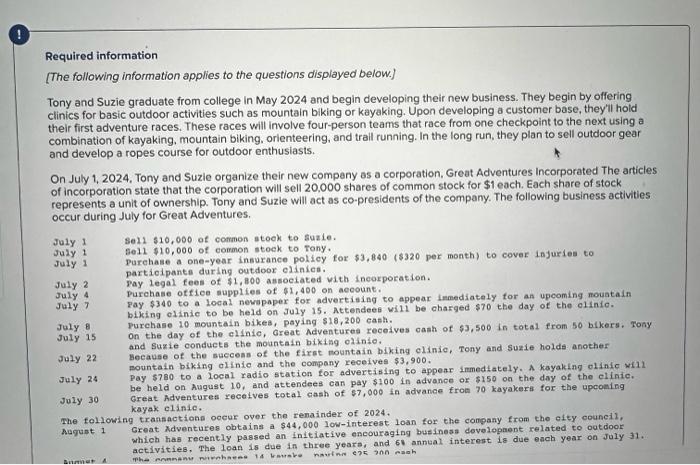

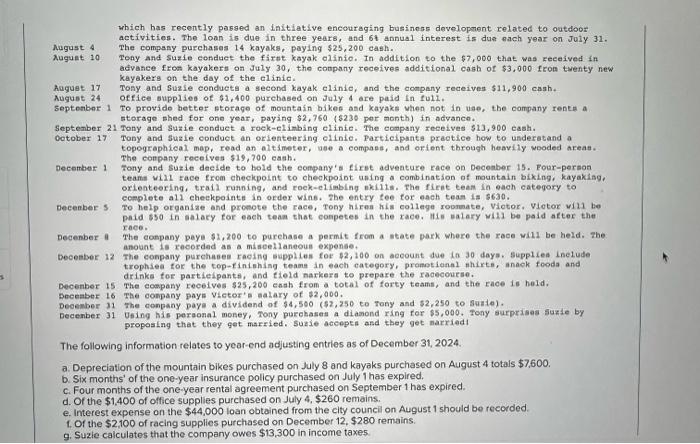

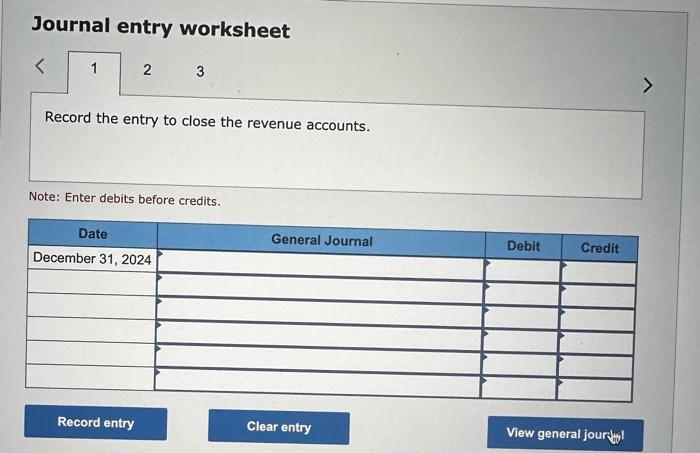

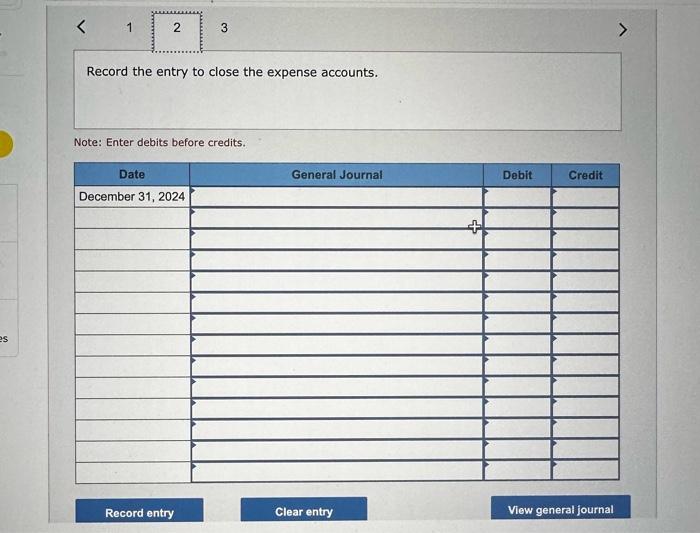

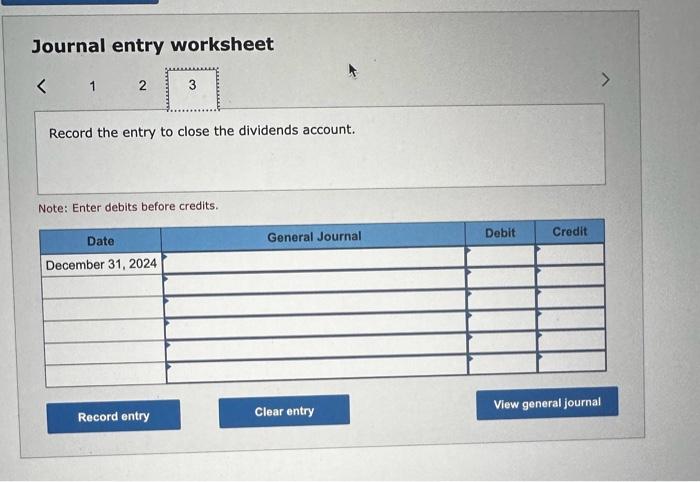

Required information [The following information applies to the questions displayed below.] Tony and Suzie graduate from college In May 2024 and begin developing their new business. They begin by offering clinics for basic outdoor activities such as mountain biking or kayaking. Upon developing a customer base, they'll hold their first adventure races. These races will involve four-person teams that race from one checkpoint to the next using a combination of kayaking, mountain biking, orienteering, and trail running. In the long run, they plan to sell outdoor gear and develop a ropes course for outdoor enthusiasts. On July 1, 2024, Tony and Suzie organize their new company as a corporation, Great Adventures Incorporated The articles of incorporation state that the corporation will sell 20,000 shares of common stock for $1 each. Each share of stock represents a unit of ownership. Tony and Suzie will act as co-presidents of the company. The following business activities occur during July for Great Adventures. Joly 1 Se12 $10,000 of common atook to suzie. July 1 Sell $10,000 of common stoek to rony. July 1 Purchase a one-year insurance policy for $3,840 (\$320 per month) to cover injuries to July 2 partioipants during outdoor elinics. Pay legal fees of $1,800 associated vith ineorporation. July 4 Purchase of fiee supplies of $1,400 on aecount. July 7 Pay $340 to a local newspaper for advertising to appear limediately tor an upeoming mouatain blking elinic to be held on July 15. Attendee vili be charged $70 the day of the olinio. July 8 Purehase 10 mountain bikes, paying $18,200 eash. July 15 On the day of the clinic, Great Adventures receives eash of $3,500 in total from 50 bikers. Tony July 22 and Suzie conducts the mountain bixing olinio, Because of the succens of the first mountain biking elinic, Tony and suzie holde another Pay $780 to a local radio station for advertising to appear immediately. A kayaking olinic will July 30 be held on Augast 10 , ind moly pountain biking olinio and the company receives $3,900. ugust 10 , and attendees can pay $100 in advance or $150 on the day of the elinic. Great Adventures recetves total cash of $7,000 in advance from 70 kayakers for the upcoming kayak e1inic. The following transactions occur over the renainder of 2024, August 1 Great Xdventures obtains a $44,000 low-interest loan for the conpany from the eity council, which has recently passed an initiative encouraging business dovelogaent related to outdoor activities, The loan is due in three years, and 6V annual interest is due aach year on July 31 . which bas recently pesged an initiative encouraging business development related to outdoor activities. The loan is due in three years, and 6t annual interest is due each year on July 31 . Mugust 4 The company purchases 14 kayaks, paying $25,200 cash. Auguet 10 Tony ard suzie conduct the firtt kayak olinio. In addftion to the $7, 000 that was