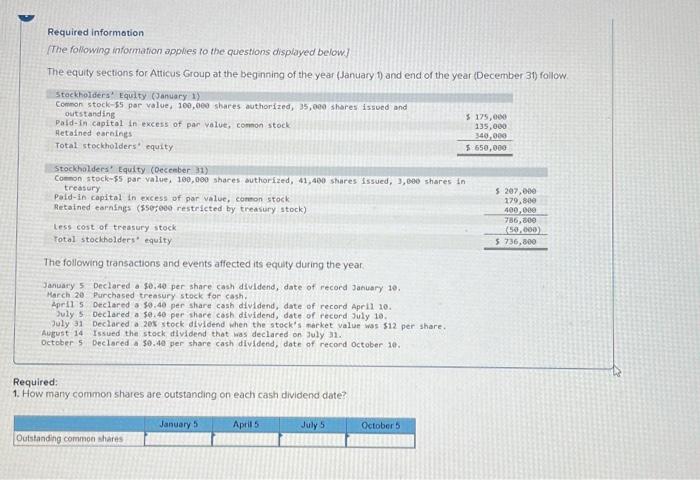

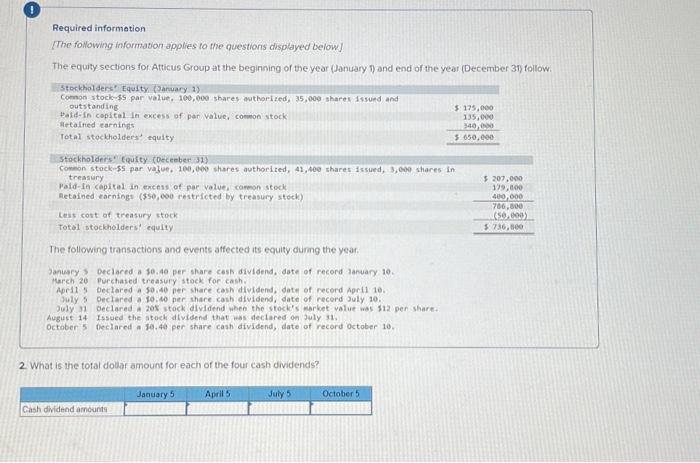

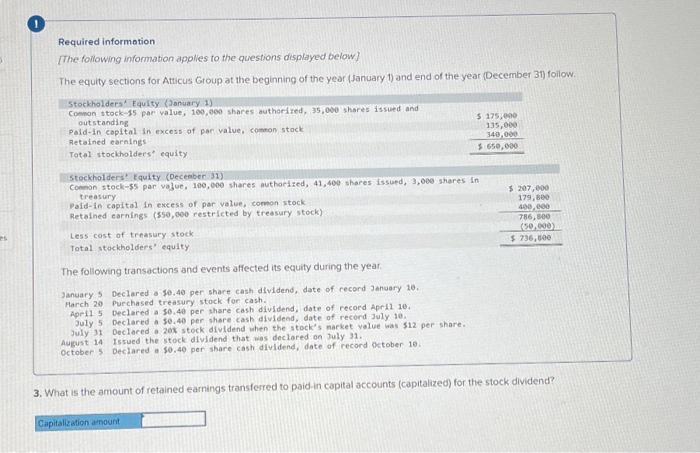

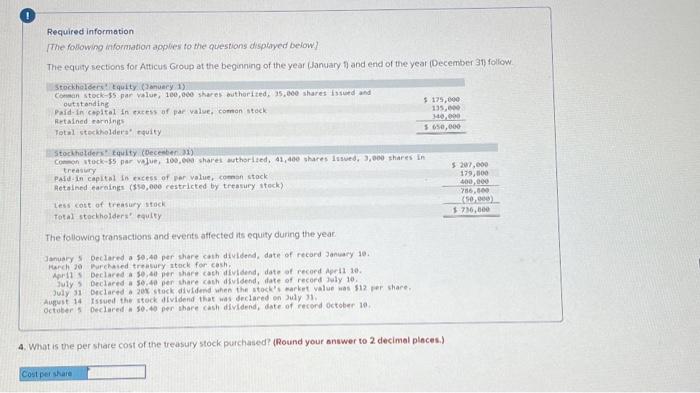

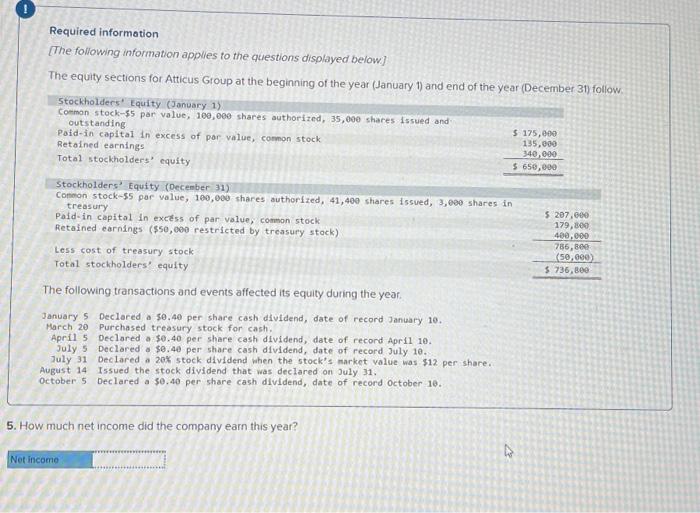

Required information [The following information applies to the questions displayed below] The equity sections for Atticus Group at the beginning of the year (January 1) and end of the year (December 31) follow. The following transactions and events affected its equity during the year January 5 Declared a 50,40 per share cash dividend, date of record Jahuary 10. March 20 Purchased treasury stock for cash. 2pril 5 Dectared a $9.40 per share cash divldend, date of record April 10. July 5 - oeclared a 50.40 per share cash dividend, date of record July 10 . July 31 Declared a 205 stock dlyldend when the stock's market value was s12 per share. August 14 Issued the stock dlvidend that las declared on July 31. october 5 beclared a 30.40 per share cash dividend, date of record october 10. Required: 1. How mary common shares are outstanding on each cash dividend date? Required informetion The following information applies to the questions displayed below] The equity sections for Atticus Group at the beginning of the year (January 7 ) and end of the year (December 3) follow. The following transactions and events affected its equity dunng the year. Janusey s Declared a 10.4e per share cask dividend, date of record lanuary 10. Mareh 20 furchased treasury stock for cash. Apr11 5 beclared a so.40 per share caih dividend, date of recerd Apri1 10. July 5 peclared a 10, 50 per share cash dividend, date of recerd July 10. July 31 declared a 205 stock divldend when the stock's merket value was 312 per share. August 14 issued the stoek dividend that was dectared on july 31. October'5 Declared a 50.40 per share cash dividend, date of record october 10. 2. What is the total doldar amount for each of the four cash dividends? Required information [The following information applies to the questions displayed below] The equity sections for Atticus Group at the beginning of the year (January 1 ) and end of the year (December 3i) foilow. The following transactions and events affected its equity during the year 3anuary 5 Declared o $0.40 