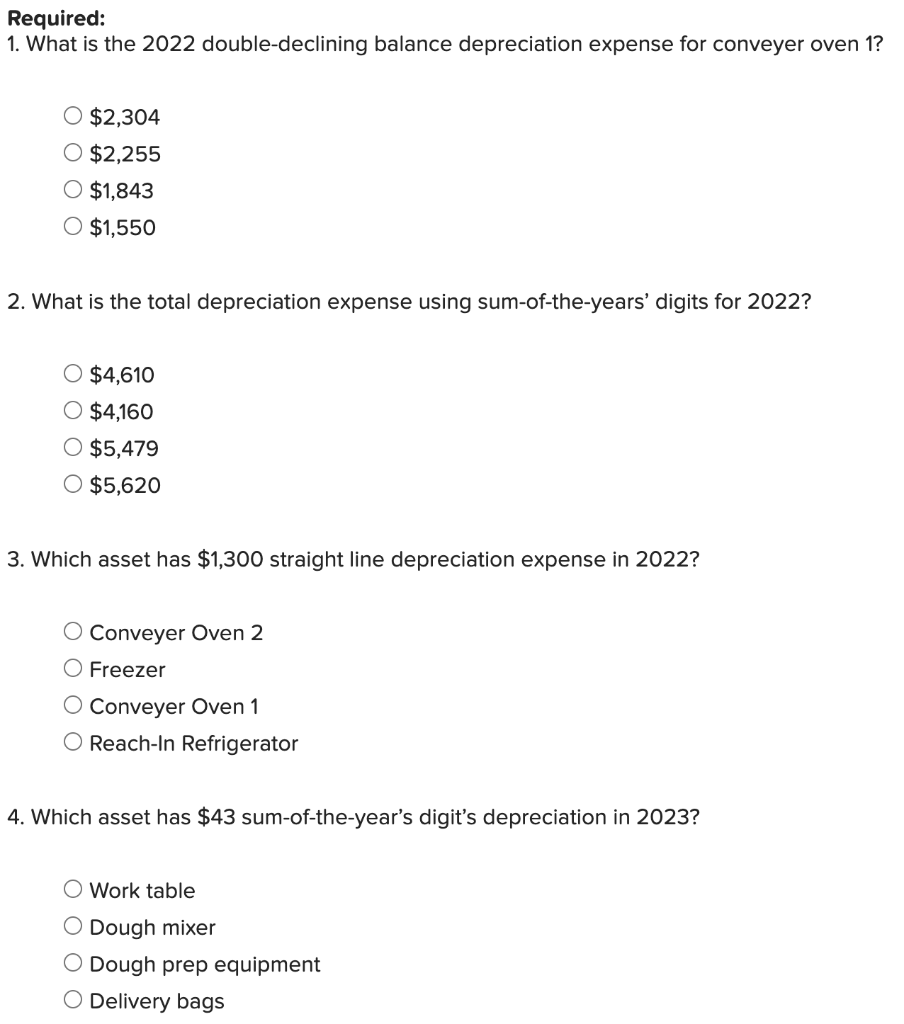

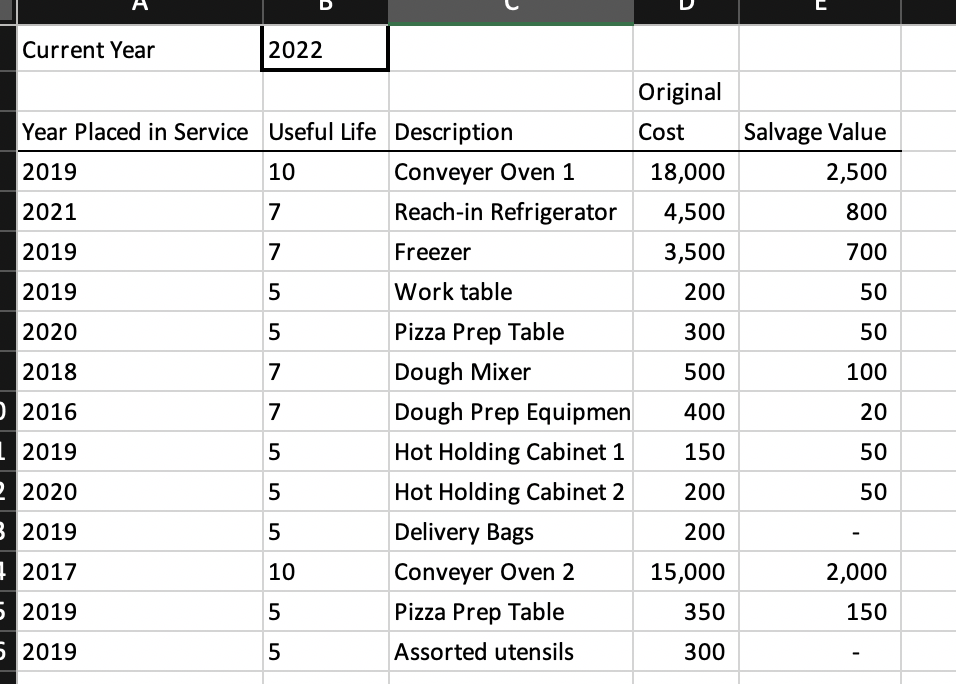

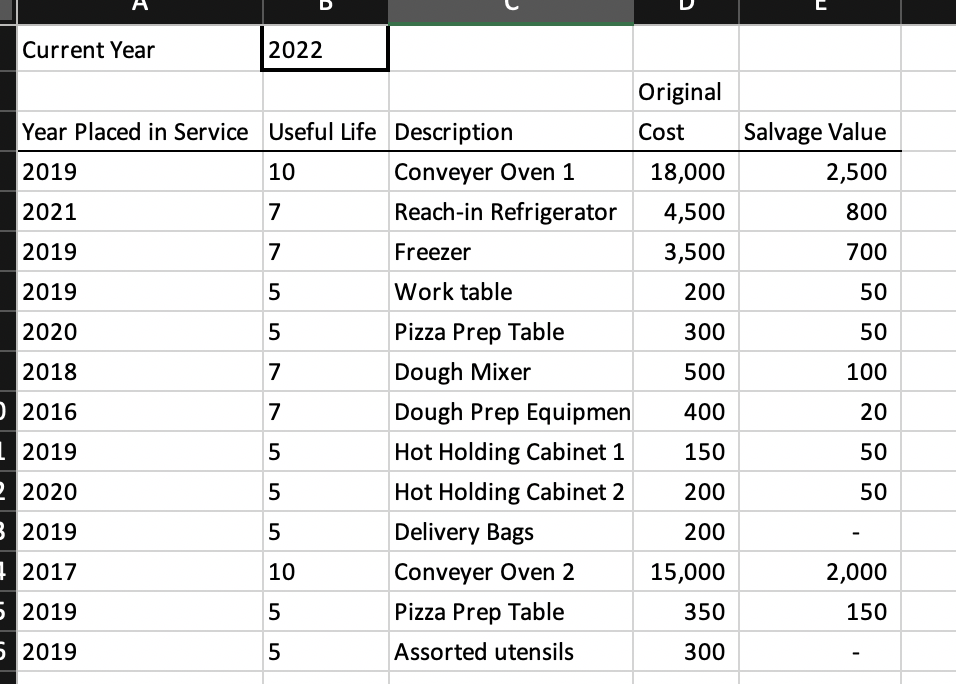

Required information [The following information applies to the questions displayed below.) NOTE: Throughout this lab, every time a screenshot is requested, use your computer's screenshot tool, and paste each screenshot to the same Word document. Label each screenshot in accordance to what is noted in the lab. This document with all of the screenshots included should be uploaded through Connect as a Word or PDF document when you have reached the final step of the lab. In this lab, you will: Required: Calculate depreciation expense using straight-line depreciation, double- declining balance and sum-of-the-year's digits depreciation. Ask the Question: How does depreciation differ by the depreciation method chosen? Master the Data: Pathway Gardens is a landscaping company. It has various equipment that appears on its fixed asset schedule included in the spreadsheet Lab 1-2.xlsx. We will compute the depreciation using three different methods and compare and contrast them. Software needed Excel Screen capture tool (Windows: Snipping Tool; Mac: Cmd+Shift+4) . Data: Excel File Lab 1-2 Alt Data.xlsx Perform the Analysis: Refer to Lab 1-2 Alternative in the text for instructions and Lab 1-2 steps for each of the lab parts. Share the Story: We have now computed the depreciation for Pathway Gardens using three different depreciation methods. We now have the information we need to compare each method. This data analytics can help us determine which depreciation method should be used. Part 1: Upload Your Files Part 2: Assessment Required: 1. What is the 2022 double-declining balance depreciation expense for conveyer oven 