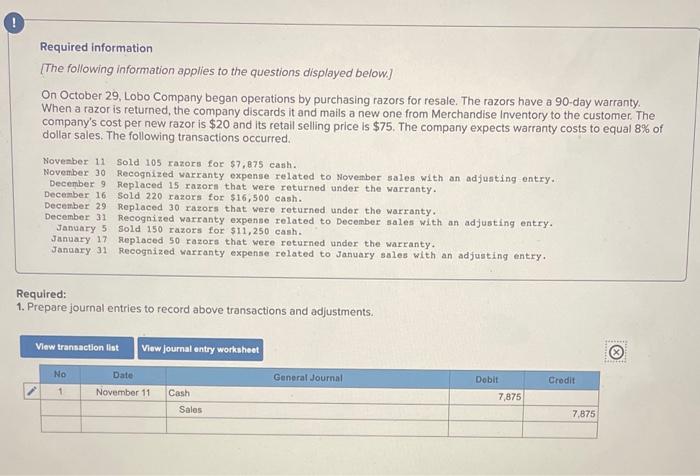

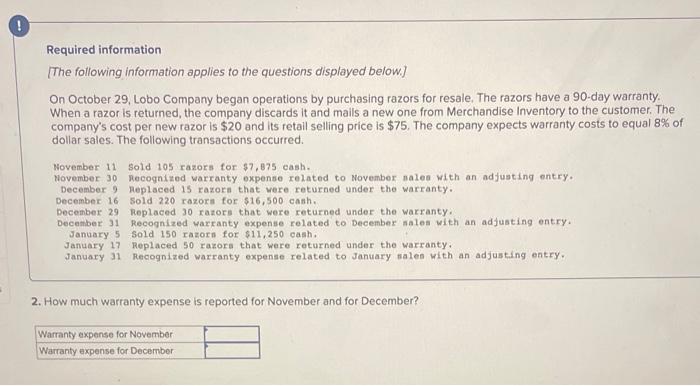

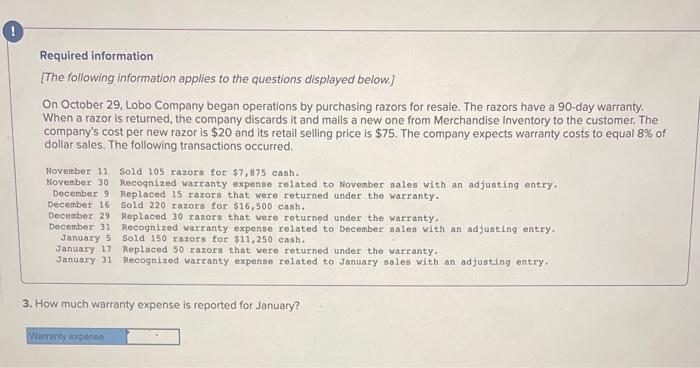

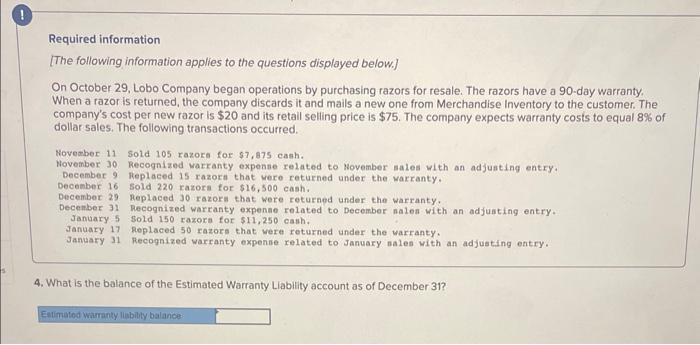

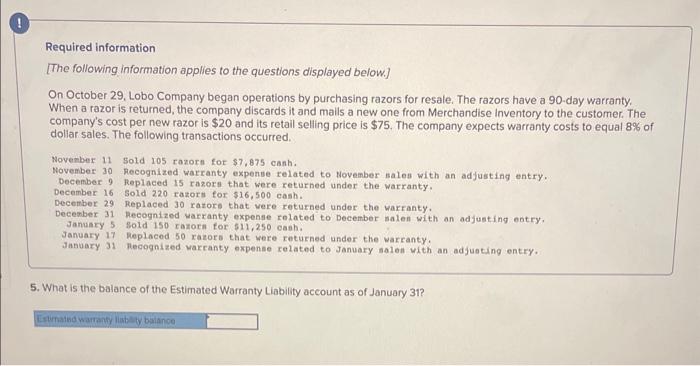

Required information [The following information applies to the questions displayed below.] On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90 -day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $20 and its retail selling price is $75. The company expects warranty costs to equal 8% of dollar sales. The following transactions occurred. Noveaber 11 Sold 105 razors for $7,875 cash. November 30 Recognized warranty expense related to November sales with an adjusting entry. December 9 Replaced 15 razora that were returned under the warranty. December 16 sold 220 razors for $16,500 cash. December 29 Replaced 30 razors that were returned under the warranty. December 31 Recognized warranty expense related to December sales with an adjusting entry. January 5 sold 150 razors for 511,250 cash. January 17 replaced 50 razors that were returned under the warranty. January 31 Recognized warranty expense related to January sales with an adjusting entry. Required: 1. Prepare journal entries to record above transactions and adjustments. Required information [The following information applies to the questions displayed below] On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90-day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $20 and its retail selling price is $75. The company expects warranty costs to equal 8% of dollar sales. The following transactions occurred. November 11 sold 105 razors for $7,875 eash. November 30 Recognized warranty expense related to November nalee with an adjusting entry. December 9 heplaced 15 razorn that vere returned under the warranty. December 16 sold 220 razorn for $16,500 cash. December 29 Replaced 30 razors that were returned under the warranty. December 31 Recognized varranty expense related to December sales with an adjusting entry. January 5 sold 150 razorn for $11,250 cash. January 17 Replaced 50 razora that were returned under the warranty. January 31 Recognized warranty expense related to January sales with an adjusting entry. 2. How much warranty expense is reported for November and for December? Required information [The following information applies to the questions displayed below.] On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90 -day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $20 and its retail selling price is $75. The company expects warranty costs to equal 8% of dollar sales. The following transactions occurred. November 11 Sold 105 razori for $7,875cash. November 30 