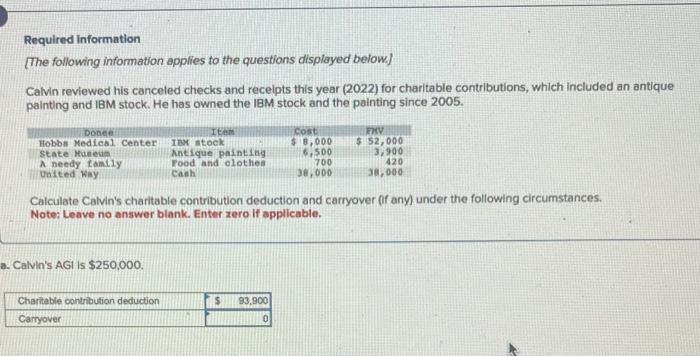

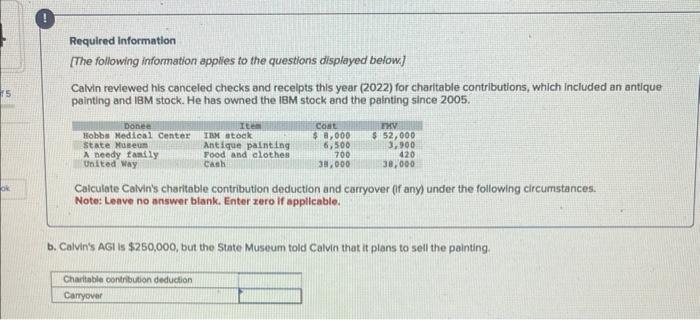

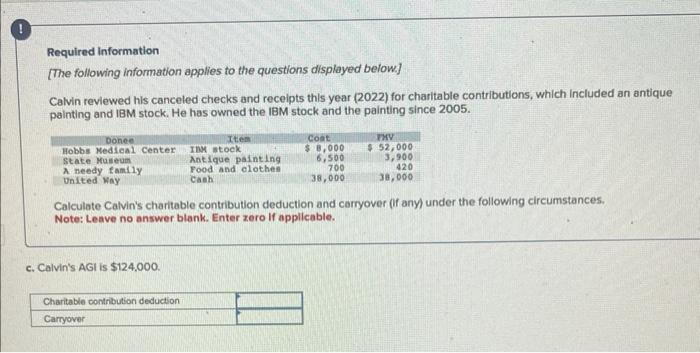

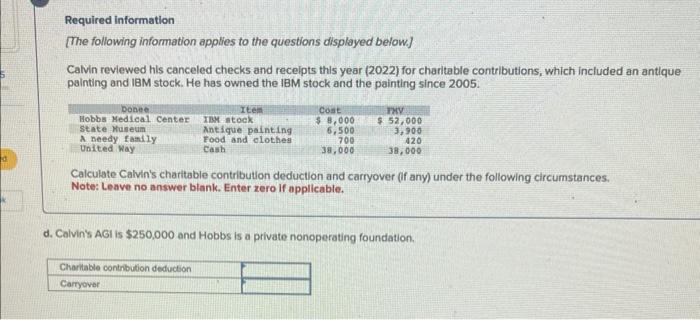

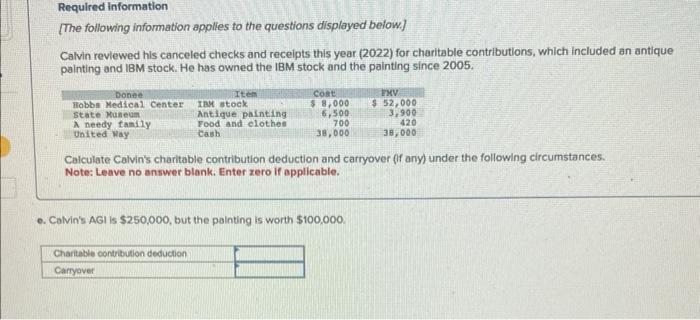

Required Information [The following information applies to the questions displayed below] Calvin reviewed his canceled checks and recelpts this year (2022) for charitable contributions, which included an antique painting and IBM stock. He has owned the IBM stock and the painting since 2005. Calculate Calvin's charitable contribution deduction and carryover (f any) under the following circumstances. Note: Leave no answer blank. Enter zero If applicable. a. Calvin's AGi is $250,000. Required Information [The following information applies to the questions displayed below] Calvin reviewed his canceled checks and recelpts this year (2022) for charitable contributions, which included an antique painting and 18M stock. He has owned the 18M stock and the painting since 2005. Calculate Calvin's charitable contribution deduction and carryover (if any) under the following circumstances. Note: Leave no answer blank. Enter zero if applicable. b. Calvin's AGI is $250,000, but the State Museum told Calvin that it plans to sell the painting Required Information [The following information applies to the questions displayed below] Calvin reviewed his canceled checks and recelpts thls year (2022) for charitable contributions, which included an antique painting and IBM stock. He has owned the IBM stock and the painting since 2005. Calculate Calvin's charitable contribution deduction and carryover (if any) under the following circumstances. Note: Leave no answer blank. Enter zero If applicable. c. Calvin's AGI is $124,000. Required information [The following information applies to the questions displayed below] Calvin reviewed his canceled checks and recelpts this year (2022) for charitable contributions, which included an antique painting and IBM stock. He has owned the IBM stock and the painting since 2005. Calculate Calvin's charitable contribution deduction and carryover (if any) under the following circumstances. Note: Leave no answer blank. Enter zero if applicable. d. Calvin's AGI is $250,000 and Hobbs is a private nonoperating foundation. [The following information applies to the questions displayed below] Calvin revlewed his canceled checks and recelpts this year (2022) for charitable contributions, which included an antique painting and IBM stock. He has owned the IBM stock and the painting since 2005. Calculate Calvin's charitable contribution deduction and carryover (if any) under the following circumstances. Note: Leave no answer blank. Enter zero if applicable. e. Calvin's AGI is $250,000, but the painting is worth $100,000