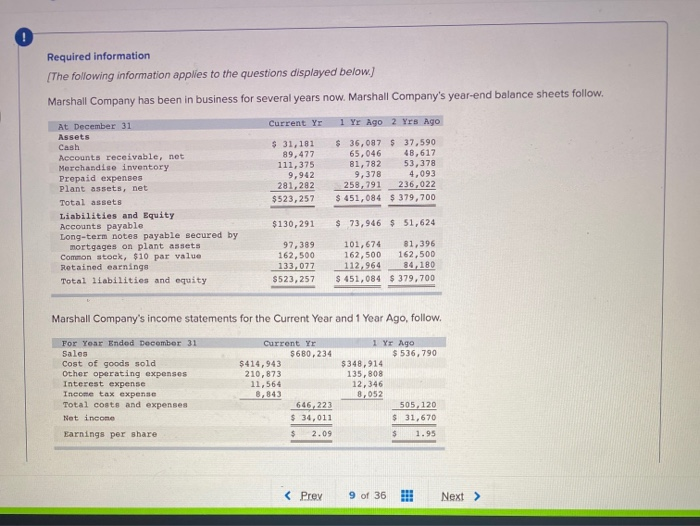

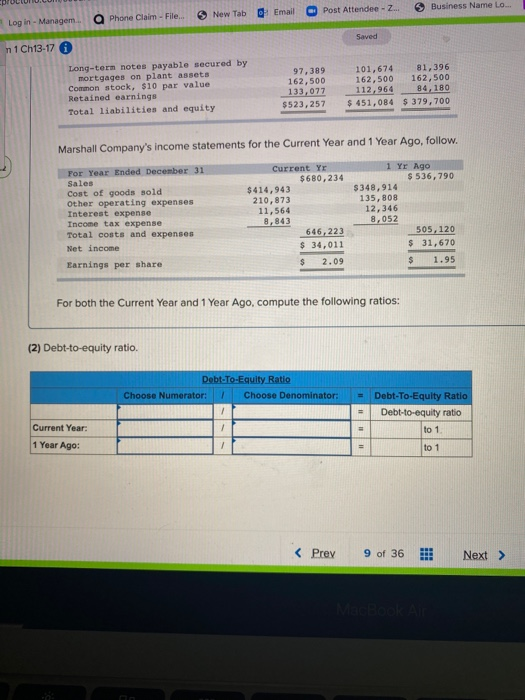

Required information [The following information applies to the questions displayed below.) Marshall Company has been in business for several years now. Marshall Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago $ 31,181 89,477 111,375 9,942 281, 282 $523,257 $ 35,087 $37.590 65,046 48,617 81,782 53,378 9,378 4,093 258,792 236,022 $ 451,084 $ 379,700 At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $130,291 $ 73,946 $ 51,624 97,389 162,500 133,077 $523, 257 101,674 81,396 162,500 162,500 112,964 84,180 $ 451,084 $ 379,700 Marshall Company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Earnings per share Current Yr $680,234 $414,943 210,873 11,564 8,843 646, 223 $ 34,011 1 yr ago $ 536,790 $348,914 135,808 12,346 8,052 505,120 $ 31,670 $ 1.95 $ 2.09 Post Attendee - Z... 3 Business Name Lo... New Tab Email Log in - Managem 0 Phone Claim - File Saved n 1 Ch13-17 Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity 97,389 162,500 133,077 $523,257 101,674 81,396 162,500 162,500 112,964 84, 180 $ 451,084 $ 379,700 Marshall Company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Earnings per share Current Yr $680,234 $414,943 210,873 11,564 8,843 646, 223 $ 34,011 1 Yr Ago $ 536,790 $348,914 135,808 12,346 8,052 505,120 $ 31,670 $ 1.95 $ 2.09 For both the Current Year and 1 Year Ago, compute the following ratios: (2) Debt-to-equity ratio. Debt-To-Equity Ratio Choose Numerator: 1 Choose Denominator: 1 = Debt-To-Equity Ratio Debt-to-equity ratio to 1 to 1 1 Current Year: 1 Year Ago: BRE