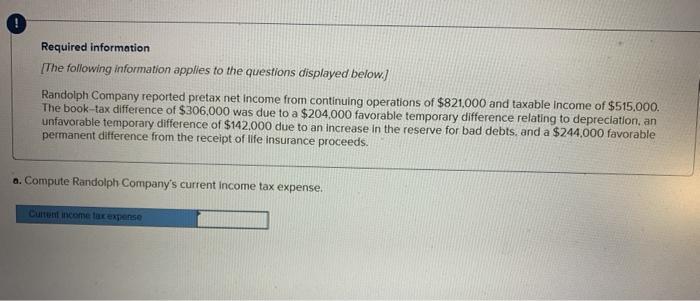

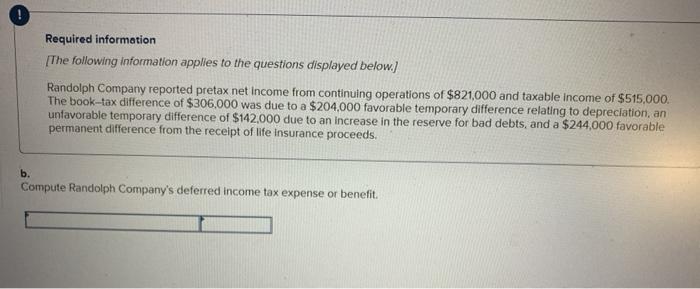

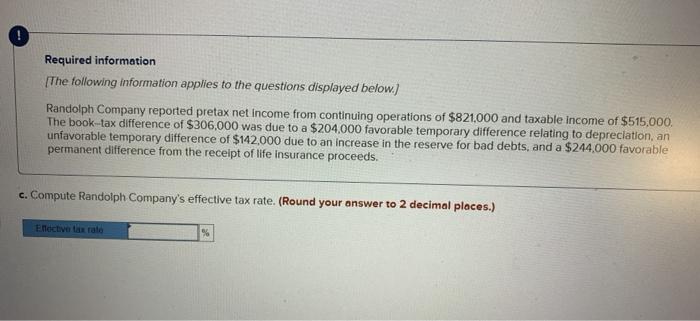

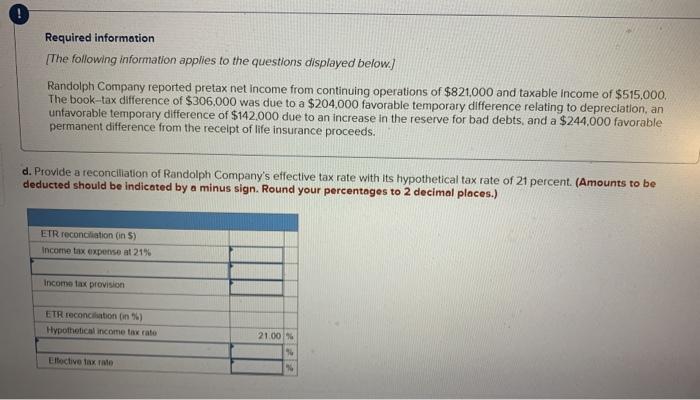

Required information [The following information applies to the questions displayed below) Randolph Company reported pretax net income from continuing operations of $821,000 and taxable income of $515.000. The book-tax difference of $306,000 was due to a $204,000 favorable temporary difference relating to depreciation, an unfavorable temporary difference of $142.000 due to an increase in the reserve for bad debts, and a $244.000 favorable permanent difference from the receipt of life insurance proceeds. a. Compute Randolph Company's current Income tax expense. Current income tax expense ! Required information The following information applies to the questions displayed below.) Randolph Company reported pretax net income from continuing operations of $821,000 and taxable income of $515,000. The book-tax difference of $306,000 was due to a $204,000 favorable temporary difference relating to depreciation, an unfavorable temporary difference of $142,000 due to an increase in the reserve for bad debts, and a $244,000 favorable permanent difference from the receipt of life insurance proceeds. b. Compute Randolph Company's deferred income tax expense or benefit Required information The following information applies to the questions displayed below.) Randolph Company reported pretax net income from continuing operations of $821.000 and taxable income of $515,000. The book-tax difference of $306,000 was due to a $204,000 favorable temporary difference relating to depreciation, an unfavorable temporary difference of $142,000 due to an increase in the reserve for bad debts, and a $244.000 favorable permanent difference from the receipt of life insurance proceeds. c. Compute Randolph Company's effective tax rate. (Round your answer to 2 decimal places.) Efective tax rate % Required information [The following information applies to the questions displayed below.) Randolph Company reported pretax net income from continuing operations of $821,000 and taxable income of $515.000, The book-tax difference of $306,000 was due to a $204,000 favorable temporary difference relating to depreciation, an unfavorable temporary difference of $142.000 due to an increase in the reserve for bad debts, and a $244.000 favorable permanent difference from the receipt of life insurance proceeds. d. Provide a reconciliation of Randolph Company's effective tax rate with its hypothetical tax rate of 21 percent. (Amounts to be deducted should be indicated by a minus sign. Round your percentages to 2 decimal places.) ETR reconciliation (in 5) Income tax expense at 21% Income tax provision ETR reconciliation in ) Hypothetical income tax rate 21.00% Elective tax rate