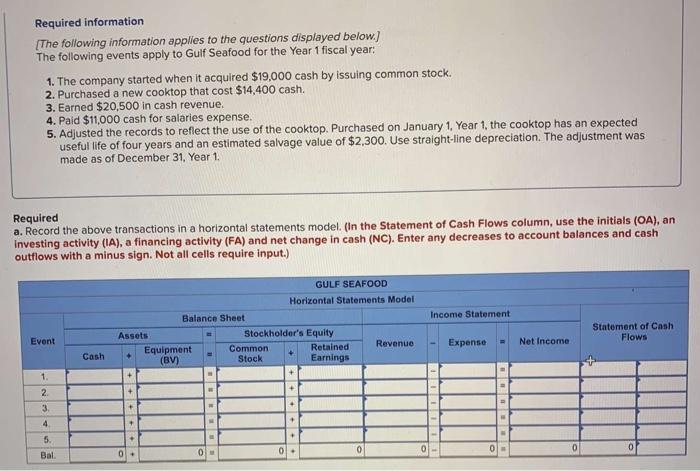

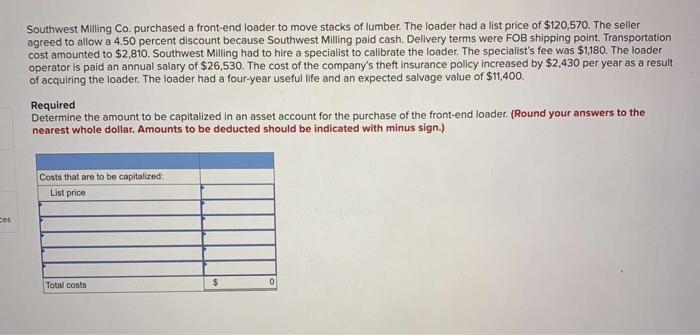

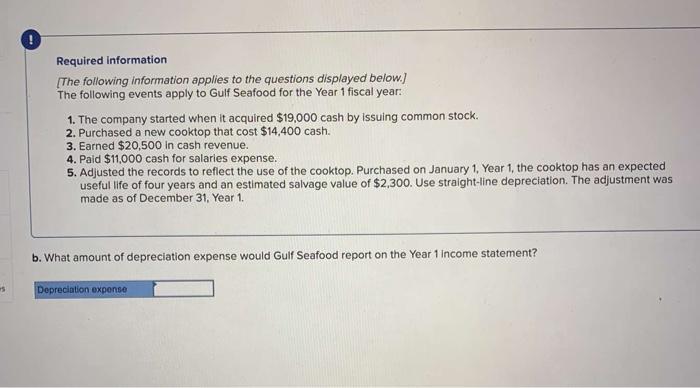

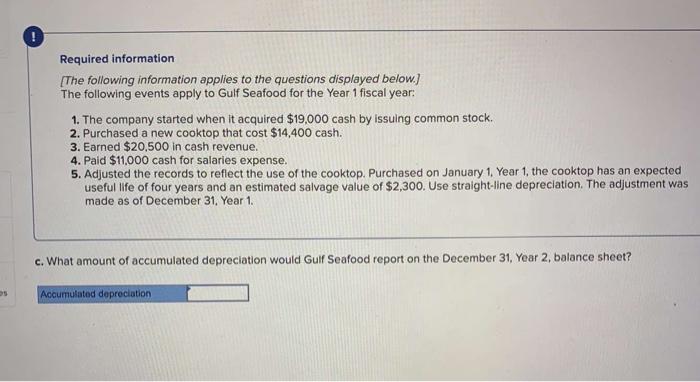

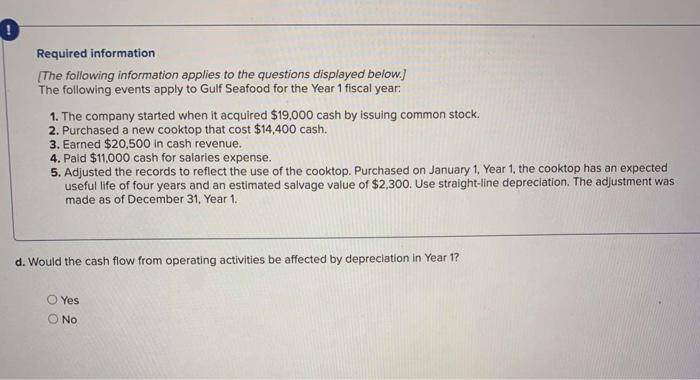

Required information [The following information applies to the questions displayed below.) The following events apply to Gulf Seafood for the Year 1 fiscal year: 1. The company started when it acquired $19,000 cash by issuing common stock. 2. Purchased a new cooktop that cost $14,400 cash. 3. Earned $20,500 in cash revenue. 4. Paid $11,000 cash for salaries expense. 5. Adjusted the records to reflect the use of the cooktop. Purchased on January 1, Year 1, the cooktop has an expected useful life of four years and an estimated salvage value of $2,300. Use straight-line depreciation. The adjustment was made as of December 31, Year 1. Required a. Record the above transactions in a horizontal statements model. (In the Statement of Cash Flows column, use the initials (OA), an Investing activity (IA), a financing activity (FA) and net change in cash (NC). Enter any decreases to account balances and cash outflows with a minus sign. Not all cells require input.) Income Statement GULF SEAFOOD Horizontal Statements Model Balance Sheet Assets Stockholder's Equity Equipment Common Retained Revenue (BV) Stock Earnings Statement of Cash Flows Event Expense Net Income Cash + 1. 2 3 .. +++ 4 5 Ol 0. 0 0 Ol Bal Southwest Milling Co. purchased a front-end loader to move stacks of lumber. The loader had a list price of $120,570. The seller agreed to allow a 4.50 percent discount because Southwest Milling paid cash. Delivery terms were FOB shipping point. Transportation cost amounted to $2,810. Southwest Milling had to hire a specialist to calibrate the loader. The specialist's fee was $1,180. The loader operator is paid an annual salary of $26,530. The cost of the company's theft Insurance policy increased by $2,430 per year as a result of acquiring the loader. The loader had a four-year useful life and an expected salvage value of $11,400 Required Determine the amount to be capitalized in an asset account for the purchase of the front-end loader. (Round your answers to the nearest whole dollar. Amounts to be deducted should be indicated with minus sign.) Costs that are to be