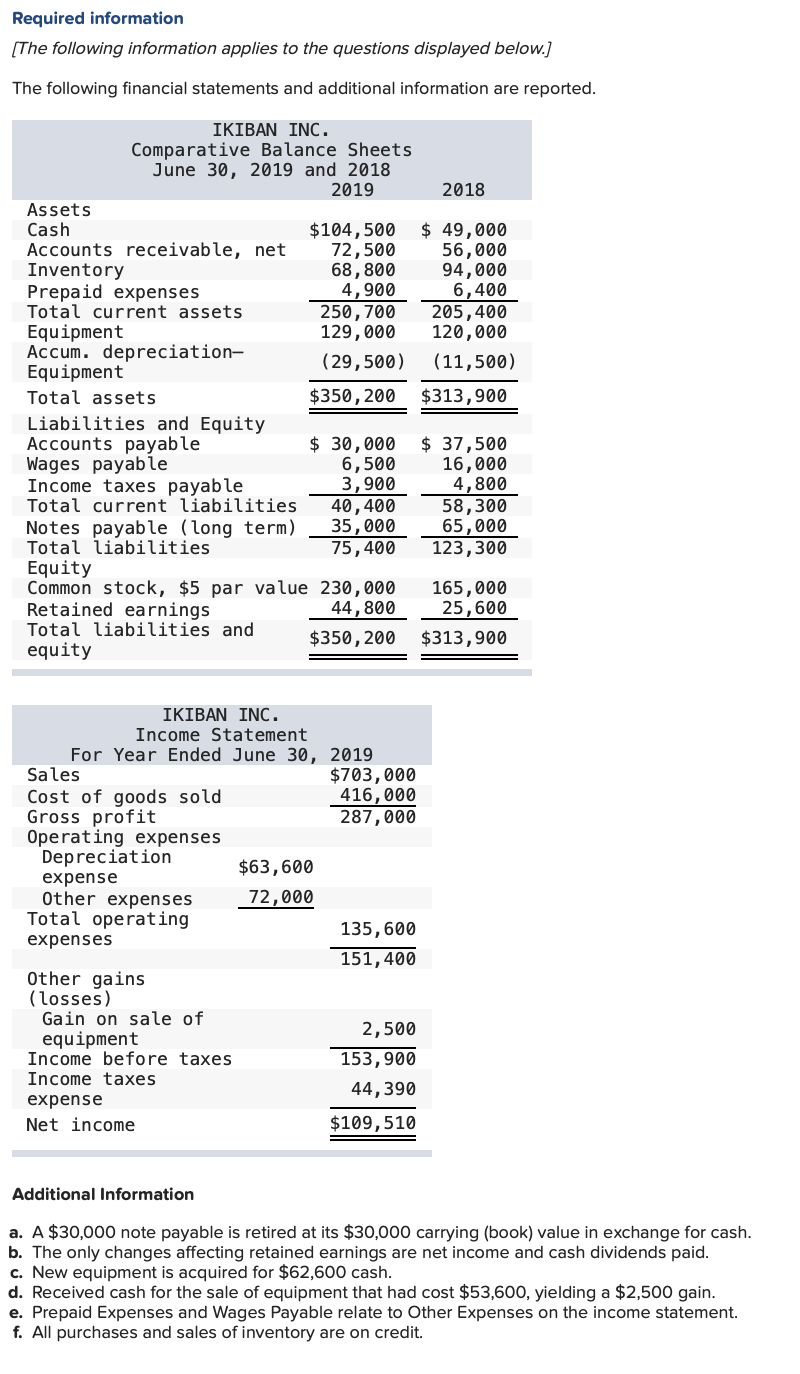

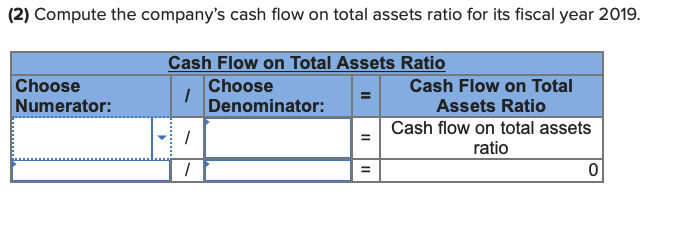

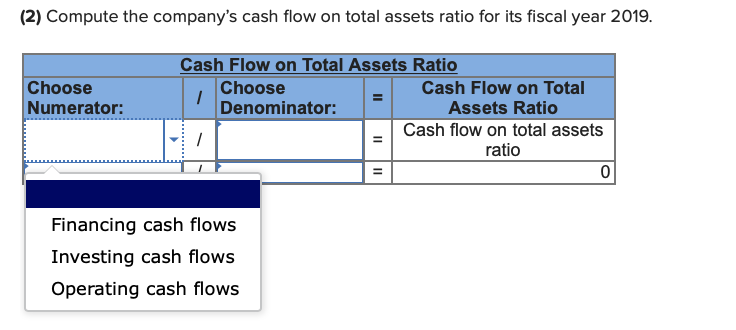

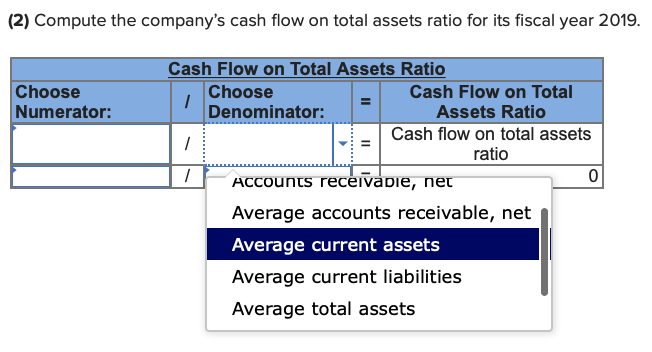

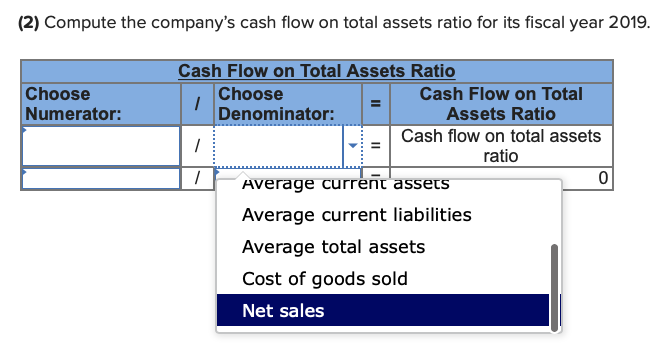

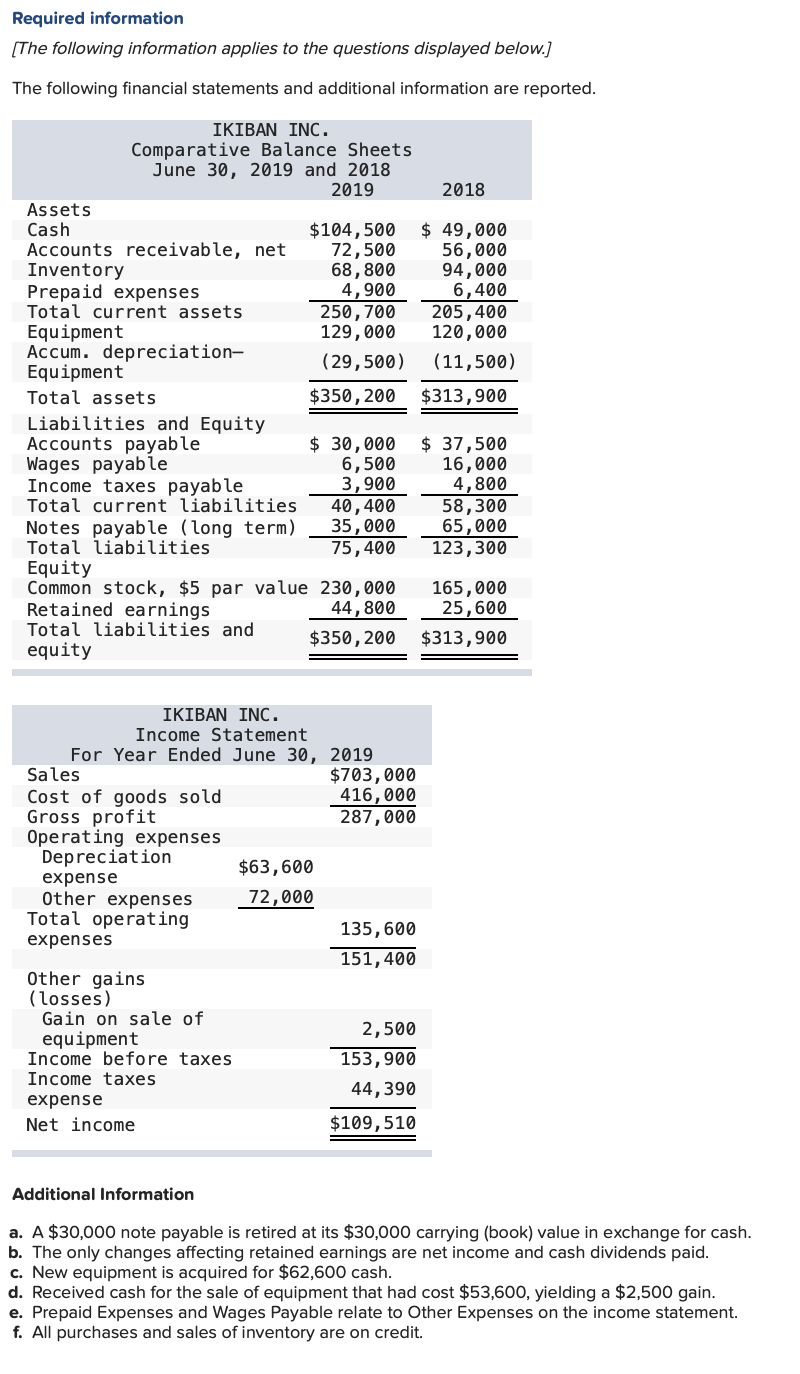

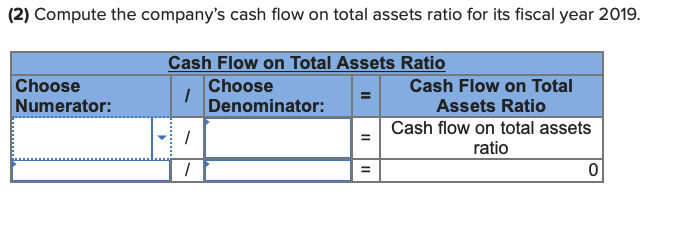

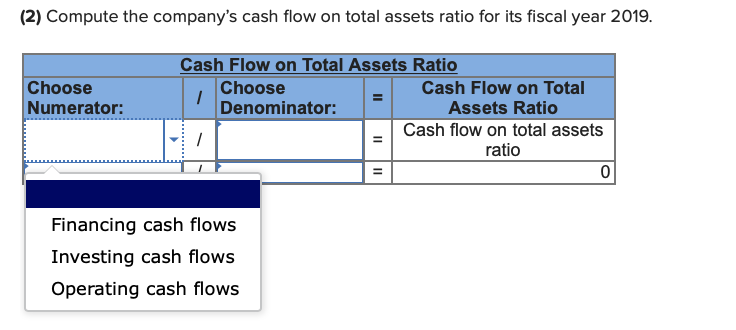

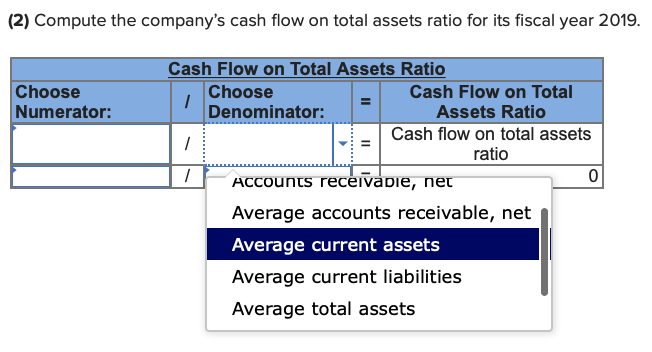

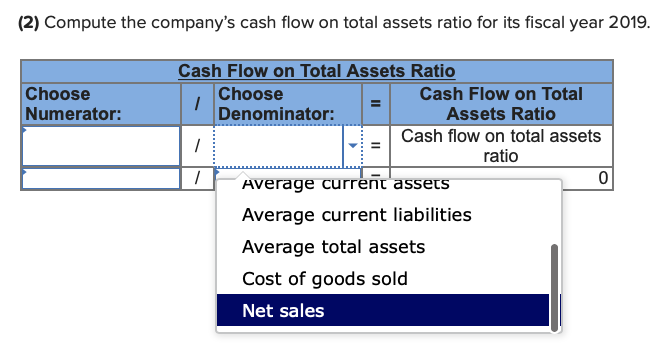

Required information [The following information applies to the questions displayed below.) The following financial statements and additional information are reported. IKIBAN INC. Comparative Balance Sheets June 30, 2019 and 2018 2019 2018 Assets Cash $104,500 $ 49,000 Accounts receivable, net 72,500 56,000 Inventory 68,800 94,000 Prepaid expenses 4,900 6,400 Total current assets 250,700 205,400 Equipment 