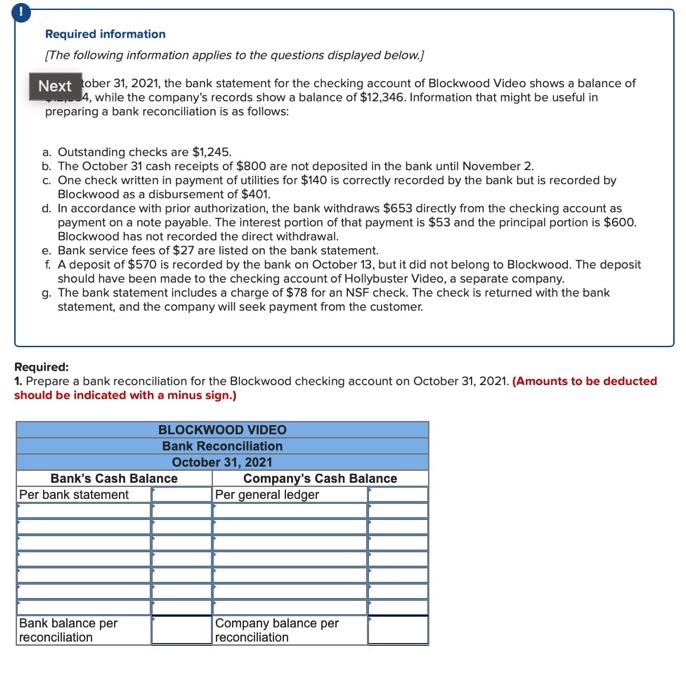

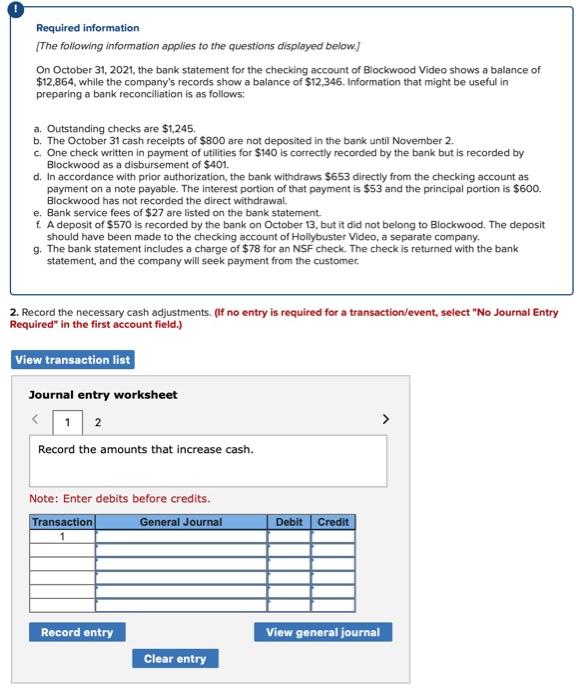

Required information [The following information applies to the questions displayed below.) Nextober 31, 2021, the bank statement for the checking account of Blockwood Video shows a balance of 4, while the company's records show a balance of $12,346. Information that might be useful in preparing a bank reconciliation is as follows: a. Outstanding checks are $1,245. b. The October 31 cash receipts of $800 are not deposited in the bank until November 2. c. One check written in payment of utilities for $140 is correctly recorded by the bank but is recorded by Blockwood as a disbursement of $401. d. In accordance with prior authorization, the bank withdraws $653 directly from the checking account as payment on a note payable. The interest portion of that payment is $53 and the principal portion is $600. Blockwood has not recorded the direct withdrawal. e. Bank service fees of $27 are listed on the bank statement. f. A deposit of $570 is recorded by the bank on October 13, but it did not belong to Blockwood. The deposit should have been made to the checking account of Hollybuster Video, a separate company. g. The bank statement includes a charge of $78 for an NSF check. The check is returned with the bank statement, and the company will seek payment from the customer. Required: 1. Prepare a bank reconciliation for the Blockwood checking account on October 31, 2021. (Amounts to be deducted should be indicated with a minus sign.) BLOCKWOOD VIDEO Bank Reconciliation October 31, 2021 Bank's Cash Balance Company's Cash Balance Per bank statement Per general ledger Bank balance per reconciliation Company balance per reconciliation Required information [The following information applies to the questions displayed below.) On October 31, 2021, the bank statement for the checking account of Blockwood Video shows a balance of $12,864, while the company's records show a balance of $12,346. Information that might be useful in preparing a bank reconciliation is as follows: a. Outstanding checks are $1.245. b. The October 31 cash receipts of $800 are not deposited in the bank until November 2. C One check written in payment of utilities for $140 is correctly recorded by the bank but is recorded by Blockwood as a disbursement of $401. d. In accordance with prior authorization, the bank withdraws $653 directly from the checking account as payment on a note payable. The interest portion of that payment is $53 and the principal portion is $600. Blockwood has not recorded the direct withdrawal. e. Bank service fees of $27 are listed on the bank statement. . A deposit of $570 is recorded by the bank on October 13, but it did not belong to Blockwood. The deposit should have been made to the checking account of Hollybuster Video, a separate company 9. The bank statement includes a charge of $78 for an NSF check. The check is returned with the bank statement, and the company will seek payment from the customer 2. Record the necessary cash adjustments. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Record entry View general journal Clear entry