capitalized List price ces $ 0 Total costs Required information The following information applies to the questions displayed below.) The following events apply to Gulf Seafood for the Year 1 fiscal year: 1. The company started when it acquired $19,000 cash by issuing common stock 2. Purchased a new cooktop that cost $14,400 cash. 3. Earned $20,500 in cash revenue. 4. Paid $11,000 cash for salaries expense. 5. Adjusted the records to reflect the use of the cooktop. Purchased on January 1, Year 1, the cooktop has an expected useful life of four years and an estimated salvage value of $2,300. Use straight-line depreciation. The adjustment was made as of December 31, Year 1. b. What amount of depreciation expense would Gulf Seafood report on the Year 1 Income statement? Depreciation expense Required information [The following information applies to the questions displayed below.) The following events apply to Gulf Seafood for the Year 1 fiscal year: 1. The company started when it acquired $19,000 cash by issuing common stock 2. Purchased a new cooktop that cost $14,400 cash. 3. Earned $20,500 in cash revenue. 4. Paid $11.000 cash for salaries expense. 5. Adjusted the records to reflect the use of the cooktop. Purchased on January 1, Year 1, the cooktop has an expected useful life of four years and an estimated salvage value of $2,300. Use straight-line depreciation. The adjustment was made as of December 31. Year 1. c. What amount of accumulated depreciation would Gulf Seafood report on the December 31, Year 2, balance sheet? Accumulated depreciation O Required information (The following information applies to the questions displayed below.) The following events apply to Gulf Seafood for the Year 1 fiscal year 1. The company started when it acquired $19,000 cash by issuing common stock. 2. Purchased a new cooktop that cost $14,400 cash. 3. Earned $20,500 in cash revenue. 4. Paid $11,000 cash for salaries expense. 5. Adjusted the records to reflect the use of the cooktop. Purchased on January 1, Year 1, the cooktop has an expected useful life of four years and an estimated salvage value of $2,300. Use straight-line depreciation. The adjustment was made as of December 31, Year 1. d. Would the cash flow from operating activities be affected by depreciation in Year 1? Yes No