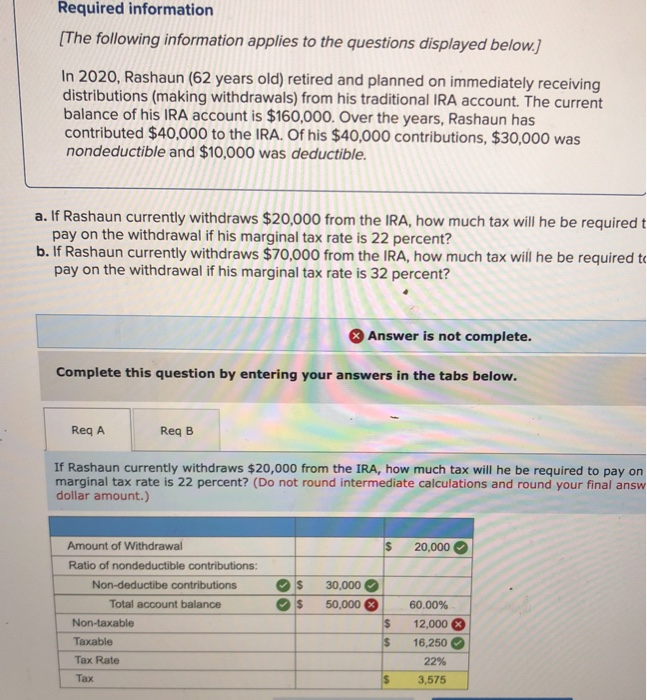

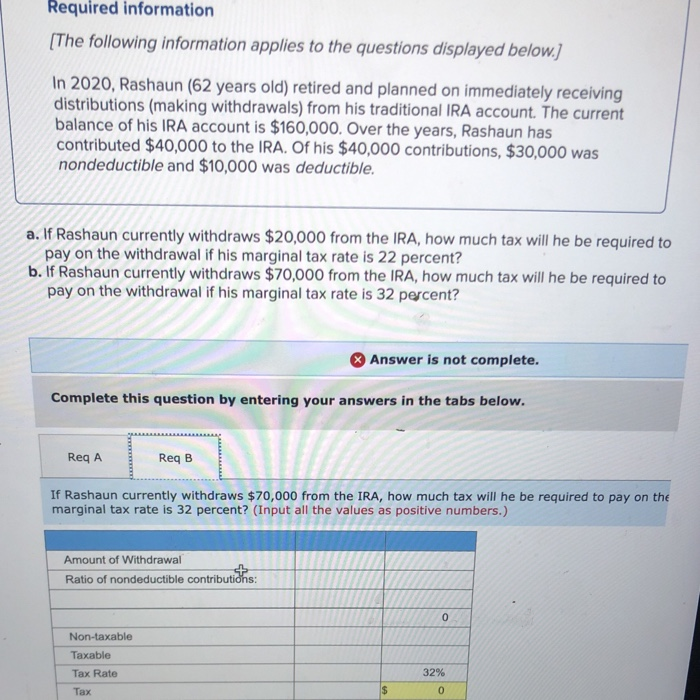

Required information [The following information applies to the questions displayed below.) In 2020, Rashaun (62 years old) retired and planned on immediately receiving distributions (making withdrawals) from his traditional IRA account. The current balance of his IRA account is $160,000. Over the years, Rashaun has contributed $40,000 to the IRA. Of his $40,000 contributions, $30,000 was nondeductible and $10,000 was deductible. a. If Rashaun currently withdraws $20,000 from the IRA, how much tax will he be required t pay on the withdrawal if his marginal tax rate is 22 percent? b. If Rashaun currently withdraws $70,000 from the IRA, how much tax will he be required to pay on the withdrawal if his marginal tax rate is 32 percent? Answer is not complete. Complete this question by entering your answers in the tabs below. Reg A ReqB If Rashaun currently withdraws $20,000 from the IRA, how much tax will he be required to pay on marginal tax rate is 22 percent? (Do not round intermediate calculations and round your final answ dollar amount.) $ 20.000 Amount of Withdrawal Ratio of nondeductible contributions: Non-deductibe contributions Total account balance $ 30.000 $ 50,000 $ Non-taxable Taxable $ 60.00% 12,000 16,250 22% 3,575 Tax Rate Tax $ Required information [The following information applies to the questions displayed below.) In 2020, Rashaun (62 years old) retired and planned on immediately receiving distributions (making withdrawals) from his traditional IRA account. The current balance of his IRA account is $160,000. Over the years, Rashaun has contributed $40,000 to the IRA. Of his $40,000 contributions, $30,000 was nondeductible and $10,000 was deductible. a. If Rashaun currently withdraws $20,000 from the IRA, how much tax will he be required to pay on the withdrawal if his marginal tax rate is 22 percent? b. If Rashaun currently withdraws $70,000 from the IRA, how much tax will he be required to pay on the withdrawal if his marginal tax rate is 32 percent? Answer is not complete. Complete this question by entering your answers in the tabs below. Req A Req B If Rashaun currently withdraws $70,000 from the IRA, how much tax will he be required to pay on the marginal tax rate is 32 percent? (Input all the values as positive numbers.) Amount of Withdrawal Ratio of nondeductible contributions: 0 Non-taxable Taxable Tax Rate Tax 32% 0