per share cash dividend, date of record January 10. Harch 20 Purchased treasury stock for cash. Aprit 5 beclared a 50,40 per share cash dividend, dote of record Apr11 10. July 5 Declared a se.40 per thare cast dividend, date of record july 10. July 31 Decloced a 20 stock dividend when the stock's narket volue bas $12 per share. August 14 Issued the stock dividend that aas declored on July 31. october 5 beclared a $0.40 per share cash dividend, date of record actober 10. 3. What is the amount of retained earnings transferred to poid in capital accounts (capitalized) for the stock dividend? Required information [The following intormation apolies to the questions disptoyed below? The equity sectons for Atticus Group at the beginning of the year (January i) and end of the year (December 3i) foliow. The following transactions and everits affected its equity during the year. January 5 beclared a 50;40 per thare canh dividend, date of recard Janiary 10. lareh 20 hurehaled tratury itock for cash. Mord1 5 beclaced a 50,40 per thare cach dividend, date of record Apel1 10. July. 5 beclares a se.40 per thare cash divibend, date of record fuly 10. july 31 beclared a zok stock divldend when the itock's narket value nas 112 per share, August 14 Issued the stock dlvidend that was declared on 3uly 31 octoter os peclared on 50.40 per thare cash dividend, date of record october as. 4. What is the per share cost of the treasury stock purchased? (Round your anawer to 2 decimal plnces.) Required information [The following information applies to the questions displayed below] The equity sections for Atticus Group at the beginning of the year (January 1) and end of the year (December 31) follow January 5 Declared a 50.40 per share cash dividend, date of record January 10. March 20 Purchased treasury stock for cash. April 5 Declared a $0.40 per share cash dividend, date of recond April 10. July 5 Declared a $0.40 per share cash dividend, date of record July 10. July 31 Declared a 20% stock dividend when the stock's market value was $12 per share. August 14 Issued the stock dividend that was declared on July 31. october 5 Declared a $0.40 per share cash dividend, date of record october 10. 5. How much net income did the company earn this year