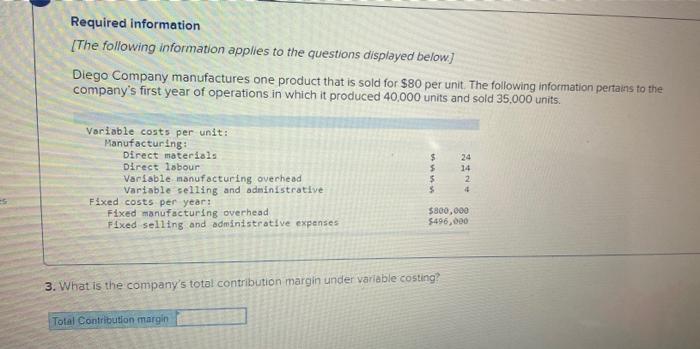

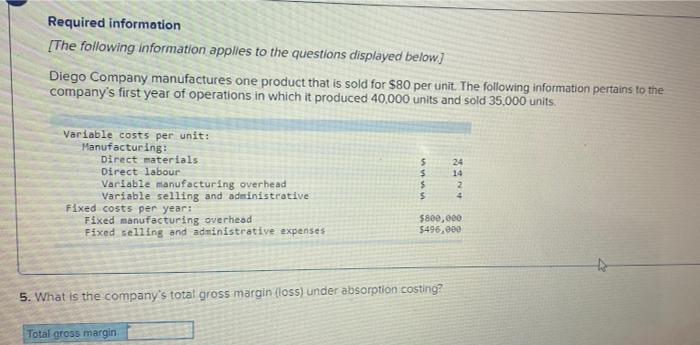

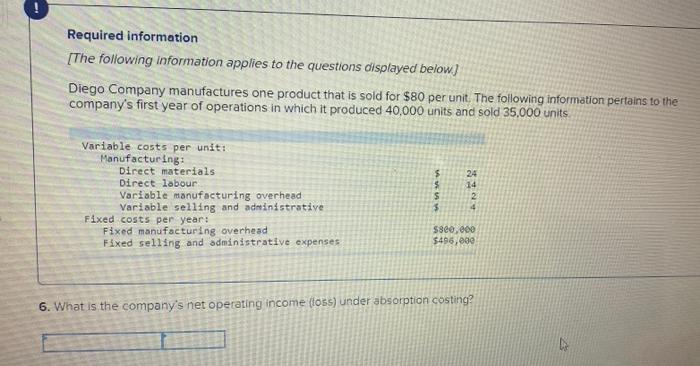

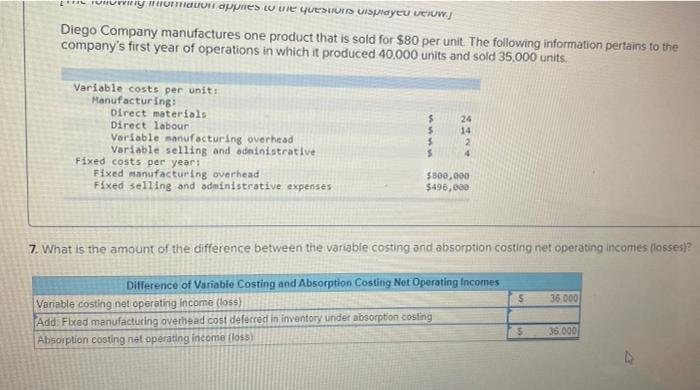

Required information [The following information applies to the questions displayed below) Diego Company manufactures one product that is sold for $80 per unit. The following information pertains to the company's first year of operations in which it produced 40,000 units and sold 35,000 units. $ Variable costs per unit: Manufacturing: Direct materials Direct labour Variable manufacturing overhead Variable selling and administrative Fixed costs per year! Fixed manufacturing overhead Fixed selling and administrative expenses 24 14 2 4 5 $800,000 $496,000 3. What is the company's total contribution margin under variable costing? Total Contribution margin Required information [The following information applies to the questions displayed below) Diego Company manufactures one product that is sold for $80 per unit. The following information pertains to the company's first year of operations in which it produced 40.000 units and sold 35,000 units. Variable costs per unit: Manufacturing: Direct materials Direct labour Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expenses 5 $ $ 5 24 14 2 5 $800,000 $496,000 5. What is the company's total gross margin (loss) under absorption costing? Total gross margin Required information [The following information applies to the questions displayed below) Diego Company manufactures one product that is sold for $80 per unit. The following information pertains to the company's first year of operations in which it produced 40,000 units and sold 35,000 units Variable costs per unit: Manufacturing: Direct materials Direct labour Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expenses 24 14 2 4 5 58ee, 800 $495,000 6. What is the company's net operating income foss) under absorption costing? MUHY PHOTO CON appies w uie YUeSUUTIS LISprayeu veuws Diego Company manufactures one product that is sold for $80 per unit. The following information pertains to the company's first year of operations in which it produced 40,000 units and sold 35,000 units. Variable costs per unit: Manufacturing: Direct materials Direct labour Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expenses 24 14 2 4 $800,000 $496,000 7. What is the amount of the difference between the variable costing and absorption costing net operating incomes (losses? $ 35.000 Difference of Variable Costing and Absorption Costing Net Operating Incomes Variable costing net operating income (loss) Add: Fixed manufacturing overhead cost deferred in inventory under absorption costing Absorption costing net operating income (los) 5 36.000