feceived in advance from kayakeri on July 30, the conpany receives additional casb of $3,000 fron trenty new kayakers on the diay of the elinie. Auguet.17 Tony and suaie condueta a second kayak elinie, and the company receives $11,900 cash. August 24 Office bupplies of $1,400 purebased on July 4 are paid in full. septenber 1 To provide better ntorage of mountain bikes and kayaks when not in uae. the company renea a storage shed for one year, paying $2,760 ( $230 per month) in advance. September 21 Tony and suzie conduct a rock-climbing elinie. The company receives 513,900 eash. oetober 17 Tony and Juzie conduet an orienteering elinie. Participants practice how to underatand a topegrephieal map, read an altimeter, bee a compasa, and orient through heavily wooded areats. The company recelves 519,700 eath. December 1 Fony and Suzin deelde to hold the eompany's first adveature race on Decenber 15. Four-person teamin vid race from checicpoint to cheokpoiot uning a combination of mountain biking, kayakiag, orienteering, traid rusning, and rock-elimbing nkills. Fhe firat tean in each eategory to complete all eheckpoints in order wine. The entry tee for each teas is $630. Decenber 5. To help organiae and promote the race, Tony hiren hia college roonute, Vietor, Vietor vili be phid 550 in adlary tor each tean that conpetes in the race. Hid walary mili be paid atter the race. Decenber i The conpany paye $1,200 to purchase a permit from a mete park where the race wild be held. the becenber 12 The conpany purchases racing sapplies foe $2,100 on account due ia 30 daya . Suppliea inelude trophiea for the top-finishing teame in each category, promatienal fhirte, anack fooda and drinks foe partieipants, and field narkers to prepare the racecourie. Deoenber 15 The cospany recelves 525,200 ensh from a total of forty teami, and the race is held, Deeeaber 16 The conpany paym Victor's alary of $2,000. Deoenber 31 the eonpany paya a dividend of 54,500(52,250 co Tony and 52,250 to 3416). December 31 Using his peraonal money, Tony purchasea a dianond ring tor $5,000. Tony surprisas suzie by propesing that they get married. Suzie aceepea and they get narriadi The following information relates to year-end adjusting entries as of December: 31,2024. a. Depreciation of the mountain bikes purchased on July 8 and kayak purchased on August 4 totals $7,600. b. Six months' of the one-year insurance policy purchased on July 1 has expired. c. Four months of the one-year rental agreement purchased on September 1 has expired. d. Of the $1,400 of office supplies purchased on July 4,$260 remains. e. Interest expense on the $44,000 loan obtained from the city council on August 1 should be recorded. f. Of the $2,100 of racing supplies purchased on December 12,$280 remains. 9. Suzie calculates that the company owes $13,300 in income taxes Journal entry worksheet Record the entry to close the revenue accounts. Note: Enter debits before credits. Record the entry to close the expense accounts. Note: Enter debits before credits. Journal entry worksheet Record the entry to close the dividends account. Note: Enter debits before credits