Recognized warranty expense related to November sales with an adjugting ontry. December 9 Replaced 15 razors that were returned under the warranty. December 16 sold 220 razors for $16,500 cash. December 29 Replaced 30 razors that were roturned under the warranty. December 11 Recognized warranty expenze related to December ales with an adjusting entry. January 5 Sold 150 razors for $11,250cash. January 17 Replaced 50 razord that were returned under the warranty. January 31 Recognized warranty expense related to January sales with an adjustimg entry. 3. How much warranty expense is reported for January? Required information [The following information applies to the questions displayed below.] On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90-day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $20 and its retail selling price is $75. The company expects warranty cosis to equal 8% of dollar sales. The following transactions occurred. Noveober 11 sold 105 razore for $7,875 cash. November 30 Recognized warranty expense related to November sales with an adjusting entry. December 9 Replaced 15 razort that wero returned under the warranty. December 16 sold 220 razora for $16,500cash. December 29 Replaced 30 razori that were returned under the warranty. December 31 Recognized Warranty expenae rolated to December nalen with an adjuating entry. January 5 \$old 150 razora for $11,250 eath. January 17 replaced 50 razors that were returned under the varranty. January 31 Recognized warranty expense related to January nalen with an adjusting entry. 4. What is the balance of the Estimated Warranty Liability account as of December 31 ? Required information [The following information applies to the questions displayed below.] On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90 -day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $20 and its retail selling price is $75. The company expects warranty costs to equal 8% of doliar sales. The following transactions occurred. Novenber 11 Sold 105 razorn for $7,875 canh. November 30 recognized warranty expenue related to November sales with an adjusting entry. December 9 Replaced is razors that were returned under the warranty. Decamber 16 sold 220 razor for $16,500 eash. December 29 Replaced 30 razore that vere returned under the varranty. Decenber 31 hecognized varranty expense rolated to Decenber palen with an adjusting eotry. January 5 sold 150 razorn tor 511,250 eash. January 17 heplaced 50 razors that were returned under the warranty. January 31 lecognized varranty expense related to January nalen with an adjueting entry. 5. What is the balance of the Estimated Warranty Liability account as of January 31