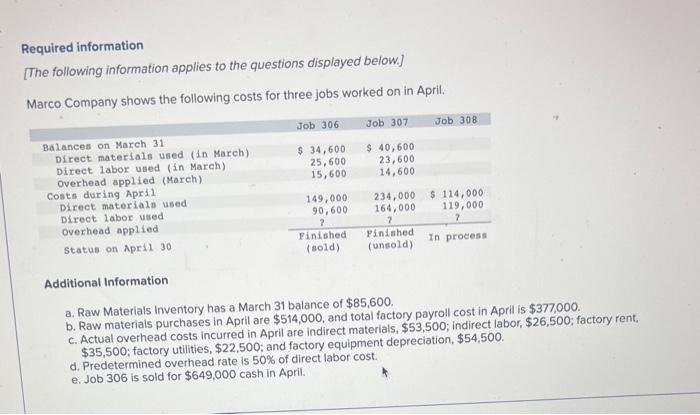

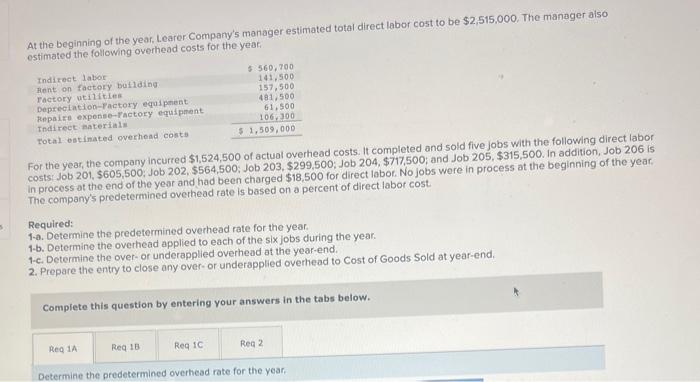

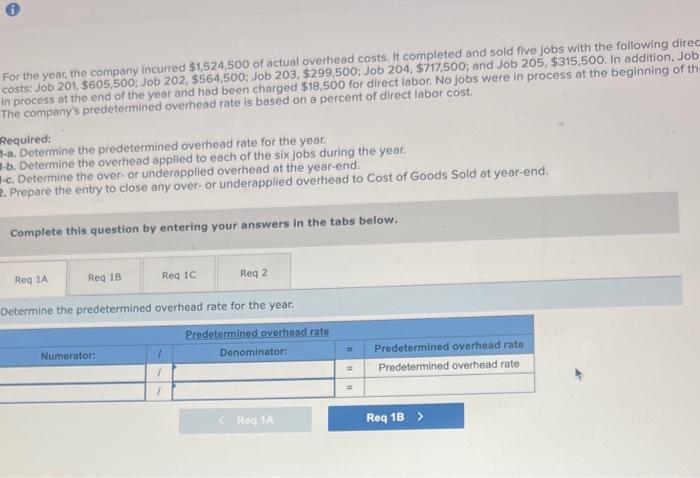

Required information [The following information applies to the questions displayed below.] Marco Company shows the following costs for three jobs worked on in April. Additional Information a. Raw Materials Inventory has a March 31 balance of $85,600. b. Raw materials purchases in April are $514,000, and total factory payroll cost in April is $377,000. c. Actual overhead costs incurred in April are indirect materials, $53,500; indirect labor, $26,500; factory rent, $35,500; factory utilities, $22,500; and factory equipment depreciation, $54,500. d. Predetermined overhead rate is 50% of direct labor cost. e. Job 306 is sold for $649,000 cash in April. At the beginning of the year. Learer Company's manager estimated total direct labor cost to be $2,515,000, The manager also actimated the following overhead costs for the year For the year, the company incurred $1,524,500 of actual overhead costs. It completed and sold five jobs with the following direct labor costs: Job 201, \$605,500; Job 202,\$564,500; Job 203,\$299,500; Job 204,\$717,500; and Job 205, \$315,500. In addition, Job 206 is in process at the end of the year and had been charged $18,500 for direct labor. No jobs were in process at the beginning of the year: The company's predetermined overhead rate is based on a percent of direct labor cost. Required: 1-a. Determine the predetermined overhead rate for the year. 1-b. Determine the overhead applied to each of the six jobs during the year. 1-c. Determine the over-or underapplied overhead at the year-end. 2. Prepare the entry to close any over-or underapplied overhead to Cost of Goods Sold at year-end. Compiete this question by entering your answers in the tabs below. Determine the predetermined overhead rate for the year. For the year, the company incurred $1,524,500 of actual overhead costs. It completed and sold five jobs with the following direc costs: Job 201, \$605,500; Job 202, \$564,500; Job 203, \$299,500; Job 204, \$717,500; and Job 205, \$315,500. In addition, Job in process at the end of the year and had been charged $18,500 for direct labor. No jobs were in process at the beginning of th The company's predetermined overhead rate is based on a percent of direct labor cost. Required: 1-a. Determine the predetermined overhead rate for the year. 1.b. Determine the overhead applled to each of the six jobs during the year. -c. Determine the over-or underapplied overhead at the year-end. 2. Prepare the entry to close any over-or underapplied overhead to Cost of Goods Sold at year-end. Complete this question by entering your answers in the tabs below. Determine the predetermined overhead rate for the year: Required information [The following information applies to the questions displayed below.] Marco Company shows the following costs for three jobs worked on in April. Additional Information a. Raw Materials Inventory has a March 31 balance of $85,600. b. Raw materials purchases in April are $514,000, and total factory payroll cost in April is $377,000. c. Actual overhead costs incurred in April are indirect materials, $53,500; indirect labor, $26,500; factory rent, $35,500; factory utilities, $22,500; and factory equipment depreciation, $54,500. d. Predetermined overhead rate is 50% of direct labor cost. e. Job 306 is sold for $649,000 cash in April. At the beginning of the year. Learer Company's manager estimated total direct labor cost to be $2,515,000, The manager also actimated the following overhead costs for the year For the year, the company incurred $1,524,500 of actual overhead costs. It completed and sold five jobs with the following direct labor costs: Job 201, \$605,500; Job 202,\$564,500; Job 203,\$299,500; Job 204,\$717,500; and Job 205, \$315,500. In addition, Job 206 is in process at the end of the year and had been charged $18,500 for direct labor. No jobs were in process at the beginning of the year: The company's predetermined overhead rate is based on a percent of direct labor cost. Required: 1-a. Determine the predetermined overhead rate for the year. 1-b. Determine the overhead applied to each of the six jobs during the year. 1-c. Determine the over-or underapplied overhead at the year-end. 2. Prepare the entry to close any over-or underapplied overhead to Cost of Goods Sold at year-end. Compiete this question by entering your answers in the tabs below. Determine the predetermined overhead rate for the year. For the year, the company incurred $1,524,500 of actual overhead costs. It completed and sold five jobs with the following direc costs: Job 201, \$605,500; Job 202, \$564,500; Job 203, \$299,500; Job 204, \$717,500; and Job 205, \$315,500. In addition, Job in process at the end of the year and had been charged $18,500 for direct labor. No jobs were in process at the beginning of th The company's predetermined overhead rate is based on a percent of direct labor cost. Required: 1-a. Determine the predetermined overhead rate for the year. 1.b. Determine the overhead applled to each of the six jobs during the year. -c. Determine the over-or underapplied overhead at the year-end. 2. Prepare the entry to close any over-or underapplied overhead to Cost of Goods Sold at year-end. Complete this question by entering your answers in the tabs below. Determine the predetermined overhead rate for the year