129,000 120,000 Accum. depreciation- (29,500) (11,500) Equipment Total assets $350,200 $313,900 Liabilities and Equity Accounts payable $ 30,000 $ 37,500 Wages payable 6,500 16,000 Income taxes payable 3,900 4,800 Total current liabilities 40,400 58,300 Notes payable (long term) 35,000 65,000 Total liabilities 75,400 123,300 Equity Common stock, $5 par value 230,000 165,000 Retained earnings 44,800 25,600 Total liabilities and $350,200 $313,900 equity IKIBAN INC. Income Statement For Year Ended June 30, 2019 Sales $703,000 Cost of goods sold 416,000 Gross profit 287,000 Operating expenses Depreciation $63,600 expense Other expenses 72,000 Total operating 135,600 expenses 151,400 Other gains (losses) Gain on sale of 2,500 equipment Income before taxes 153,900 Income taxes 44,390 expense Net income $109,510 Additional Information a. A $30,000 note payable is retired at its $30,000 carrying (book) value in exchange for cash. b. The only changes affecting retained earnings are net income and cash dividends paid. c. New equipment is acquired for $62,600 cash. d. Received cash for the sale of equipment that had cost $53,600, yielding a $2,500 gain. e. Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement. f. All purchases and sales of inventory are on credit. (2) Compute the company's cash flow on total assets ratio for its fiscal year 2019. Choose Numerator: Il Cash Flow on Total Assets Ratio Choose Cash Flow on Total 1 Denominator: Assets Ratio Cash flow on total assets 1 ratio 1 0 = (2) Compute the company's cash flow on total assets ratio for its fiscal year 2019. Choose Numerator: Cash Flow on Total Assets Ratio Choose 1 Cash Flow on Total Denominator: Assets Ratio Cash flow on total assets 1 ratio 0 II II Financing cash flows Investing cash flows Operating cash flows (2) Compute the company's cash flow on total assets ratio for its fiscal year 2019. Choose Numerator: = 11 Cash Flow on Total Assets Ratio Choose 1 Cash Flow on Total Denominator: Assets Ratio 1 Cash flow on total assets ratio 1 Accounts receivadie, net 0 Average accounts receivable, net Average current assets Average current liabilities Average total assets (2) Compute the company's cash flow on total assets ratio for its fiscal year 2019. Choose Numerator: Cash Flow on Total Assets Ratio Choose Cash Flow on Total 1 Denominator: Assets Ratio 1 Cash flow on total assets ratio 1 0 Average current assets Average current liabilities Average total assets Cost of goods sold Net sales