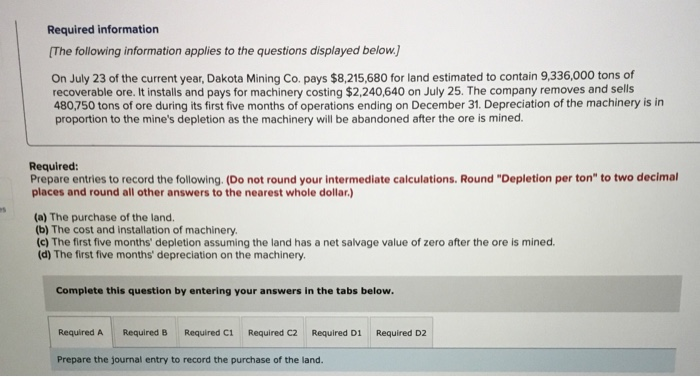

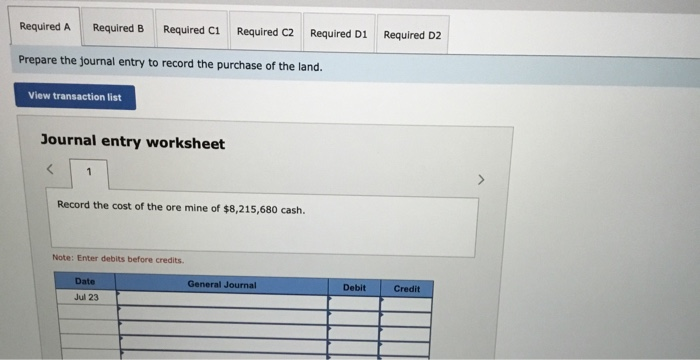

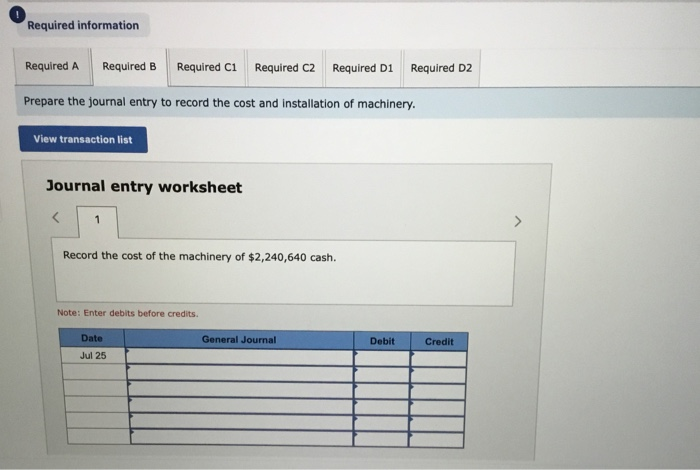

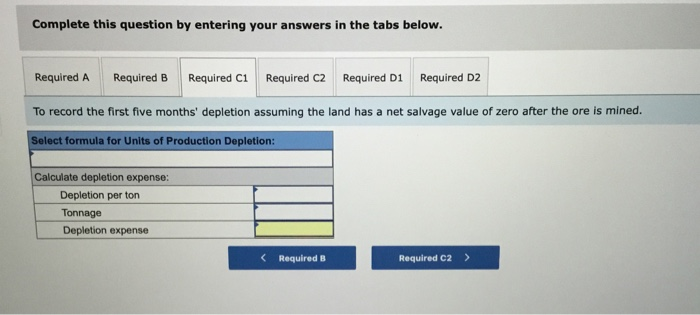

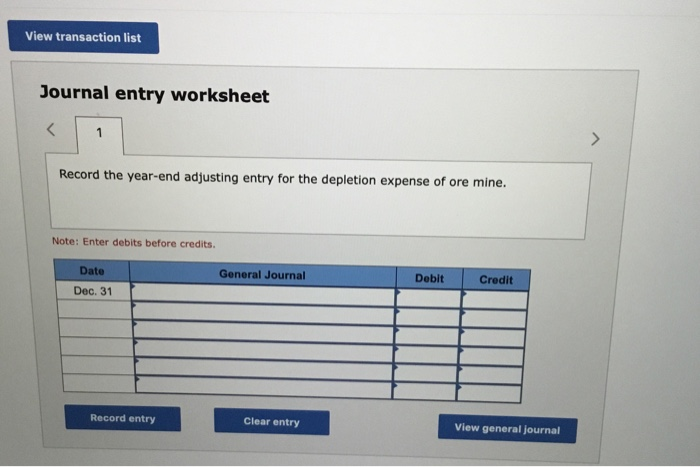

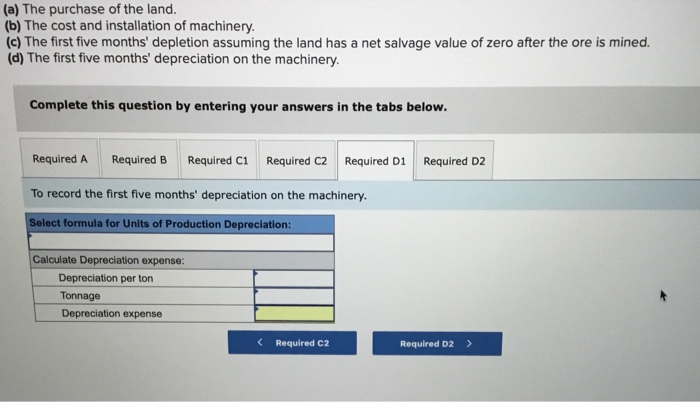

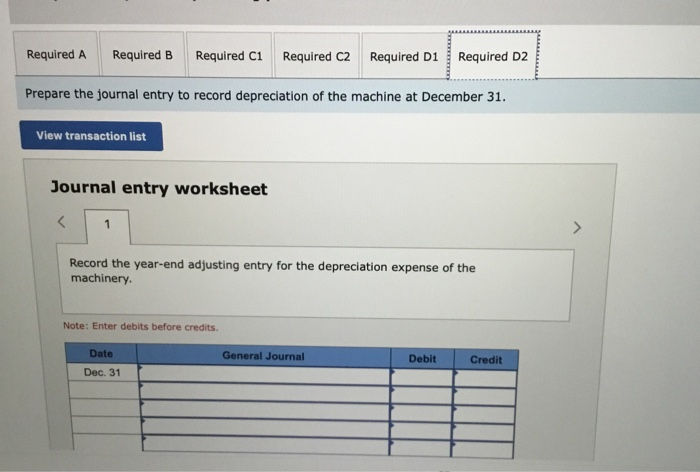

Required information The following information applies to the questions displayed below.) On July 23 of the current year, Dakota Mining Co. pays $8,215,680 for land estimated to contain 9,336,000 tons of $2,240,640 on July 25. The company removes and sells 480,750 tons of ore during its first five months of operations ending on December 31. Depreciation of the machinery is in proportion to the mine's depletion as the machinery will be abandoned after the ore is mined. Required: Prepare entries to record the following. (Do not round your intermediate calculations. Round "Depletion per ton" to two decimal places and round all other answers to the nearest whole dollar.) (a) The purchase of the land. (b) The cost and installation of machinery (c) The first five months' depletion assuming the land has a net salvage value of zero after the ore is mined. (d) The first five months depreciation on the machinery. Complete this question by entering your answers in the tabs below. Required A Required B Required C1 Required C2 Required D1 Required D2 Prepare the journal entry to record the purchase of the land. Required A Required B Required C1 Required C2 Required D1 Required D2 Prepare the journal entry to record the purchase of the land. View transaction list Journal entry worksheet Record the cost of the ore mine of $8,215,680 cash. Note: Enter debits before credits Date General Journal Debit Credit Jul 23 Required information Required A Required B Required C1 Required C2 Required D1 Required D2 Prepare the