1? O $2,304 O $2,255 O $1,843 O $1,550 2. What is the total depreciation expense using sum-of-the-years' digits for 2022? O $4,610 O $4,160 $5,479 O $5,620 3. Which asset has $1,300 straight line depreciation expense in 2022? O Conveyer Oven 2 Freezer Conveyer Oven 1 O Reach-In Refrigerator 4. Which asset has $43 sum-of-the-year's digit's depreciation in 2023? Work table O Dough mixer O Dough prep equipment O Delivery bags Current Year 2022 Original Cost Year Placed in Service Useful Life Description 2019 10 Conveyer Oven 1 2021 7 Reach-in Refrigerator 2019 7 Freezer 18,000 4,500 3,500 Salvage Value 2,500 800 700 2019 5 Work table 200 50 2020 5 300 50 2018 7 500 100 2016 7 400 20 1 2019 5 150 50 2 2020 5 Pizza Prep Table Dough Mixer Dough Prep Equipmen Hot Holding Cabinet 1 Hot Holding Cabinet 2 Delivery Bags Conveyer Oven 2 Pizza Prep Table Assorted utensils 200 50 3 2019 5 200 1 2017 10 2,000 15,000 350 2019 5 150 5 2019 5 300 Required information [The following information applies to the questions displayed below.) NOTE: Throughout this lab, every time a screenshot is requested, use your computer's screenshot tool, and paste each screenshot to the same Word document. Label each screenshot in accordance to what is noted in the lab. This document with all of the screenshots included should be uploaded through Connect as a Word or PDF document when you have reached the final step of the lab. In this lab, you will: Required: Calculate depreciation expense using straight-line depreciation, double- declining balance and sum-of-the-year's digits depreciation. Ask the Question: How does depreciation differ by the depreciation method chosen? Master the Data: Pathway Gardens is a landscaping company. It has various equipment that appears