is considering depreciating the truck by two methods: units-of-output (assuming total miles driven of 80,000) and double-declining-balance (assuming a 5-year useful life). The truck is expected to be sold for approximately $6,500 at the end of its useful life. The difference between the depreciation amount under the two methods is so great because, (You may select more tha answer. Single click the box with the question mark to produce a check mark for a correct answer and double click th with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatical graded as incorrect) truck driven less miles on average than anticipated in the first year the double-declining balance method Is affected by the lower number of miles driven. double-declining balance is an accelerated method and naturally results ini higher depreciation in the early years of the asset's Required information The following information applies to the questions displayed below. M.C. Jones purchased a truck for $30,500 to be used in his business. He is considering depreciating the truck by two methods: units-of-output (assuming total miles driven of 80,000) and double-declining-balance (assuming a 5-year useful life). The truck is expected to be sold for approximately $6,500 at the end of its useful life. The difference between the depreciation amount under the two methods is so great because, (You may select more tha answer. Single click the box with the question mark to produce a check mark for a correct answer and double click th with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatical graded as incorrect) truck driven less miles on average than anticipated in the first year the double-declining balance method Is affected by the lower number of miles driven. double-declining balance is an accelerated method and naturally results ini higher depreciation in the early years of the asset's