journal entry to record the cost and installation of machinery. View transaction list Journal entry worksheet Record the cost of the machinery of $2,240,640 cash. Note: Enter debits before credits. General Journal Debit Credit Date Jul 25 Complete this question by entering your answers in the tabs below. Required A Required B Required C1 Required C2 Required Di Required D2 To record the first five months' depletion assuming the land has a net salvage value of zero after the ore is mined. Select formula for Units of Production Depletion: Calculate depletion expense: Depletion per ton Tonnage Depletion expense View transaction list Journal entry worksheet Record the year-end adjusting entry for the depletion expense of ore mine. Note: Enter debits before credits Date General Journal Debit Credit Dec. 31 Record entry Clear entry View general Journal (a) The purchase of the land. (b) The cost and installation of machinery (c) The first five months' depletion assuming the land has a net salvage value of zero after the ore is mined. (d) The first five months' depreciation on the machinery. Complete this question by entering your answers in the tabs below. Required A Required B Required C1 Required C2 Required D1 Required D2 To record the first five months' depreciation on the machinery. Select formula for Units of Production Depreciation: Calculate Depreciation expense: Depreciation per ton Tonnage Depreciation expense Required C2 Required D2 > Required A Required B Required C1 Required C2 Required D1 Required D2 Prepare the journal entry to record depreciation of the machine at December 31. View transaction list Journal entry worksheet Record the year-end adjusting entry for the depreciation expense of the machinery Note: Enter debits before credits Date General Journal Journal Debit Dec. 31