on its fixed asset schedule included in the spreadsheet Lab 1-2.xlsx. We will compute the depreciation using three different methods and compare and contrast them. Software needed Excel Screen capture tool (Windows: Snipping Tool; Mac: Cmd+Shift+4) . Data: Excel File Lab 1-2 Alt Data.xlsx Perform the Analysis: Refer to Lab 1-2 Alternative in the text for instructions and Lab 1-2 steps for each of the lab parts. Share the Story: We have now computed the depreciation for Pathway Gardens using three different depreciation methods. We now have the information we need to compare each method. This data analytics can help us determine which depreciation method should be used. Part 1: Upload Your Files Part 2: Assessment Required: 1. What is the 2022 double-declining balance depreciation expense for conveyer oven 1? O $2,304 O $2,255 O $1,843 O $1,550 2. What is the total depreciation expense using sum-of-the-years' digits for 2022? O $4,610 O $4,160 $5,479 O $5,620 3. Which asset has $1,300 straight line depreciation expense in 2022? O Conveyer Oven 2 Freezer Conveyer Oven 1 O Reach-In Refrigerator 4. Which asset has $43 sum-of-the-year's digit's depreciation in 2023? Work table O Dough mixer O Dough prep equipment O Delivery bags Current Year 2022 Original Cost Year Placed in Service Useful Life Description 2019 10 Conveyer Oven 1 2021 7 Reach-in Refrigerator 2019 7 Freezer 18,000 4,500 3,500 Salvage Value 2,500 800 700 2019 5 Work table 200 50 2020 5 300 50 2018 7 500 100 2016 7 400 20 1 2019 5 150 50 2 2020 5 Pizza Prep Table Dough Mixer Dough Prep Equipmen Hot Holding Cabinet 1 Hot Holding Cabinet 2 Delivery Bags Conveyer Oven 2 Pizza Prep Table Assorted utensils 200 50 3 2019 5 200 1 2017 10 2,000 15,000 350 2019 5 150 5 2019 5 300