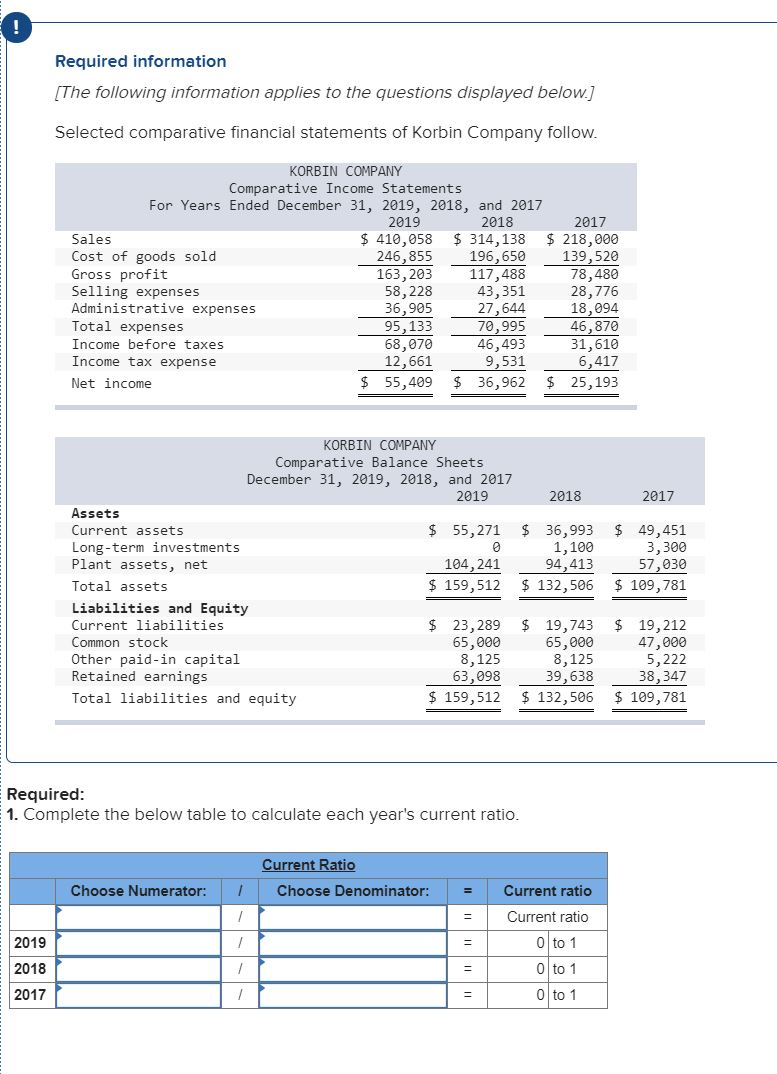

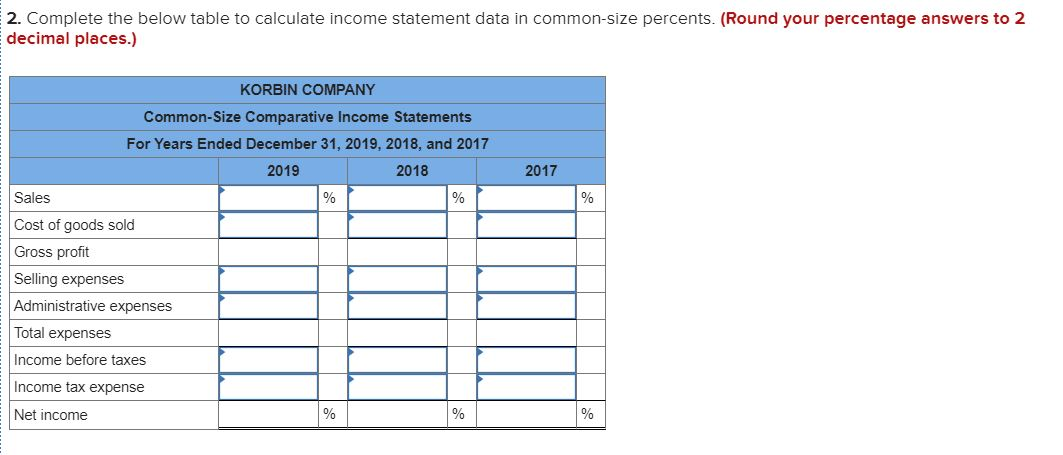

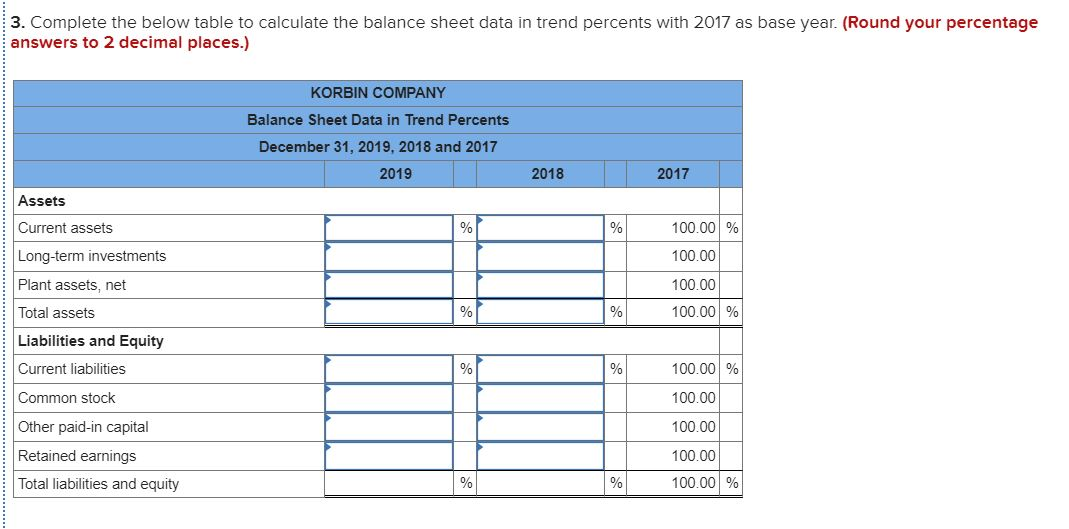

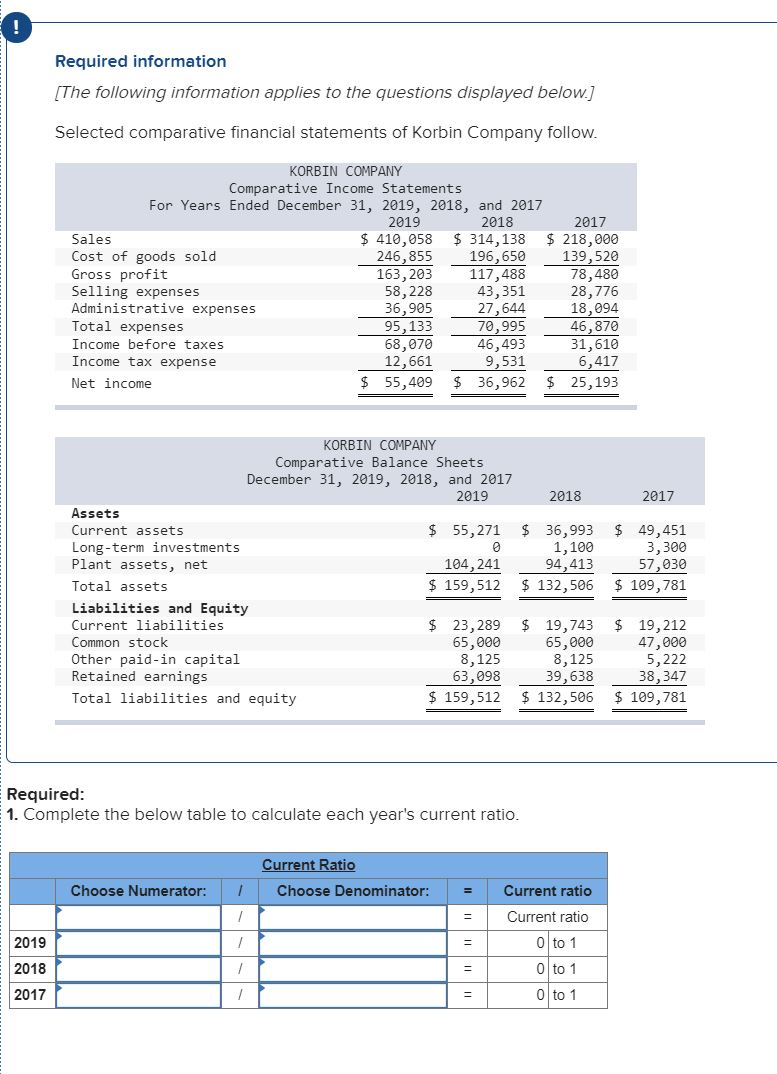

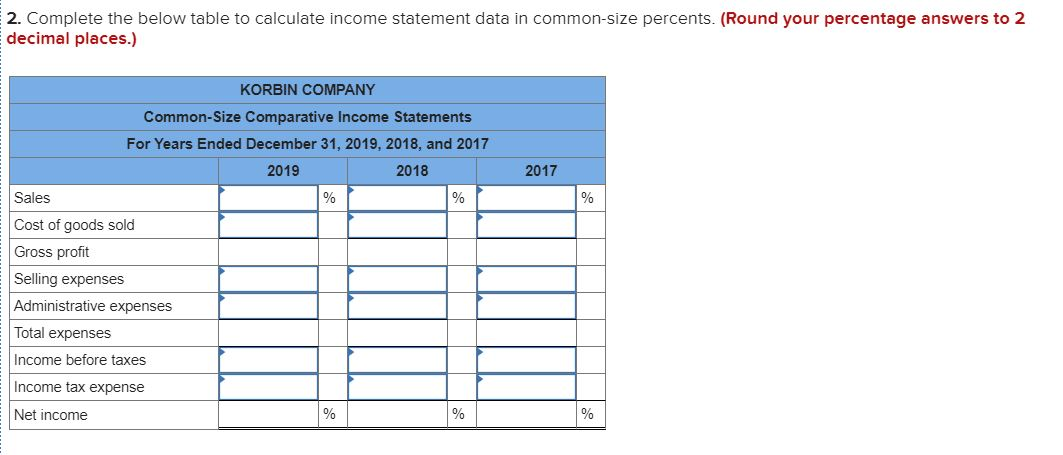

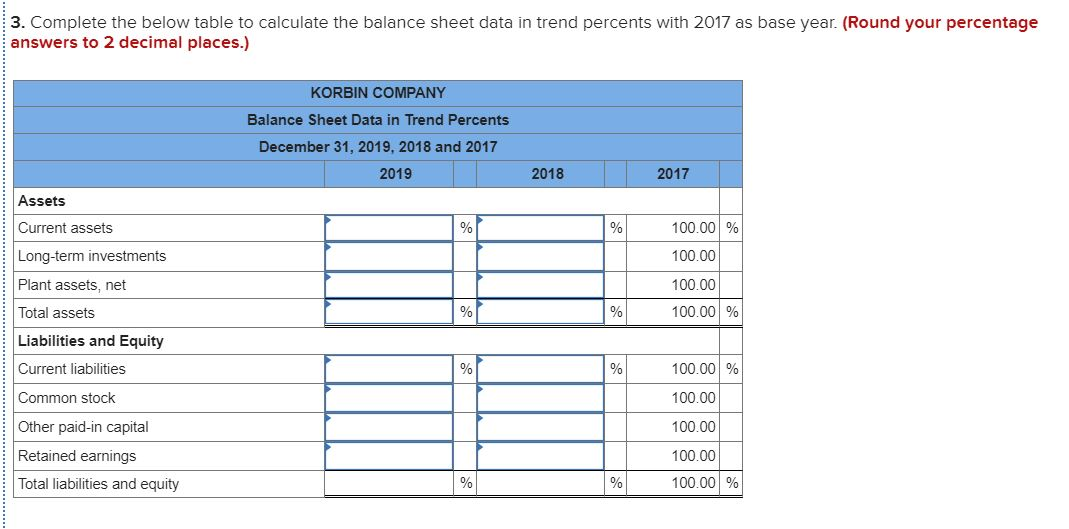

Required information [The following information applies to the questions displayed below.] Selected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended December 31, 2019, 2018, and 2017 2019 2018 2017 Sales $ 410,058 $ 314,138 $ 218,000 Cost of goods sold 246,855 196,650 139,520 Gross profit 163,203 117,488 78,480 Selling expenses 58,228 43,351 28,776 Administrative expenses 36,905 27,644 18,094 Total expenses 95, 133 70,995 46,870 Income before taxes 68,070 46,493 31,610 Income tax expense 12,661 9,531 6,417 Net income $ 55,409 $ 36,962 $ 25, 193 2017 KORBIN COMPANY Comparative Balance Sheets December 31, 2019, 2018, and 2017 2019 2018 Assets Current assets $ 55,271 $ 36,993 Long-term investments 1,100 Plant assets, net 104,241 94,413 Total assets $ 159,512 $ 132,506 Liabilities and Equity Current liabilities $ 23,289 $ 19,743 Common stock 65,000 65,000 Other paid-in capital 8,125 8,125 Retained earnings 63,098 39,638 Total liabilities and equity $ 159,512 $ 132,506 $ 49,451 3,300 57,030 $ 109, 781 $ 19,212 47,000 5,222 38,347 $ 109,781 Required: 1. Complete the below table to calculate each year's current ratio. Current Ratio Choose Denominator: Choose Numerator: 1 1 2019 / Current ratio Current ratio 0 to 1 0 to 1 0 to 1 1 2018 2017 / 2. Complete the below table to calculate income statement data in common-size percents. (Round your percentage answers to 2 decimal places.) KORBIN COMPANY Common-Size Comparative Income Statements For Years Ended December 31, 2019, 2018, and 2017 2019 2018 2017 Sales % % % Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income % % % 3. Complete the below table to calculate the balance sheet data in trend percents with 2017 as base year. (Round your percentage answers to 2 decimal places.) KORBIN COMPANY Balance Sheet Data in Trend Percents December 31, 2019, 2018 and 2017 2019 2018 2017 Assets Current assets % % 100.00 % Long-term investments 100.00 Plant assets, net 100.00 % 100.00 % Total assets Liabilities and Equity Current liabilities % 100.00 % Common stock 100.00 Other paid-in capital 100.00 Retained earnings Total liabilities and equity 100.00 100.00 % % %